Exhibit 99.2

California | Colorado | Georgia | Illinois | New Jersey | New York | Texas | Virginia | Washington 4 Q 2 5 Ea rning s S u pp l e m en ta l Pre s en tat i o n January 27, 2026 NASDAQ | HAFC

2 TABLE OF CONTENTS 4Q25 PERFORMANCE RESULTS 5 – 21 LOAN PORTFOLIO DETAILS 22 – 31 4Q25 FINANCIAL SUMMARY 32 – 32 NON - GAAP RECONCILIATION 33 – 34

3 FORWARD - LOOKING STATEMENTS Hanmi Financial Corporation (the “Company”) cautions investors that any statements contained herein that are not historical facts are forward - looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 , including, but not limited to, those statements regarding operating performance, financial position and liquidity, business strategies, regulatory, economic and competitive outlook, investment and expenditure plans, capital and financing needs and availability, litigation, plans and objectives, merger or sale activity, and all other forecasts and statements of expectation or assumption underlying any of the foregoing . These statements involve known and unknown risks and uncertainties that are difficult to predict . Investors should not rely on any forward - looking statement and should consider risks, such as changes in governmental policy, legislation and regulations, changes in monetary policy, economic uncertainty and changes in economic conditions, potential recessionary conditions, inflation, the effect of the imposition of tariffs and any retaliatory responses, the impact of a potential federal government shutdown, including our ability to effect sales of small business administration loans, fluctuations in interest rate and credit risk, competitive pressures, our ability to access cost - effective funding, the ability to enter into new markets successfully and capitalize on growth opportunities, balance sheet management, liquidity and sources of funding, the size and composition of our deposit portfolio, including the percentage of uninsured deposits in the portfolio, increased assessments by the Federal Deposit Insurance Corporation, risk and effect of natural disasters, a failure in or breach of our operational or security systems or infrastructure, including cyberattacks, the adequacy of and changes in the economic estimates and methodology of calculating our allowance for credit losses, and other operational factors . Forward - looking statements are based upon the good faith beliefs and expectations of management as of this date only and are further subject to additional risks and uncertainties, including, but not limited to, the risk factors set forth in our earnings release dated January 27 , 2026 , including the section titled “Forward Looking Statements” and the Company’s most recent Form 10 - K, 10 - Q and other filings with the Securities and Exchange Commission . The Company disclaims any obligation to update or revise the forward - looking statements herein .

4 NON - GAAP FINANCIAL INFORMATION This presentation contains financial information determined by methods other than in accordance with accounting principles generally accepted in the United States of America (“GAAP”) . These non - GAAP measures include tangible common equity to tangible assets, tangible common equity per share (including without the impact of available for sale securities on the accumulated other comprehensive income) and pro forma regulatory capital . Management uses these “non - GAAP” measures in its analysis of the Company’s performance . Management believes these non - GAAP financial measures allow for better comparability of period to period operating performance . Additionally, the Company believes this information is utilized by regulators and market analysts to evaluate a company’s financial condition and therefore, such information is useful to investors . These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non - GAAP performance measures that may be presented by other companies . A reconciliation of the non - GAAP measures used in this presentation to the most directly comparable GAAP measures is provided in the Appendix to this presentation .

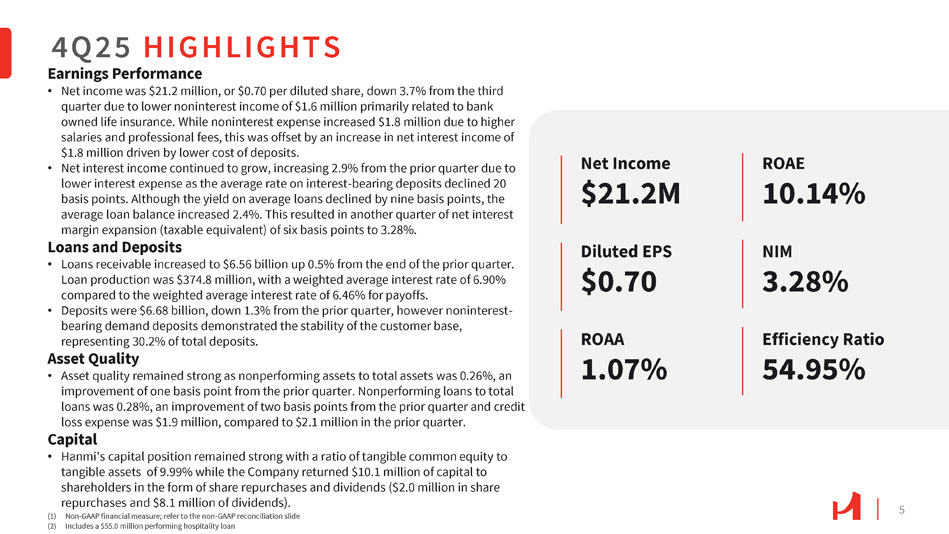

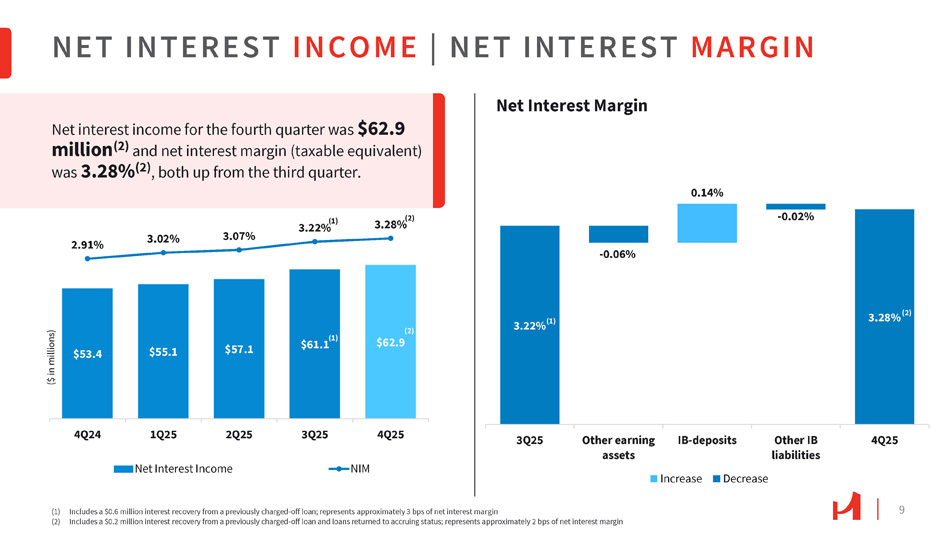

5 Net Income $21.2M Diluted EPS $0.70 ROAA 1.07% ROAE 10.14% NIM 3.28% Efficiency Ratio 54.95% Earnings Performance • Net income was $21.2 million, or $0.70 per diluted share, down 3.7% from the third quarter due to lower noninterest income of $1.6 million primarily related to bank owned life insurance. While noninterest expense increased $1.8 million due to higher salaries and professional fees, this was offset by an increase in net interest income of $1.8 million driven by lower cost of deposits. • Net interest income continued to grow, increasing 2.9% from the prior quarter due to lower interest expense as the average rate on interest - bearing deposits declined 20 basis points. Although the yield on average loans declined by nine basis points, the average loan balance increased 2.4%. This resulted in another quarter of net interest margin expansion (taxable equivalent) of six basis points to 3.28%. Loans and Deposits • Loans receivable increased to $6.56 billion up 0.5% from the end of the prior quarter. Loan production was $374.8 million, with a weighted average interest rate of 6.90% compared to the weighted average interest rate of 6.46% for payoffs. • Deposits were $6.68 billion, down 1.3% from the prior quarter, however noninterest - bearing demand deposits demonstrated the stability of the customer base, representing 30.2% of total deposits. Asset Quality • Asset quality remained strong as nonperforming assets to total assets was 0.26%, an improvement of one basis point from the prior quarter. Nonperforming loans to total loans was 0.28%, an improvement of two basis points from the prior quarter and credit loss expense was $1.9 million, compared to $2.1 million in the prior quarter. Capital • Hanmi's capital position remained strong with a ratio of tangible common equity to tangible assets of 9.99% while the Company returned $10.1 million of capital to shareholders in the form of share repurchases and dividends ($2.0 million in share repurchases and $8.1 million of dividends). (1) Non - GAAP financial measure; refer to the non - GAAP reconciliation slide (2) Includes a $55.0 million performing hospitality loan 4Q25 HIGHLIGHTS

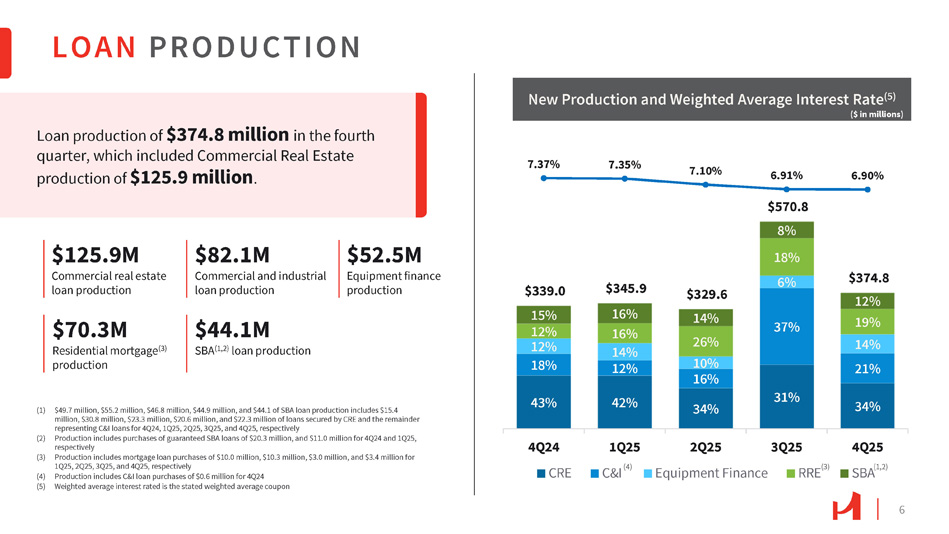

LOAN PRODUCTION 6 Loan production of $374.8 million in the fourth quarter, which included Commercial Real Estate production of $125.9 million . (1) $49.7 million, $55.2 million, $46.8 million, $44.9 million, and $44.1 of SBA loan production includes $15.4 million, $30.8 million, $23.3 million, $20.6 million, and $22.3 million of loans secured by CRE and the remainder representing C&I loans for 4Q24, 1Q25, 2Q25, 3Q25, and 4Q25, respectively (2) Production includes purchases of guaranteed SBA loans of $20.3 million, and $11.0 million for 4Q24 and 1Q25, respectively (3) Production includes mortgage loan purchases of $10.0 million, $10.3 million, $3.0 million, and $3.4 million for 1Q25, 2Q25, 3Q25, and 4Q25, respectively (4) Production includes C&I loan purchases of $0.6 million for 4Q24 (5) Weighted average interest rated is the stated weighted average coupon $125.9M Commercial real estate loan production $82.1M Commercial and industrial loan production $52.5M Equipment finance production $70.3M Residential mortgage (3) production $44.1M SBA (1,2) loan production 43% 42% 31% 34% 37% 6% $339.0 15% 12% 12% 18% $345.9 16% 16% 14% 12% $329.6 14% 26% 10% 16% 34% $570.8 8% 18% $374.8 12% 19% 14% 21% 7.37% 7.35% 7.10% 6.91% 6.90% 1Q25 C&I (4) 4Q25 SBA (1,2) 4Q24 CRE 2Q25 Equipment Finance 3Q25 RRE (3) New Production and Weighted Average Interest Rate (5) ($ in millions)

