astronics.com Nasdaq: ATRO Astronics Investor Presentation January 2026 Peter J. Gundermann, Chairman, President & CEO Nancy L. Hedges, Vice President & CFO Exhibit 99.1 Safe Harbor Statement This presentation contains forward-looking statements as defined by the Securities Exchange Act of 1934. One can identify these forward-looking statements by the use of the words “expect,” “anticipate,” “plan,” “may,” “will,” “estimate,” “feeling” or other similar expressions and include all statements with regard to the Company’s preliminary unaudited revenue and bookings for the fourth quarter of 2025 and full year 2025, 2026 revenue expectations, the amount of capital expenditures for 2025, the amount of the impact of tariffs on costs for materials to the Company and level of mitigation potential with respect thereto, the amount of backlog to be recognized as revenue over the next twelve months, the strength and length of time associated with tailwinds for the Aerospace segment, the achievement of profitability in the Test segment, the level of operating leverage the business can obtain and statements regarding the strategy of the Company and its outlook. Forward-looking statements also include all statements related to achieving any revenue or profitability expectations, expectations of continued growth, the level of liquidity, the level of cash generation, the level of demand by customers and markets and the amount of expected capital expenditures. Because such statements apply to future events, they are subject to risks and uncertainties that could cause actual results to differ materially from those contemplated by the statements. Important factors that could cause actual results to differ materially from what may be stated here include the trend in growth with passenger power and connectivity on airplanes, the state of the aerospace and defense industries, the market acceptance of newly developed products, internal production capabilities, the timing of orders received, the status of customer certification processes and delivery schedules, the demand for and market acceptance of new or existing aircraft which contain the Company’s products, the impact of regulatory activity and public scrutiny on production rates of a major U.S. aircraft manufacturer, the need for new and advanced test equipment, customer preferences and relationships, the effectiveness of the Company’s supply chain, and other factors which are described in filings by Astronics with the Securities and Exchange Commission. Except as required by applicable law, the Company assumes no obligation to update forward-looking information in this presentation whether to reflect changed assumptions, the occurrence of unanticipated events or changes in future operating results, financial conditions or prospects, or otherwise. Non-GAAP Financial Measures This presentation will discuss some non-GAAP (“adjusted”) financial measures which we believe are useful in evaluating our performance. You should not consider the presentation of this additional information in isolation or as a substitute for results compared in accordance with GAAP. The non-GAAP (“adjusted”) measures are notated and we have provided reconciliations of comparable GAAP to non-GAAP measures in tables found in the Supplemental Information portion of this presentation. astronics.com 2 astronics.com 3 Astronics Corporation (Nasdaq: ATRO) Market data as of January 14, 2026 [Source: FactSet]; Shares Outstanding as of October 30, 2025; Ownership as of most recent filings $2.4 billionMarket Cap $71.58Recent Price $71.58/ $15.4952-Week Range (high/low) 769,600Average Daily Volume (3 mos.) 1968/1972Established/IPO 31.6 millionShares Out – Common 4.0 millionShares Out – Class B 84.6%Institutional ownership 9.1%Insider ownership Russell 3000®/2000®Index membership INNOVATION. COLLABORATION. SUCCESS. Astronics serves the world’s aerospace, defense, and other mission critical industries with proven, innovative technology solutions. Our strategy is to grow value by developing technologies, organically or through acquisition, for our targeted markets. 69% 8% 21% Other 2% astronics.com 4 Solid Franchise with Leading Market Positions 92%8% Aerospace Test Systems TTM Q3 25 Sales: $830.6 million Commercial Aerospace General Aviation Defense & Government* *Includes Test and Aerospace sales Commercial Aerospace ~50/50 Line Fit/Retrofit ~50/50 Narrowbody/Widebody

