Notice of 2018 Annual Meeting of Stockholders and Proxy Statement

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| Filed by the Registrant |

☒ | |||

| Filed by a Party other than the Registrant |

☐ |

Check the appropriate box:

| ☐ | Preliminary proxy statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive proxy statement |

| ☐ | Definitive additional materials |

| ☐ | Soliciting material pursuant to Rule 14a-11(c) or Rule 14a-12 |

Global Eagle Entertainment Inc.

Payment of filing fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) | Amount previously paid: |

| (2) | Form, schedule or registration statement no.: |

| (3) | Filing party: |

| (4) | Date filed: |

Notice of 2018 Annual Meeting of Stockholders and Proxy Statement

|

Global Eagle Entertainment Inc. 6080 Center Drive, Suite 1200 Los Angeles, California 90045

|

May 20, 2020

Dear Fellow Stockholders:

We cordially invite you to attend the 2020 Annual Meeting of Stockholders of Global Eagle Entertainment Inc. on Monday, July 13, 2020, at 12:00 p.m. (Pacific Time) at 6080 Center Drive, Suite 1200, Los Angeles, California 90045. We intend to hold our Annual Meeting in person. However, we continue to monitor the situation regarding the novel coronavirus (COVID-19) closely, taking into account guidance from the Centers for Disease Control and Prevention and the World Health Organization and protocols that federal, state and local governments may impose. The health and well-being of our employees and stockholders is our top priority. Accordingly, we are planning for the possibility that the Annual Meeting may be held solely by means of remote communication if we determine that it is not advisable to hold an in-person meeting. In the event the Annual Meeting will be held solely by remote communication, we will announce the decision to do so in advance, and details on how to participate will be issued by press release, posted on our website and filed with the SEC as additional proxy material.

You can find details about the business that we will conduct at the Annual Meeting as well as other information about the Annual Meeting in the attached Notice of 2020 Annual Meeting of Stockholders and Proxy Statement. As a stockholder, you will be asked to vote on a number of proposals.

Whether or not you plan to attend the Annual Meeting, your vote is important. After reading the attached Notice of 2020 Annual Meeting of Stockholders and Proxy Statement, please promptly submit your proxy or voting instructions.

On behalf of the management team and your Board of Directors, thank you for your continued support and interest in our company.

Sincerely,

Josh Marks Chief Executive Officer and Director | |

Notice of 2020 Annual Meeting of Stockholders

July 13, 2020

12:00 p.m. (Pacific Time)

The 2020 Annual Meeting of Stockholders of Global Eagle Entertainment Inc. (the “Annual Meeting”) will be held on July 13, 2020 at 12:00 p.m. (Pacific Time) at 6080 Center Drive, Suite 1200, Los Angeles, California 90045*, for the following purposes:

AGENDA:

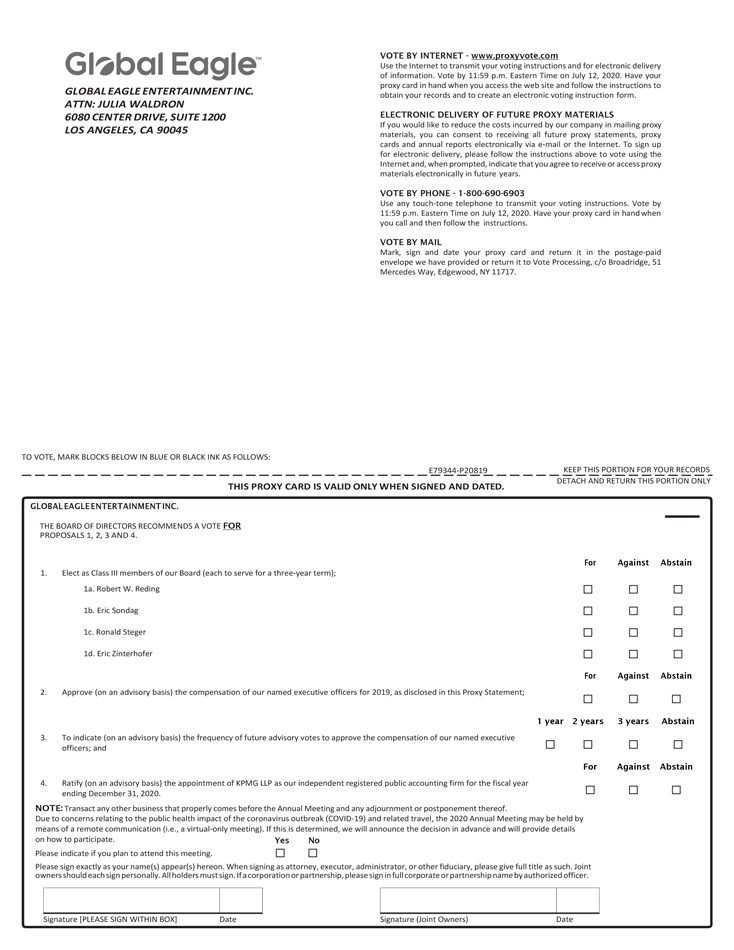

| 1. | Elect Robert W. Reding, Eric Sondag, Ronald Steger and Eric Zinterhofer as Class III members of our Board of Directors; |

| 2. | Approve (on an advisory basis) the compensation of our named executive officers for 2019; |

| 3. | To indicate (on an advisory basis) the frequency of future advisory votes to approve the compensation of our named executive officers; and |

| 4. | Ratify (on an advisory basis) the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020. |

We describe these items of business in more detail in the Proxy Statement accompanying this Notice.