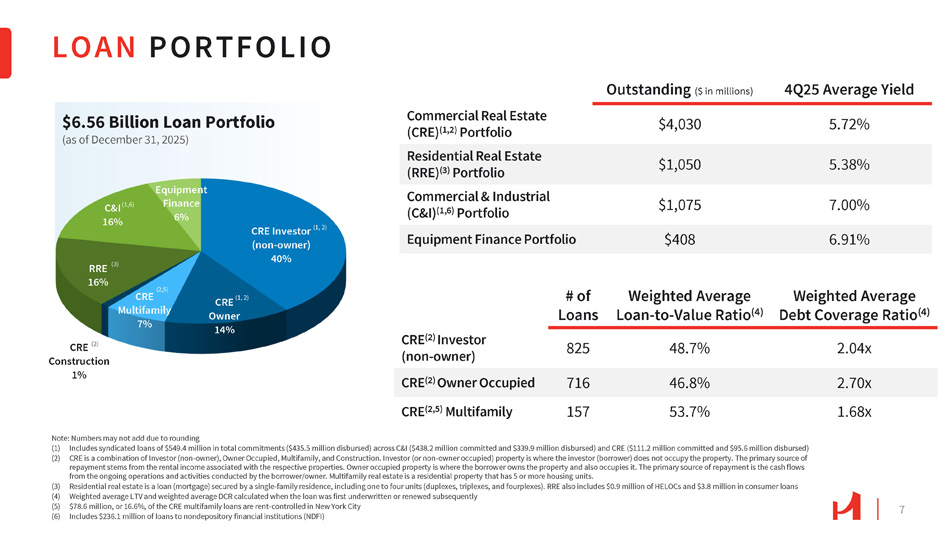

CRE Multifamily 7% 16% Equipment Finance 6% CRE (2) Construction 1% (2,5) CRE (1, 2) Owner 14% CRE Investor (1, 2) (non - owner) 40% RRE (3) C&I (1,6) 16% $6.56 Billion Loan Portfolio (as of December 31, 2025) LOAN PORTFOLIO 7 Note: Numbers may not add due to rounding (1) Includes syndicated loans of $549.4 million in total commitments ($435.5 million disbursed) across C&I ($438.2 million committed and $339.9 million disbursed) and CRE ($111.2 million committed and $95.6 million disbursed) (2) CRE is a combination of Investor (non - owner), Owner Occupied, Multifamily, and Construction. Investor (or non - owner occupied) property is where the investor (borrower) does not occupy the property. The primary source of repayment stems from the rental income associated with the respective properties. Owner occupied property is where the borrower owns the property and also occupies it. The primary source of repayment is the cash flows from the ongoing operations and activities conducted by the borrower/owner. Multifamily real estate is a residential property that has 5 or more housing units. (3) Residential real estate is a loan (mortgage) secured by a single - family residence, including one to four units (duplexes, triplexes, and fourplexes). RRE also includes $0.9 million of HELOCs and $3.8 million in consumer loans (4) Weighted average LTV and weighted average DCR calculated when the loan was first underwritten or renewed subsequently (5) $78.6 million, or 16.6%, of the CRE multifamily loans are rent - controlled in New York City (6) Includes $236.1 million of loans to nondepository financial institutions (NDFI) 4Q25 Average Yield Outstanding ($ in millions) 5.72% $4,030 Commercial Real Estate (CRE) (1,2) Portfolio 5.38% $1,050 Residential Real Estate (RRE) (3) Portfolio 7.00% $1,075 Commercial & Industrial (C&I) (1,6) Portfolio 6.91% $408 Equipment Finance Portfolio Weighted Average Debt Coverage Ratio (4) Weighted Average Loan - to - Value Ratio (4) # of Loans 2.04x 48.7% 825 CRE (2) Investor (non - owner) 2.70x 46.8% 716 CRE (2) Owner Occupied 1.68x 53.7% 157 CRE (2,5) Multifamily

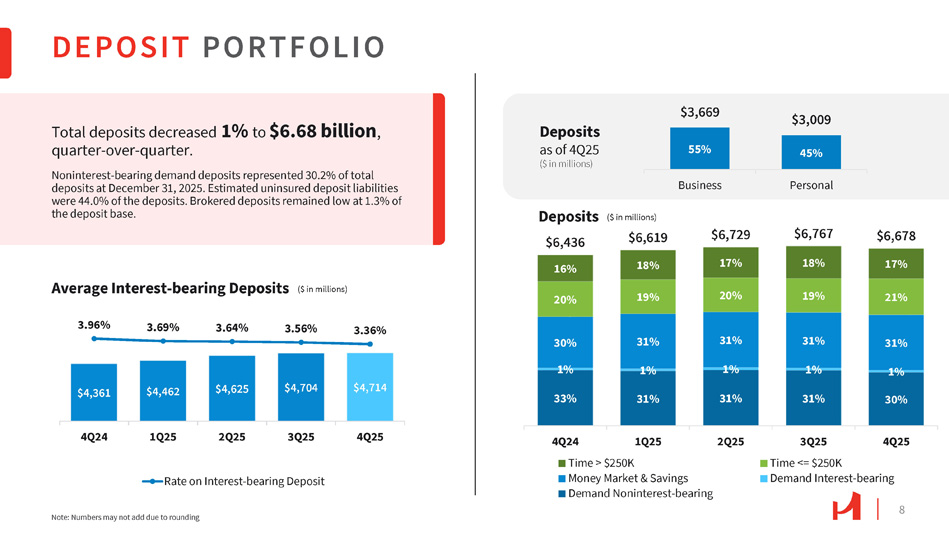

$4,361 $4,462 $4,625 $4,704 $4,714 3.96% 3.69% 3.64% 3.56% 3.36% 4Q24 1Q25 2Q25 3Q25 4Q25 Rate on Interest - bearing Deposit Average Interest - bearing Deposits DEPOSIT PORTFOLIO Total deposits decreased 1% to $6.68 billion , quarter - over - quarter. Noninterest - bearing demand deposits represented 30.2% of total deposits at December 31, 2025. Estimated uninsured deposit liabilities were 44.0% of the deposits. Brokered deposits remained low at 1.3% of the deposit base. Note: Numbers may not add due to rounding 20% Deposits $6,436 16% $6,678 $6,767 $6,729 $6,619 17% 18% 17% 18% 21% 19% 20% 19% 31% 31% 31% 31% 30% 1% 1% 1% 1% 1% 30% 31% 31% 31% 33% 4Q25 3Q25 Time <= $250K 2Q25 1Q25 4Q24 Time > $250K Demand Interest - bearing Money Market & Savings Demand Noninterest - bearing ($ in millions) Deposits as of 4Q25 ($ in millions) 55% 45% $3,669 $3,009 Business Personal 8 ($ in millions)

9 $53.4 $55.1 $57.1 2.91% 3.02% 3.07% 3.22% (1) 3.28% (2) 4Q24 1Q25 2Q25 Net Interest Income 3Q25 4Q25 NIM NET INTEREST INCOME | NET INTEREST MARGIN ($ in millions) $61.1 (1) (2) $62.9 3.22% (1) 3.28% (2) 0.14% - 0.06% - 0.02% 3Q25 Other earning assets IB - deposits Other IB liabilities 4Q25 Increase Decrease Net interest income for the fourth quarter was $62.9 million (2) and net interest margin (taxable equivalent) was 3.28% (2) , both up from the third quarter. Net Interest Margin (1) Includes a $0.6 million interest recovery from a previously charged - off loan; represents approximately 3 bps of net interest margin (2) Includes a $0.2 million interest recovery from a previously charged - off loan and loans returned to accruing status; represents approximately 2 bps of net interest margin

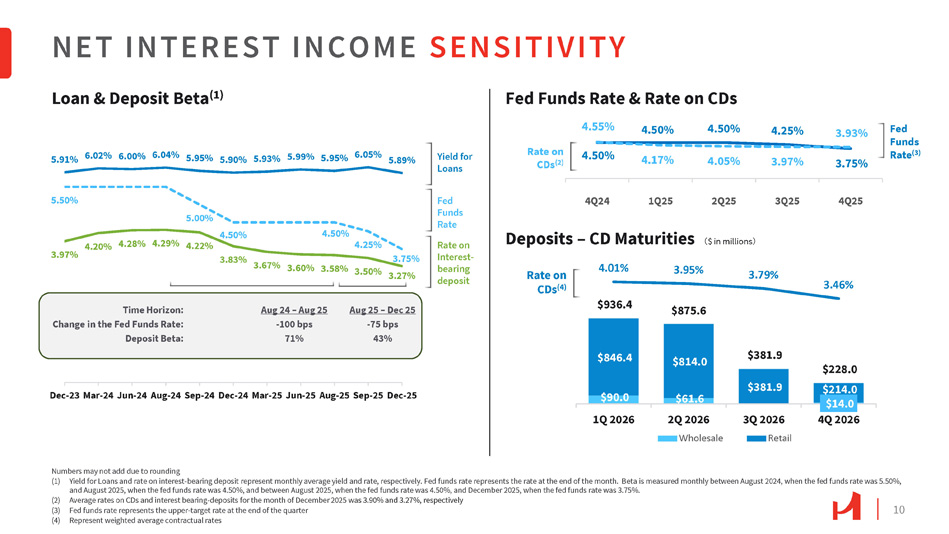

10 5.91% 6.02% 6.00% 6.04% 5.95% 5.90% 5.93% 5.99% 5.95% 6.05% 5.89% 3.97% 4.20% 3.83% 3.67% 3.60% 3.58% 3.50% 5.50% 5.00% 4.50% 4.28% 4.29% 4.22% 4.50% 4.25% 3.75% 3.27% Dec - 23 Mar - 24 Jun - 24 Aug - 24 Sep - 24 Dec - 24 Mar - 25 Jun - 25 Aug - 25 Sep - 25 Dec - 25 NET INTEREST INCOME SENSITIVITY $90.0 $61.6 $14.0 $846.4 $814.0 $381.9 $936.4 $875.6 $381.9 $228.0 $214.0 4.01% 3.95% 3.46% Rate on 3.79% CDs (4) 1Q 2026 4Q 2026 2Q 2026 Wholesale 3Q 2026 Retail 4.50% 4.50% 4.50% 4.25% 3.75% 4.55% 4.17% 4.05% 3.97% 3.93% 4Q24 1Q25 2Q25 Deposits – CD Maturities 㸦 $ in millions 㸧 3Q25 4Q25 Fed Funds Rate (3) Numbers may not add due to rounding (1) Yield for Loans and rate on interest - bearing deposit represent monthly average yield and rate, respectively. Fed funds rate represents the rate at the end of the month. Beta is measured monthly between August 2024, when the fed funds rate was 5.50%, and August 2025, when the fed funds rate was 4.50%, and between August 2025, when the fed funds rate was 4.50%, and December 2025, when the fed funds rate was 3.75%. (2) Average rates on CDs and interest bearing - deposits for the month of December 2025 wa s 3.90% and 3.27%, respectively (3) Fed funds rate represents the upper - target rate at the end of the quarter (4) Represent weighted average contractual rates Fed Funds Rate Rate on Interest - bearing deposit Yield for Loans Loan & Deposit Beta (1) Fed Funds Rate & Rate on CDs Rate on CDs (2) Time Horizon: Change in the Fed Funds Rate: Deposit Beta: Aug 24 – Aug 25 - 100 bps 71% Aug 25 – Dec 25 - 75 bps 43%