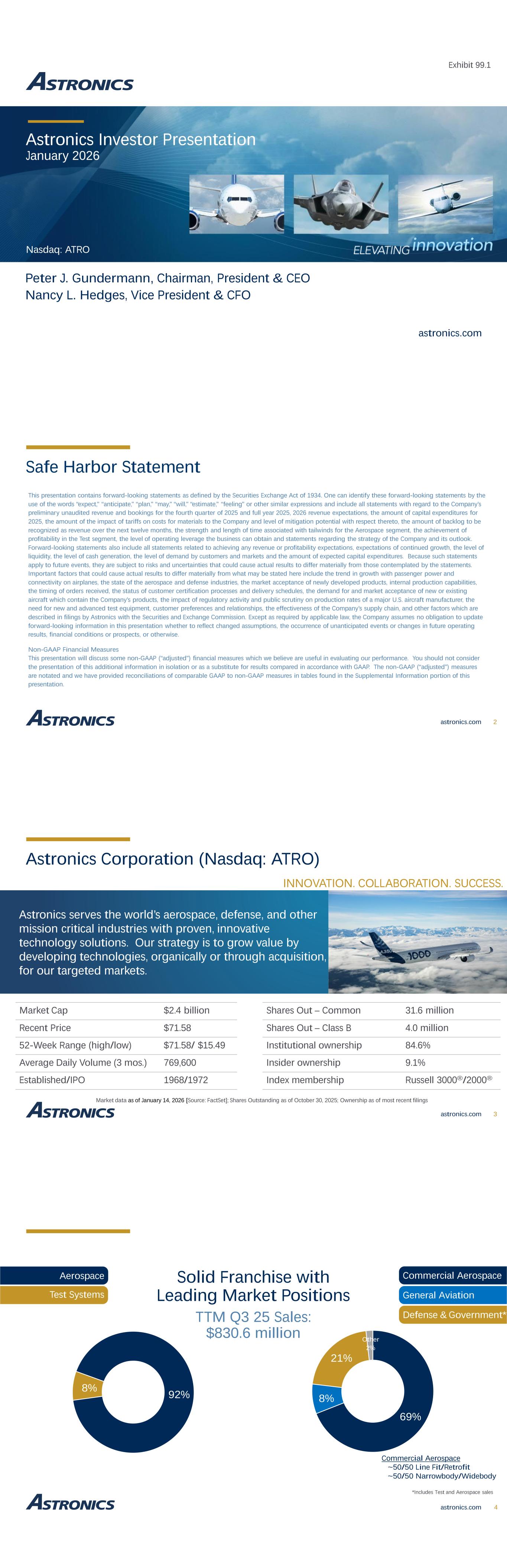

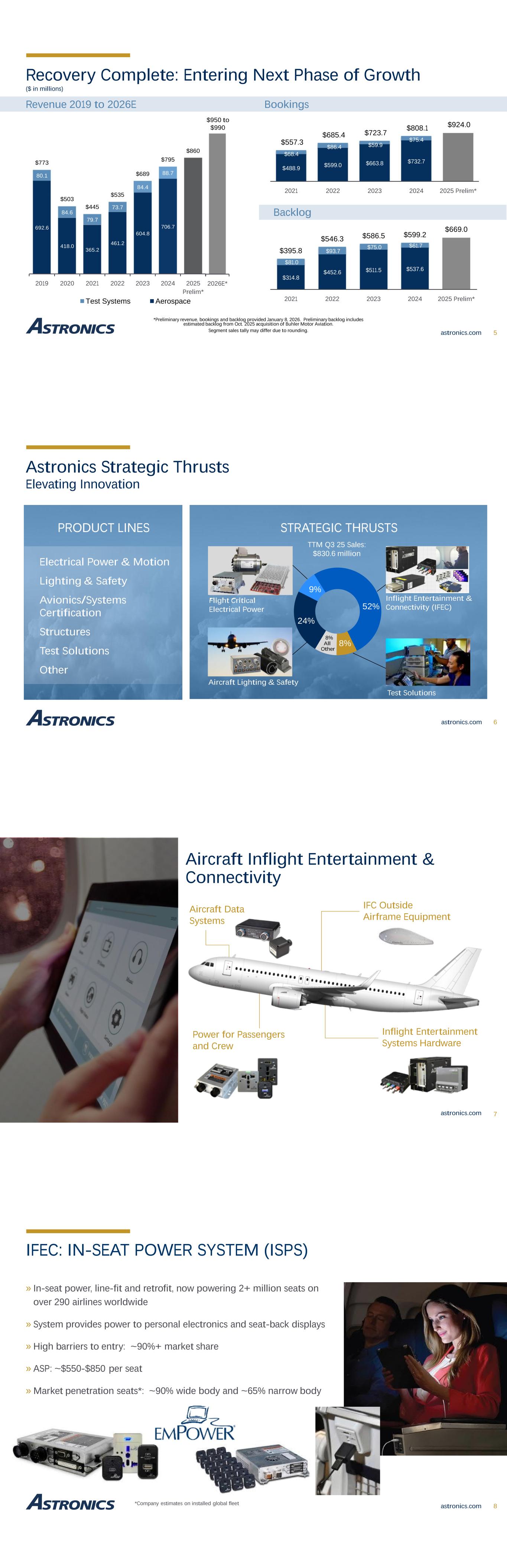

Revenue 2019 to 2026E ($ in millions) Recovery Complete: Entering Next Phase of Growth astronics.com 5 692.6 418.0 365.2 461.2 604.8 706.7 80.1 84.6 79.7 73.7 84.4 88.7 $773 $503 $445 $535 $689 $795 $860 2019 2020 2021 2022 2023 2024 2025 Prelim* Test Systems Aerospace 2026E* $950 to $990 . Segment sales tally may differ due to rounding. $314.8 $452.6 $511.5 $537.6 $81.0 $93.7 $75.0 $61.7 $395.8 $546.3 $586.5 $599.2 $669.0 2021 2022 2023 2024 2025 Prelim* Bookings Backlog $488.9 $599.0 $663.8 $732.7 $68.4 $86.4 $59.9 $75.4$557.3 $685.4 $723.7 $808.1 $924.0 2021 2022 2023 2024 2025 Prelim* *Preliminary revenue, bookings and backlog provided January 8, 2026. Preliminary backlog includes estimated backlog from Oct. 2025 acquisition of Buhler Motor Aviation. Astronics Strategic Thrusts Elevating Innovation astronics.com 6 STRATEGIC THRUSTSPRODUCT LINES Electrical Power & Motion Lighting & Safety Avionics/Systems Certification Structures Test Solutions Other Inflight Entertainment & Connectivity (IFEC) TTM Q3 25 Sales: $830.6 million Aircraft Lighting & Safety Flight Critical Electrical Power 24% 9% 52% 8% 8% All Other Test Solutions Aircraft Data Systems Aircraft Inflight Entertainment & Connectivity IFC Outside Airframe Equipment Inflight Entertainment Systems Hardware Power for Passengers and Crew 7astronics.com astronics.com 8 IFEC: IN-SEAT POWER SYSTEM (ISPS) » In-seat power, line-fit and retrofit, now powering 2+ million seats on over 290 airlines worldwide » System provides power to personal electronics and seat-back displays » High barriers to entry: ~90%+ market share » ASP: ~$550-$850 per seat » Market penetration seats*: ~90% wide body and ~65% narrow body *Company estimates on installed global fleet

Lighting & Safety Solutions Cabin Emergency / Safety Systems Exterior Cockpit 9 astronics.com 10 Aircraft Lighting Systems Industry Leader in Aircraft Lighting Illuminating commercial, business and military aircraft, including Airbus, Boeing, Embraer, Lockheed and Textron A complete array of innovative, lightweight, reliable, solid-state lighting systems Products » Exterior lighting systems » Cabin lighting systems » Cockpit lighting systems Markets » Commercial transport » Military » Business and general aviation Flight Critical Electrical Power astronics.com 11 The technology for the future of small aircraft: Solid-state power distribution systems replace extensive wiring and traditional electromechanical components with modular electronics and software Selected for the U.S. Army Future Long-Range Assault Aircraft (FLRAA) program » Intelligent systems for power generation, distribution and conversion » Increased reliability » Reduced weight » Automation, flexibility » Lower life cycle cost » Reduces pilot workload First Mover Advantage: Establishing leadership in small aircraft airframe power astronics.com 12 Addressing Trends: Modernization of Aircraft Clean, Streamlined Cockpit Modern Cockpit with Electronic Circuit Breakers Pilatus PC-24 Traditional Cockpit with Mechanical Circuit Breakers Learjet 45

