September 26, 20200000050863December 262020Q3FALSE80,08473,3214,0984,2904,0984,2901.321.260.660.630.080.351.852.451.703.302.353.104.002.704.102.882.703.403.702.603.753.152.453.904.004.604.804.254.904.104.104.103.733.254.753.104.952.402.705.005.003.256,4471.021.3525,49423,25710,39211,54715,1129,92011,22012,42100000508632019-12-292020-09-26xbrli:shares00000508632020-09-26iso4217:USD00000508632020-06-282020-09-2600000508632019-06-302019-09-2800000508632018-12-302019-09-280000050863us-gaap:RetainedEarningsMember2020-06-282020-09-260000050863us-gaap:RetainedEarningsMember2019-12-292020-09-26iso4217:USDxbrli:shares00000508632019-12-2800000508632018-12-2900000508632019-09-280000050863us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2020-06-270000050863us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-06-270000050863us-gaap:RetainedEarningsMember2020-06-2700000508632020-06-270000050863us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-06-282020-09-260000050863us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2020-06-282020-09-260000050863us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2020-09-260000050863us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-09-260000050863us-gaap:RetainedEarningsMember2020-09-260000050863us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2019-06-290000050863us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-06-290000050863us-gaap:RetainedEarningsMember2019-06-2900000508632019-06-290000050863us-gaap:RetainedEarningsMember2019-06-302019-09-280000050863us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-06-302019-09-280000050863us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2019-06-302019-09-280000050863us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2019-09-280000050863us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-09-280000050863us-gaap:RetainedEarningsMember2019-09-280000050863us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2019-12-280000050863us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-280000050863us-gaap:RetainedEarningsMember2019-12-280000050863us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-292020-09-260000050863us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2019-12-292020-09-260000050863us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2018-12-290000050863us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-290000050863us-gaap:RetainedEarningsMember2018-12-290000050863us-gaap:RetainedEarningsMember2018-12-302019-09-280000050863us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-302019-09-280000050863us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2018-12-302019-09-280000050863intc:DCGPlatformMember2020-06-282020-09-260000050863intc:DCGPlatformMember2019-06-302019-09-280000050863intc:DCGPlatformMember2019-12-292020-09-260000050863intc:DCGPlatformMember2018-12-302019-09-280000050863intc:OtherProductOrServiceMemberintc:DataCenterGroupMember2020-06-282020-09-260000050863intc:OtherProductOrServiceMemberintc:DataCenterGroupMember2019-06-302019-09-280000050863intc:OtherProductOrServiceMemberintc:DataCenterGroupMember2019-12-292020-09-260000050863intc:OtherProductOrServiceMemberintc:DataCenterGroupMember2018-12-302019-09-280000050863intc:DataCenterGroupMember2020-06-282020-09-260000050863intc:DataCenterGroupMember2019-06-302019-09-280000050863intc:DataCenterGroupMember2019-12-292020-09-260000050863intc:DataCenterGroupMember2018-12-302019-09-280000050863intc:InternetOfThingsGroupMember2020-06-282020-09-260000050863intc:InternetOfThingsGroupMember2019-06-302019-09-280000050863intc:InternetOfThingsGroupMember2019-12-292020-09-260000050863intc:InternetOfThingsGroupMember2018-12-302019-09-280000050863intc:MobileyeMember2020-06-282020-09-260000050863intc:MobileyeMember2019-06-302019-09-280000050863intc:MobileyeMember2019-12-292020-09-260000050863intc:MobileyeMember2018-12-302019-09-280000050863intc:InternetofThingsMember2020-06-282020-09-260000050863intc:InternetofThingsMember2019-06-302019-09-280000050863intc:InternetofThingsMember2019-12-292020-09-260000050863intc:InternetofThingsMember2018-12-302019-09-280000050863intc:NonVolatileMemorySolutionsGroupMember2020-06-282020-09-260000050863intc:NonVolatileMemorySolutionsGroupMember2019-06-302019-09-280000050863intc:NonVolatileMemorySolutionsGroupMember2019-12-292020-09-260000050863intc:NonVolatileMemorySolutionsGroupMember2018-12-302019-09-280000050863intc:ProgrammableSolutionsGroupMember2020-06-282020-09-260000050863intc:ProgrammableSolutionsGroupMember2019-06-302019-09-280000050863intc:ProgrammableSolutionsGroupMember2019-12-292020-09-260000050863intc:ProgrammableSolutionsGroupMember2018-12-302019-09-280000050863intc:PlatformMemberintc:ClientComputingGroupMember2020-06-282020-09-260000050863intc:PlatformMemberintc:ClientComputingGroupMember2019-06-302019-09-280000050863intc:PlatformMemberintc:ClientComputingGroupMember2019-12-292020-09-260000050863intc:PlatformMemberintc:ClientComputingGroupMember2018-12-302019-09-280000050863intc:OtherProductOrServiceMemberintc:ClientComputingGroupMember2020-06-282020-09-260000050863intc:OtherProductOrServiceMemberintc:ClientComputingGroupMember2019-06-302019-09-280000050863intc:OtherProductOrServiceMemberintc:ClientComputingGroupMember2019-12-292020-09-260000050863intc:OtherProductOrServiceMemberintc:ClientComputingGroupMember2018-12-302019-09-280000050863intc:ClientComputingGroupMember2020-06-282020-09-260000050863intc:ClientComputingGroupMember2019-06-302019-09-280000050863intc:ClientComputingGroupMember2019-12-292020-09-260000050863intc:ClientComputingGroupMember2018-12-302019-09-280000050863us-gaap:AllOtherSegmentsMember2020-06-282020-09-260000050863us-gaap:AllOtherSegmentsMember2019-06-302019-09-280000050863us-gaap:AllOtherSegmentsMember2019-12-292020-09-260000050863us-gaap:AllOtherSegmentsMember2018-12-302019-09-280000050863intc:IOTGPlatformMember2020-06-282020-09-260000050863intc:IOTGPlatformMember2019-06-302019-09-280000050863intc:IOTGPlatformMember2019-12-292020-09-260000050863intc:IOTGPlatformMember2018-12-302019-09-280000050863intc:DesktopPlatformMember2020-06-282020-09-260000050863intc:DesktopPlatformMember2019-06-302019-09-280000050863intc:DesktopPlatformMember2019-12-292020-09-260000050863intc:DesktopPlatformMember2018-12-302019-09-280000050863intc:NotebookPlatformMember2020-06-282020-09-260000050863intc:NotebookPlatformMember2019-06-302019-09-280000050863intc:NotebookPlatformMember2019-12-292020-09-260000050863intc:NotebookPlatformMember2018-12-302019-09-280000050863intc:OtherPlatformMember2020-06-282020-09-260000050863intc:OtherPlatformMember2019-06-302019-09-280000050863intc:OtherPlatformMember2019-12-292020-09-260000050863intc:OtherPlatformMember2018-12-302019-09-280000050863intc:PlatformMember2020-06-282020-09-260000050863intc:PlatformMember2019-06-302019-09-280000050863intc:PlatformMember2019-12-292020-09-260000050863intc:PlatformMember2018-12-302019-09-280000050863intc:OtherProductOrServiceMember2020-06-282020-09-260000050863intc:OtherProductOrServiceMember2019-06-302019-09-280000050863intc:OtherProductOrServiceMember2019-12-292020-09-260000050863intc:OtherProductOrServiceMember2018-12-302019-09-280000050863us-gaap:SubsequentEventMember2020-10-192020-10-190000050863us-gaap:SubsequentEventMember2020-10-222020-10-220000050863srt:ScenarioForecastMember2025-03-012025-03-310000050863intc:PrepaidSupplyAgreementsMember2020-09-260000050863intc:PrepaidSupplyAgreementsMember2019-12-280000050863intc:SoftwareServicesandOtherMember2020-09-260000050863intc:SoftwareServicesandOtherMember2019-12-280000050863intc:PrepaidSupplyAgreementsMember2019-12-292020-09-2600000508632020-08-012020-08-310000050863intc:A2020RestructuringProgramMember2020-06-282020-09-260000050863intc:A2019RestructuringProgramMember2019-06-302019-09-280000050863intc:A2020RestructuringProgramMember2019-12-292020-09-260000050863intc:A2019RestructuringProgramMember2018-12-302019-09-280000050863us-gaap:DebtSecuritiesMember2020-06-282020-09-260000050863us-gaap:DebtSecuritiesMember2019-12-292020-09-260000050863us-gaap:DebtSecuritiesMember2018-12-302019-09-280000050863us-gaap:DebtSecuritiesMember2019-06-302019-09-280000050863us-gaap:CorporateDebtSecuritiesMember2020-09-260000050863us-gaap:CorporateDebtSecuritiesMember2019-12-280000050863us-gaap:FixedIncomeSecuritiesMember2020-09-260000050863us-gaap:FixedIncomeSecuritiesMember2019-12-280000050863intc:GovernmentDebtSecuritiesMember2020-09-260000050863intc:GovernmentDebtSecuritiesMember2019-12-280000050863intc:ImFlashTechnologiesLlcMember2019-09-28xbrli:pure0000050863us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2019-12-292020-09-260000050863intc:MoovitMember2020-05-042020-05-040000050863intc:MoovitMember2020-05-0400000508632020-07-312020-07-310000050863us-gaap:CommercialPaperMember2020-09-260000050863intc:DebtInstrumentThirtyEightMember2020-09-260000050863intc:DebtInstrumentThirtyEightMember2019-12-280000050863intc:DebtInstrumentFortyMember2020-09-260000050863intc:DebtInstrumentFortyMember2019-12-280000050863intc:DebtinstrumentThirtySevenMember2020-09-260000050863intc:DebtinstrumentThirtySevenMember2019-12-280000050863intc:DebtInstrumentFourteenMember2020-09-260000050863intc:DebtInstrumentFourteenMember2019-12-280000050863intc:DebtInstrumentThirtyOneMember2020-09-260000050863intc:DebtInstrumentThirtyOneMember2019-12-280000050863intc:DebtInstrumentSevenMember2020-09-260000050863intc:DebtInstrumentSevenMember2019-12-280000050863intc:DebtInstrumentThirtyNineMember2020-09-260000050863intc:DebtInstrumentThirtyNineMember2019-12-280000050863intc:DebtInstrumentFifteenMember2020-09-260000050863intc:DebtInstrumentFifteenMember2019-12-280000050863intc:DebtInstrumentTwentyThreeMember2020-09-260000050863intc:DebtInstrumentTwentyThreeMember2019-12-280000050863intc:DebtInstrumentTenMember2020-09-260000050863intc:DebtInstrumentTenMember2019-12-280000050863intc:DebtInstrumentTwentyNineMember2020-09-260000050863intc:DebtInstrumentTwentyNineMember2019-12-280000050863intc:DebtInstrumentFortyOneMember2020-09-260000050863intc:DebtInstrumentFortyOneMember2019-12-280000050863intc:DebtInstrumentFortyFourMember2020-09-260000050863intc:DebtInstrumentFortyFourMember2019-12-280000050863intc:FixedrateSeniorNotes3.40dueMarch2025Member2020-09-260000050863intc:FixedrateSeniorNotes3.40dueMarch2025Member2019-12-280000050863intc:DebtInstrumentSixteenMember2020-09-260000050863intc:DebtInstrumentSixteenMember2019-12-280000050863intc:DebtInstrumentThirtyTwoMember2020-09-260000050863intc:DebtInstrumentThirtyTwoMember2019-12-280000050863intc:FixedrateSeniorNotes3.75dueMarch2027Member2020-09-260000050863intc:FixedrateSeniorNotes3.75dueMarch2027Member2019-12-280000050863intc:DebtInstrumentFortyTwoMember2020-09-260000050863intc:DebtInstrumentFortyTwoMember2019-12-280000050863intc:A2019SeniorNotesdueDecember2029at2.45Member2020-09-260000050863intc:A2019SeniorNotesdueDecember2029at2.45Member2019-12-280000050863intc:FixedrateSeniorNotes3.90dueMarch2030Member2020-09-260000050863intc:FixedrateSeniorNotes3.90dueMarch2030Member2019-12-280000050863intc:DebtInstrumentElevenMember2020-09-260000050863intc:DebtInstrumentElevenMember2019-12-280000050863intc:FixedrateSeniorNotes4.60dueMarch2040Member2020-09-260000050863intc:FixedrateSeniorNotes4.60dueMarch2040Member2019-12-280000050863intc:DebtInstrumentEightMember2020-09-260000050863intc:DebtInstrumentEightMember2019-12-280000050863intc:DebtInstrumentTwelveMember2020-09-260000050863intc:DebtInstrumentTwelveMember2019-12-280000050863intc:DebtInstrumentSeventeenMember2020-09-260000050863intc:DebtInstrumentSeventeenMember2019-12-280000050863intc:DebtInstrumentThirtyThreeMember2020-09-260000050863intc:DebtInstrumentThirtyThreeMember2019-12-280000050863intc:DebtInstrumentFortyThreeMember2020-09-260000050863intc:DebtInstrumentFortyThreeMember2019-12-280000050863intc:A6404.10SeniorNotesdueAugust2047Member2020-09-260000050863intc:A6404.10SeniorNotesdueAugust2047Member2019-12-280000050863intc:A2017SeniornotesdueDecember2047at3.73Member2020-09-260000050863intc:A2017SeniornotesdueDecember2047at3.73Member2019-12-280000050863intc:A2019SeniorNotesdueDecember2049at3.25Member2020-09-260000050863intc:A2019SeniorNotesdueDecember2049at3.25Member2019-12-280000050863intc:FixedrateSeniorNotes4.75dueMarch2050Member2020-09-260000050863intc:FixedrateSeniorNotes4.75dueMarch2050Member2019-12-280000050863intc:FixedrateSeniorNotes3.10dueFebruary2060Member2020-09-260000050863intc:FixedrateSeniorNotes3.10dueFebruary2060Member2019-12-280000050863intc:FixedrateSeniorNotes4.95dueMarch2060Member2020-09-260000050863intc:FixedrateSeniorNotes4.95dueMarch2060Member2019-12-280000050863intc:OregonandArizonaBondsMember2020-09-260000050863intc:OregonandArizonaBondsMember2019-12-280000050863intc:StateofOregonBusinessDevelopmentCommissionMember2020-09-260000050863intc:StateofOregonBusinessDevelopmentCommissionMember2019-12-280000050863intc:IndustrialAuthorityoftheCityofChandlerArizonaMember2020-09-260000050863intc:IndustrialAuthorityoftheCityofChandlerArizonaMember2019-12-280000050863intc:DebtInstrumentFourMember2020-09-260000050863intc:DebtInstrumentFourMember2019-12-280000050863us-gaap:FairValueHedgingMemberus-gaap:InterestRateSwapMember2019-12-292020-09-260000050863us-gaap:FairValueHedgingMemberus-gaap:InterestRateSwapMember2019-12-292020-06-270000050863intc:DebtInstrumentTwentyThreeMemberus-gaap:CrossCurrencyInterestRateContractMember2020-09-260000050863intc:ConvertibleDebentures2009Memberus-gaap:ConvertibleDebtMember2020-03-292020-06-270000050863intc:SeniorNotesDueMay2020Memberus-gaap:SeniorNotesMember2020-03-292020-06-270000050863us-gaap:SeniorNotesMemberintc:SeniorNotesDueJuly2020Member2020-06-282020-09-260000050863us-gaap:SeniorNotesMember2020-09-260000050863intc:DebtInstrumentThirtyEightMemberus-gaap:LondonInterbankOfferedRateLIBORMember2019-12-292020-09-260000050863us-gaap:LondonInterbankOfferedRateLIBORMemberintc:DebtInstrumentFortyMember2019-12-292020-09-260000050863srt:MinimumMemberintc:OregonandArizonaBondsMember2020-09-260000050863srt:MaximumMemberintc:OregonandArizonaBondsMember2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CashEquivalentsMemberus-gaap:CorporateDebtSecuritiesMember2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMemberus-gaap:CorporateDebtSecuritiesMember2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CashEquivalentsMemberus-gaap:CorporateDebtSecuritiesMember2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMemberus-gaap:CorporateDebtSecuritiesMember2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMemberus-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel1Member2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMemberus-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel2Member2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CashEquivalentsMemberus-gaap:FixedIncomeSecuritiesMember2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMemberus-gaap:FixedIncomeSecuritiesMember2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMemberus-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel1Member2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMemberus-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel2Member2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CashEquivalentsMemberus-gaap:FixedIncomeSecuritiesMember2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMemberus-gaap:FixedIncomeSecuritiesMember2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMemberus-gaap:FairValueInputsLevel1Memberintc:GovernmentDebtSecuritiesMember2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMemberus-gaap:FairValueInputsLevel2Memberintc:GovernmentDebtSecuritiesMember2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CashEquivalentsMemberintc:GovernmentDebtSecuritiesMember2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMemberintc:GovernmentDebtSecuritiesMember2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMemberus-gaap:FairValueInputsLevel1Memberintc:GovernmentDebtSecuritiesMember2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMemberus-gaap:FairValueInputsLevel2Memberintc:GovernmentDebtSecuritiesMember2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CashEquivalentsMemberintc:GovernmentDebtSecuritiesMember2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMemberintc:GovernmentDebtSecuritiesMember2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMemberus-gaap:FairValueInputsLevel1Member2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMemberus-gaap:FairValueInputsLevel2Member2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CashEquivalentsMember2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMember2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMemberus-gaap:FairValueInputsLevel1Member2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMemberus-gaap:FairValueInputsLevel2Member2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CashEquivalentsMember2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMember2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ShortTermInvestmentsMemberus-gaap:CorporateDebtSecuritiesMember2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:CorporateDebtSecuritiesMember2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ShortTermInvestmentsMemberus-gaap:CorporateDebtSecuritiesMember2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:CorporateDebtSecuritiesMember2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel1Member2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel2Member2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ShortTermInvestmentsMemberus-gaap:FixedIncomeSecuritiesMember2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:FixedIncomeSecuritiesMember2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel1Member2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel2Member2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ShortTermInvestmentsMemberus-gaap:FixedIncomeSecuritiesMember2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:FixedIncomeSecuritiesMember2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel1Memberintc:GovernmentDebtSecuritiesMember2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel2Memberintc:GovernmentDebtSecuritiesMember2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ShortTermInvestmentsMemberintc:GovernmentDebtSecuritiesMember2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberintc:GovernmentDebtSecuritiesMember2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel1Memberintc:GovernmentDebtSecuritiesMember2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberus-gaap:FairValueInputsLevel2Memberintc:GovernmentDebtSecuritiesMember2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ShortTermInvestmentsMemberintc:GovernmentDebtSecuritiesMember2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ShortTermInvestmentsMemberintc:GovernmentDebtSecuritiesMember2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel1Member2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel2Member2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FixedIncomeSecuritiesMember2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FixedIncomeSecuritiesMember2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel1Member2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel2Member2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FixedIncomeSecuritiesMember2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FixedIncomeSecuritiesMember2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberintc:GovernmentDebtSecuritiesMember2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberintc:GovernmentDebtSecuritiesMember2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberintc:GovernmentDebtSecuritiesMember2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberintc:GovernmentDebtSecuritiesMember2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberintc:GovernmentDebtSecuritiesMember2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberintc:GovernmentDebtSecuritiesMember2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberintc:GovernmentDebtSecuritiesMember2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberintc:GovernmentDebtSecuritiesMember2019-12-280000050863us-gaap:OtherCurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2020-09-260000050863us-gaap:OtherCurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2020-09-260000050863us-gaap:OtherCurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2020-09-260000050863us-gaap:OtherCurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMember2020-09-260000050863us-gaap:OtherCurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2019-12-280000050863us-gaap:OtherCurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2019-12-280000050863us-gaap:OtherCurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2019-12-280000050863us-gaap:OtherCurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMember2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel1Member2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel2Member2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:EquitySecuritiesMember2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMember2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel1Member2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMemberus-gaap:FairValueInputsLevel2Member2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:EquitySecuritiesMember2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EquitySecuritiesMember2019-12-280000050863us-gaap:OtherLongTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2020-09-260000050863us-gaap:OtherLongTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2020-09-260000050863us-gaap:OtherLongTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2020-09-260000050863us-gaap:OtherLongTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2020-09-260000050863us-gaap:OtherLongTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2019-12-280000050863us-gaap:OtherLongTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2019-12-280000050863us-gaap:OtherLongTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2019-12-280000050863us-gaap:OtherLongTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2019-12-280000050863us-gaap:OtherLongTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel1Member2020-09-260000050863us-gaap:OtherLongTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel2Member2020-09-260000050863us-gaap:OtherLongTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FixedIncomeSecuritiesMember2020-09-260000050863us-gaap:OtherLongTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FixedIncomeSecuritiesMember2020-09-260000050863us-gaap:OtherLongTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel1Member2019-12-280000050863us-gaap:OtherLongTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel2Member2019-12-280000050863us-gaap:OtherLongTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FixedIncomeSecuritiesMember2019-12-280000050863us-gaap:OtherLongTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FixedIncomeSecuritiesMember2019-12-280000050863us-gaap:OtherLongTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberintc:GovernmentDebtSecuritiesMember2020-09-260000050863us-gaap:OtherLongTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberintc:GovernmentDebtSecuritiesMember2020-09-260000050863us-gaap:OtherLongTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberintc:GovernmentDebtSecuritiesMember2020-09-260000050863us-gaap:OtherLongTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberintc:GovernmentDebtSecuritiesMember2020-09-260000050863us-gaap:OtherLongTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberintc:GovernmentDebtSecuritiesMember2019-12-280000050863us-gaap:OtherLongTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberintc:GovernmentDebtSecuritiesMember2019-12-280000050863us-gaap:OtherLongTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberintc:GovernmentDebtSecuritiesMember2019-12-280000050863us-gaap:OtherLongTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberintc:GovernmentDebtSecuritiesMember2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherNoncurrentAssetsMemberus-gaap:FairValueInputsLevel1Member2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherNoncurrentAssetsMemberus-gaap:FairValueInputsLevel2Member2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherNoncurrentAssetsMemberus-gaap:FairValueInputsLevel3Member2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherNoncurrentAssetsMember2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherNoncurrentAssetsMemberus-gaap:FairValueInputsLevel1Member2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherNoncurrentAssetsMemberus-gaap:FairValueInputsLevel2Member2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherNoncurrentAssetsMemberus-gaap:FairValueInputsLevel3Member2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherNoncurrentAssetsMember2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMember2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMember2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherCurrentLiabilitiesMemberus-gaap:FairValueInputsLevel1Member2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherCurrentLiabilitiesMemberus-gaap:FairValueInputsLevel2Member2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:OtherCurrentLiabilitiesMember2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherCurrentLiabilitiesMember2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherCurrentLiabilitiesMemberus-gaap:FairValueInputsLevel1Member2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherCurrentLiabilitiesMemberus-gaap:FairValueInputsLevel2Member2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:OtherCurrentLiabilitiesMember2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherCurrentLiabilitiesMember2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:FairValueInputsLevel1Member2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:FairValueInputsLevel2Member2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:FairValueInputsLevel3Member2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherNoncurrentLiabilitiesMember2020-09-260000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:FairValueInputsLevel1Member2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:FairValueInputsLevel2Member2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:FairValueInputsLevel3Member2019-12-280000050863us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherNoncurrentLiabilitiesMember2019-12-280000050863us-gaap:FairValueMeasurementsNonrecurringMember2020-09-260000050863us-gaap:FairValueMeasurementsNonrecurringMember2019-12-280000050863us-gaap:AccumulatedNetInvestmentGainLossIncludingPortionAttributableToNoncontrollingInterestMember2019-12-280000050863us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2019-12-280000050863us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetGainLossIncludingPortionAttributableToNoncontrollingInterestMember2019-12-280000050863us-gaap:AccumulatedTranslationAdjustmentMember2019-12-280000050863us-gaap:AccumulatedNetInvestmentGainLossIncludingPortionAttributableToNoncontrollingInterestMember2019-12-292020-09-260000050863us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2019-12-292020-09-260000050863us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetGainLossIncludingPortionAttributableToNoncontrollingInterestMember2019-12-292020-09-260000050863us-gaap:AccumulatedTranslationAdjustmentMember2019-12-292020-09-260000050863us-gaap:AccumulatedNetInvestmentGainLossIncludingPortionAttributableToNoncontrollingInterestMember2020-09-260000050863us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2020-09-260000050863us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetGainLossIncludingPortionAttributableToNoncontrollingInterestMember2020-09-260000050863us-gaap:AccumulatedTranslationAdjustmentMember2020-09-260000050863us-gaap:ForeignExchangeContractMember2020-09-260000050863us-gaap:ForeignExchangeContractMember2019-12-280000050863us-gaap:InterestRateContractMember2020-09-260000050863us-gaap:InterestRateContractMember2019-12-280000050863us-gaap:OtherContractMember2020-09-260000050863us-gaap:OtherContractMember2019-12-280000050863us-gaap:OtherAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:ForeignExchangeContractMember2020-09-260000050863us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:ForeignExchangeContractMemberus-gaap:OtherLiabilitiesMember2020-09-260000050863us-gaap:OtherAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:ForeignExchangeContractMember2019-12-280000050863us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:ForeignExchangeContractMemberus-gaap:OtherLiabilitiesMember2019-12-280000050863us-gaap:OtherAssetsMemberus-gaap:InterestRateContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-09-260000050863us-gaap:InterestRateContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherLiabilitiesMember2020-09-260000050863us-gaap:OtherAssetsMemberus-gaap:InterestRateContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2019-12-280000050863us-gaap:InterestRateContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherLiabilitiesMember2019-12-280000050863us-gaap:OtherAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-09-260000050863us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherLiabilitiesMember2020-09-260000050863us-gaap:OtherAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMember2019-12-280000050863us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherLiabilitiesMember2019-12-280000050863us-gaap:OtherAssetsMemberus-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2020-09-260000050863us-gaap:ForeignExchangeContractMemberus-gaap:OtherLiabilitiesMemberus-gaap:NondesignatedMember2020-09-260000050863us-gaap:OtherAssetsMemberus-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2019-12-280000050863us-gaap:ForeignExchangeContractMemberus-gaap:OtherLiabilitiesMemberus-gaap:NondesignatedMember2019-12-280000050863us-gaap:OtherAssetsMemberus-gaap:InterestRateContractMemberus-gaap:NondesignatedMember2020-09-260000050863us-gaap:InterestRateContractMemberus-gaap:OtherLiabilitiesMemberus-gaap:NondesignatedMember2020-09-260000050863us-gaap:OtherAssetsMemberus-gaap:InterestRateContractMemberus-gaap:NondesignatedMember2019-12-280000050863us-gaap:InterestRateContractMemberus-gaap:OtherLiabilitiesMemberus-gaap:NondesignatedMember2019-12-280000050863us-gaap:OtherAssetsMemberus-gaap:OtherContractMemberus-gaap:NondesignatedMember2020-09-260000050863us-gaap:OtherContractMemberus-gaap:OtherLiabilitiesMemberus-gaap:NondesignatedMember2020-09-260000050863us-gaap:OtherAssetsMemberus-gaap:OtherContractMemberus-gaap:NondesignatedMember2019-12-280000050863us-gaap:OtherContractMemberus-gaap:OtherLiabilitiesMemberus-gaap:NondesignatedMember2019-12-280000050863us-gaap:OtherAssetsMemberus-gaap:NondesignatedMember2020-09-260000050863us-gaap:OtherLiabilitiesMemberus-gaap:NondesignatedMember2020-09-260000050863us-gaap:OtherAssetsMemberus-gaap:NondesignatedMember2019-12-280000050863us-gaap:OtherLiabilitiesMemberus-gaap:NondesignatedMember2019-12-280000050863us-gaap:OtherAssetsMember2020-09-260000050863us-gaap:OtherLiabilitiesMember2020-09-260000050863us-gaap:OtherAssetsMember2019-12-280000050863us-gaap:OtherLiabilitiesMember2019-12-280000050863us-gaap:ForeignExchangeContractMember2020-06-282020-09-260000050863us-gaap:ForeignExchangeContractMember2019-12-292020-09-260000050863us-gaap:ForeignExchangeContractMember2019-06-302019-09-280000050863us-gaap:ForeignExchangeContractMember2018-12-302019-09-280000050863us-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:FairValueHedgingMember2019-12-292020-09-260000050863us-gaap:InterestRateContractMember2020-06-282020-09-260000050863us-gaap:InterestRateContractMember2019-06-302019-09-280000050863us-gaap:InterestRateContractMember2019-12-292020-09-260000050863us-gaap:InterestRateContractMember2018-12-302019-09-280000050863us-gaap:LongTermDebtMemberus-gaap:FairValueHedgingMemberus-gaap:InterestRateSwapMember2020-09-260000050863us-gaap:LongTermDebtMemberus-gaap:FairValueHedgingMemberus-gaap:InterestRateSwapMember2019-12-280000050863us-gaap:LongTermDebtMemberus-gaap:FairValueHedgingMemberus-gaap:InterestRateSwapMember2019-12-292020-09-260000050863us-gaap:LongTermDebtMemberus-gaap:FairValueHedgingMemberus-gaap:InterestRateSwapMember2019-12-292020-06-270000050863us-gaap:NondesignatedMember2019-12-292020-09-260000050863us-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2020-06-282020-09-260000050863us-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2019-06-302019-09-280000050863us-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2019-12-292020-09-260000050863us-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2018-12-302019-09-280000050863us-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:InterestRateContractMemberus-gaap:NondesignatedMember2020-06-282020-09-260000050863us-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:InterestRateContractMemberus-gaap:NondesignatedMember2019-06-302019-09-280000050863us-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:InterestRateContractMemberus-gaap:NondesignatedMember2019-12-292020-09-260000050863us-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:InterestRateContractMemberus-gaap:NondesignatedMember2018-12-302019-09-280000050863intc:VariousMemberus-gaap:OtherContractMemberus-gaap:NondesignatedMember2020-06-282020-09-260000050863intc:VariousMemberus-gaap:OtherContractMemberus-gaap:NondesignatedMember2019-06-302019-09-280000050863intc:VariousMemberus-gaap:OtherContractMemberus-gaap:NondesignatedMember2019-12-292020-09-260000050863intc:VariousMemberus-gaap:OtherContractMemberus-gaap:NondesignatedMember2018-12-302019-09-280000050863us-gaap:NondesignatedMember2020-06-282020-09-260000050863us-gaap:NondesignatedMember2019-06-302019-09-280000050863us-gaap:NondesignatedMember2018-12-302019-09-28iso4217:EUR0000050863intc:EcFineMember2009-05-012009-05-31