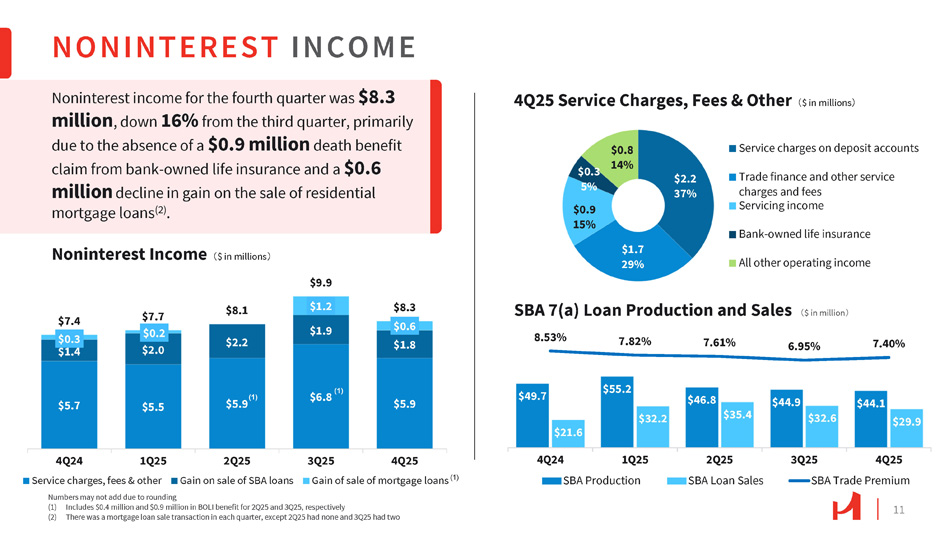

11 $2.2 37% $1.7 29% $0.3 5% $0.9 15% $0.8 14% Service charges on deposit accounts Trade finance and other service charges and fees Servicing income Bank - owned life insurance All other operating income NONINTEREST INCOME $49.7 $55.2 $46.8 $44.9 $44.1 $21.6 $32.2 $35.4 $32.6 $29.9 8.53% 7.82% 7.61% 6.95% 7.40% 4Q24 1Q25 SBA Production 2Q25 SBA Loan Sales 3Q25 4Q25 SBA Trade Premium $5.7 $5.5 $6.8 $5.9 $1.4 $2.0 $2.2 $1.9 $1.8 $0.3 $0.2 $1.2 $0.6 $7.4 $7.7 $8.1 $9.9 $8.3 4Q24 1Q25 Service charges, fees & other 2Q25 Gain on sale of SBA loans (1) $5.9 Numbers may not add due to rounding (1) Includes $0.4 million and $0.9 million in BOLI benefit for 2Q25 and 3Q25, respectively (2) There was a mortgage loan sale transaction in each quarter, except 2Q25 had none and 3Q25 had two Noninterest income for the fourth quarter was $8.3 million , down 16% from the third quarter, primarily due to the absence of a $0.9 million death benefit claim from bank - owned life insurance and a $0.6 million decline in gain on the sale of residential mortgage loans (2) . Noninterest Income 㸦 $ in millions 㸧 4Q25 Service Charges, Fees & Other 㸦 $ in millions 㸧 SBA 7(a) Loan Production and Sales 㸦 $ in million 㸧 (1) 3Q25 4Q25 Gain of sale of mortgage loans (1)

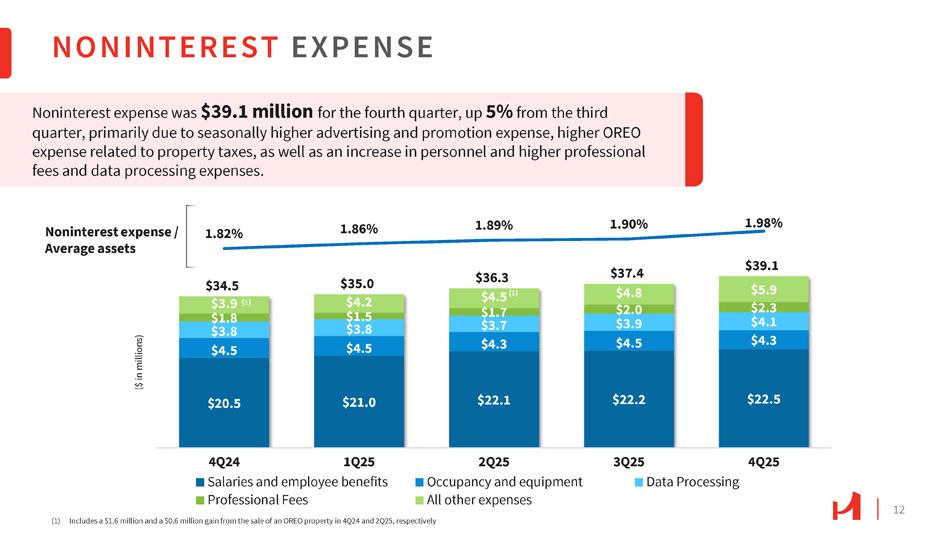

NONINTEREST EXPENSE 12 (1) Includes a $1.6 million and a $0.6 million gain from the sale of an OREO property in 4Q24 and 2Q25, respectively Noninterest expense was $39.1 million for the fourth quarter, up 5% from the third quarter, primarily due to seasonally higher advertising and promotion expense, higher OREO expense related to property taxes, as well as an increase in personnel and higher professional fees and data processing expenses. $20.5 $21.0 $22.1 $22.2 $22.5 $35.0 $4.2 $1.5 $3.8 $4.5 $37.4 $4.8 $2.0 $3.9 $4.5 $39.1 $5.9 $2.3 $4.1 $4.3 1.82% 1.86% 1.89% 1.90% 1.98% 4Q24 1Q25 Salaries and employee benefits Professional Fees 2Q25 Occupancy and equipment All other expenses $34.5 $3.9 (1) $1.8 $3.8 $4.5 $36.3 $4.5 (1) $1.7 $3.7 $4.3 3Q25 4Q25 Data Processing Noninterest expense / Average assets ($ in millions)

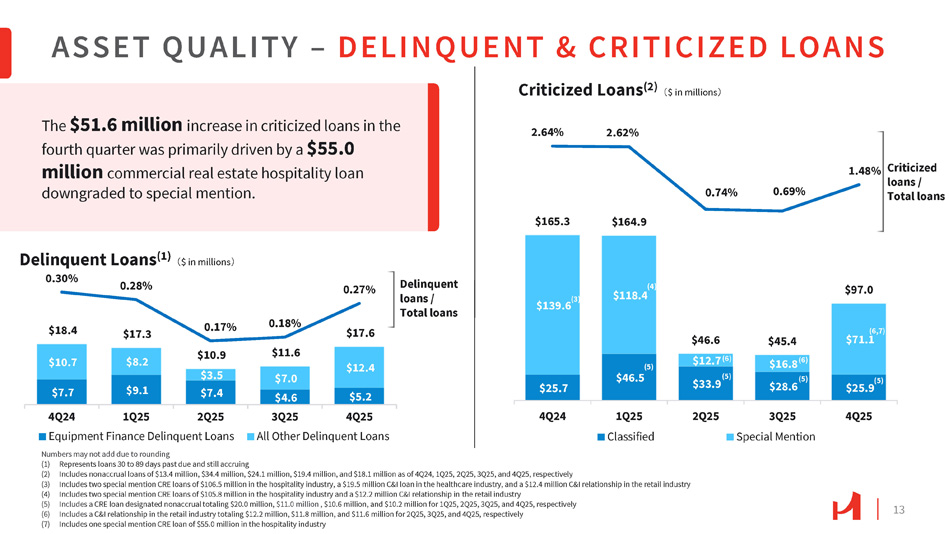

13 $7.7 $9.1 $5.2 $10.7 $8.2 $12.4 $18.4 $17.3 $10.9 $3.5 $7.4 $11.6 $7.0 $4.6 $17.6 0.30% 0.28% 0.17% 0.18% 0.27% 3Q25 4Q25 All Other Delinquent Loans 4Q24 1Q25 2Q25 Equipment Finance Delinquent Loans Numbers may not add due to rounding ASSET QUALITY – DELINQUENT & CRITICIZED LOANS Delinquent loans / Total loans $118.4 $165.3 $164.9 $97.0 2.64% 2.62% 0.74% 0.69% 1.48% Criticized loans / Total loans $139.6 (3) (1) Represents loans 30 to 89 days past due and still accruing (2) Includes nonaccrual loans of $13.4 million, $34.4 million, $24.1 million, $19.4 million, and $18.1 million as of 4Q24, 1Q25, 2Q25, 3Q25, and 4Q25, respectively (3) Includes two special mention CRE loans of $106.5 million in the hospitality industry, a $19.5 million C&I loan in the healthcare industry, and a $12.4 million C&I relationship in the retail industry (4) Includes two special mention CRE loans of $105.8 million in the hospitality industry and a $12.2 million C&I relationship in the retail industry (5) Includes a CRE loan designated nonaccrual totaling $20.0 million, $11.0 million , $10.6 million, and $10.2 million for 1Q25, 2Q25, 3Q25, and 4Q25, respectively (6) Includes a C&I relationship in the retail industry totaling $12.2 million, $11.8 million, and $11.6 million for 2Q25, 3Q25, and 4Q25, respectively (7) Includes one special mention CRE loan of $55.0 million in the hospitality industry (4) (6,7) $71.1 $25.9 (5) $45.4 $16.8 (6) (5) $28.6 $46.6 $12.7 (6) $33.9 (5) (5) $46.5 $25.7 4Q25 3Q25 Special Mention 2Q25 1Q25 Classified 4Q24 The $51.6 million increase in criticized loans in the fourth quarter was primarily driven by a $55.0 million commercial real estate hospitality loan downgraded to special mention. Delinquent Loans (1) 㸦 $ in millions 㸧 Criticized Loans (2) 㸦 $ in millions 㸧

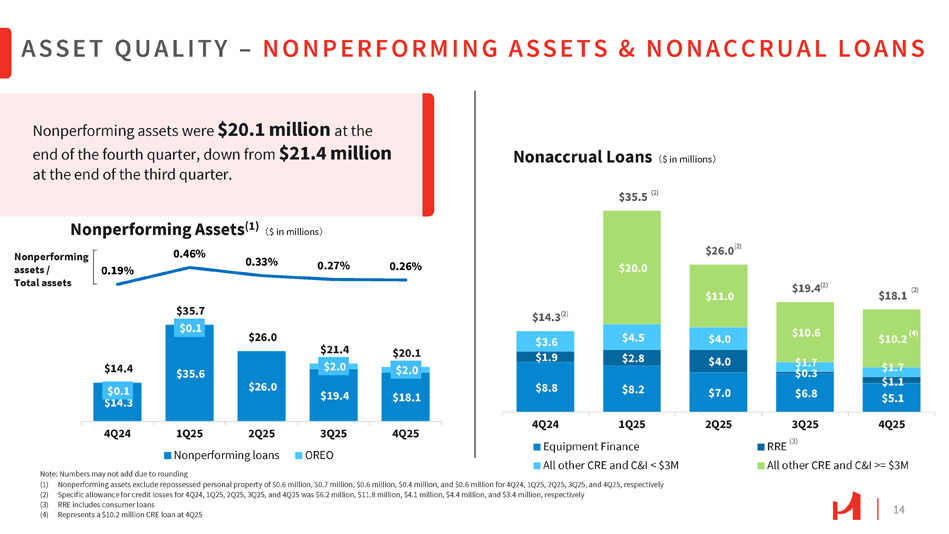

14 Nonperforming assets were $20.1 million at the end of the fourth quarter, down from $21.4 million at the end of the third quarter. $14.3 $35.6 $26.0 $19.4 $18.1 $0.1 $0.1 $2.0 $2.0 $14.4 $35.7 $26.0 $21.4 $20.1 0.19% 0.46% 0.33% 0.27% 0.26% 4Q25 3Q25 OREO ASSET QUALITY – NONPERFORMING ASSETS & NONACCRUAL LOANS (1) Nonperforming assets exclude repossessed personal property of $0.6 million, $0.7 million, $0.6 million, $0.4 million, and $0.6 million for 4Q24, 1Q25, 2Q25, 3Q25, and 4Q25, respectively (2) Specific allowance for credit losses for 4Q24, 1Q25, 2Q25, 3Q25, and 4Q25 was $6.2 million, $11.8 million, $4.1 million, $4.4 million, and $3.4 million, respectively (3) RRE includes consumer loans (4) Represents a $10.2 million CRE loan at 4Q25 4Q24 1Q25 2Q25 Nonperforming loans Note: Numbers may not add due to rounding $8.8 $8.2 $7.0 $4.5 $2.8 $4.0 $4.0 $1.7 $0.3 $6.8 $20.0 $11.0 $10.6 $35.5 (2) $19.4 2Q25 4Q25 4Q24 1Q25 Equipment Finance All other CRE and C&I < $3M $14.3 (2) $3.6 $1.9 3Q25 RRE (3) $18.1 (2) All other CRE and C&I >= $3M (2) $26.0 (2) $10.2 (4) $1.7 $1.1 $5.1 Nonperforming Assets (1) 㸦 $ in millions 㸧 Nonaccrual Loans 㸦 $ in millions 㸧 Nonperforming assets / Total assets