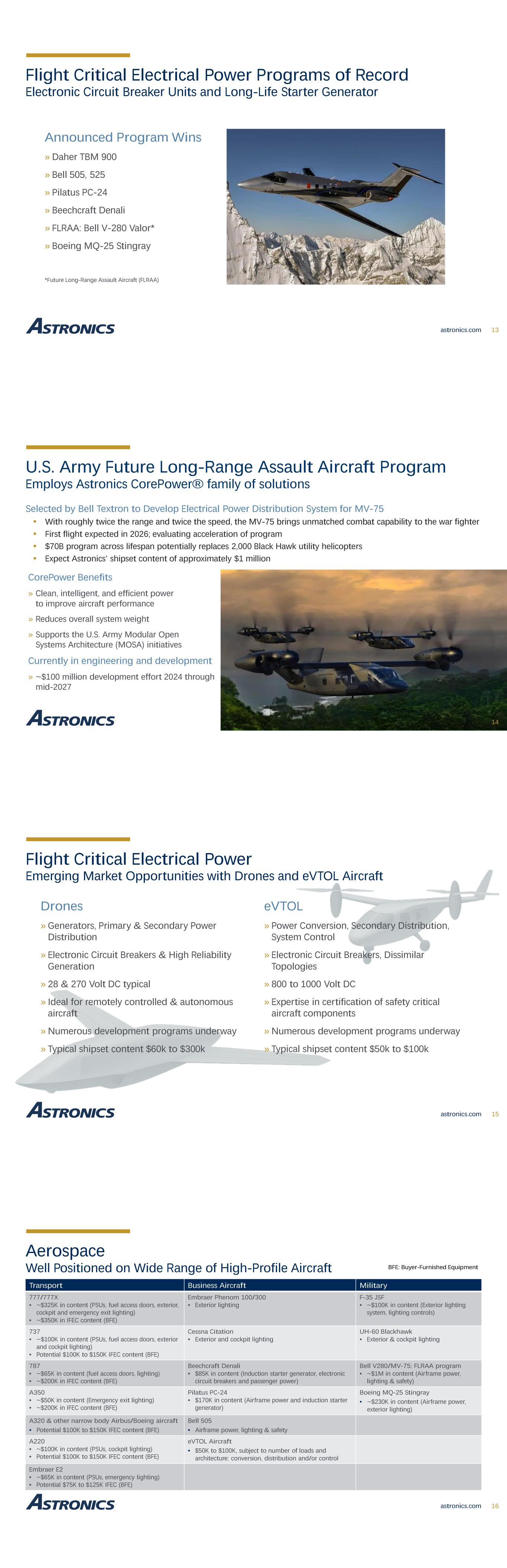

astronics.com 13 Flight Critical Electrical Power Programs of Record Electronic Circuit Breaker Units and Long-Life Starter Generator Announced Program Wins » Daher TBM 900 » Bell 505, 525 » Pilatus PC-24 » Beechcraft Denali » FLRAA: Bell V-280 Valor* » Boeing MQ-25 Stingray *Future Long-Range Assault Aircraft (FLRAA) U.S. Army Future Long-Range Assault Aircraft Program 14 Selected by Bell Textron to Develop Electrical Power Distribution System for MV-75 • With roughly twice the range and twice the speed, the MV-75 brings unmatched combat capability to the war fighter • First flight expected in 2026; evaluating acceleration of program • $70B program across lifespan potentially replaces 2,000 Black Hawk utility helicopters • Expect Astronics’ shipset content of approximately $1 million Employs Astronics CorePower® family of solutions CorePower Benefits » Clean, intelligent, and efficient power to improve aircraft performance » Reduces overall system weight » Supports the U.S. Army Modular Open Systems Architecture (MOSA) initiatives Currently in engineering and development » ~$100 million development effort 2024 through mid-2027 astronics.com 15 Flight Critical Electrical Power Emerging Market Opportunities with Drones and eVTOL Aircraft Drones » Generators, Primary & Secondary Power Distribution » Electronic Circuit Breakers & High Reliability Generation » 28 & 270 Volt DC typical » Ideal for remotely controlled & autonomous aircraft » Numerous development programs underway » Typical shipset content $60k to $300k eVTOL » Power Conversion, Secondary Distribution, System Control » Electronic Circuit Breakers, Dissimilar Topologies » 800 to 1000 Volt DC » Expertise in certification of safety critical aircraft components » Numerous development programs underway » Typical shipset content $50k to $100k Aerospace Well Positioned on Wide Range of High-Profile Aircraft astronics.com 16 MilitaryBusiness AircraftTransport F-35 JSF • ~$100K in content (Exterior lighting system, lighting controls) Embraer Phenom 100/300 • Exterior lighting 777/777X • ~$325K in content (PSUs, fuel access doors, exterior, cockpit and emergency exit lighting) • ~$350K in IFEC content (BFE) UH-60 Blackhawk • Exterior & cockpit lighting Cessna Citation • Exterior and cockpit lighting 737 • ~$100K in content (PSUs, fuel access doors, exterior and cockpit lighting) • Potential $100K to $150K IFEC content (BFE) Bell V280/MV-75: FLRAA program • ~$1M in content (Airframe power, lighting & safety) Beechcraft Denali • $85K in content (Induction starter generator, electronic circuit breakers and passenger power) 787 • ~$65K in content (fuel access doors, lighting) • ~$200K in IFEC content (BFE) Boeing MQ-25 Stingray • ~$230K in content (Airframe power, exterior lighting) Pilatus PC-24 • $170K in content (Airframe power and induction starter generator) A350 • ~$50K in content (Emergency exit lighting) • ~$200K in IFEC content (BFE) Bell 505 • Airframe power, lighting & safety A320 & other narrow body Airbus/Boeing aircraft • Potential $100K to $150K IFEC content (BFE) eVTOL Aircraft • $50K to $100K, subject to number of loads and architecture: conversion, distribution and/or control A220 • ~$100K in content (PSUs, cockpit lighting) • Potential $100K to $150K IFEC content (BFE) Embraer E2 • ~$65K in content (PSUs, emergency lighting) • Potential $75K to $125K IFEC (BFE) BFE: Buyer-Furnished Equipment