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| | | | | | | | | | | |

| | ☑ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| | For the quarterly period ended | September 26, 2020 |

Or

| | | | | | | | |

| | ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the transition period from to |

Commission File Number 000-06217

INTEL CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | | 94-1672743 |

| (State or other jurisdiction of incorporation or organization) | | | | (I.R.S. Employer Identification No.) |

| | | | |

| 2200 Mission College Boulevard, | Santa Clara, | California | | 95054-1549 |

| (Address of principal executive offices) | | | | (Zip Code) |

(408) 765-8080

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, $0.001 par value | INTC | Nasdaq Global Select Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

| Large Accelerated Filer | | Accelerated filer | | Non-accelerated filer | | Smaller reporting company | Emerging growth company |

☑

| | ¨ | | ¨ | | ☐ | ☐ |

| | | | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

As of September 26, 2020, the registrant had outstanding 4,098 million shares of common stock.

TABLE OF CONTENTS

THE ORGANIZATION OF OUR QUARTERLY REPORT ON FORM 10-Q

The order and presentation of content in our Form 10-Q differs from the traditional SEC Form 10-Q format. Our format is designed to improve readability and better present how we organize and manage our business. See "Form 10-Q Cross-Reference Index" within Other Key Information for a cross-reference index to the traditional SEC Form 10-Q format. To reflect our focus on transforming from a PC-centric1 company to a data-centric company, we have presented our data-centric businesses1 first in "Segment Trends and Results" within MD&A.

We have defined certain terms and abbreviations used throughout our Form 10-Q in "Key Terms" within the Consolidated Condensed Financial Statements and Supplemental Details.

The preparation of our Consolidated Condensed Financial Statements is in conformity with U.S. GAAP. Our Form 10-Q includes key metrics that we use to measure our business, some of which are non-GAAP measures. See "Non-GAAP Financial Measures" within MD&A for an explanation of these measures and why management uses them and believes they provide investors with useful supplemental information.

| | | | | | | | | | | |

| | | Page |

FORWARD-LOOKING STATEMENTS | | | |

OUR PANDEMIC RESPONSE | | | |

A QUARTER IN REVIEW | | | |

CONSOLIDATED CONDENSED FINANCIAL STATEMENTS AND SUPPLEMENTAL DETAILS | | | |

| Consolidated Condensed Statements of Income | | |

| Consolidated Condensed Statements of Comprehensive Income | | |

| Consolidated Condensed Balance Sheets | | |

| Consolidated Condensed Statements of Cash Flows | | |

| Consolidated Condensed Statements of Stockholders' Equity | | |

| Notes to Consolidated Condensed Financial Statements | | |

| Key Terms | | |

| | | |

MANAGEMENT'S DISCUSSION AND ANALYSIS | | | |

| | | |

| | | |

| Segment Trends and Results | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Consolidated Results of Operations | | |

| Liquidity and Capital Resources | | |

| Contractual Obligations | | |

| Quantitative and Qualitative Disclosures about Market Risk | | |

| Non-GAAP Financial Measures | | |

| | | |

OTHER KEY INFORMATION | | | |

| Risk Factors | | |

| Controls and Procedures | | |

| | | |

| Issuer Purchases of Equity Securities | | |

| Exhibits | | |

| Form 10-Q Cross-Reference Index | | |

1 Intel's definition is included in "Key Terms" within the Consolidated Condensed Financial Statements and Supplemental Details.

FORWARD-LOOKING STATEMENTS

This Form 10-Q contains forward-looking statements that involve a number of risks and uncertainties. Words such as "anticipate," "expect," "intend," "anticipate," "plan," "mission," "opportunity," "future," "to be," "believes," "estimated," "continue," "likely," "may," "might," "potentially," "will," "would," "should," "could," and variations of such words and similar expressions are intended to identify such forward-looking statements. In addition, any statements that refer to future responses to and effects of COVID-19; projections of our future financial performance and demand; our anticipated growth and trends in our businesses or operations; projected growth and trends in markets relevant to our businesses; business plans; future products and technology and the expected availability and benefits of such products and technology; expected timing and impact of acquisitions, divestitures, and other significant transactions, including statements relating to the pending divestiture of our NAND memory business to SK hynix Inc. (SK hynix), NAND manufacturing and supply arrangements between Intel and SK hynix, and our expected use of proceeds from the divestiture; expected completion of restructuring activities; availability, uses, sufficiency, and cost of capital and capital resources, including expected returns to stockholders such as dividends and share repurchases; our valuation; the settlement of our ASR agreements; accounting estimates and judgments regarding reported matters, events and contingencies and our intentions with respect to such matters, events and contingencies, and the actual results thereof; future production capacity and product supply; the future purchase, use, and availability of products, components and services supplied by third parties, including third-party manufacturing services; tax-related expectations; uncertain events or assumptions; and other characterizations of future events or circumstances are forward-looking statements. Such statements are based on management's expectations as of the date of this filing, unless an earlier date is specified, and involve many risks and uncertainties that could cause our actual results to differ materially from those expressed or implied in our forward-looking statements. Such risks and uncertainties include those described throughout this report, our 2019 Form 10-K, and our Form 10-Q reports for the quarters ended March 28, 2020 and June 27, 2020, particularly the "Risk Factors" sections of such reports, as well as the risks and uncertainties described in our Form 8-K announcing our agreement to divest our NAND memory business to SK hynix, filed with the SEC on October 20, 2020. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. Readers are urged to carefully review and consider the various disclosures made in this Form 10-Q and in other documents we file from time to time with the SEC that disclose risks and uncertainties that may affect our business. Unless specifically indicated otherwise, the forward-looking statements in this Form 10-Q do not reflect the potential impact of any divestitures, mergers, acquisitions, or other business combinations that have not been completed as of the date of this filing. In addition, the forward-looking statements in this Form 10-Q are made as of the date of this filing, unless an earlier date is specified, including expectations based on third-party information and projections that management believes to be reputable, and Intel does not undertake, and expressly disclaims any duty, to update such statements, whether as a result of new information, new developments, or otherwise, except to the extent that disclosure may be required by law.