Only stockholders of record as of the close of business on May 14, 2020 are entitled to receive notice of, and to vote at, the Annual Meeting and any and all adjournments or postponements thereof. Stockholders who hold shares in street name may vote through their brokers, banks or other nominees.

Regardless of the number of shares you own or whether you plan to attend the Annual Meeting, please vote. All stockholders of record can vote (i) over the Internet by accessing the Internet website specified on the enclosed proxy card and following the instructions provided to you, (ii) by calling the toll-free telephone number specified on the enclosed proxy card and following the instructions when prompted, (iii) by written proxy by signing and dating the enclosed proxy card and returning it to us pursuant to the instructions under “Other Matters—How do I vote?” on page 36 of this Proxy Statement or (iv) by attending the Annual Meeting and voting in person.

*As part of our precautions regarding COVID-19, we are planning for the possibility that the Annual Meeting may be held solely by means of remote communication. If we take this step, we will announce the decision to do so in advance on our website at www.globaleagle.com under “Investors”, and details on how to participate, vote, and examine the list of stockholders as of the record date will be issued by press release, posted at that location on our website, and filed with the SEC as additional proxy material. Please monitor our website for updated information.

We encourage you to receive all proxy materials electronically. If you wish to receive these materials electronically, please follow the instructions on the proxy card. See also “Other Matters—Electronic Access to Proxy Statement and Annual Report” on page 40 of the Proxy Statement for more information in this regard.

By Order of the Board of Directors,

Jeffrey A. Leddy

Executive Chairman of the Company and Chairman of the Board

May 20, 2020

HOW DO I VOTE?

|

|

|

| |||

| INTERNET Visit the website listed on your proxy card |

BY PHONE Call the telephone number on your proxy card |

BY MAIL Sign, date and return your proxy card |

IN PERSON Attend the Annual Meeting | |||

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE 2020 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JULY 13, 2020

This Notice of 2020 Annual Meeting and Proxy Statement and our 2019 Annual Report are available

on our website at www.globaleagle.com under “Investors—Financial Info.”

PROXY STATEMENT

FOR THE 2020 ANNUAL MEETING OF STOCKHOLDERS

To Be Held on July 13, 2020

This Proxy Statement is being furnished to stockholders of record of Global Eagle Entertainment Inc. (“Global Eagle,” the “Company,” “we,” “us” or “our”) as of the close of business on May 14, 2020 in connection with the solicitation by our Board of Directors (the “Board”) of proxies for our 2020 Annual Meeting of Stockholders (the “Annual Meeting”) to be held at 6080 Center Drive, Suite 1200, Los Angeles, California 90045, on Monday, July 13, 2020, at 12:00 p.m. (Pacific Time), or at any and all adjournments or postponements thereof, for the purposes stated in the Notice of 2020 Annual Meeting of Stockholders. This Proxy Statement and the enclosed form of proxy is being sent to our stockholders on or about May 27, 2020.

RELIANCE ON SECURITIES AND EXCHANGE COMMISSION ORDER

On April 29, 2020, the Company filed a Current Report on Form 8-K announcing that it was relying on, and is filing this Proxy Statement in reliance on, the Order of the Securities and Exchange Commission (the “SEC”), dated March 25, 2020, pursuant to Section 36 of the Securities Exchange Act of 1934 modifying exemptions from the reporting and proxy delivery requirements for public companies (Release No. 34-88465).

The COVID-19 pandemic has disrupted, and continues to disrupt, the Company’s day-to-day activities, including limiting the Company’s access to facilities, as well as the day-to-day activities of the Company’s financial service providers. These disruptions have limited support from the Company’s staff and professional advisers. This has, in turn, impacted the Company’s ability to complete its audit and file this Proxy Statement by April 29, 2020, the original due date.

Why am I receiving these materials?

We have sent you these proxy materials because our Board is soliciting your proxy to vote at the Annual Meeting, including at any adjournments or postponements of the Annual Meeting. We invite you to attend the Annual Meeting to vote on the proposals described in this Proxy Statement. However, you do not need to attend the meeting to vote your shares. Instead, you may complete, sign and return the enclosed proxy card, or follow the instructions below to submit your proxy over the telephone or through the Internet.

How do I attend the Annual Meeting?

Stockholders may participate in the Annual Meeting by visiting 6080 Center Drive, Suite 1200, Los Angeles, California 90045, on Monday, July 13, 2020, at 12:00 p.m. (Pacific Time). We discuss how to vote in person at the Annual Meeting below under “Other Matters—How do I vote?” on page 36.

We intend to hold our Annual Meeting in person. However, we continue to monitor the situation regarding the novel coronavirus (COVID-19) closely, taking into account guidance from the Centers for Disease Control and Prevention and the World Health Organization and protocols that federal, state and local governments may impose. The health and well-being of our employees and stockholders is our top priority. Accordingly, we are planning for the possibility that the Annual Meeting may be held solely by means of remote communication if we determine that it is not advisable to hold an in-person meeting. In the event the Annual Meeting will be held solely by remote communication, we will announce the decision to do so in advance, and details on how to participate will be issued by press release, posted on our website and filed with the SEC as additional proxy material. Please monitor our website for updated information.

|

● 2020 Proxy Statement

|

1

|

INTRODUCTORY INFORMATION

Who can vote at the Annual Meeting?