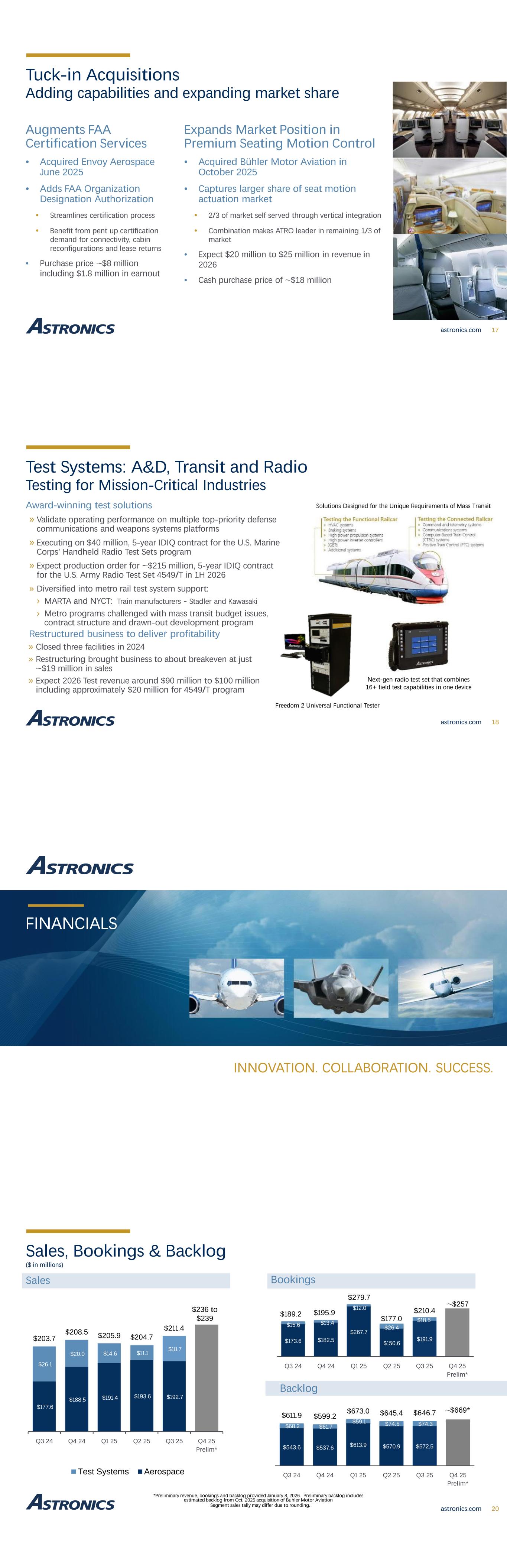

astronics.com 17 Adding capabilities and expanding market share Tuck-in Acquisitions Augments FAA Certification Services • Acquired Envoy Aerospace June 2025 • Adds FAA Organization Designation Authorization • Streamlines certification process • Benefit from pent up certification demand for connectivity, cabin reconfigurations and lease returns • Purchase price ~$8 million including $1.8 million in earnout Expands Market Position in Premium Seating Motion Control • Acquired Bühler Motor Aviation in October 2025 • Captures larger share of seat motion actuation market • 2/3 of market self served through vertical integration • Combination makes ATRO leader in remaining 1/3 of market • Expect $20 million to $25 million in revenue in 2026 • Cash purchase price of ~$18 million astronics.com 18 Test Systems: A&D, Transit and Radio Testing for Mission-Critical Industries » Validate operating performance on multiple top-priority defense communications and weapons systems platforms » Executing on $40 million, 5-year IDIQ contract for the U.S. Marine Corps’ Handheld Radio Test Sets program » Expect production order for ~$215 million, 5-year IDIQ contract for the U.S. Army Radio Test Set 4549/T in 1H 2026 » Diversified into metro rail test system support: › MARTA and NYCT: Train manufacturers - Stadler and Kawasaki › Metro programs challenged with mass transit budget issues, contract structure and drawn-out development program Next-gen radio test set that combines 16+ field test capabilities in one device Award-winning test solutions Restructured business to deliver profitability » Closed three facilities in 2024 » Restructuring brought business to about breakeven at just ~$19 million in sales » Expect 2026 Test revenue around $90 million to $100 million including approximately $20 million for 4549/T program Freedom 2 Universal Functional Tester Solutions Designed for the Unique Requirements of Mass Transit FINANCIALS INNOVATION. COLLABORATION. SUCCESS. $173.6 $182.5 $267.7 $150.6 $191.9 $15.6 $13.4 $12.0 $26.4 $18.5 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 Prelim* $543.6 $537.6 $613.9 $570.9 $572.5 $68.2 $61.7 $59.1 $74.5 $74.3 $611.9 $599.2 $673.0 $645.4 $646.7 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 Prelim* Sales ($ in millions) Sales, Bookings & Backlog astronics.com 20 Bookings Backlog Segment sales tally may differ due to rounding. $177.6 $188.5 $191.4 $193.6 $192.7 $26.1 $20.0 $14.6 $11.1 $18.7 $203.7 $208.5 $205.9 $204.7 $211.4 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 Prelim* Test Systems Aerospace *Preliminary revenue, bookings and backlog provided January 8, 2026. Preliminary backlog includes estimated backlog from Oct. 2025 acquisition of Buhler Motor Aviation $236 to $239 ~$257 ~$669* $210.4 $177.0 $279.7 $195.9$189.2