Intel, the Intel logo, 3D XPoint, Intel Atom, Intel Core, Intel Evo, Iris, and Intel Optane, are trademarks of Intel Corporation or its subsidiaries in the U.S. and/or other countries.

* Other names and brands may be claimed as the property of others.

As we closely monitor the COVID-19 pandemic, our top priority remains protecting the health and safety of our employees. Our Pandemic Leadership Team regularly reviews and adapts our policies based on evolving research and guidance related to the virus. While essential operations continue in our factories and labs around the world, we have restricted travel and meetings, changed our business processes, published a wealth of information, and adapted to a world where many in our workforce are remote and those coming on-site are following new safety measures. We have a multi-phase plan to return to working on-site, and remain committed to delivering for our customers and supporting our communities. Our world-class safety standards and supply chain operations have to date allowed our factories to continue to operate safely and with mostly on-time deliveries. We will continue to actively monitor the situation and review our plans based on the requirements and recommendations of the federal, state, and local authorities.

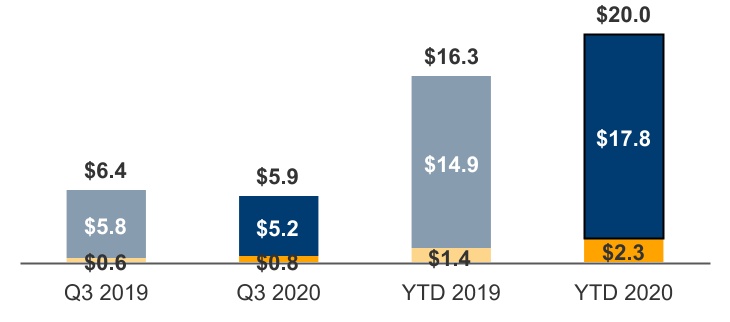

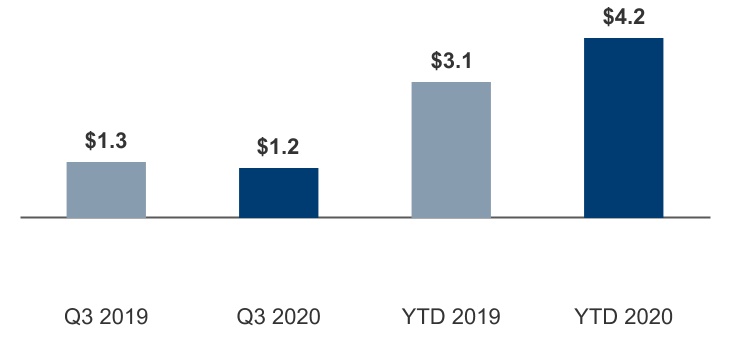

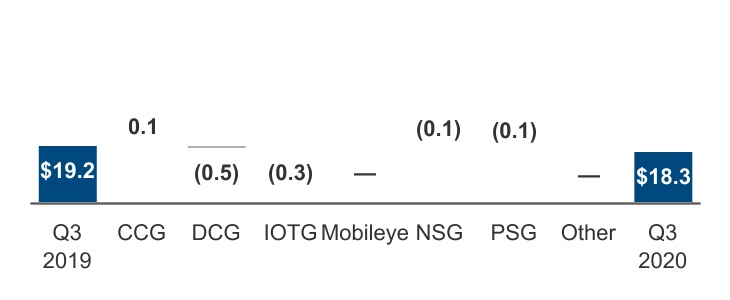

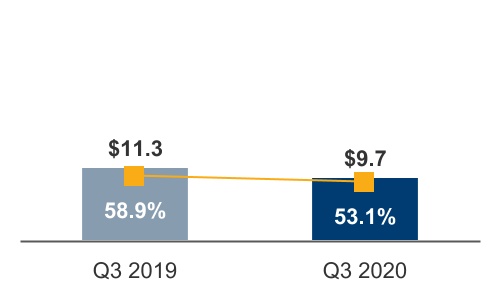

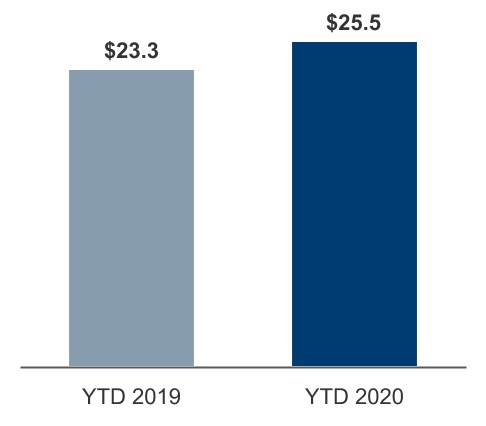

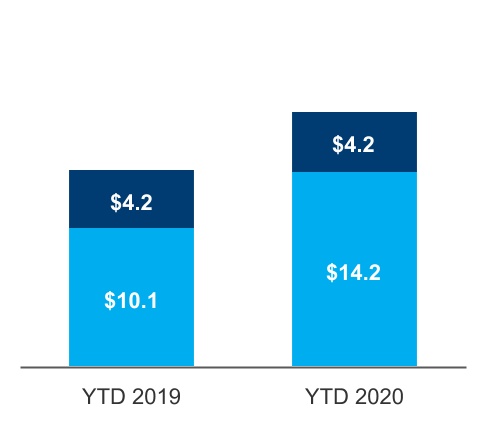

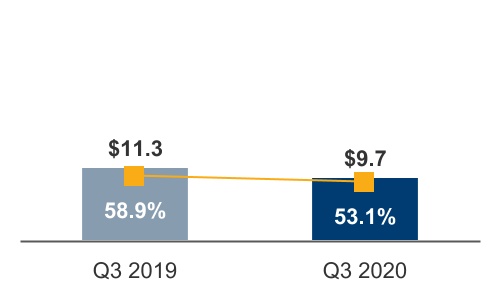

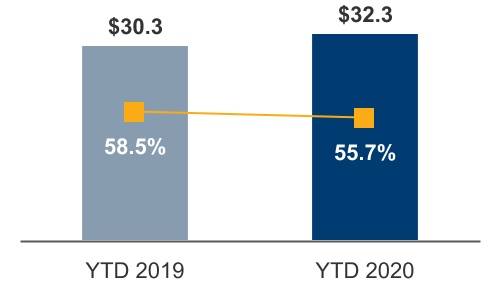

Total revenue of $18.3 billion was down $857 million year over year as our data-centric businesses declined 10%, partially offset by 1% growth in our PC-centric business. Data-centric revenue was down primarily due to COVID-related demand impacts. DCG ASPs declined on higher SoC volume and mix shift from the enterprise and government market segment to cloud service providers. We also experienced weaker demand for IOTG platform1 products. Our PC-centric business was slightly up, driven by strength in notebook demand, partially offset by lower desktop demand, and lower notebook ASP resulting from higher demand in consumer and education segments. Lower platform ASP and higher platform unit cost resulted in lower gross margin dollars and operating income, partially offset by platform volume growth and improved NAND pricing and cost. In the first nine months, we generated $25.5 billion of cash flow from operations and returned $18.4 billion to stockholders, including $4.2 billion in dividends and $14.2 billion in buybacks. Buybacks include those repurchased under ASR agreements entered into in Q3, of which $2.0 billion remains to be settled by the end of 2020.

| | | | | | | | | | | | | | | | | | | | |

REVENUE | | OPERATING INCOME | | DILUTED EPS | | CASH FLOWS |

■ PC-CENTRIC $B ■ DATA-CENTRIC $B | | ■ GAAP $B ■ NON-GAAP $B | | ■ GAAP ■ NON-GAAP | | ■ OPERATING CASH FLOW $B ■ FREE CASH FLOW $B |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| $18.3B | | | | $5.1B | | $5.4B | | $1.02 | | $1.11 | | $25.5B | | $15.1B |

| GAAP | | | | GAAP | | non-GAAP2 | | GAAP | | non-GAAP2 | | GAAP | | non-GAAP2 |

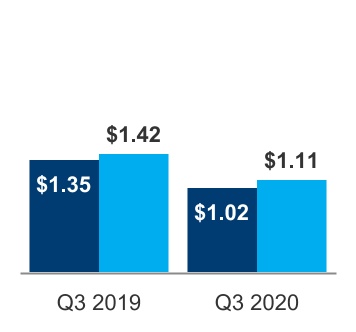

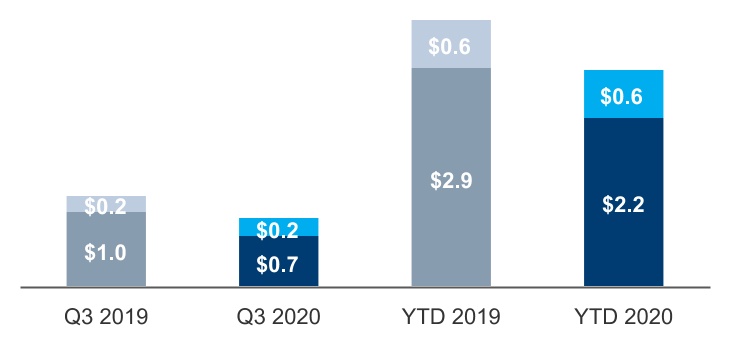

| Revenue down $857M or 4% from Q3 2019 | | | | Operating income down $1.4B or 22% from Q3 2019; Q3 2020 operating margin at 28% | | Operating income down $1.5B or 22% from Q3 2019; Q3 2020 operating margin at 29% | | Diluted EPS down $0.34 or 25% from Q3 2019 | | Diluted EPS down $0.31 or 22% from Q3 2019 | | Operating cash flow up $2.2B or 10% from YTD Q3 2019 | | Free cash flow up $3.4B or 29% from YTD Q3 2019 |

| | | | | | | | | | | | | | |

| Decline in most data-centric businesses, partially offset by growth in our PC-centric business | | | | Lower gross margin dollars from platform ASP decline, higher platform unit cost from increased mix of 10nm products, higher platform reserves, and lower sell-through of previously reserved non-qualified platform product, partially offset by higher platform unit volume, improved NAND pricing and cost, and lower spending | | | | Lower gross margin dollars and higher tax rate, partially offset by lower shares outstanding | | | | Higher net income, partially offset by working capital changes driven by accounts payable and other assets and liabilities; free cash flow increased due to higher operating cash flow and lower capital spending | | |