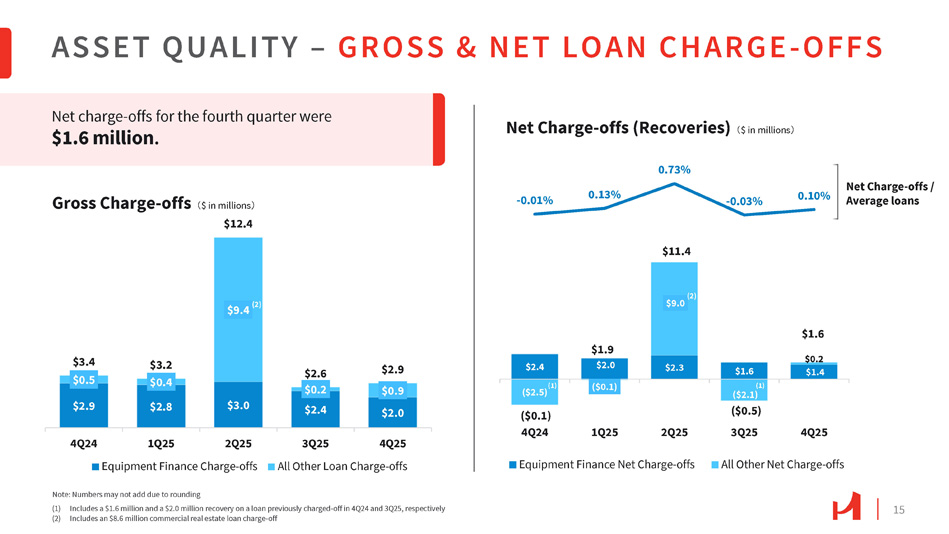

15 $2.9 $2.8 $3.0 $2.4 $2.0 $0.5 $0.4 $0.2 $0.9 $3.4 $3.2 $2.6 $2.9 $9.4 (2) 4Q24 1Q25 2Q25 Equipment Finance Charge - offs 3Q25 4Q25 All Other Loan Charge - offs ASSET QUALITY – GROSS & NET LOAN CHARGE - OFFS $2.4 $2.3 $1.6 ($0.1) $0.2 $1.4 $1.9 $2.0 $11.4 $1.6 (2) $9.0 (1) ($2.5) ($0.1) 4Q24 (1) ($2.1) ($0.5) 3Q25 - 0.01% 0.13% 0.73% - 0.03% 0.10% 1Q25 2Q25 4Q25 Equipment Finance Net Charge - offs All Other Net Charge - offs Note: Numbers may not add due to rounding (1) Includes a $1.6 million and a $2.0 million recovery on a loan previously charged - off in 4Q24 and 3Q25, respectively (2) Includes an $8.6 million commercial real estate loan charge - off Net charge - offs for the fourth quarter were $1.6 million . Gross Charge - offs 㸦 $ in millions 㸧 $12.4 Net Charge - offs (Recoveries) 㸦 $ in millions 㸧 Net Charge - offs / Average loans

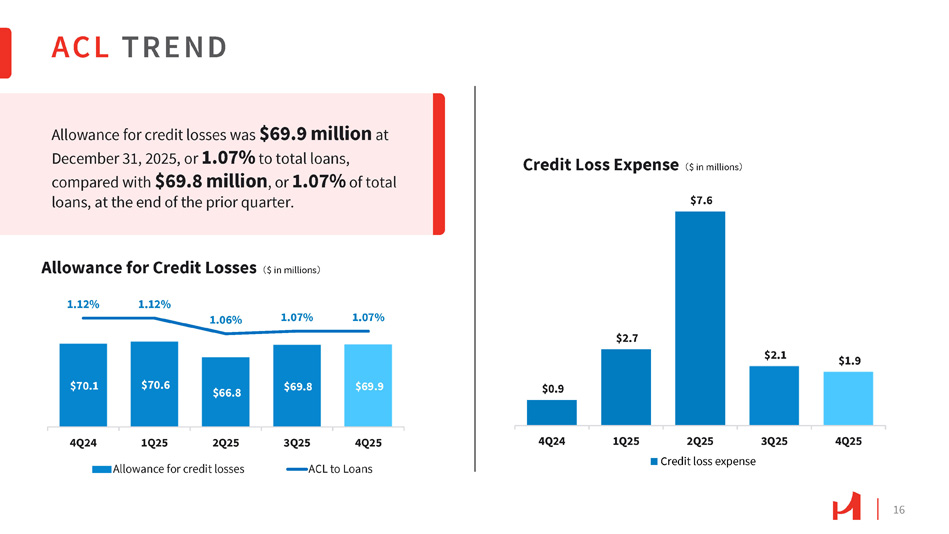

16 $70.1 $70.6 $66.8 $69.8 $69.9 1.06% 1.07% 1.07% Allowance for Credit Losses 㸦 $ in millions 㸧 1.12% 1.12% 4Q24 1Q25 2Q25 Allowance for credit losses 3Q25 4Q25 ACL to Loans $0.9 $2.7 Credit Loss Expense 㸦 $ in millions 㸧 $7.6 $2.1 $1.9 4Q24 1Q25 2Q25 Credit loss expense 3Q25 4Q25 Allowance for credit losses was $69.9 million at December 31, 2025, or 1.07% to total loans, compared with $69.8 million , or 1.07% of total loans, at the end of the prior quarter. ACL TREND

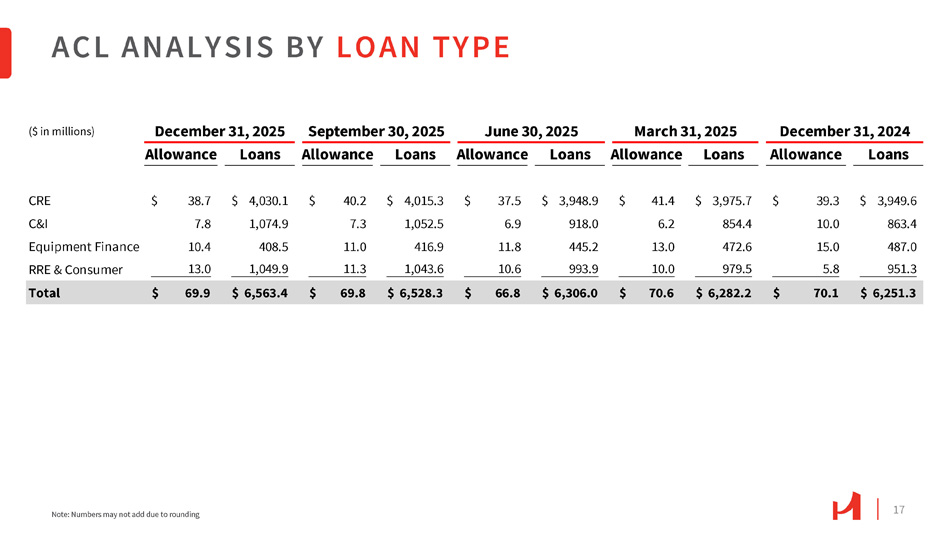

17 ACL ANALYSIS BY LOAN TYPE Note: Numbers may not add due to rounding Loans Allowance Loans Allowance Loans Allowance Loans Allowance Loans Allowance $ 3,949.6 $ 39.3 $ 3,975.7 $ 41.4 $ 3,948.9 $ 37.5 $ 4,015.3 $ 40.2 $ 4,030.1 $ 38.7 CRE 863.4 10.0 854.4 6.2 918.0 6.9 1,052.5 7.3 1,074.9 7.8 C&I 487.0 15.0 472.6 13.0 445.2 11.8 416.9 11.0 408.5 10.4 Equipment Finance 951.3 5.8 979.5 10.0 993.9 10.6 1,043.6 11.3 1,049.9 13.0 RRE & Consumer $ 6,251.3 $ 70.1 $ 6,282.2 $ 70.6 $ 6,306.0 $ 66.8 $ 6,528.3 $ 69.8 $ 6,563.4 $ 69.9 Total ($ in millions) December 31, 2025 September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024

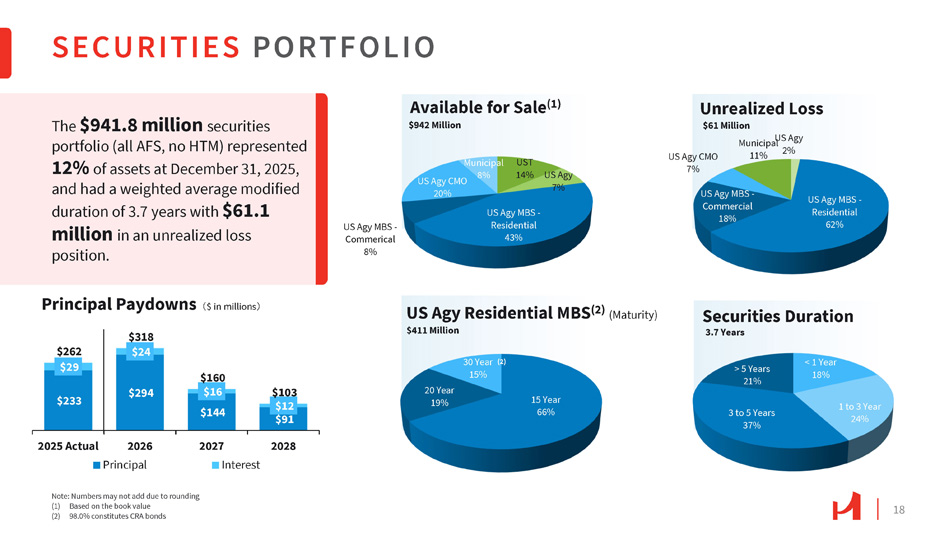

18 15 Year 66% 20 Year 19% SECURITIES PORTFOLIO $233 $294 $144 $91 $29 $24 $16 $12 $262 $318 $160 $103 2025 Actual 2026 Principal 2028 2027 Interest 2% US Agy MBS - Residential 62% US Agy MBS - Commercial 18% US Agy CMO 7% Municipa U l S Agy 11% UST 14% US Agy 7% US Agy MBS - Residential 43% US Agy MBS - Commerical 8% US Agy CMO 20% Municipal 8% Available for Sale (1) $942 Million < 1 Year 18% 1 to 3 Year 24% 3 to 5 Years 37% > 5 Years 21% $411 Million 30 Year (2) 15% Unrealized Loss $61 Million Securities Duration 3.7 Years Note: Numbers may not add due to rounding (1) Based on the book value (2) 98.0% constitutes CRA bonds The $941.8 million securities portfolio (all AFS, no HTM) represented 12% of assets at December 31, 2025, and had a weighted average modified duration of 3.7 years with $61.1 million in an unrealized loss position. Principal Paydowns 㸦 $ in millions 㸧 US Agy Residential MBS (2) (Maturity)