Only our stockholders of record at the close of business on May 14, 2020 (which is the record date for the Annual Meeting) will be entitled to vote at the Annual Meeting. On this record date, there were 3,744,643 shares of our common stock outstanding and entitled to vote. For ten days prior to the Annual Meeting, during normal business hours, we will make available for examination by any stockholder a complete list of all stockholders on the record date. We will make this list available at our offices at 6080 Center Drive, Suite 1200, Los Angeles, California 90045. We will also make this list of stockholders available at the Annual Meeting.

Stockholders of Record: Shares Registered in Your Name

If at the close of business on May 14, 2020 your shares were registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, then you are a stockholder of record. As a stockholder of record, you may vote in person during the meeting or vote by proxy.

Beneficial Owners: Shares Registered in the Name of a Broker or Bank

If at the close of business on May 14, 2020 you held your shares in an account at a brokerage firm, bank, dealer or other similar organization, rather than in your own name, then you are a beneficial owner of shares held in “street name” and that organization will forward these proxy materials to you. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the Annual Meeting without a legal proxy.

What am I voting on?

The matters scheduled for a vote are to:

| 1. | Elect Robert W. Reding, Eric Sondag, Ronald Steger and Eric Zinterhofer as Class III members of our Board (each to serve for a three-year term); |

| 2. | Approve (on an advisory basis) the compensation of our named executive officers for 2019, as disclosed in this Proxy Statement; |

| 3. | To indicate (on an advisory basis) the frequency of future advisory votes to approve the compensation of our named executive officers; and |

| 4. | Ratify (on an advisory basis) the appointment of KPMG LLP (“KPMG”) as our independent registered public accounting firm for the fiscal year ending December 31, 2020. |

What are the recommendations of our Board?

Unless you give other instructions on your signed proxy card, or by telephone or on the Internet, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of our Board. We set forth the recommendations of our Board, together with a description of each item, in this Proxy Statement. In summary, our Board recommends a vote:

| • | FOR the election of Robert W. Reding, Eric Sondag, Ronald Steger and Eric Zinterhofer as Class III members of our Board (each to serve for a three-year term) (see Proposal 1); |

| • | FOR the approval (on an advisory basis) of the compensation of our named executive officers for 2019 (see Proposal 2); |

| 2

|

|

● 2020 Proxy Statement

|

INTRODUCTORY INFORMATION

| • | FOR EVERY YEAR, on the advisory vote on the frequency of future advisory votes to approve the compensation of our named executive officers (see Proposal 3); and |

| • | FOR the ratification (on an advisory basis) of the appointment of KPMG as our independent registered public accounting firm for the fiscal year ending December 31, 2020 (see Proposal 4). |

How many votes do I have?

For each matter that we are submitting for your vote, you have one vote for each share of common stock that you owned at the close of business on May 14, 2020.

How many votes are needed to approve each proposal?

| • | For Proposal 1 (the election of our Class III director nominees), the four director nominees will be elected if the votes cast “FOR” each such director nominee exceed the votes cast “AGAINST” that nominee. Votes to “ABSTAIN” and broker non-votes are not considered “votes cast,” and so will have no effect on the outcome of the nominee’s election. |

| • | To be approved, Proposal 2 (the advisory approval of the compensation of our named executive officers for 2019) must receive “FOR” votes from the holders of a majority of votes cast, i.e., the votes cast “FOR” the Proposal must exceed the votes cast as “AGAINST.” Votes to “ABSTAIN” and broker non-votes are not considered “votes cast,” and so will have no effect on the outcome of this Proposal. The outcome of this vote is advisory only, and will not be binding on us. |

| • | For Proposal 3 (the advisory vote on the frequency of future advisory votes to approve the compensation of our named executive officers), the frequency receiving the highest number votes cast will be the frequency considered to be recommended by stockholders, although such vote will not be binding on the Company. Abstentions and broker non-votes will have no effect on the outcome of this proposal. |

| • | To be approved, Proposal 4 (the advisory ratification of the appointment of KPMG as our independent registered public accounting firm for the fiscal year ending December 31, 2020) must receive “FOR” votes from the holders of a majority of the votes cast, i.e., the votes cast “FOR” the Proposal must exceed the votes cast as “AGAINST.” Votes to “ABSTAIN” and broker non-votes are not considered “votes cast,” and so will have no effect on the outcome of this Proposal. (Note that in the absence of instructions from you, your broker may use its discretion to vote your shares on this Proposal. See “Other Matters—What are ‘broker non-votes’?” on page 39.) The outcome of this vote is advisory only, and will not be binding on us. |

|

● 2020 Proxy Statement

|

3

|

PROPOSAL 1 ELECT CLASS III DIRECTOR NOMINEES

(ROBERT W. REDING, ERIC SONDAG, RONALD STEGER AND ERIC ZINTERHOFER)

Our Board currently consists of three classes (Classes I, II and III). Our stockholders elect one class of directors each year. All directors are elected for three-year terms or until their successors are elected and qualified, or, if sooner, until the director’s death, resignation or removal.

At the Annual Meeting, our stockholders will vote to elect our Class III director nominees (Robert W. Reding, Eric Sondag, Ronald Steger and Eric Zinterhofer). Messrs. Reding, Sondag, Steger and Zinterhofer are incumbent directors. If elected, the Class III directors will each have a term expiring at the 2023 Annual Meeting of Stockholders. We set forth below on page 5 under “Directors and Executive Officers” information concerning each nominee for director. Each director nominee has agreed to serve if elected.