1 See "Key Terms" within Consolidated Condensed Financial Statements and Supplemental Details.

2 See "Non-GAAP Financial Measures" within MD&A.

BUSINESS SUMMARY

•Decline in our data-centric businesses was primarily driven by COVID-related demand impacts on the DCG enterprise and government market segment, IOTG, and NSG. DCG ASPs declined on higher SoC volume and mix shift from enterprise and government to cloud service providers. The data-centric decline was partially offset by higher platform volume with continued strength in cloud service providers, and improved NAND pricing and cost.

•Growth in our PC-centric business was driven by strength in notebook demand, partially offset by lower desktop demand, lower notebook ASP resulting from higher demand for consumer and education PCs, and LTE modem volume decline.

•We launched our new processor family for laptops, 11th Gen Intel® CoreTM processors with Intel® Iris® Xe graphics leveraging our new 10nm SuperFin process technology. We also introduced the Intel® EvoTM platform brand for designs powered by 11th Gen Intel® CoreTM processors. Intel® EvoTM technology is verified, measured, and tested against specifications and key experience indicators as part of the next edition of our laptop innovation program Project Athena.

•We announced new IoT enhanced processors, Intel Atom® x6000E Series and 11th Gen Intel® CoreTM for IOT, which are designed to solve customers' challenges at the edge.

•On October 19, 2020, we signed an agreement with SK hynix to divest of our NAND memory business, including our NAND memory fabrication facility in Dalian, China and certain related equipment and tangible assets (the “Fab Assets”), our NAND solid-state drive business (the “NAND SSD Business”), and our NAND memory technology and manufacturing business (the “NAND Business”), for total consideration of $9.0 billion in cash. We intend to use proceeds from the transaction to invest in our long-term growth priorities. The transaction will occur over two closings, the second of which is expected to occur no earlier than March 2025.

| | |

| CONSOLIDATED CONDENSED STATEMENTS OF INCOME |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | | Nine Months Ended | | |

(In Millions, Except Per Share Amounts; Unaudited) | | Sep 26, 2020 | | Sep 28, 2019 | | Sep 26, 2020 | | Sep 28, 2019 |

Net revenue | | $ | 18,333 | | | $ | 19,190 | | | $ | 57,889 | | | $ | 51,756 | |

Cost of sales | | 8,592 | | | 7,895 | | | 25,625 | | | 21,494 | |

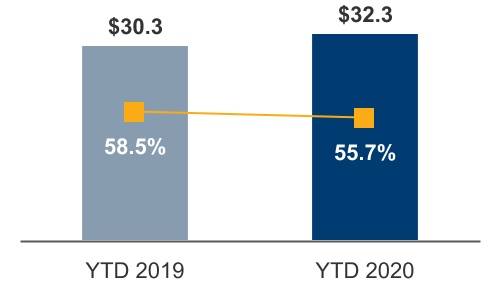

Gross margin | | 9,741 | | | 11,295 | | | 32,264 | | | 30,262 | |

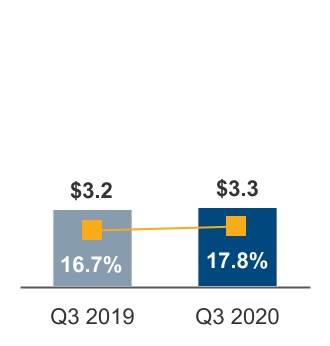

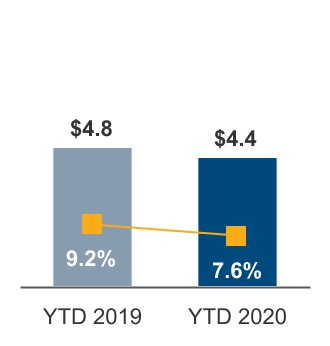

Research and development | | 3,272 | | | 3,208 | | | 9,901 | | | 9,978 | |

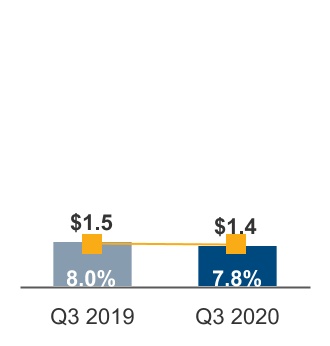

Marketing, general and administrative | | 1,435 | | | 1,536 | | | 4,423 | | | 4,758 | |

Restructuring and other charges | | (25) | | | 104 | | | 146 | | | 288 | |

Operating expenses | | 4,682 | | | 4,848 | | | 14,470 | | | 15,024 | |

Operating income | | 5,059 | | | 6,447 | | | 17,794 | | | 15,238 | |

Gains (losses) on equity investments, net | | 56 | | | 318 | | | 212 | | | 922 | |

Interest and other, net | | (74) | | | (46) | | | (416) | | | (170) | |

Income before taxes | | 5,041 | | | 6,719 | | | 17,590 | | | 15,990 | |

Provision for taxes | | 765 | | | 729 | | | 2,548 | | | 1,847 | |

Net income | | $ | 4,276 | | | $ | 5,990 | | | $ | 15,042 | | | $ | 14,143 | |

| Earnings per share—basic | | $ | 1.02 | | | $ | 1.36 | | | $ | 3.55 | | | $ | 3.18 | |

Earnings per share—diluted | | $ | 1.02 | | | $ | 1.35 | | | $ | 3.52 | | | $ | 3.14 | |

| | | | | | | | |

Weighted average shares of common stock outstanding: | | | | | | | | |

Basic | | 4,188 | | | 4,391 | | | 4,233 | | | 4,450 | |

Diluted | | 4,211 | | | 4,433 | | | 4,269 | | | 4,507 | |

See accompanying notes.

| | | | | | | | | | | |

| FINANCIAL STATEMENTS | Consolidated Condensed Statements of Income | 5 |

| | |

| CONSOLIDATED CONDENSED STATEMENTS OF COMPREHENSIVE INCOME |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | | Nine Months Ended | | |

(In Millions; Unaudited) | | Sep 26, 2020 | | Sep 28, 2019 | | Sep 26, 2020 | | Sep 28, 2019 |

Net income | | $ | 4,276 | | | $ | 5,990 | | | $ | 15,042 | | | $ | 14,143 | |

| Changes in other comprehensive income, net of tax: | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Net unrealized holding gains (losses) on derivatives | | 206 | | | (115) | | | 257 | | | 138 | |

| Actuarial valuation and other pension benefits (expenses), net | | 11 | | | 9 | | | 34 | | | 26 | |

| Translation adjustments and other | | (5) | | | 6 | | | 49 | | | 88 | |

| Other comprehensive income (loss) | | 212 | | | (100) | | | 340 | | | 252 | |

| Total comprehensive income | | $ | 4,488 | | | $ | 5,890 | | | $ | 15,382 | | | $ | 14,395 | |

See accompanying notes.

| | | | | | | | | | | |

| FINANCIAL STATEMENTS | Consolidated Condensed Statements of Comprehensive Income | 6 |

| | |

| CONSOLIDATED CONDENSED BALANCE SHEETS |

| | | | | | | | | | | | | | |

(In Millions) | | Sep 26, 2020 | | Dec 28, 2019 |

| | (unaudited) | | |

Assets | | | | |

Current assets: | | | | |

| Cash and cash equivalents | | $ | 3,356 | | | $ | 4,194 | |

| Short-term investments | | 2,987 | | | 1,082 | |

| Trading assets | | 11,910 | | | 7,847 | |

| Accounts receivable | | 7,140 | | | 7,659 | |

| Inventories | | 9,273 | | | 8,744 | |

| | | | |

| Other current assets | | 2,119 | | | 1,713 | |

Total current assets | | 36,785 | | | 31,239 | |

| | | | |

| Property, plant and equipment, net of accumulated depreciation of $80,084 ($73,321 as of December 28, 2019) | | 59,205 | | | 55,386 | |