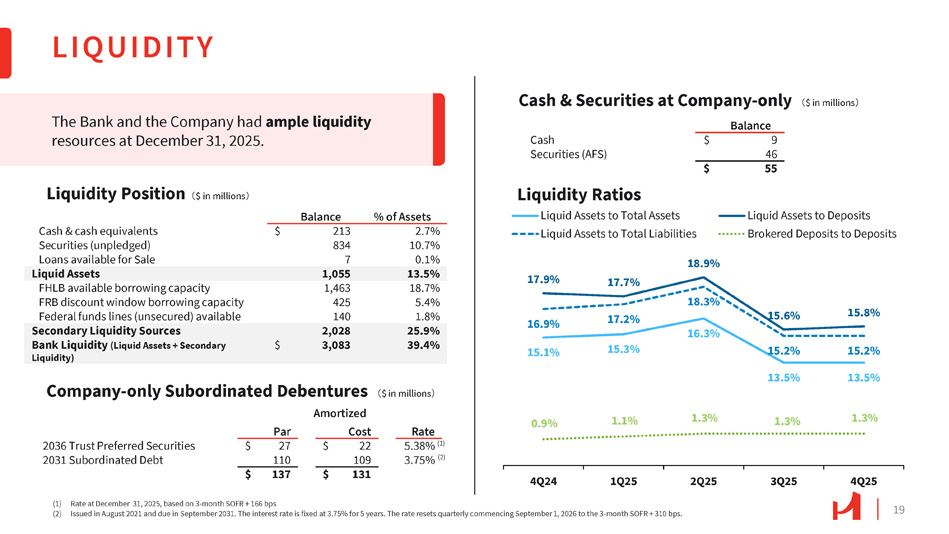

19 LIQUIDITY 4Q24 1Q25 (1) Rate at December 31, 2025, based on 3 - month SOFR + 166 bps (2) Issued in August 2021 and due in September 2031. The interest rate is fixed at 3.75% for 5 years. The rate resets quarterly commencing September 1, 2026 to the 3 - month SOFR + 310 bps. 15.1% 15.3% 16.3% 17.9% 17.7% 18.9% 15.6% 15.8% 16.9% 17.2% 18.3% 15.2% 13.5% 15.2% 13.5% 0.9% 1.1% 1.3% 1.3% 1.3% 2Q25 3Q25 4Q25 Liquid Assets to Total Assets Liquid Assets to Total Liabilities Liquid Assets to Deposits Brokered Deposits to Deposits Liquidity Position 㸦 $ in millions 㸧 Cash & Securities at Company - only 㸦 $ in millions 㸧 Company - only Subordinated Debentures 㸦 $ in millions 㸧 Liquidity Ratios % of Assets Balance 2.7% 213 $ Cash & cash equivalents 10.7% 834 Securities (unpledged) 0.1% 7 Loans available for Sale 13.5% 1,055 Liquid Assets 18.7% 1,463 FHLB available borrowing capacity 5.4% 425 FRB discount window borrowing capacity 1.8% 140 Federal funds lines (unsecured) available 25.9% 2,028 Secondary Liquidity Sources 39.4% 3,083 $ Bank Liquidity (Liquid Assets + Secondary Liquidity) Balance 9 $ Cash 46 Securities (AFS) 55 $ Amortized Rate Cost Par 5.38% 22 $ 27 $ 2036 Trust Preferred Securities 3.75% 109 110 2031 Subordinated Debt 131 $ 137 $ The Bank and the Company had ample liquidity resources at December 31, 2025. (1) (2)

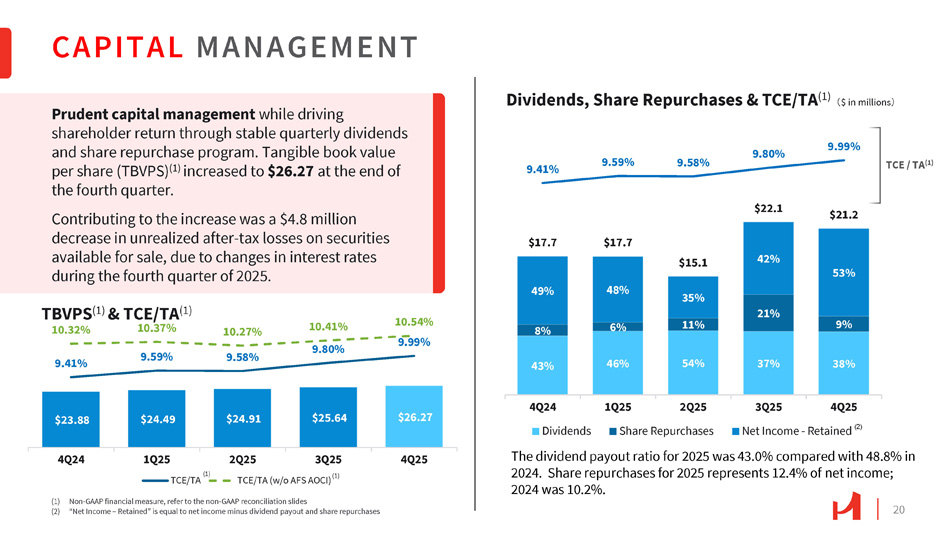

20 43% 46% 54% 37% 38% 8% 6% 21% 9% 49% 48% 35% 11% 42% 53% $17.7 $17.7 $15.1 $22.1 $21.2 9.41% 9.59% 9.58% 9.80% 9.99% 4Q24 Dividends 1Q25 2Q25 Share Repurchases 3Q25 4Q25 Net Income - Retained (2) $23.88 $24.49 $24.91 $25.64 $26.27 9.41% 9.59% 10.32% 10.37% 10.27% 9.58% 10.41% 9.80% 10.54% 9.99% 4Q24 1Q25 4Q25 (1) TCE/TA 2Q25 3Q25 TCE/TA (w/o AFS AOCI) (1) (1) Non - GAAP financial measure, refer to the non - GAAP reconciliation slides (2) “Net Income – Retained” is equal to net income minus dividend payout and share repurchases CAPITAL MANAGEMENT TCE / TA (1) Prudent capital management while driving shareholder return through stable quarterly dividends and share repurchase program. Tangible book value per share (TBVPS) (1) increased to $26.27 at the end of the fourth quarter. Contributing to the increase was a $4.8 million decrease in unrealized after - tax losses on securities available for sale, due to changes in interest rates during the fourth quarter of 2025. TBVPS (1) & TCE/TA (1) Dividends, Share Repurchases & TCE/TA (1) 㸦 $ in millions 㸧 The dividend payout ratio for 2025 was 43.0% compared with 48.8% in 2024. Share repurchases for 2025 represents 12.4% of net income; 2024 was 10.2%.

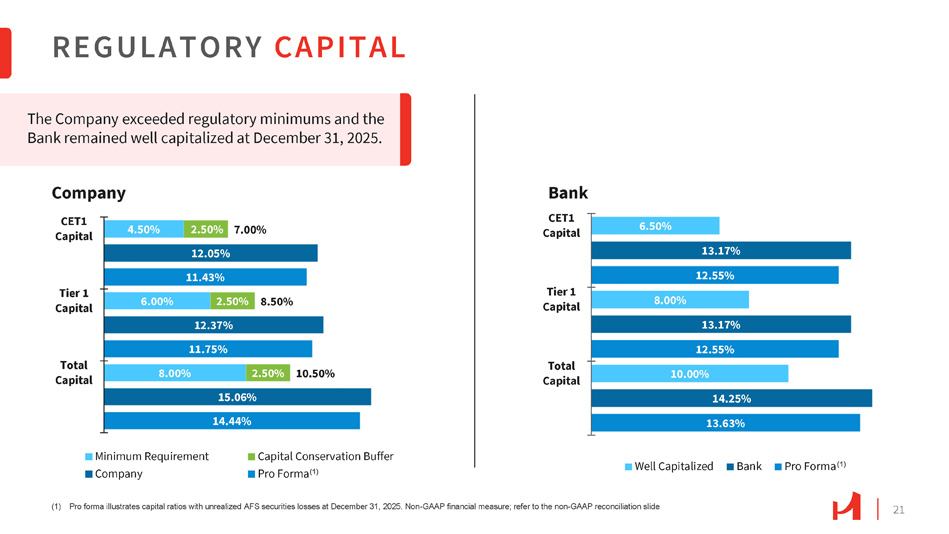

21 REGULATORY CAPITAL 8.00% 6.00% 4.50% 2.50% 15.06% 14.44% 2.50% 12.37% 11.75% 10.50% 8.50% 2.50% 7.00% 12.05% 11.43% Total Capital Tier 1 Capital CET1 Capital Minimum Requirement Company Capital Conservation Buffer Pro Forma (1) 8.00% 6.50% 13.17% 12.55% 10.00% 14.25% 13.63% 13.17% 12.55% Total Capital Tier 1 Capital Bank CET1 Capital Well Capitalized Bank Pro Forma (1) (1) Pro forma illustrates capital ratios with unrealized AFS securities losses at December 31, 2025. Non - GAAP financial measure; refer to the non - GAAP reconciliation slide Company The Company exceeded regulatory minimums and the Bank remained well capitalized at December 31, 2025.

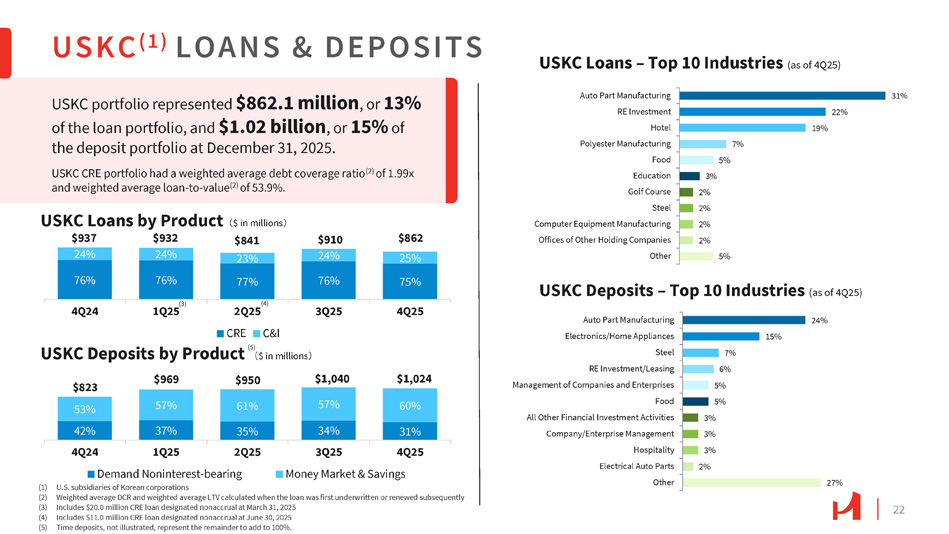

USKC ( 1 ) LOANS & DEPOSITS USKC portfolio represented $862.1 million , or 13% of the loan portfolio, and $1.02 billion , or 15% of the deposit portfolio at December 31, 2025. USKC CRE portfolio had a weighted average debt coverage ratio (2) of 1.99x and weighted average loan - to - value (2) of 53.9%. USKC Loans – Top 10 Industries (as of 4Q25) 31% 22% 19% 7% 5% 3% 2% 2% 2% 2% 5% Auto Part Manufacturing RE Investment Hotel Polyester Manufacturing Food Education Golf Course Steel Computer Equipment Manufacturing Offices of Other Holding Companies Other 24% 15% 7% 6% Auto Part Manufacturing Electronics/Home Appliances Steel RE Investment/Leasing 5% Management of Companies and Enterprises 5% Food 3% All Other Financial Investment Activities 3% Company/Enterprise Management 3% Hospitality 2% Electrical Auto Parts 27% Other 22 USKC Deposits – Top 10 Industries (as of 4Q25) $937 24% 76% $932 24% 76% $841 23% 77% $910 24% 76% $862 25% 75% 4Q24 1Q25 3Q25 4Q25 USKC Loans by Product 㸦 $ in millions 㸧 USKC Deposits by Product 㸦 $ in millions 㸧 $1,024 $1,040 $950 $823 $969 60% 31% 57% 34% 61% 35% 53% 57% 42% 37% 4Q25 3Q25 2Q25 4Q24 1Q25 Demand Noninterest - bearing Money Market & Savings (1) U.S. subsidiaries of Korean corporations (2) Weighted average DCR and weighted average LTV calculated when the loan was first underwritten or renewed subsequently (3) Includes $20.0 million CRE loan designated nonaccrual at March 31, 2025 (4) Includes $11.0 million CRE loan designated nonaccrual at June 30, 2025 (5) Time deposits, not illustrated, represent the remainder to add to 100%. (5) (3) (4) 2Q25 CRE C&I