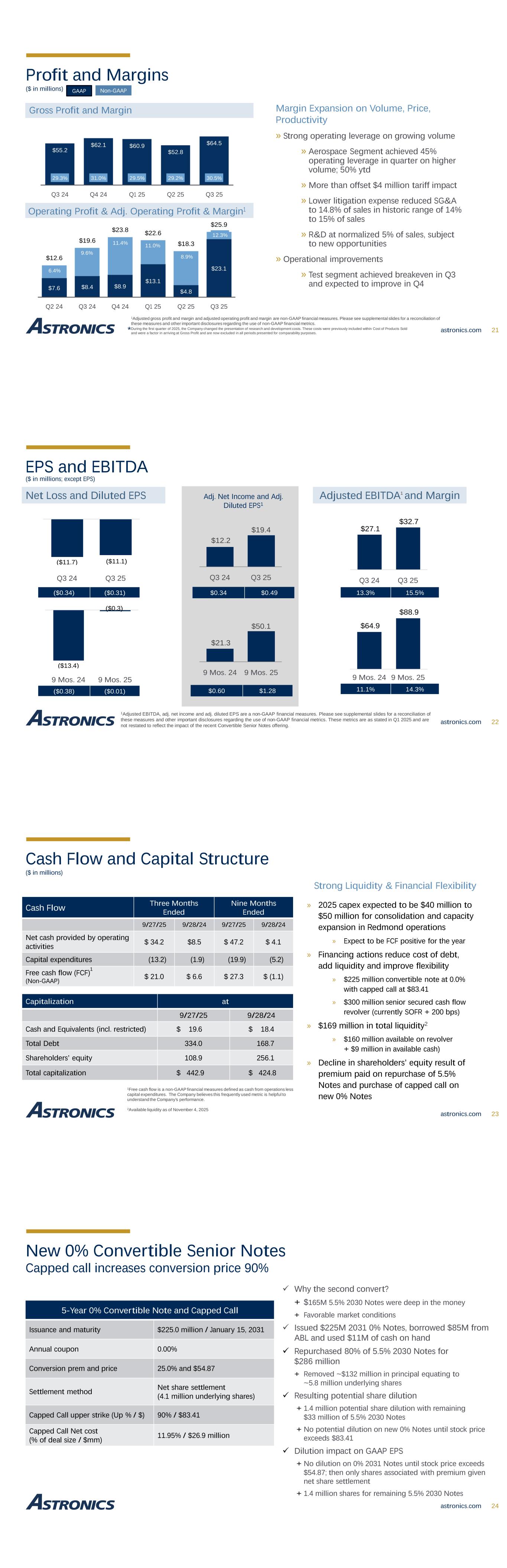

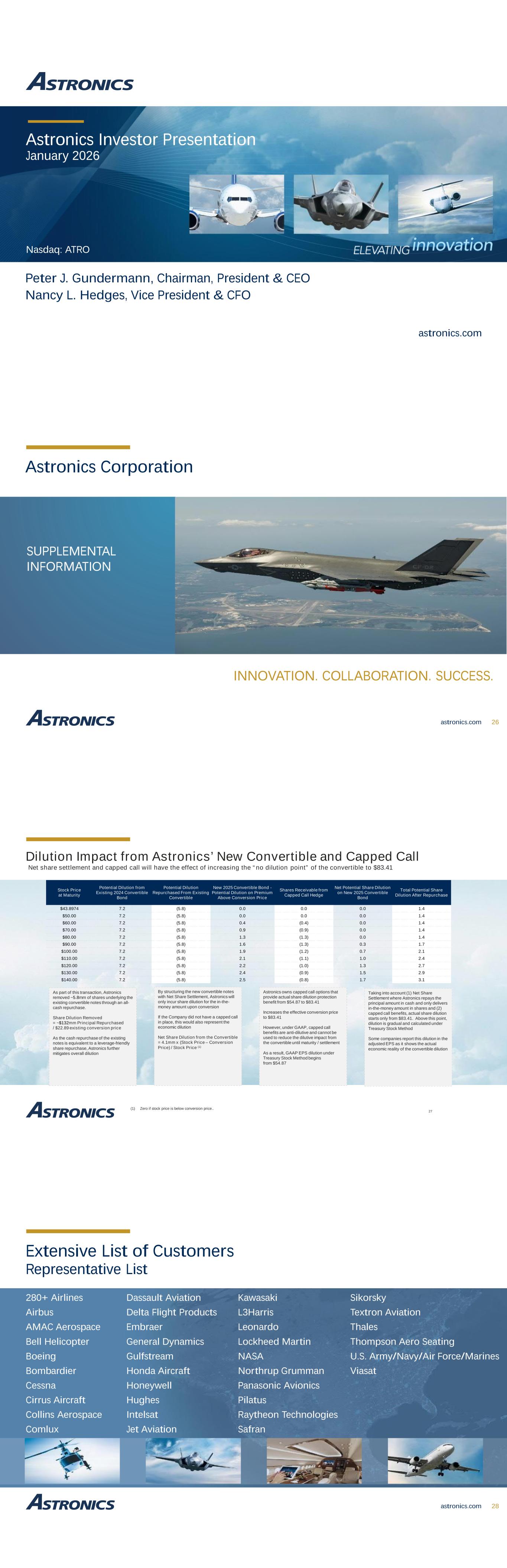

Gross Profit and Margin ($ in millions) Profit and Margins astronics.com 21 Operating Profit & Adj. Operating Profit & Margin1 Margin Expansion on Volume, Price, Productivity » Strong operating leverage on growing volume » Aerospace Segment achieved 45% operating leverage in quarter on higher volume; 50% ytd » More than offset $4 million tariff impact » Lower litigation expense reduced SG&A to 14.8% of sales in historic range of 14% to 15% of sales » R&D at normalized 5% of sales, subject to new opportunities » Operational improvements » Test segment achieved breakeven in Q3 and expected to improve in Q4 During the first quarter of 2025, the Company changed the presentation of research and development costs. These costs were previously included within Cost of Products Sold and were a factor in arriving at Gross Profit and are now excluded in all periods presented for comparability purposes.* $7.6 $8.4 $8.9 $13.1 $4.8 $23.16.4% 9.6% 11.4% 11.0% 8.9% 12.3% $12.6 $19.6 $23.8 $22.6 $18.3 $25.9 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 $55.2 $62.1 $60.9 $52.8 $64.5 29.3% 31.0% 29.5% 29.2% 30.5% Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 GAAP Non-GAAP 1Adjusted gross profit and margin and adjusted operating profit and margin are non-GAAP financial measures. Please see supplemental slides for a reconciliation of these measures and other important disclosures regarding the use of non-GAAP financial metrics. ($11.7) ($11.1) Q3 24 Q3 25 ($0.31)($0.34) Net Loss and Diluted EPS Adjusted EBITDA1 and Margin astronics.com 22 EPS and EBITDA $27.1 $32.7 Q3 24 Q3 25 1Adjusted EBITDA, adj. net income and adj. diluted EPS are a non-GAAP financial measures. Please see supplemental slides for a reconciliation of these measures and other important disclosures regarding the use of non-GAAP financial metrics. These metrics are as stated in Q1 2025 and are not restated to reflect the impact of the recent Convertible Senior Notes offering. ($ in millions; except EPS) Adj. Net Income and Adj. Diluted EPS1 $12.2 $19.4 Q3 24 Q3 25 $0.49$0.34 15.5%13.3% ($13.4) ($0.3) 9 Mos. 24 9 Mos. 25 ($0.01)($0.38) $21.3 $50.1 9 Mos. 24 9 Mos. 25 $1.28$0.60 $64.9 $88.9 9 Mos. 24 9 Mos. 25 14.3%11.1% astronics.com 23 Cash Flow and Capital Structure ($ in millions) Nine Months Ended Three Months EndedCash Flow 9/28/249/27/259/28/249/27/25 $ 4.1$ 47.2$8.5$ 34.2Net cash provided by operating activities (5.2)(19.9)(1.9)(13.2)Capital expenditures $ (1.1)$ 27.3$ 6.6$ 21.0Free cash flow (FCF)1 (Non-GAAP) atCapitalization 9/28/249/27/25 $ 18.4$ 19.6Cash and Equivalents (incl. restricted) 168.7334.0Total Debt 256.1108.9Shareholders’ equity $ 424.8$ 442.9Total capitalization » 2025 capex expected to be $40 million to $50 million for consolidation and capacity expansion in Redmond operations » Expect to be FCF positive for the year » Financing actions reduce cost of debt, add liquidity and improve flexibility » $225 million convertible note at 0.0% with capped call at $83.41 » $300 million senior secured cash flow revolver (currently SOFR + 200 bps) » $169 million in total liquidity2 » $160 million available on revolver + $9 million in available cash) » Decline in shareholders’ equity result of premium paid on repurchase of 5.5% Notes and purchase of capped call on new 0% Notes Strong Liquidity & Financial Flexibility 1Free cash flow is a non-GAAP financial measures defined as cash from operations less capital expenditures. The Company believes this frequently used metric is helpful to understand the Company’s performance. 2Available liquidity as of November 4, 2025 astronics.com 24 New 0% Convertible Senior Notes Capped call increases conversion price 90% 5-Year 0% Convertible Note and Capped Call $225.0 million / January 15, 2031Issuance and maturity 0.00%Annual coupon 25.0% and $54.87Conversion prem and price Net share settlement (4.1 million underlying shares)Settlement method 90% / $83.41Capped Call upper strike (Up % / $) 11.95% / $26.9 millionCapped Call Net cost (% of deal size / $mm) Why the second convert? + $165M 5.5% 2030 Notes were deep in the money + Favorable market conditions Issued $225M 2031 0% Notes, borrowed $85M from ABL and used $11M of cash on hand Repurchased 80% of 5.5% 2030 Notes for $286 million + Removed ~$132 million in principal equating to ~5.8 million underlying shares Resulting potential share dilution + 1.4 million potential share dilution with remaining $33 million of 5.5% 2030 Notes + No potential dilution on new 0% Notes until stock price exceeds $83.41 Dilution impact on GAAP EPS + No dilution on 0% 2031 Notes until stock price exceeds $54.87; then only shares associated with premium given net share settlement + 1.4 million shares for remaining 5.5% 2030 Notes