Required Vote

This is an uncontested Board election. As such, under our amended and restated by-laws (the “by-laws”), each nominee must receive the affirmative vote of a majority of the votes cast on his or her election, i.e., the votes cast “FOR” such director nominee must exceed the votes cast “AGAINST.” Shares represented by executed proxies (but with no marking indicating “FOR” or “AGAINST” the nominee) will be voted “FOR” the election of the director nominees. Votes to “ABSTAIN” and broker non-votes are not considered “votes cast,” and so will have no effect on the outcome of the nominee’s election. If any nominee becomes unavailable for election as a result of an unexpected occurrence (such as his or her death prior to the Annual Meeting), your shares will be voted “FOR” the election of a substitute nominee that we propose.

Board Recommendation

|

OUR BOARD RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF ROBERT W. REDING, ERIC SONDAG, RONALD STEGER AND ERIC ZINTERHOFER AS CLASS III MEMBERS OF OUR BOARD AS OUTLINED IN THIS PROPOSAL 1. |

| 4

|

|

● 2020 Proxy Statement

|

DIRECTORS AND EXECUTIVE OFFICERS

Following the Annual Meeting, assuming the four Class III nominees are elected, the Company’s directors will be as follows:

|

Name

|

Class I

|

Class II

|

Class III

| |||

|

Jeff Leddy, Board Chair

|

X

|

|||||

|

Leslie Ferraro

|

X

|

|||||

|

Josh Marks

|

X

|

|||||

|

Robert W. Reding

|

X

| |||||

|

Harry E. Sloan

|

X

|

|||||

|

Eric Sondag

|

X

| |||||

|

Ronald Steger

|

X

| |||||

|

Eric Zinterhofer

|

X

| |||||

|

Total directors in Class

|

2

|

2

|

4

|

CLASS III DIRECTORS

Term expiring (and nominated for re-election) at this Annual Meeting

|

Robert W. Reding

Age: 70

Director Since: January 2013

Board Committee: Compensation (Chair), Audit

|

Robert W. Reding has been a member of our Board since January 2013. He has been a consultant in the commercial airline industry since January 2012. Prior to that, from September 2007 until December 2012, Mr. Reding was Executive Vice President—Operations for American Airlines and Executive Vice President of AMR Corporation. Prior to that, Mr. Reding served as Senior Vice President—Technical Operations for American Airlines from May 2003 to September 2007. Mr. Reding joined AMR Corporation in March 2000 and served as Chief Operations Officer of its AMR Eagle division through May 2003. Prior to joining AMR Corporation, Mr. Reding served as President and Chief Executive Officer of Reno Air (from 1992 to 1998) and as President and Chief Executive Officer of Canadian Regional Airlines (from 1998 to 2000). Mr. Reding is a graduate of the United States Air Force pilot training program and served as an officer and pilot flight examiner with the United States Air Force from 1972 to 1979. He has an FAA Air Transport Pilot Rating for Douglas DC-9-MD-80 and Boeing 737 series aircraft and has accumulated over 10,000 hours as a commercial pilot. He has served as a board member of various aviation, civic and charitable organizations. Mr. Reding has a BS in Aeronautical Engineering from California Polytechnic State University and an MBA from Southern Illinois University. | |

|

We believe Mr. Reding is qualified to serve on our Board due to his operating and management experience, including more than 30 years of experience in the airline industry. | ||

|

Eric Sondag

Age: 44

Director Since: March 2018

Board Committees: Audit, Governance

|

Eric Sondag has been a member of our Board since March 2018. He is a Partner at Searchlight Capital Partners, a private equity firm, where he has worked since 2011. Mr. Sondag has served on the board of directors of Gymboree Group Inc. (OTCMKTS: GMBE) since October 2017 and on the board of directors of Cengage Learning Holdings II Inc. (OTCMKTS: CNGO) since April 2014. Mr. Sondag also serves on the board of advisors for Georgetown University’s McDonough School of Business. Prior to joining Searchlight Capital Partners, Mr. Sondag worked at GTCR Golder Rauner in Chicago in various capacities. Mr. Sondag has a BS from Georgetown University and has completed the Executive Management Program at INSEAD in Singapore. | |

|

We believe Mr. Sondag is qualified to serve on our Board due to his extensive investment experience in the media and technology industries. | ||

|

● 2020 Proxy Statement

|

5

|

DIRECTORS AND EXECUTIVE OFFICERS

|

Ronald Steger

Age: 66

Director Since: April 2017

Board Committee: Audit (Chair)

|

Ronald Steger has been a member of our Board since April 2017 and has served as our Audit Committee Chair since June 2017. He has served on the board of directors of Great Lakes Dredge and Dock Corporation (Nasdaq: GLDD) since May 2018, where he has served on that board’s Audit Committee since May 2018 and as Chair of that Committee since August 2019. He previously served on the board of directors of Sentinel Energy Services Inc. (Nasdaq: STNL) (a pre-business-combination special purpose acquisition company) from November 2018 to January 2020, where he served on that board’s Audit Committee. He also previously served on the board of directors of Overseas Shipholding Group, Inc. (NYSE: OSG) from August 2014 to June 2018, where he served on that board's Corporate Governance & Risk Committee and as Chair of its Audit Committee, and on the board of directors of International Seaways Inc. (NYSE: INSW) from November 2016 to June 2017, where he served on that board's Audit Committee and as Chair of its Corporate Governance & Risk Assessment Committee. Since September 2015, Mr. Steger has served as the Senior Technical Advisor to the Effectus Group, an accounting advisory firm based in Silicon Valley, and since February 2014, he has served on the Advisory Board of ATREG, Inc., a global advisory firm specializing in the semiconductor and related advanced technology verticals. Mr. Steger began his career with KPMG in 1976 and was admitted into its partnership in 1986. He served as an SEC Reviewing Partner at KPMG from 2003 to 2013 and retired from KPMG in December 2013. Mr. Steger has a BS in Accounting from Villanova University. | |