| Equity investments | | 3,679 | | | 3,967 | |

| Other long-term investments | | 2,720 | | | 3,276 | |

| Goodwill | | 26,955 | | | 26,276 | |

| Identified intangible assets, net | | 9,881 | | | 10,827 | |

| Other long-term assets | | 6,036 | | | 5,553 | |

Total assets | | $ | 145,261 | | | $ | 136,524 | |

| | | | |

Liabilities, temporary equity, and stockholders’ equity | | | | |

Current liabilities: | | | | |

| Short-term debt | | $ | 504 | | | $ | 3,693 | |

| Accounts payable | | 5,159 | | | 4,128 | |

| Accrued compensation and benefits | | 3,197 | | | 3,853 | |

| | | | |

| | | | |

| Other accrued liabilities | | 13,252 | | | 10,636 | |

Total current liabilities | | 22,112 | | | 22,310 | |

| | | | |

| Debt | | 36,059 | | | 25,308 | |

| Contract liabilities | | 1,381 | | | 1,368 | |

| Income taxes payable, non-current | | 4,811 | | | 4,919 | |

| Deferred income taxes | | 2,995 | | | 2,044 | |

Other long-term liabilities | | 3,349 | | | 2,916 | |

| Contingencies (Note 13) | | | | |

Temporary equity | | — | | | 155 | |

Stockholders’ equity: | | | | |

| Preferred stock | | — | | | — | |

| Common stock and capital in excess of par value, 4,098 issued and outstanding (4,290 issued and outstanding as of December 28, 2019) | | 23,335 | | | 25,261 | |

| Accumulated other comprehensive income (loss) | | (940) | | | (1,280) | |

| Retained earnings | | 52,159 | | | 53,523 | |

Total stockholders’ equity | | 74,554 | | | 77,504 | |

Total liabilities, temporary equity, and stockholders’ equity | | $ | 145,261 | | | $ | 136,524 | |

See accompanying notes.

| | | | | | | | | | | |

| FINANCIAL STATEMENTS | Consolidated Condensed Balance Sheets | 7 |

| | |

| CONSOLIDATED CONDENSED STATEMENTS OF CASH FLOWS |

| | | | | | | | | | | | | | |

| | Nine Months Ended | | |

(In Millions; Unaudited) | | Sep 26, 2020 | | Sep 28, 2019 |

| | | | |

| Cash and cash equivalents, beginning of period | | $ | 4,194 | | | $ | 3,019 | |

| Cash flows provided by (used for) operating activities: | | | | |

| Net income | | 15,042 | | | 14,143 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

| Depreciation | | 7,925 | | | 6,647 | |

| Share-based compensation | | 1,393 | | | 1,290 | |

| | | | |

| | | | |

| Amortization of intangibles | | 1,311 | | | 1,211 | |

| (Gains) losses on equity investments, net | | (105) | | | (395) | |

| | | | |

| | | | |

| | | | |

| Changes in assets and liabilities: | | | | |

| Accounts receivable | | 525 | | | (156) | |

| Inventories | | (570) | | | (1,376) | |

| Accounts payable | | 355 | | | 728 | |

| Accrued compensation and benefits | | (488) | | | (365) | |

| Prepaid supply agreements | | (91) | | | (674) | |

| Income taxes | | 493 | | | 435 | |

| Other assets and liabilities | | (296) | | | 1,769 | |

| Total adjustments | | 10,452 | | | 9,114 | |

| Net cash provided by operating activities | | 25,494 | | | 23,257 | |

| Cash flows provided by (used for) investing activities: | | | | |

| Additions to property, plant and equipment | | (10,392) | | | (11,547) | |

| | | | |

| Purchases of available-for-sale debt investments | | (6,323) | | | (2,028) | |

| | | | |

| Maturities and sales of available-for-sale debt investments | | 5,037 | | | 3,118 | |

| Purchases of trading assets | | (14,744) | | | (5,769) | |

| Maturities and sales of trading assets | | 11,227 | | | 5,467 | |

| | | | |

| | | | |

| | | | |

| Sales of equity investments | | 339 | | | 1,414 | |

| | | | |

| | | | |

| | | | |

| Other investing | | (256) | | | (575) | |

| Net cash used for investing activities | | (15,112) | | | (9,920) | |

| Cash flows provided by (used for) financing activities: | | | | |

| Increase (decrease) in short-term debt, net | | — | | | 835 | |

| | | | |

| | | | |

| Issuance of long-term debt, net of issuance costs | | 10,247 | | | 650 | |

| Repayment of debt and debt conversion | | (4,525) | | | (1,478) | |

| Proceeds from sales of common stock through employee equity incentive plans | | 897 | | | 797 | |

| Repurchase of common stock | | (12,229) | | | (10,100) | |

Accelerated share repurchase forward agreements | | (2,000) | | | — | |

| | | | |

| Payment of dividends to stockholders | | (4,215) | | | (4,214) | |

| | | | |

| | | | |

| | | | |

| Other financing | | 605 | | | 1,089 | |

| Net cash provided by (used for) financing activities | | (11,220) | | | (12,421) | |

| | | | |

| Net increase (decrease) in cash and cash equivalents | | (838) | | | 916 | |

| Cash and cash equivalents, end of period | | $ | 3,356 | | | $ | 3,935 | |

| | | | |

| Supplemental disclosures of noncash investing activities and cash flow information: | | | | |

| Acquisition of property, plant, and equipment included in accounts payable and accrued liabilities | | $ | 2,752 | | | $ | 2,376 | |

| | | | |

| | | | |

| Cash paid during the period for: | | | | |

| Interest, net of capitalized interest | | $ | 459 | | | $ | 312 | |

| Income taxes, net of refunds | | $ | 1,986 | | | $ | 1,334 | |

See accompanying notes.

| | | | | | | | | | | |

| FINANCIAL STATEMENTS | Consolidated Condensed Statements of Cash Flows | 8 |

| | |

| CONSOLIDATED CONDENSED STATEMENTS OF STOCKHOLDERS' EQUITY |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock and Capital in Excess of Par Value | | | | Accumulated Other Comprehensive Income (Loss) | | Retained Earnings | | Total |

| (In Millions, Except Per Share Amounts; Unaudited) | | Shares | | Amount | | | | | | |

| Three Months Ended | | | | | | | | | | |

| | | | | | | | | | |

| Balance as of June 27, 2020 | | 4,253 | | | $ | 25,516 | | | $ | (1,152) | | | $ | 57,646 | | | $ | 82,010 | |

| Net income | | — | | | — | | | — | | | 4,276 | | | 4,276 | |

| Other comprehensive income (loss) | | — | | | — | | | 212 | | | — | | | 212 | |

| Employee equity incentive plans and other | | 12 | | | 385 | | | — | | | — | | | 385 | |

| Share-based compensation | | — | | | 452 | | | — | | | — | | | 452 | |

| Temporary equity reduction | | — | | | — | | | — | | | — | | | — | |

| Convertible debt | | — | | | — | | | — | | | — | | | — | |

| | | | | | | | | | |

| Repurchase of common stock | | (166) | | | (993) | | | — | | | (7,007) | | | (8,000) | |

| Accelerated share repurchase forward agreements | | — | | | (2,000) | | | — | | | — | | | (2,000) | |

| Restricted stock unit withholdings | | (1) | | | (25) | | | — | | | — | | | (25) | |

| Cash dividends declared ($0.66 per share) | | — | | | — | | | — | | | (2,756) | | | (2,756) | |

| Balance as of September 26, 2020 | | 4,098 | | | $ | 23,335 | | | $ | (940) | | | $ | 52,159 | | | $ | 74,554 | |

| | | | | | | | | | |

| Balance as of June 29, 2019 | | 4,430 | | | $ | 25,140 | | | $ | (622) | | | $ | 50,429 | | | $ | 74,947 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Net income | | — | | | — | | | — | | | 5,990 | | | 5,990 | |

| Other comprehensive income (loss) | | — | | | — | | | (100) | | | — | | | (100) | |

| Employee equity incentive plans and other | | 13 | | | 466 | | | — | | | — | | | 466 | |

| Share-based compensation | | — | | | 427 | | | — | | | — | | | 427 | |

| Temporary equity reduction | | — | | | 80 | | | — | | | — | | | 80 | |

| Convertible debt | | — | | | (278) | | | — | | | — | | | (278) | |

| | | | | | | | | | |

| Repurchase of common stock | | (92) | | | (523) | | | — | | | (3,966) | | | (4,489) | |

| Restricted stock unit withholdings | | (1) | | | (22) | | | — | | | (6) | | | (28) | |

| Cash dividends declared ($0.63 per share) | | — | | | — | | | — | | | (2,773) | | | (2,773) | |

| | | | | | | | | | |

| Balance as of September 28, 2019 | | 4,350 | | | $ | 25,290 | | | $ | (722) | | | $ | 49,674 | | | $ | 74,242 | |

| | | | | | | | | | |

| Nine Months Ended | | | | | | | | | | |

| | | | | | | | | | |

| Balance as of December 28, 2019 | | 4,290 | | | $ | 25,261 | | | $ | (1,280) | | | $ | 53,523 | | | $ | 77,504 | |

| Net income | | — | | | — | | | — | | | 15,042 | | | 15,042 | |

| Other comprehensive income (loss) | | — | | | — | | | 340 | | | — | | | 340 | |

| Employee equity incentive plans and other | | 54 | | | 1,014 | | | — | | | — | | | 1,014 | |

| Share-based compensation | | — | | | 1,393 | | | — | | | — | | | 1,393 | |

| Temporary equity reduction | | — | | | 155 | | | — | | | — | | | 155 | |

| Convertible debt | | — | | | (750) | | | — | | | — | | | (750) | |

| | | | | | | | | | |

| Repurchase of common stock | | (237) | | | (1,413) | | | — | | | (10,696) | | | (12,109) | |