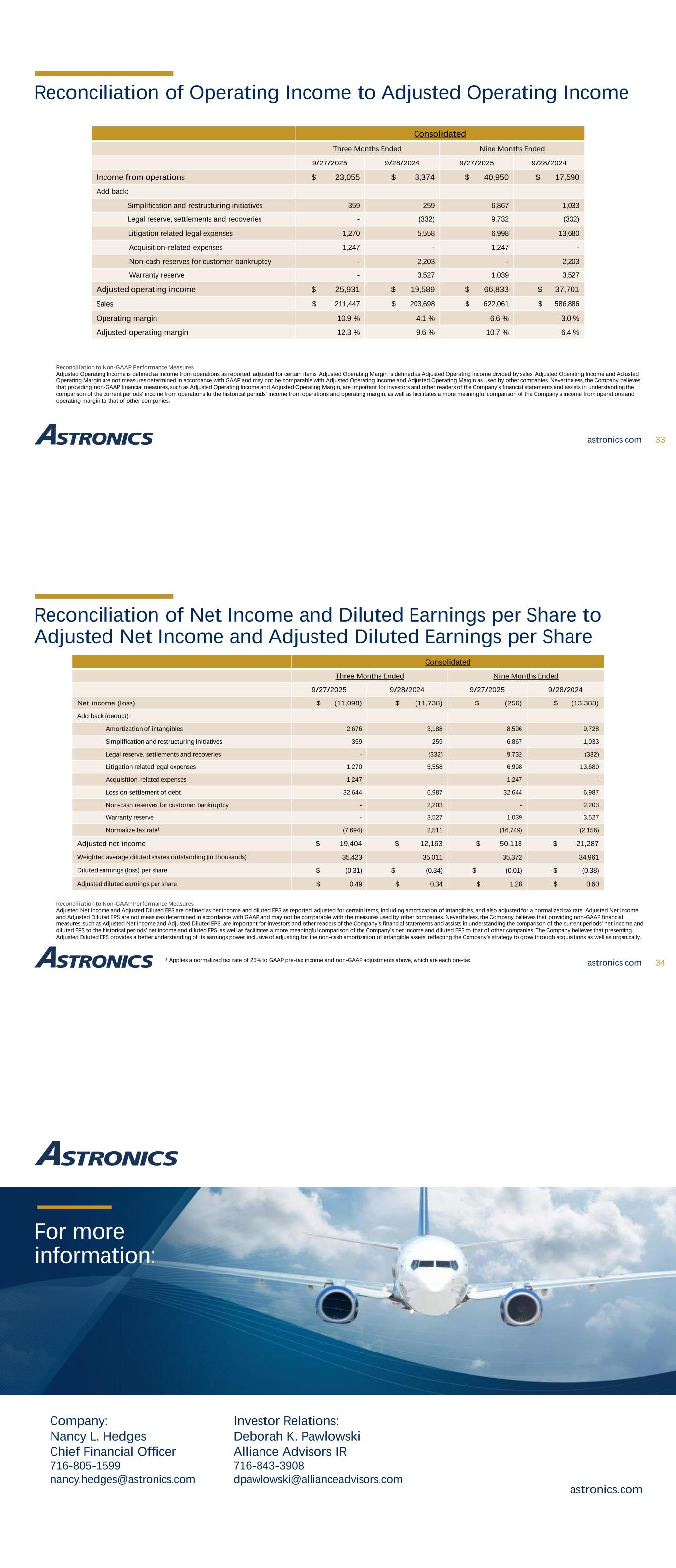

astronics.com Nasdaq: ATRO Astronics Investor Presentation January 2026 Peter J. Gundermann, Chairman, President & CEO Nancy L. Hedges, Vice President & CFO astronics.com 26 Astronics Corporation SUPPLEMENTAL INFORMATION INNOVATION. COLLABORATION. SUCCESS. 27 By structuring the new convertible notes with Net Share Settlement, Astronics will only incur share dilution for the in-the- money amount upon conversion If the Company did not have a capped call in place, this would also represent the economic dilution Net Share Dilution from the Convertible = 4.1mm x (Stock Price – Conversion Price) / Stock Price (1) Astronics owns capped call options that provide actual share dilution protection benefit from $54.87 to $83.41 Increases the effective conversion price to $83.41 However, under GAAP, capped call benefits are anti-dilutive and cannot be used to reduce the dilutive impact from the convertible until maturity / settlement As a result, GAAP EPS dilution under Treasury Stock Method begins from $54.87 Taking into account (1) Net Share Settlement where Astronics repays the principal amount in cash and only delivers in-the-money amount in shares and (2) capped call benefits, actual share dilution starts only from $83.41. Above this point, dilution is gradual and calculated under Treasury Stock Method Some companies report this dilution in the adjusted EPS as it shows the actual economic reality of the convertible dilution Net share settlement and capped call will have the effect of increasing the “no dilution point” of the convertible to $83.41 (1) Zero if stock price is below conversion price.. As part of this transaction, Astronics removed ~ 5.8mm of shares underlying the existing convertible notes through an all- cash repurchase. Share Dilution Removed = ~$132mm Principal Repurchased / $22.89 existing conversion price As the cash repurchase of the existing notes is equivalent to a leverage-friendly share repurchase, Astronics further mitigates overall dilution Total Potential Share Dilution After Repurchase Net Potential Share Dilution on New 2025 Convertible Bond Shares Receivable from Capped Call Hedge New 2025 Convertible Bond - Potential Dilution on Premium Above Conversion Price Potential Dilution Repurchased From Existing Convertible Potential Dilution from Existing 2024 Convertible Bond Stock Price at Maturity 1.40.00.00.0(5.8)7.2$43.8974 1.40.00.00.0(5.8)7.2$50.00 1.40.0(0.4)0.4(5.8)7.2$60.00 1.40.0(0.9)0.9(5.8)7.2$70.00 1.40.0(1.3)1.3(5.8)7.2$80.00 1.70.3(1.3)1.6(5.8)7.2$90.00 2.10.7(1.2)1.9(5.8)7.2$100.00 2.41.0(1.1)2.1(5.8)7.2$110.00 2.71.3(1.0)2.2(5.8)7.2$120.00 2.91.5(0.9)2.4(5.8)7.2$130.00 3.11.7(0.8)2.5(5.8)7.2$140.00 Dilution Impact from Astronics’ New Convertible and Capped Call Extensive List of Customers Representative List 280+ Airlines Airbus AMAC Aerospace Bell Helicopter Boeing Bombardier Cessna Cirrus Aircraft Collins Aerospace Comlux Dassault Aviation Delta Flight Products Embraer General Dynamics Gulfstream Honda Aircraft Honeywell Hughes Intelsat Jet Aviation Sikorsky Textron Aviation Thales Thompson Aero Seating U.S. Army/Navy/Air Force/Marines Viasat astronics.com 28 Kawasaki L3Harris Leonardo Lockheed Martin NASA Northrup Grumman Panasonic Avionics Pilatus Raytheon Technologies Safran