|

We believe Mr. Steger is qualified to serve on our Board due to his experience serving on boards of public companies and his extensive background in accounting. | ||

|

Eric Zinterhofer

Age: 48

Director Since: March 2018

Board Committee: Compensation

|

Eric Zinterhofer has been a member of our Board since March 2018. He is a Founding Partner at Searchlight Capital Partners, a private equity firm, where he has worked since 2010. Mr. Zinterhofer has served on the board of directors of Hemisphere Media Group, Inc. (Nasdaq: HMTV) since October 2016, and is a member of that board’s Executive Committee; on the board of directors of Charter Communications, Inc. (Nasdaq: CHTR) since November 2009, and is a member of that board’s Compensation and Benefits Committee, its Finance Committee and its Nominating and Governance Committee; on the board of directors of Liberty Latin America Ltd. (Nasdaq: LILA) since December 2017; and on the board of directors of Roots Corporation (TSX: ROOT) since December 2015. He previously served on the board of directors of Dish TV India Ltd. (NSE: DISHTV) from December 2009 to March 2017, and on the board of directors of General Communication Inc. (FRA: CG1) from March 2015 to March 2018. | |

|

We believe Mr. Zinterhofer is qualified to serve on our Board due to his extensive investment experience in the media and technology industries and as a director of a large telecommunications company. | ||

CLASS I DIRECTORS

Terms Expiring at the 2021 Annual Meeting of Stockholders

|

Jeff Leddy

Age: 65

Director Since: February 2013

Executive Chairman of the Company and Chairman of the Board Since: April 2018

Board Committees: None

|

Jeff Leddy has been Executive Chairman of our Company and Chairman of our Board of Directors since April 2018 and has served as a member of our Board of Directors since February 2013. He served as our Chief Executive Officer from February 2017 to March 2018. Mr. Leddy previously served as Chief Executive Officer of Verizon Telematics, Inc. (formerly Hughes Telematics, Inc. prior to its acquisition by Verizon Communications in July 2012) from December 2006 until January 2015 and served as a member of its board of directors from April 2006 to July 2012. From 2005 to 2011, he served on the boards of directors of various Hughes Communications-affiliated companies. From April 2003 through December 2006, Mr. Leddy served as Chief Executive Officer and President of SkyTerra Communications, Inc., and he served on its board of directors from 2006 to 2008. Prior to becoming Skyterra’s Chief Executive Officer, Mr. Leddy served in the roles of President, Chief Operating Officer and Senior Vice President of Operations for that company. Mr. Leddy has a BA in Physics from the Georgia Institute of Technology and an MS in Electrical Engineering from Stanford University. | |

|

We believe Mr. Leddy is qualified to serve on our Board due to his extensive experience with satellite communications and telematics businesses and extensive executive experience, including his public company experience as a chief executive officer and director. | ||

| 6

|

|

● 2020 Proxy Statement

|

DIRECTORS AND EXECUTIVE OFFICERS

|

Josh Marks

Age: 43

Director Since: April 2018

Board Committees: None

|

Josh Marks joined our company in August 2015 and has served as our Chief Executive Officer and as a member of our Board of Directors since April 2018. He previously served as our Executive Vice President, Connectivity from April 2017 to March 2018, as our Executive Vice President, Aviation Connectivity from July 2016 to March 2017 and as our Senior Vice President, Operations Solutions from August 2015 through June 2016. From January 2011 to August 2015, Mr. Marks was the Chief Executive Officer and a Director of Marks Systems, Inc. (d/b/a masFlight), an aviation big-data analytics company that he co-founded and that we acquired in August 2015. From February 2008 to December 2010, Mr. Marks was the Chief Financial Officer and a Director of eJet Aviation Holdings, a provider of VIP aircraft maintenance services, and the Executive Director of the American Aviation Institute, a commercial aviation policy think-tank. From 2003 to 2008, Mr. Marks served as a senior executive of MAXjet Airways, a transatlantic premium airline he co-founded. Earlier in his career, Mr. Marks served as Associate Director of the George Washington University aviation institute and held key roles at two technology companies, Virtualis Systems (acquired by Allegiance Telecom) and VelociGen (acquired by SOA Software). Mr. Marks has a BA and an MBA from Harvard University. | |

|

We believe Mr. Marks is qualified to serve on our Board due to his broad aviation and transportation experience and extensive experience with companies in the technology and analytics industries. | ||

CLASS II DIRECTORS

Terms expiring at the 2022 Annual Meeting

|

Leslie Ferraro

Age: 58

Director Since: June 2019

Board Committee: Compensation, Governance

|

Leslie Ferraro has been a member of our Board since June 2019. Ms. Ferraro has been President of QxH, a business division of Qurate Retail Inc. (Nasdaq: QRTEA), since September 2019. Ms. Ferraro is also currently on the board of directors of two private equity portfolio companies; Edelman Financial Engines, LLC (formerly Edelman Financial Services prior to its acquisition of Financial Engines in July 2018) since February 2018 and Save-A-Lot, Inc., since July 2018. Ms. Ferraro also served on the board of directors of Hong Kong Disneyland Resort from 2010 to 2015. Ms. Ferraro is the former Co-Chair of Consumer Products and Interactive Media for the Walt Disney Company (“Disney”) and previously served as both the President of Disney Consumer Products and as Executive Vice President of Global Marketing, Sales and Travel Operations for Walt Disney Parks and Resorts. Ms. Ferraro has a BA in Economics from George Washington University, a Masters Diploma from London School of Economics and an MBA in Finance from New York University's Stern School of Business. | |

| Consumer Products and as Executive Vice President of Global Marketing, Sales and Travel Operations for Walt Disney Parks and Resorts. Ms. Ferraro has a BA in Economics from George Washington University, a Masters Diploma from London School of Economics and an MBA in Finance from New York University’s Stern School of Business.