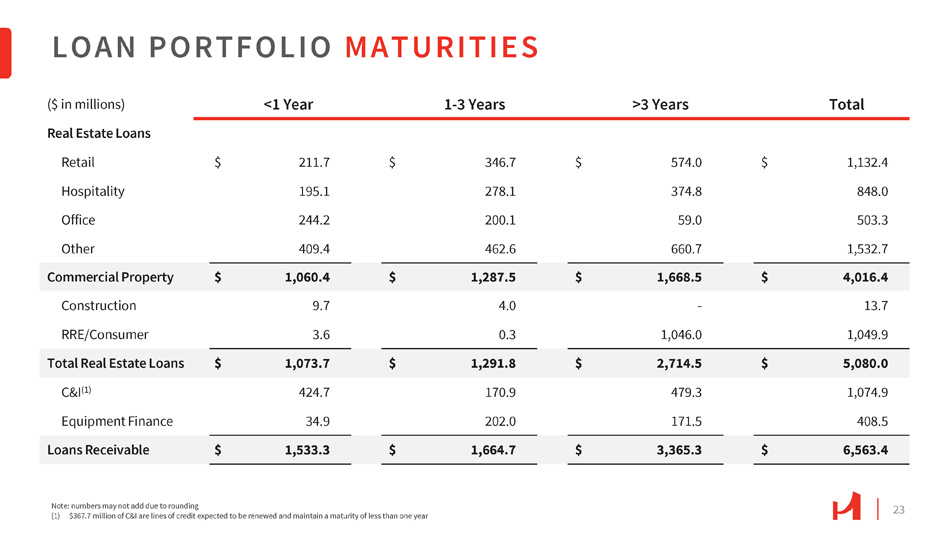

23 Total >3 Years 1 - 3 Years <1 Year ($ in millions) Real Estate Loans 1,132.4 $ 574.0 $ 346.7 $ 211.7 $ Retail 848.0 374.8 278.1 195.1 Hospitality 503.3 59.0 200.1 244.2 Office 1,532.7 660.7 462.6 409.4 Other 4,016.4 $ 1,668.5 $ 1,287.5 $ 1,060.4 $ Commercial Property 13.7 - 4.0 9.7 Construction 1,049.9 1,046.0 0.3 3.6 RRE/Consumer 5,080.0 $ 2,714.5 $ 1,291.8 $ 1,073.7 $ Total Real Estate Loans 1,074.9 479.3 170.9 424.7 C&I (1) 408.5 171.5 202.0 34.9 Equipment Finance 6,563.4 $ 3,365.3 $ 1,664.7 $ 1,533.3 $ Loans Receivable LOAN PORTFOLIO MATURITIES Note: numbers may not add due to rounding (1) $367.7 million of C&I are lines of credit expected to be renewed and maintain a maturity of less than one year

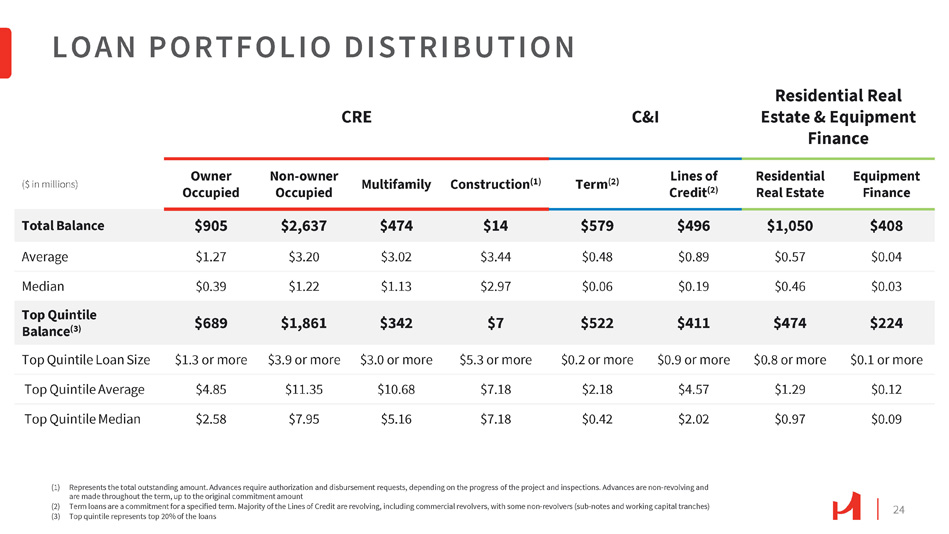

24 LOAN PORTFOLIO DISTRIBUTION Residential Real Estate & Equipment Finance C&I CRE Equipment Finance Residential Real Estate Lines of Credit (2) Term (2) Construction (1) Multifamily Non - owner Occupied Owner Occupied ($ in millions) $408 $1,050 $496 $579 $14 $474 $2,637 $905 Total Balance $0.04 $0.57 $0.89 $0.48 $3.44 $3.02 $3.20 $1.27 Average $0.03 $0.46 $0.19 $0.06 $2.97 $1.13 $1.22 $0.39 Median $224 $474 $411 $522 $7 $342 $1,861 $689 Top Quintile Balance (3) $0.1 or more $0.8 or more $0.9 or more $0.2 or more $5.3 or more $3.0 or more $3.9 or more $1.3 or more Top Quintile Loan Size $0.12 $1.29 $4.57 $2.18 $7.18 $10.68 $11.35 $4.85 Top Quintile Average $0.09 $0.97 $2.02 $0.42 $7.18 $5.16 $7.95 $2.58 Top Quintile Median (1) Represents the total outstanding amount. Advances require authorization and disbursement requests, depending on the progress of the project and inspections. Advances are non - revolving and are made throughout the term, up to the original commitment amount (2) Term loans are a commitment for a specified term. Majority of the Lines of Credit are revolving, including commercial revolvers, with some non - revolvers (sub - notes and working capital tranches) (3) Top quintile represents top 20% of the loans

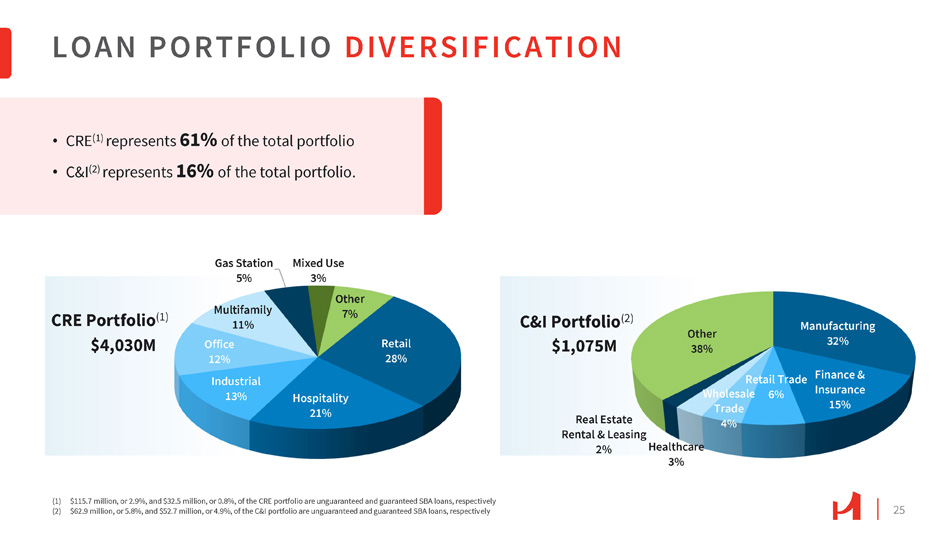

LOAN PORTFOLIO DIVERSIFICATION (1) $115.7 million, or 2.9%, and $32.5 million, or 0.8%, of the CRE portfolio are unguaranteed and guaranteed SBA loans, respectively (2) $62.9 million, or 5.8%, and $52.7 million, or 4.9%, of the C&I portfolio are unguaranteed and guaranteed SBA loans, respectively Retail 28% Hospitality 21% Industrial 13% Office 12% Multifamily 11% Gas Station 5% Mixed Use 3% Other 7% CRE Portfolio (1) $4,030M Manufacturing 32% Insurance 15% Retail Trade Finance & Wholesale 6% Trade 4% Healthcare 3% Real Estate Rental & Leasing 2% Other 38% C&I Portfolio (2) $1,075M • CRE (1) represents 61% of the total portfolio • C&I (2) represents 16% of the total portfolio. 25

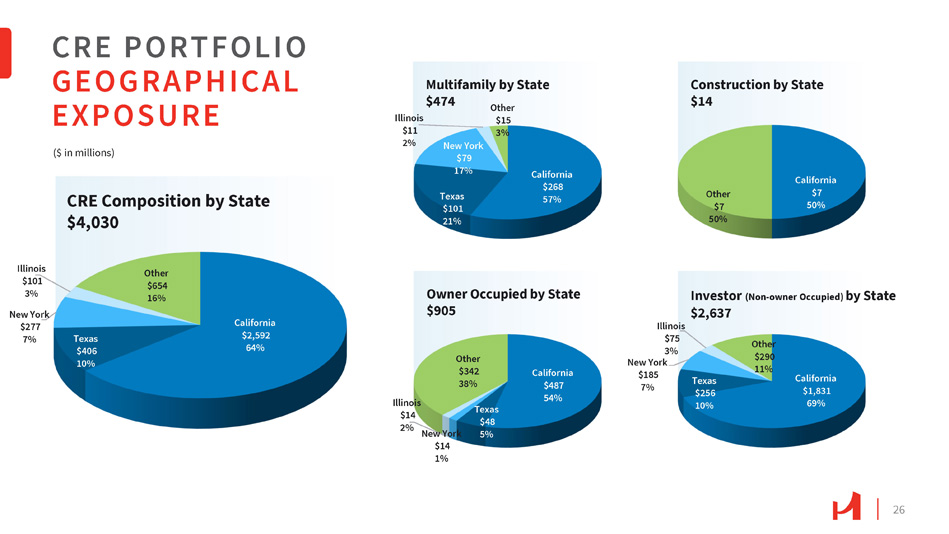

California $2,592 64% Texas $406 10% Illinois $101 3% New York $277 7% Other $654 16% CRE Composition by State $4,030 CRE PORTFOLIO GEOGRAPHICAL EXPOSURE 26 California $7 50% Other $7 50% Construction by State $14 California $487 54% Texas $48 5% New York $14 1% Illinois $14 2% Other $342 38% Owner Occupied by State $905 California $1,831 69% Texas $256 10% Illinois $75 3% New York $185 7% Other $290 11% Investor (Non - owner Occupied) by State $2,637 California $268 57% Texas $101 21% New York $79 17% Illinois $11 2% Other $15 3% Multifamily by State $474 ($ in millions)

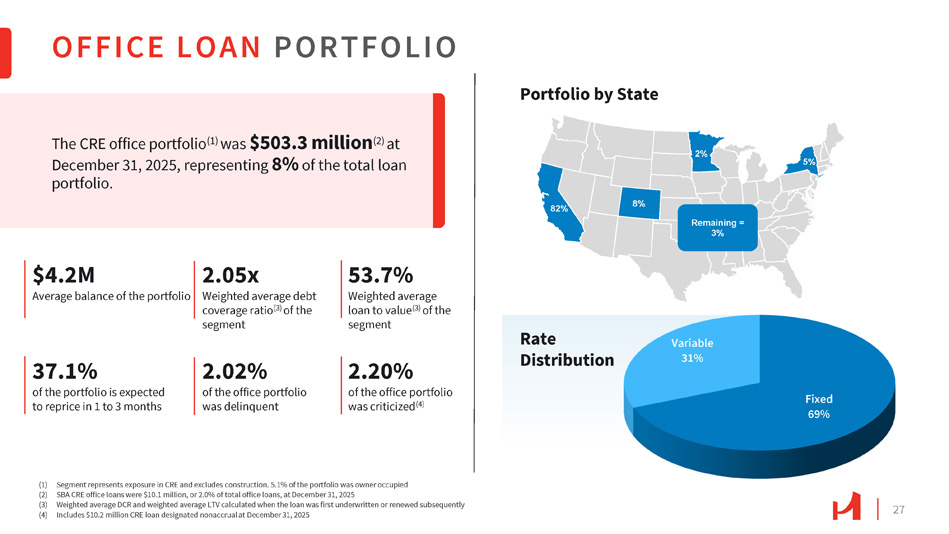

Rate Distribution Portfolio by State Fixed 69% Variable 31% OFFICE LOAN PORTFOLIO 27 (1) Segment represents exposure in CRE and excludes construction. 5.1% of the portfolio was owner occupied (2) SBA CRE office loans were $10.1 million, or 2.0% of total office loans, at December 31, 2025 (3) Weighted average DCR and weighted average LTV calculated when the loan was first underwritten or renewed subsequently (4) Includes $10.2 million CRE loan designated nonaccrual at December 31, 2025 The CRE office portfolio (1) was $503.3 million (2) at December 31, 2025, representing 8% of the total loan portfolio. $4.2M Average balance of the portfolio 2.05x Weighted average debt coverage ratio (3) of the segment 53.7% Weighted average loan to value (3) of the segment 37.1% of the portfolio is expected to reprice in 1 to 3 months 2.02% of the office portfolio was delinquent 2.20% of the office portfolio was criticized (4) Remaining = 3% 82% 8% 2% 5%