| Accelerated share repurchase forward agreements | | — | | | (2,000) | | | — | | | — | | | (2,000) | |

| Restricted stock unit withholdings | | (9) | | | (325) | | | — | | | (135) | | | (460) | |

| Cash dividends declared ($1.32 per share) | | — | | | — | | | — | | | (5,575) | | | (5,575) | |

| Balance as of September 26, 2020 | | 4,098 | | | $ | 23,335 | | | $ | (940) | | | $ | 52,159 | | | $ | 74,554 | |

| | | | | | | | | | |

| Balance as of December 29, 2018 | | 4,516 | | | $ | 25,365 | | | $ | (974) | | | $ | 50,172 | | | $ | 74,563 | |

| Net income | | — | | | — | | | — | | | 14,143 | | | 14,143 | |

| Other comprehensive income (loss) | | — | | | — | | | 252 | | | — | | | 252 | |

| Employee equity incentive plans and other | | 52 | | | 869 | | | — | | | — | | | 869 | |

| Share-based compensation | | — | | | 1,287 | | | — | | | — | | | 1,287 | |

| Temporary equity reduction | | — | | | 253 | | | — | | | — | | | 253 | |

| Convertible debt | | — | | | (990) | | | — | | | — | | | (990) | |

| Repurchase of common stock | | (209) | | | (1,182) | | | — | | | (8,902) | | | (10,084) | |

| Restricted stock unit withholdings | | (9) | | | (312) | | | — | | | (137) | | | (449) | |

| Cash dividends declared ($1.26 per share) | | — | | | — | | | — | | | (5,602) | | | (5,602) | |

| Balance as of September 28, 2019 | | 4,350 | | | $ | 25,290 | | | $ | (722) | | | $ | 49,674 | | | $ | 74,242 | |

See accompanying notes.

| | | | | | | | | | | |

| FINANCIAL STATEMENTS | Consolidated Condensed Statements of Stockholders' Equity | 9 |

| | |

| NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS |

| | | | | |

| NOTE 1 : | BASIS OF PRESENTATION |

We prepared our interim Consolidated Condensed Financial Statements that accompany these notes in conformity with U.S. GAAP, consistent in all material respects with those applied in our 2019 Form 10-K.

We have made estimates and judgments affecting the amounts reported in our Consolidated Condensed Financial Statements and the accompanying notes. The inputs into our judgments and estimates consider the economic implications of COVID-19 on our critical and significant accounting estimates. The actual results that we experience may differ materially from our estimates. The interim financial information is unaudited, and reflects all normal adjustments that are, in our opinion, necessary to provide a fair statement of results for the interim periods presented. This report should be read in conjunction with the Consolidated Financial Statements in our 2019 Form 10-K where we include additional information about our policies and the methods and assumptions used in our estimates.

| | | | | |

| NOTE 2 : | OPERATING SEGMENTS |

We manage our business through the following operating segments:

•DCG

•IOTG

•Mobileye

•NSG

•PSG

•CCG

We derive a substantial majority of our revenue from platform products, which are our principal products and considered as one class of product. We offer platform products that incorporate various components and technologies, including a microprocessor and chipset, a stand-alone SoC, or a multichip package. Platform products are used in various form factors across our DCG, IOTG, and CCG operating segments. Our non-platform, or adjacent products, can be combined with platform products to form comprehensive platform solutions to meet customer needs.

DCG and CCG are our reportable operating segments. IOTG, Mobileye, NSG, and PSG do not meet the quantitative thresholds to qualify as reportable operating segments; however, we have elected to disclose the results of these non-reportable operating segments. Our Internet of Things portfolio, presented as Internet of Things, is comprised of IOTG and Mobileye operating segments.

We have an “all other” category that includes revenue, expenses, and charges such as:

•results of operations from non-reportable segments not otherwise presented;

•historical results of operations from divested businesses;

•results of operations of start-up businesses that support our initiatives, including our foundry business;

•amounts included within restructuring and other charges;

•a portion of employee benefits, compensation, and other expenses not allocated to the operating segments; and

•acquisition-related costs, including amortization and any impairment of acquisition-related intangibles and goodwill.

The CODM, who is our CEO, does not evaluate operating segments using discrete asset information. Operating segments do not record inter-segment revenue. We do not allocate gains and losses from equity investments, interest and other income, or taxes to operating segments. Although the CODM uses operating income to evaluate the segments, operating costs included in one segment may benefit other segments. The accounting policies for segment reporting are the same as for Intel as a whole.

| | | | | | | | | | | |

| FINANCIAL STATEMENTS | Notes to Financial Statements | 10 |

Net revenue and operating income (loss) for each period were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | | Nine Months Ended | | |

(In Millions) | | Sep 26, 2020 | | Sep 28, 2019 | | Sep 26, 2020 | | Sep 28, 2019 |

| Net revenue: | | | | | | | | |

| Data Center Group | | | | | | | | |

| Platform | | $ | 5,151 | | | $ | 5,819 | | | $ | 17,759 | | | $ | 14,854 | |

| Adjacent | | 754 | | | 564 | | | 2,256 | | | 1,414 | |

| | 5,905 | | | 6,383 | | | 20,015 | | | 16,268 | |

| Internet of Things | | | | | | | | |

| IOTG | | 677 | | | 1,005 | | | 2,230 | | | 2,901 | |

| Mobileye | | 234 | | | 229 | | | 634 | | | 639 | |

| | 911 | | | 1,234 | | | 2,864 | | | 3,540 | |

| | | | | | | | |

| | | | | | | | |

| Non-Volatile Memory Solutions Group | | 1,153 | | | 1,290 | | | 4,150 | | | 3,145 | |

| Programmable Solutions Group | | 411 | | | 507 | | | 1,431 | | | 1,482 | |

| Client Computing Group | | | | | | | | |

| Platform | | 8,762 | | | 8,379 | | | 25,703 | | | 24,128 | |

| Adjacent | | 1,085 | | | 1,330 | | | 3,415 | | | 3,008 | |

| | 9,847 | | | 9,709 | | | 29,118 | | | 27,136 | |

| | | | | | | | |

| All other | | 106 | | | 67 | | | 311 | | | 185 | |

| Total net revenue | | $ | 18,333 | | | $ | 19,190 | | | $ | 57,889 | | | $ | 51,756 | |

| | | | | | | | |

| Operating income (loss): | | | | | | | | |

| Data Center Group | | $ | 1,903 | | | $ | 3,115 | | | 8,494 | | | $ | 6,756 | |

| | | | | | | | |

| Internet of Things | | | | | | | | |

| IOTG | | 61 | | | 309 | | | 374 | | | 854 | |

| Mobileye | | 47 | | | 67 | | | 131 | | | 188 | |

| | 108 | | | 376 | | | 505 | | | 1,042 | |

| | | | | | | | |

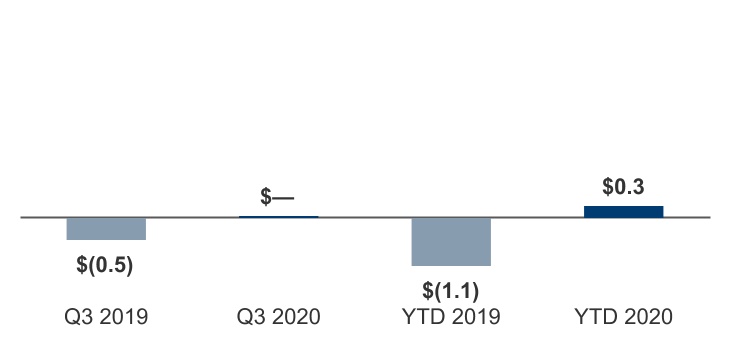

| Non-Volatile Memory Solutions Group | | 29 | | | (499) | | | 285 | | | (1,080) | |

| Programmable Solutions Group | | 40 | | | 92 | | | 217 | | | 233 | |

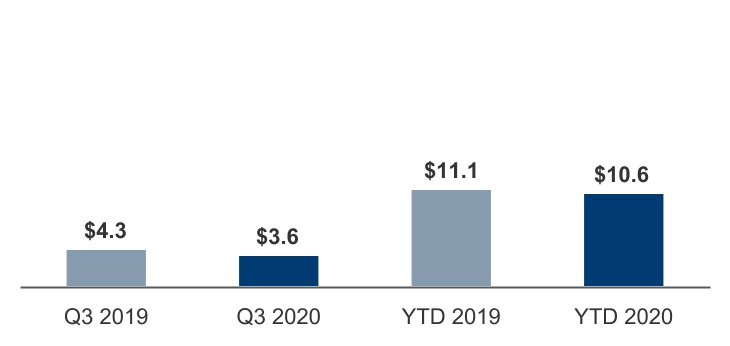

| Client Computing Group | | 3,554 | | | 4,305 | | | 10,621 | | | 11,114 | |

| All other | | (575) | | | (942) | | | (2,328) | | | (2,827) | |

| Total operating income | | $ | 5,059 | | | $ | 6,447 | | | $ | 17,794 | | | $ | 15,238 | |

| | | | | | | | | | | |

| FINANCIAL STATEMENTS | Notes to Financial Statements | 11 |