We believe Ms. Ferraro is qualified to serve on our Board due to her extensive products, marketing and commercial operations experience with Disney and her knowledge of the media and entertainment industries. | ||

|

Harry E. Sloan

Age: 70

Director Since: May 2011

Board Committee: Governance (Chair)

|

Harry E. Sloan has been a member of our Board since 2011. (He also served as our Chairman and Chief Executive Officer from 2011—when we were formed as a special purpose acquisition company—until January 2013—when we consummated our business combination with Row 44 and Advanced Inflight Alliance AG.) Mr. Sloan has served as Chairman of the Board and Chief Executive Officer of Flying Eagle Acquisition Corp. (NYSE: FEAC.U), a public-acquisition vehicle, since January 2020. Mr. Sloan served on the board of directors of Videocon d2h Limited (Nasdaq: VDTH) from May 2016 to April 2018, where he was a member of that board’s Nomination, Remuneration and Compensation Committee. Mr. Sloan was also previously Chairman and Chief Executive Officer of Silver Eagle Acquisition Corp. (a special purpose acquisition company) from April 2013 through its business combination with Videocon in March 2015. From November 2010 to December 2013, Mr. Sloan served on the board of directors of Promotora De Informaciones, S.A. (NYSE: PRIS) (also known as PRISA). From 2005 to 2009, Mr. Sloan served as Chairman and Chief Executive Officer of Metro-Goldwyn-Mayer, Inc., and was its Chairman until 2011. From 1990 to 2001, Mr. Sloan was Chairman and Chief Executive Officer of SBS Broadcasting, S.A., a company that he founded in 1990, and he served as its Executive Chairman until 2005. Mr. Sloan currently serves on the Board of Visitors of the UCLA Anderson School of Management and on the Executive Board of UCLA School of Theater, Film and Television. Mr. Sloan has a BA from the University of California, Los Angeles and a JD from Loyola Law School. | |

|

We believe Mr. Sloan is qualified to serve on our Board due to his extensive background and experience as an executive in the media and entertainment industries and his substantial mergers-and-acquisitions experience. | ||

|

● 2020 Proxy Statement

|

7

|

DIRECTORS AND EXECUTIVE OFFICERS

Our current executive officers are as follows:

|

Name

|

Age

|

Title

| ||

|

Jeff Leddy

|

65

|

Executive Chairman

| ||

|

Josh Marks

|

43

|

Chief Executive Officer

| ||

|

Christian Mezger

|

51

|

Executive Vice President and Chief Financial Officer

| ||

|

Per Norén

|

55

|

President

| ||

|

R. Jason Everett

|

45

|

Vice President and Chief Accounting Officer

|

The following is biographical information for our current executive officers (other than our Company’s Executive Chairman, Jeff Leddy, and our CEO, Josh Marks, who are members of our Board and whose biographical information we have provided under “Directors and Executive Officers—Directors” on page 5).

Christian Mezger

Christian Mezger joined the Company as Chief Financial Officer in May 2019. Mr. Mezger previously served as President and Chief Executive Officer of Ciber, Inc. from June 2017 to December 2017, and as Chief Executive Officer of CMTSU Liquidation Inc. (f/k/a Ciber, Inc.) from January 2018 to May 2019. Mr. Mezger also served as Executive Vice President and Chief Financial Officer for Ciber, Inc. from February 2014 to December 2017 and as its Senior Vice President, Corporate Finance from August 2011 to February 2014. Prior to Ciber, Inc., Mr. Mezger served as Vice President of the Technology Services business of Hewlett Packard Company/Compaq Computer Corporation (NYSE: HPQ), from June 2010 to July 2011, as its Vice President of its Worldwide Financial Planning & Analysis team from April 2009 to May 2010, and as Senior Director of its Corporate Planning and Global Function Finance team from June 2007 to April 2009. Mr. Mezger also had a number of roles within Hewlett Packard Company prior to June 2007, including as Director of its Office of the Strategy and Technology Finance team, Manager of its Operational Management Reporting and HP Financial Analysis team, and Finance Manager for its Strategic Finance & Special Reports team. Mr. Mezger received an MBA-equivalent degree in International Business Management with a specialization in International Finance and International Marketing from the University of Vienna. Mr. Mezger currently sits on the Advisory Board at the University of Denver’s School of Accountancy.

Per Norén

Per Norén joined our Company in March 2017 and has served as our President since November 2018. He previously served as our Executive Vice President and Chief Commercial Officer from April 2018 to November 2018 and as our Senior Vice President, Aviation Connectivity from March 2017 to March 2018. From August 2007 to February 2017, Mr. Norén held several senior positions at The Boeing Company, including as its Chief Customer Officer for Digital Aviation from January 2016 to February 2017, as its Vice President, Digital Solutions from January 2013 to December 2015 and as its Vice President, Information Services from January 2010 to December 2012. He was previously President and Chief Executive Officer of Carmen Systems, a technology, analytics and software company for the aviation and transportation industries, from 1998 to 2007. Mr. Norén graduated from the Swedish Military Academy and the Gothenburg School of Business, Economics and Law at The University of Gothenburg, Sweden. He also has a degree from the Executive Education Program at Harvard Business School.