astronics.com 29 Created a Portfolio for Growth 2013 2014 2015 2016 2017 2018 2019 PECO Manufacturing » July 2013 » Aerospace: Manufacturing Services PGA Avionics » December 2013 » Aerospace: Power, Executive Armstrong Aerospace » January 2015 » Aerospace: Systems Certification, Power AeroSat » October 2013 » Aerospace: Connectivity EADS N.A. Test » February 2014 » Semiconductor and A&D Test Custom Control Concepts » April 2017 » Aerospace: Executive Telefonix PDT » December 2017 » Aerospace: Connectivity Sale of Semi Test Business » February 2019 » Semiconductor Test Freedom Communication Technologies » July 2019 » A&D Test Diagnosys Test Systems » October 2019 » A&D Test Select Competitors » Airbus KID – Systeme » Burrana » Collins Aerospace » Crane Aerospace ELECTRICAL POWER » Safran » Honeywell » Transdigm » Collins Aerospace LIGHTING & SAFETY AVIONICS » Viavi » Lockheed » National Instruments TEST SOLUTIONS » Meggitt » Safran » Ametek » Transdigm » Whelan » Diehl Aerospace » Kontron » Panasonic » Teradyne » Ametek » Keysight » Rhode & Schwartz Q3 2025Q2 2025Q1 2025Q4 2024Q3 2024 $ (11,098)$ 1,314$ 9,528($ 2,832)($ 11,738)GAAP Consolidated Net Income (Loss) 2,9203,0973,1504,1666,217Interest expense (1,226)5376463,4086,565Income tax expense (benefit) 5,1635,3785,5885,8946,041Depreciation and amortization 1,4391,5572,3452,1571,772Equity-based compensation expense ---624-Early retirement penalty waiver -----Non-cash 401K contribution and quarterly bonus accrual1 3596,2292791,411259Simplification and restructuring initiatives -3,5046,2284,762(332)Legal reserve, settlements and recoveries 1,2702,7532,9756,0665,558Litigation related legal expenses 1,247----Acquisition-related expenses 32,644--3,1616,987Loss on settlement of debt ---1,0322,203Non-cash reserves for customer bankruptcy -1,039-1,6903,527Warranty reserve $ 32,718$ 25,408$ 30,739$ 31,539$ 27,059Adjusted EBITDA Reconciliation of GAAP Net Income (Loss) to Adjusted EBITDA astronics.com 31 Reconciliation to Non-GAAP Performance Measures In addition to reporting net income, a U.S. generally accepted accounting principle (“GAAP”) measure, we present Adjusted EBITDA (earnings before interest, income taxes, depreciation and amortization, non-cash equity-based compensation expense, goodwill, intangible and long-lived asset impairment charges, equity investment income or loss, legal reserves, settlements and recoveries, restructuring charges, loss on extinguishment of debt, unusual specific warranty reserves, and customer bankruptcy reserve) which is a non-GAAP measure. The Company’s management believes Adjusted EBITDA is an important measure of operating performance because it allows management, investors and others to evaluate and compare the performance of its core operations from period to period by removing the impact of the capital structure (interest), tangible and intangible asset base (depreciation and amortization), taxes, equity- based compensation expense, goodwill, and other items as noted previously which are not commensurate with the core activities of the reporting period in which it is included. As such, the Company uses Adjusted EBITDA as a measure of performance when evaluating its business and as a basis for planning and forecasting. Adjusted EBITDA is not a measure of financial performance under GAAP and is not calculated through the application of GAAP. As such, it should not be considered as a substitute for the GAAP measure of net income and, therefore, should not be used in isolation of, but in conjunction with, the GAAP measure. Adjusted EBITDA, as presented, may produce results that vary from the GAAP measure and may not be comparable to a similarly defined non-GAAP measure used by other companies. 1 The sum of the four discrete quarters for the year ended December 31, 2024, does not sum to the zero-balance shown for the full year. In the first quarter of 2024, it was assumed that annual incentive compensation would be paid in stock, and thus such amount ($1.4 million) was presented as an addback for Adjusted EBITDA purposes. In the fourth quarter of 2024, it was concluded that all annual incentive compensation amounts would be paid in cash, and thus the addback for the full year has been eliminated. A reconciling adjustment has not been made to the quarter ended December 31, 2024, as it is deemed unnecessarily distortive to the Adjusted EBITDA measure for the quarter. Consolidated Nine Months EndedThree Months Ended 9/28/20249/27/20259/28/20249/27/2025 $ (13,383)$ (256)$ (11,738)$ (11,098)GAAP Consolidated Net Income 17,8329,1676,2172,920Interest expense 4,940(43)6,565(1,226)Income tax expense (benefit) 18,57216,1296,0415,163Depreciation and amortization expense 6,4145,3411,7721,439Equity-based compensation expense 3,454---Non-cash 401K contribution and quarter bonus accrual1 1,0336,867259359Simplification and restructuring initiatives (332)9,732(332)-Legal reserve, settlements and recoveries 13,6806,9985,5581,270Litigation-related legal expenses -1,247-1,247Acquisition-related expenses 6,98732,6446,98732,644Loss on settlement of debt 2,203-2,203-Non-cash reserves for customer bankruptcy 3,5271,0393,527-Warranty reserve $ 64,927$ 88,865$ 27,059$ 32,718Adjusted EBITDA1 $ 586,886$ 622,061$ 203,698$ 211,447Sales 11.1 %14.3 %13.3 %15.5 %Adjusted EBITDA margin % Reconciliation of GAAP Net Income (Loss) to Adjusted EBITDA astronics.com 32 Reconciliation to Non-GAAP Performance Measures In addition to reporting net income, a U.S. generally accepted accounting principle (“GAAP”) measure, we present Adjusted EBITDA (earnings before interest, income taxes, depreciation and amortization, non-cash equity-based compensation expense, goodwill, intangible and long-lived asset impairment charges, equity investment income or loss, legal reserves, settlements and recoveries, restructuring charges, gains or losses associated with the sale of businesses and grant benefits recorded related to the AMJP program), which is a non-GAAP measure. The Company’s management believes Adjusted EBITDA is an important measure of operating performance because it allows management, investors and others to evaluate and compare the performance of its core operations from period to period by removing the impact of the capital structure (interest), tangible and intangible asset base (depreciation and amortization), taxes, equity-based compensation expense, goodwill and other items as noted previously, which are not commensurate with the core activities of the reporting period in which it is included. As such, the Company uses Adjusted EBITDA as a measure of performance when evaluating its business and as a basis for planning and forecasting. Adjusted EBITDA is not a measure of financial performance under GAAP and is not calculated through the application of GAAP. As such, it should not be considered as a substitute for the GAAP measure of net income and, therefore, should not be used in isolation of, but in conjunction with, the GAAP measure. Adjusted EBITDA, as presented, may produce results that vary from the GAAP measure and may not be comparable to a similarly defined non-GAAP measure used by other companies. 1 Adjusted EBITDA is defined as net income before interest expense, income taxes, depreciation, amortization, and other adjustments. Adjusted EBITDA Margin is defined as Adjusted EBITDA divided by sales. Adjusted EBITDA and Adjusted EBITDA Margin are not measures determined in accordance with GAAP and may not be comparable with Adjusted EBITDA and Adjusted EBITDA Margin as used by other companies. Nevertheless, the Company believes that providing nonGAAP financial measures, such as Adjusted EBITDA and Adjusted EBITDA Margin, are important for investors and other readers of the Company’s financial statements.