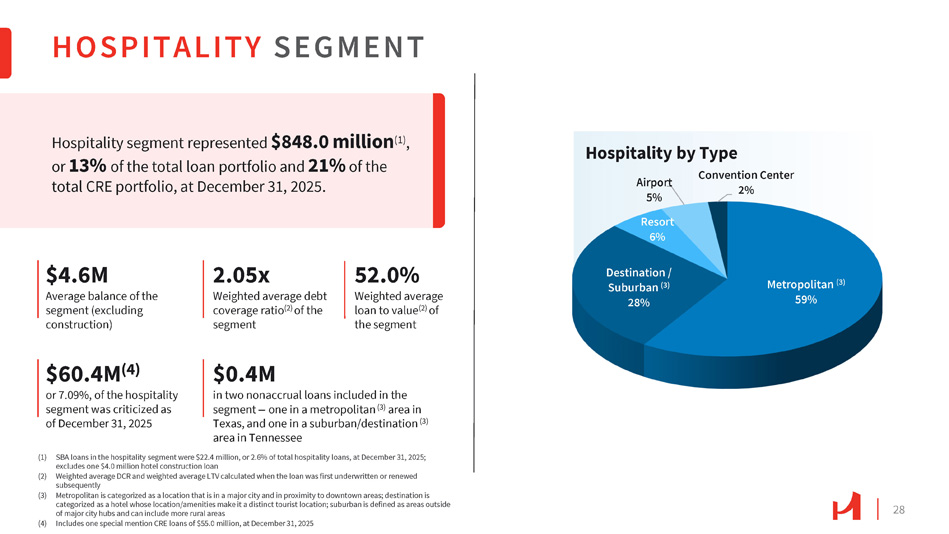

28 HOSPITALITY SEGMENT (1) SBA loans in the hospitality segment were $22.4 million, or 2.6% of total hospitality loans, at December 31, 2025; excludes one $4.0 million hotel construction loan (2) Weighted average DCR and weighted average LTV calculated when the loan was first underwritten or renewed subsequently (3) Metropolitan is categorized as a location that is in a major city and in proximity to downtown areas; destination is categorized as a hotel whose location/amenities make it a distinct tourist location; suburban is defined as areas outside of major city hubs and can include more rural areas (4) Includes one special mention CRE loans of $55.0 million, at December 31, 2025 Hospitality segment represented $848.0 million (1) , or 13% of the total loan portfolio and 21% of the total CRE portfolio, at December 31, 2025. $4.6M Average balance of the segment (excluding construction) 2.05x Weighted average debt coverage ratio (2) of the segment 52.0% Weighted average loan to value (2) of the segment $60.4M (4) or 7.09%, of the hospitality segment was criticized as of December 31, 2025 $0.4M in two nonaccrual loans included in the segment – one in a metropolitan (3) area in Texas, and one in a suburban/destination (3) area in Tennessee (3) Metropolitan 59% Destination / Suburban (3) 28% Airport 5% Resort 6% Convention Center 2% Hospitality by Type

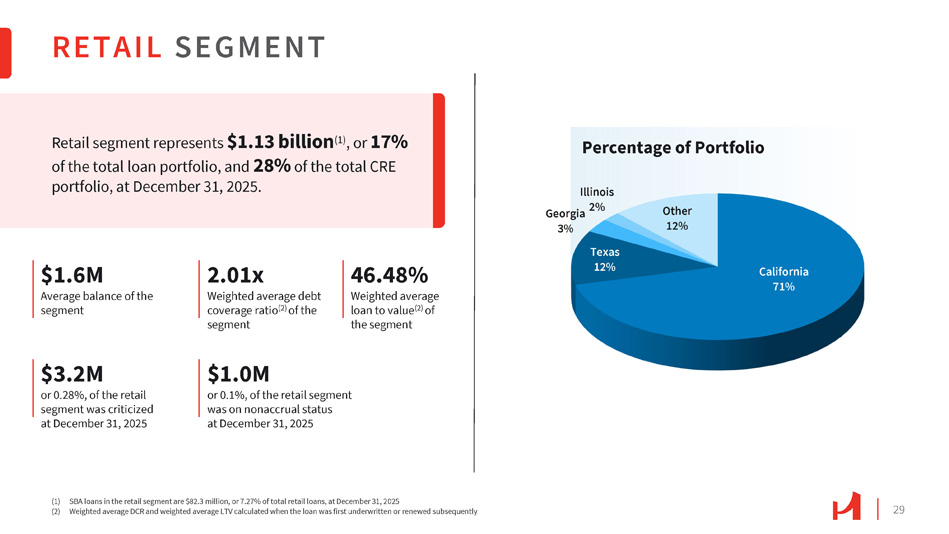

29 RETAIL SEGMENT Retail segment represents $1.13 billion (1) , or 17% of the total loan portfolio, and 28% of the total CRE portfolio, at December 31, 2025. $1.6M Average balance of the segment 2.01x Weighted average debt coverage ratio (2) of the segment 46.48% Weighted average loan to value (2) of the segment $3.2M or 0.28%, of the retail segment was criticized at December 31, 2025 $1.0M or 0.1%, of the retail segment was on nonaccrual status at December 31, 2025 California 71% Texas 12% Illinois Georgia 2% 3% Other 12% Percentage of Portfolio (1) SBA loans in the retail segment are $82.3 million, or 7.27% of total retail loans, at December 31, 2025 (2) Weighted average DCR and weighted average LTV calculated when the loan was first underwritten or renewed subsequently

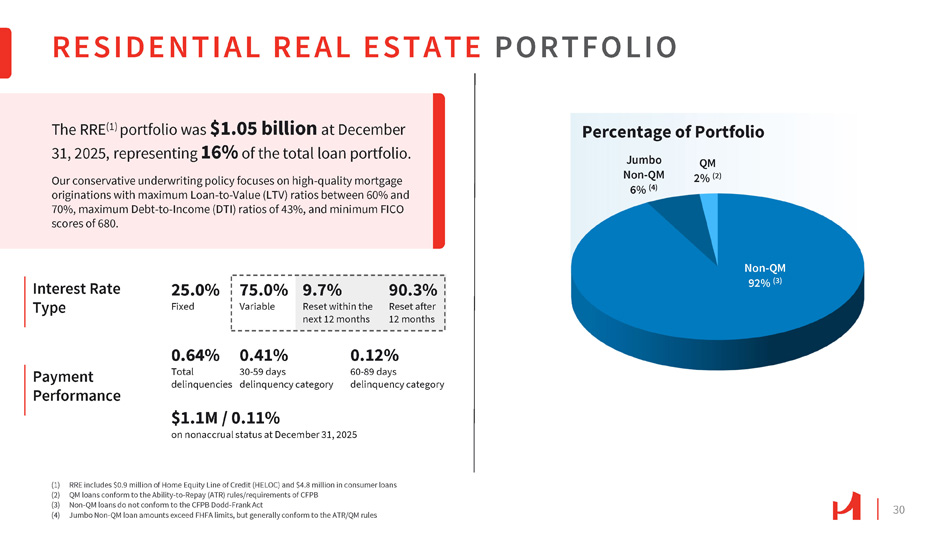

30 Payment Performance RESIDENTIAL REAL ESTATE PORTFOLIO The RRE (1) portfolio was $1.05 billion at December 31, 2025, representing 16% of the total loan portfolio. Our conservative underwriting policy focuses on high - quality mortgage originations with maximum Loan - to - Value (LTV) ratios between 60% and 70%, maximum Debt - to - Income (DTI) ratios of 43%, and minimum FICO scores of 680. 25.0% Fixed Non - QM 92% (3) Jumbo Non - QM 6% (4) QM 2% (2) (1) RRE includes $0.9 million of Home Equity Line of Credit (HELOC) and $4.8 million in consumer loans (2) QM loans conform to the Ability - to - Repay (ATR) rules/requirements of CFPB (3) Non - QM loans do not conform to the CFPB Dodd - Frank Act (4) Jumbo Non - QM loan amounts exceed FHFA limits, but generally conform to the ATR/QM rules Interest Rate Type 75.0% Variable 0.64% 0.41% Total 30 - 59 days delinquencies delinquency category 9.7% 90.3% Reset within the Reset after next 12 months 12 months 0.12% 60 - 89 days delinquency category $1.1M / 0.11% on nonaccrual status at December 31, 2025 Percentage of Portfolio

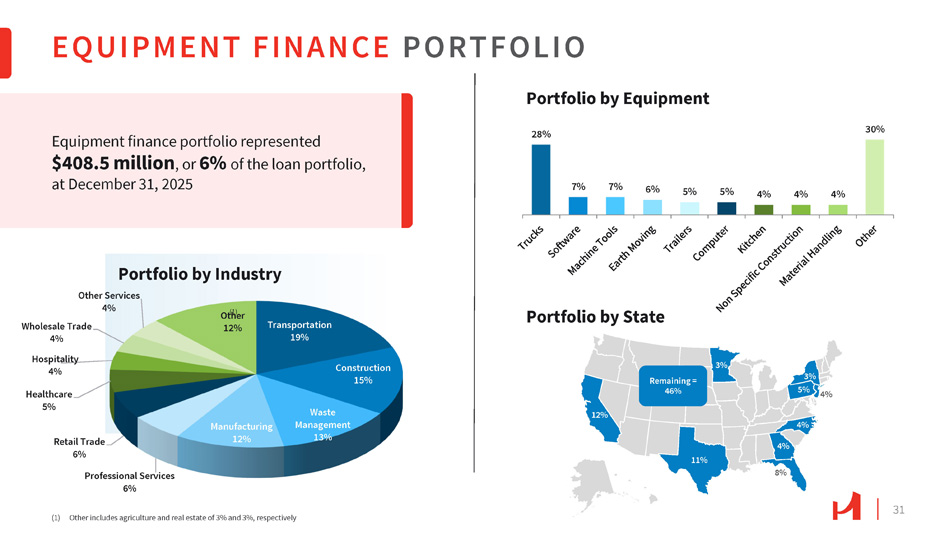

4% 3% 5% Remaining = 46% 12% 11% 4% 8% 4% 3% EQUIPMENT FINANCE PORTFOLIO 31 Transportation 19% Construction 15% Waste Management 13% Manufacturing 12% Retail Trade 6% Professional Services 6% Wholesale Trade 4% Hospitality 4% Healthcare 5% Other Services 4% Portfolio by Industry Ot ( h 1) er 12% (1) Other includes agriculture and real estate of 3% and 3%, respectively Equipment finance portfolio represented $408.5 million , or 6% of the loan portfolio, at December 31, 2025 7% 7% 6% 5% 5% 4% 4% 4% Portfolio by Equipment 28% 30% Portfolio by State