R. Jason Everett

R. Jason Everett joined our Company in July 2019 and became Chief Accounting Officer in August 2019. Mr. Everett previously served as Vice President, Corporate Controller and Treasurer at Webroot Inc. from June 2017 to July 2019. He also served as Vice President and Global Controller at Ciber, Inc. from September 2015 to June 2017. Prior to that, he held two roles at Newmont Mining Corporation (NYSE: NEM) between April 2013 and August 2015: Director of Financial Reporting and Technical Accounting and Director of Corporate Accounting. Earlier in his career, Mr. Everett held several senior management positions at various companies from 1996 to 2013. He has a BS in Accounting from Mount Saint Mary’s University, an MBA from University of Denver’s Daniels College of Business and is a Certified Public Accountant.

| 8

|

|

● 2020 Proxy Statement

|

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Director Independence

Pursuant to Nasdaq Listing Rules, our Board must affirmatively determine that a majority of the members of our Board qualify as “independent.” Consistent with this requirement, based on a review and assessment performed by the Company’s counsel of all relevant identified transactions and relationships between each of our directors, or any of their family members, and us, our senior management and our independent registered public accounting firm, our Board affirmatively determined that each of our current directors (other than Messrs. Leddy and Marks, who are our Executive Chairman and our CEO, respectively) meets the standards of independence under applicable Nasdaq Listing Rules. In making this determination, our Board found all of our directors (other than Messrs. Leddy and Marks) to be free of any relationship that would impair their individual exercise of independent judgment with regard to the Company. Our Board also determined that each member of its Audit Committee and of its Compensation Committee is independent under Nasdaq Listing Rules applicable to service on those committees.

Board Leadership Structure

The Board annually elects a director to be chairperson of the Board. The Board Chair may or may not be an officer of the Company. The Board believes that it should decide whether to have an officer also serve as the Board Chair based on its business judgment after considering relevant factors, including the specific needs of the business and what is in the best interests of the Company’s stockholders. Currently, Mr. Leddy (who is our Company’s Executive Chairman) also serves as our Board Chair.

If the individual elected as Board Chair is an officer of the Company, or if the Board Chair is not independent, the Board believes that a Lead Independent Director should be appointed to help ensure robust independent leadership on the Board. When this is the case, the independent directors elect the Lead Independent Director. The Board will consider rotating the Lead Independent Director, if any, at such intervals as the Board determines based on the recommendation of its Corporate Governance & Nominating Committee (the “Governance Committee”). Stephen Hasker served as our Lead Independent Director until he resigned from the Board in May 2020, due to a change in his employment. Following the Annual Meeting, we expect that our independent directors will elect a new Lead Independent Director.

The Lead Independent Director presides at any meeting of the Board at which the Board Chair is not present, including at executive sessions for independent directors, at meetings or portions of meetings on topics where the Board Chair or the Board raises a possible conflict of interest involving the Board Chair, and when requested by the Board Chair. The Lead Independent Director may call meetings of the independent directors or of the Board, at such time and place as he or she determines. In addition, the Lead Independent Director facilitates communication between the Board Chair and the independent directors; reviews and provides input on meeting agendas and meeting schedules for the Board; and performs such other duties as the Governance Committee may from time to time establish.

Meetings of the Board

Our Board met ten times during 2019. During 2019, each Board member attended at least 75% of the aggregate number of meetings held for the Board and for the committees on which he or she served, except for Messrs. Zinterhofer and Sloan and Ms. Ferraro. Messrs. Zinterhofer and Sloan attended 73% and 67% respectively of the aggregate number of meetings held by the Board and the committees on which they served, including three out of the four regularly scheduled Board meetings and all of their Committee meetings. Messrs. Zinterhofer and Sloan were unable to attend some of the other, ad-hoc meetings called by the Board due to unavoidable schedule conflicts. Ms. Ferraro attended 71% of the aggregate number of meetings held by the Board and the committees on which she served, including two out of the three regularly scheduled Board meetings and one of the two committee meetings. Under our Board’s Corporate Governance Guidelines, all Board members are expected to attend our annual stockholders’ meeting. Messrs. Hasker, Leddy, Marks and Steger attended our 2019 Annual Meeting of Stockholders.

|

● 2020 Proxy Statement

|

9

|

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Independent Director Meetings

Our non-management directors generally meet in executive session (i.e., without management present) each time that the Board convenes for a regularly scheduled meeting. Our Lead Independent Director generally presides over executive sessions of our independent directors.

Code of Ethics

We have a Code of Ethics that applies to all of our employees, officers and directors, including those officers responsible for financial reporting. Our Code of Ethics is available on our website at www.globaleagle.com under “Investors—Governance.” We adopted our Code of Ethics to promote honest and ethical conduct and compliance with applicable governmental laws, rules and regulations.

Corporate Governance

We are committed to maintaining the highest standards of business conduct and corporate governance, as set forth in the following table and description of key governance policies.