Reconciliation of Operating Income to Adjusted Operating Income astronics.com 33 Reconciliation to Non-GAAP Performance Measures Adjusted Operating Income is defined as income from operations as reported, adjusted for certain items. Adjusted Operating Margin is defined as Adjusted Operating Income divided by sales. Adjusted Operating Income and Adjusted Operating Margin are not measures determined in accordance with GAAP and may not be comparable with Adjusted Operating Income and Adjusted Operating Margin as used by other companies. Nevertheless, the Company believes that providing non-GAAP financial measures, such as Adjusted Operating Income and Adjusted Operating Margin, are important for investors and other readers of the Company’s financial statements and assists in understanding the comparison of the current periods’ income from operations to the historical periods’ income from operations and operating margin, as well as facilitates a more meaningful comparison of the Company’s income from operations and operating margin to that of other companies. Consolidated Nine Months EndedThree Months Ended 9/28/20249/27/20259/28/20249/27/2025 $ 17,590$ 40,950$ 8,374$ 23,055Income from operations Add back: 1,0336,867259359Simplification and restructuring initiatives (332)9,732(332)-Legal reserve, settlements and recoveries 13,6806,9985,5581,270Litigation related legal expenses -1,247-1,247Acquisition-related expenses 2,203-2,203-Non-cash reserves for customer bankruptcy 3,5271,0393,527-Warranty reserve $ 37,701$ 66,833$ 19,589$ 25,931Adjusted operating income $ 586,886$ 622,061$ 203,698$ 211,447Sales 3.0 %6.6 %4.1 %10.9 %Operating margin 6.4 %10.7 %9.6 %12.3 %Adjusted operating margin Reconciliation of Net Income and Diluted Earnings per Share to Adjusted Net Income and Adjusted Diluted Earnings per Share astronics.com 341 Applies a normalized tax rate of 25% to GAAP pre-tax income and non-GAAP adjustments above, which are each pre-tax. Reconciliation to Non-GAAP Performance Measures Adjusted Net Income and Adjusted Diluted EPS are defined as net income and diluted EPS as reported, adjusted for certain items, including amortization of intangibles, and also adjusted for a normalized tax rate. Adjusted Net Income and Adjusted Diluted EPS are not measures determined in accordance with GAAP and may not be comparable with the measures used by other companies. Nevertheless, the Company believes that providing non-GAAP financial measures, such as Adjusted Net Income and Adjusted Diluted EPS, are important for investors and other readers of the Company’s financial statements and assists in understanding the comparison of the current periods’ net income and diluted EPS to the historical periods’ net income and diluted EPS, as well as facilitates a more meaningful comparison of the Company’s net income and diluted EPS to that of other companies. The Company believes that presenting Adjusted Diluted EPS provides a better understanding of its earnings power inclusive of adjusting for the non-cash amortization of intangible assets, reflecting the Company’s strategy to grow through acquisitions as well as organically. Consolidated Nine Months EndedThree Months Ended 9/28/20249/27/20259/28/20249/27/2025 $ (13,383)$ (256)$ (11,738)$ (11,098)Net income (loss) Add back (deduct): 9,7288,5963,1882,676Amortization of intangibles 1,0336,867259359Simplification and restructuring initiatives (332)9,732(332)-Legal reserve, settlements and recoveries 13,6806,9985,5581,270Litigation related legal expenses -1,247-1,247Acquisition-related expenses 6,98732,6446,98732,644Loss on settlement of debt 2,203-2,203-Non-cash reserves for customer bankruptcy 3,5271,0393,527-Warranty reserve (2,156)(16,749)2,511(7,694)Normalize tax rate1 $ 21,287$ 50,118$ 12,163$ 19,404Adjusted net income 34,96135,37235,01135,423Weighted average diluted shares outstanding (in thousands) $ (0.38)$ (0.01)$ (0.34)$ (0.31)Diluted earnings (loss) per share $ 0.60$ 1.28$ 0.34$ 0.49Adjusted diluted earnings per share For more information: astronics.com Company: Nancy L. Hedges Chief Financial Officer 716-805-1599 nancy.hedges@astronics.com Investor Relations: Deborah K. Pawlowski Alliance Advisors IR 716-843-3908 dpawlowski@allianceadvisors.com