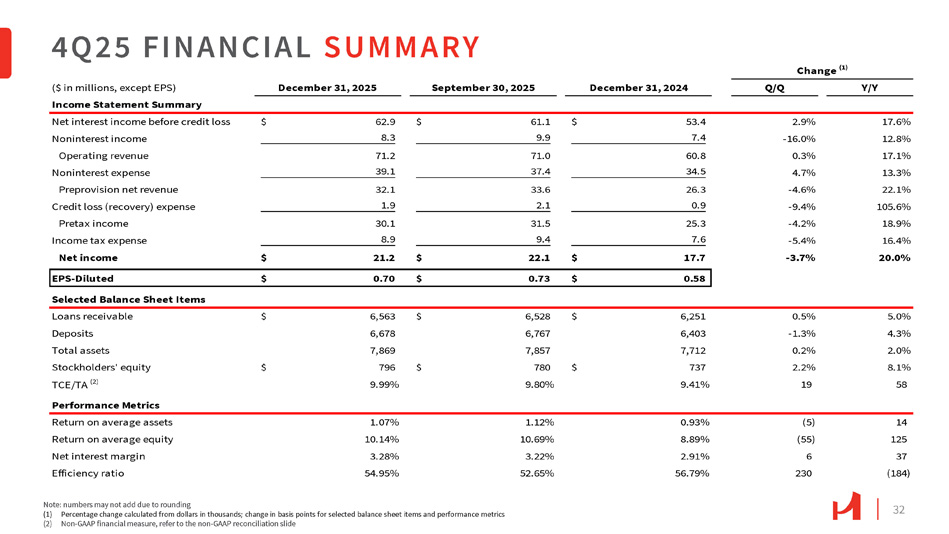

32 4 Q 25 FINANCIAL SUMMARY Note: numbers may not add due to rounding (1) Percentage change calculated from dollars in thousands; change in basis points for selected balance sheet items and performance metrics (2) Non - GAAP financial measure, refer to the non - GAAP reconciliation slide ($ in millions, except EPS) December 31, 2025 September 30, 2025 Income Statement Summary December 31, 2024 Q/Q Y/Y 17.6% 2.9% 53.4 $ 61.1 $ 62.9 $ Net interest income before credit loss 12.8% - 16.0% 7.4 9.9 8.3 Noninterest income 17.1% 0.3% 60.8 71.0 71.2 Operating revenue 13.3% 4.7% 34.5 37.4 39.1 Noninterest expense 22.1% - 4.6% 26.3 33.6 32.1 Preprovision net revenue 105.6% - 9.4% 0.9 2.1 1.9 Credit loss (recovery) expense 18.9% - 4.2% 25.3 31.5 30.1 Pretax income 16.4% - 5.4% 7.6 9.4 8.9 Income tax expense 20.0% - 3.7% 17.7 $ 22.1 $ 21.2 $ Net income 0.58 $ 0.73 $ 0.70 $ EPS - Diluted Selected Balance Sheet Items 5.0% 0.5% 6,251 $ 6,528 $ 6,563 $ Loans receivable 4.3% - 1.3% 6,403 6,767 6,678 Deposits 2.0% 0.2% 7,712 7,857 7,869 Total assets 8.1% 2.2% 737 $ 780 $ 796 $ Stockholders' equity 58 19 9.41% 9.80% 9.99% TCE/TA (2) Performance Metrics 14 (5) 0.93% 1.12% 1.07% Return on average assets 125 (55) 8.89% 10.69% 10.14% Return on average equity 37 6 2.91% 3.22% 3.28% Net interest margin (184) 230 56.79% 52.65% 54.95% Efficiency ratio Change (1)

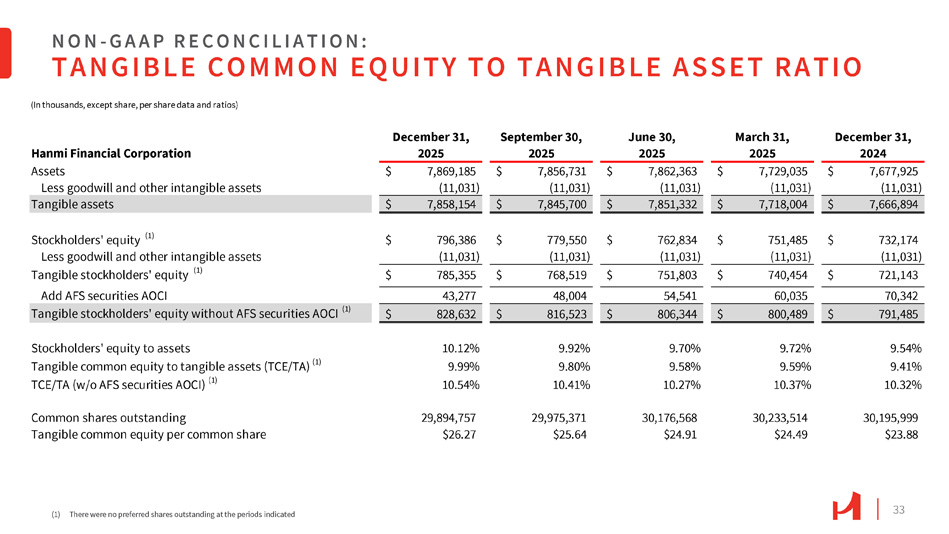

33 NON - G A A P R E C O N C I L I A T I O N : TANGIBLE COMMON EQUITY TO TANGIBLE ASSET RATIO (1) There were no preferred shares outstanding at the periods indicated December 31, March 31, June 30, September 30, December 31, 2024 2025 2025 2025 2025 Hanmi Financial Corporation 7,677,925 $ 7,729,035 $ 7,862,363 $ 7,856,731 $ 7,869,185 $ Assets (11,031) (11,031) (11,031) (11,031) (11,031) Less goodwill and other intangible assets $ 7,666,894 $ 7,718,004 $ 7,851,332 $ 7,845,700 $ 7,858,154 Tangible assets 732,174 $ 751,485 $ 762,834 $ 779,550 $ 796,386 $ Stockholders' equity (1) (11,031) (11,031) (11,031) (11,031) (11,031) Less goodwill and other intangible assets 721,143 $ 740,454 $ 751,803 $ 768,519 $ 785,355 $ Tangible stockholders' equity (1) 70,342 60,035 54,541 48,004 43,277 Add AFS securities AOCI $ 791,485 $ 800,489 $ 806,344 $ 816,523 $ 828,632 Tangible stockholders' equity without AFS securities AOCI (1) 9.54% 9.72% 9.70% 9.92% 10.12% Stockholders' equity to assets 9.41% 9.59% 9.58% 9.80% 9.99% Tangible common equity to tangible assets (TCE/TA) (1) 10.32% 10.37% 10.27% 10.41% 10.54% TCE/TA (w/o AFS securities AOCI) (1) 30,195,999 30,233,514 30,176,568 29,975,371 29,894,757 Common shares outstanding $23.88 $24.49 $24.91 $25.64 $26.27 Tangible common equity per common share (In thousands, except share, per share data and ratios)

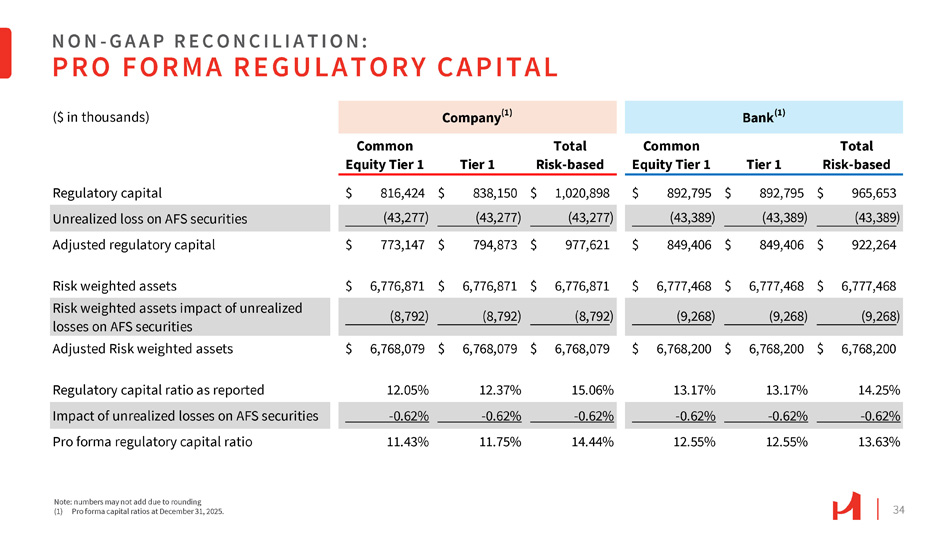

34 NON - G A A P R E C O N C I L I A T I O N : PRO FORMA REGULATORY CAPITAL Note: numbers may not add due to rounding (1) Pro forma capital ratios at December 31, 2025. Bank (1) Company (1) ($ in thousands) Total Risk - based Tier 1 Common Equity Tier 1 Total Risk - based Tier 1 Common Equity Tier 1 $ 965,653 $ 892,795 $ 892,795 $ 1,020,898 $ 838,150 $ 816,424 Regulatory capital (43,389 ) (43,389 ) (43,389 ) (43,277 ) (43,277 ) (43,277 ) Unrealized loss on AFS securities $ 922,264 $ 849,406 $ 849,406 $ 977,621 $ 794,873 $ 773,147 Adjusted regulatory capital $ 6,777,468 $ 6,777,468 $ 6,777,468 $ 6,776,871 $ 6,776,871 $ 6,776,871 Risk weighted assets $ 6,768,200 $ 6,768,200 $ 6,768,200 $ 6,768,079 $ 6,768,079 $ 6,768,079 Adjusted Risk weighted assets 14.25% 13.17% 13.17% 15.06% 12.37% 12.05% Regulatory capital ratio as reported - 0.62% - 0.62% - 0.62% - 0.62% - 0.62% - 0.62% Impact of unrealized losses on AFS securities 13.63% 12.55% 12.55% 14.44% 11.75% 11.43% Pro forma regulatory capital ratio Risk weighted assets impact of unrealized losses on AFS securities (8,792 ) (8,792 ) (8,792 ) (9,268 ) (9,268 ) (9,268 )

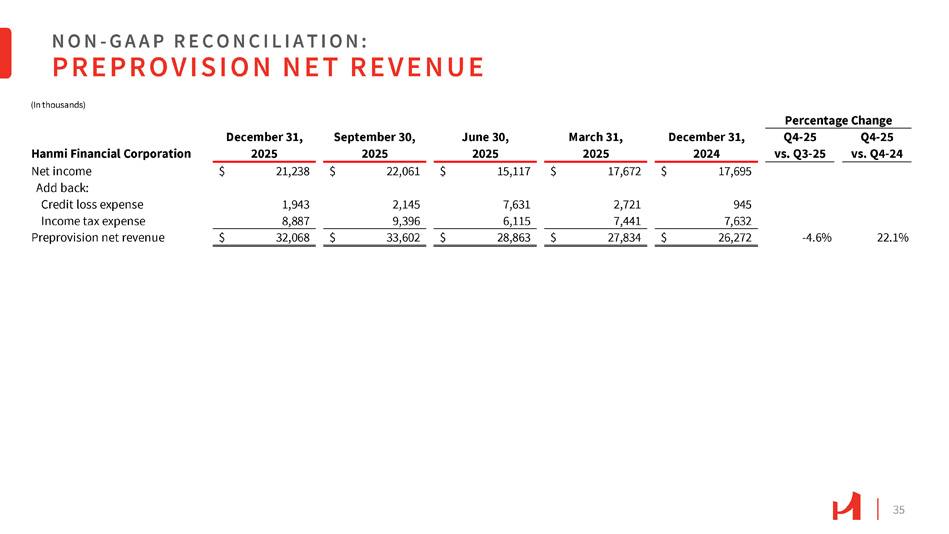

35 NON - G A A P R E C O N C I L I A T I O N : PREPROVISION NET REVENUE (In thousands) Percentage Change Q4 - 25 Q4 - 25 December 31, March 31, June 30, September 30, December 31, vs. Q3 - 25 vs. Q4 - 24 2024 2025 2025 2025 2025 Hanmi Financial Corporation $ 17,695 945 $ 17,672 2,721 $ 15,117 7,631 $ 22,061 2,145 $ 21,238 1,943 Net income Add back: Credit loss expense 7,632 7,441 6,115 9,396 8,887 Income tax expense - 4.6% 22.1% $ 26,272 $ 27,834 $ 28,863 $ 33,602 $ 32,068 Preprovision net revenue