GOVERNANCE HIGHLIGHTS

| • Eight directors, all of whom are independent (other than our Board Chair and Executive Chairman, Jeff Leddy, and our CEO, Josh Marks)

|

• Pay-for-performance compensation program, which includes performance-based annual cash bonus payments (our AIP bonuses) and performance-based equity grants (our PSU and cash-settled stock option awards containing performance-based vesting terms) | |

|

• Expect to appoint a new Lead Independent Director to replace Mr. Hasker |

• Annual “say on pay” votes, with most recent favorable “say on pay” vote over 99% | |

|

• Regular executive sessions of independent directors |

• Stock ownership requirements for Executive Chairman, CEO and directors | |

| • Risk oversight by the Board and its key committees |

• Insider Trading Policy restricting trading, pledging and hedging of our stock | |

|

• No “over-boarding” by our directors on other public-company boards (i.e., serve on more than five public-company boards) |

• Majority voting requirement for directors in uncontested elections | |

|

• Focus on Board diversity, including gender representation | ||

Our key governance policies include:

| • | Corporate Governance Guidelines. Our Board has adopted Corporate Governance Guidelines to provide a framework for effective corporate governance at our company. These guidelines describe the principles and practices that our Board will follow in carrying out its corporate-governance responsibilities. For example, under these guidelines, our directors may not be “over-boarded,” i.e., serve on more than five public-company boards (with service on our Board constituting one of the five) without the consent of our Governance Committee. |

| • | Related Party Transactions Policy. Our Audit Committee has a Related Party Transactions Policy whereby our Audit Committee must review and approve related party transactions between us and our directors, executive officers, their family members and our significant stockholders because these transactions may give rise to potential conflicts of interest. See “Related Party Transactions Policy and Transactions—Related Party Transactions Policy” beginning on page 33. |

| • | Whistleblower Policy and Procedures. Our Whistleblower Policy and Procedures direct our Audit Committee to investigate complaints (received directly or through management) regarding: |

| • | fraud or deliberate error in the preparation, evaluation, review or audit of our financial statements; |

| 10

|

|

● 2020 Proxy Statement

|

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

| • | fraud or deliberate error in the recording and maintaining of our financial records; |

| • | deficiencies in or noncompliance with our internal accounting controls; |

| • | misrepresentations or false statements to or by our senior officers or accountants regarding a matter contained in our financial records; |

| • | our financial reports or audit reports; and |

| • | deviations from full and fair reporting of our financial condition. |

To this end, we maintain an EthicsPoint whistleblower hotline (staffed by a third-party vendor) to provide all of our current and former employees, vendors, customers, stockholders and other stakeholders with an anonymous and confidential method to report misconduct by us or our personnel. The hotline is available to report concerns regarding the financial-reporting, record-keeping and control matters covered by our Whistleblower Policy and Procedures. It is also available for compliance-related concerns; concerns regarding other inappropriate and illegal workplace conduct, such as fraud, criminal and other illegal acts; employment and human-resources complaints (e.g., discrimination and harassment); and concerns regarding enterprise-related risk. The hotline is reachable toll-free at (866) 422-3580 or at www.globaleagle.ethicspoint.com.

| • | Conflicts of Interest Policy. Our Governance Committee has a Conflicts of Interest Policy to address actual, potential and apparent conflicts of interest that may arise in connection with personal and professional relationships. Under this policy, directors and executive officers must disclose all conflicts of interest to the Board, which must approve any “conflicted” transaction. |

| • | Equity Award Policy. Our Board has an Equity Award Policy to ensure that equity awards issued under our equity incentive plans are generally made on a regular schedule and duly approved by our independent Compensation Committee. Our management equity grants are generally issued every year at the Compensation Committee meeting during the Spring or Summer. In addition, the pricing date for equity grants must generally occur during an “open-window” trading period or two full trading days after our next earnings release (whichever occurs first), and cannot precede the date on which the Compensation Committee actually approves the issuance of the award. |

Information Regarding Committees of the Board of Directors

Our Board has an Audit Committee, a Compensation Committee and a Corporate Governance & Nominating Committee. We have posted the charter for each of our Board committees on our website at www.globaleagle.com under “Investors—Governance.” The following table provides the current membership (as of April 2020) and the total number of meetings during 2019 for each of these Board committees.

|

Name

|

Audit(+)

|

Compensation(+)

|

Corporate

| |||

|

Jeff Leddy, Board Chair |

||||||

|

Josh Marks |

||||||

|

Leslie Ferraro |

X(+) |

X | ||||

|

Robert W. Reding |

X(+) |

X* |

||||

|

Harry E. Sloan |

X* | |||||

|

Eric Sondag |

X |

X | ||||

|

Ronald Steger |

X* |

|||||

|

Eric Zinterhofer |

X |

|||||

|

Total meetings in 2019 |

9 |

5 |

2 |

| * | Committee Chair |

| + | Stephen Hasker was the Company’s Lead Independent Director and a member of the Audit Committee and Compensation Committee until his resignation in May 2020. Upon his resignation, Robert W. Reding and Leslie Ferraro were appointed to fill the resulting vacancies on the Audit Committee and Compensation Committee, respectively. |

|

● 2020 Proxy Statement

|

11

|

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Role of the Board and Its Committees in Risk Oversight

Below is a description of each committee of our Board.

Audit Committee—All members of our Audit Committee are financially literate. Ronald Steger also qualifies as an “audit committee financial expert” as defined in applicable SEC rules because he meets the requirement for past employment experience in finance or accounting and has the requisite professional certification in accounting. The responsibilities of our Audit Committee include:

| • | appointing our independent registered public accounting firm, determining the compensation of our independent registered public accounting firm and pre-approving our engagement of our independent registered public accounting firm for audit and non-audit services to be performed by that independent registered public accounting firm and the related fees for those services; |

| • | overseeing our independent registered public accounting firm; |

| • | meeting with our independent registered public accounting firm to discuss the audit and quarterly reviews; |

| • | reviewing with our independent registered public accounting firm and management the adequacy of our internal controls over financial reporting, and any significant findings and recommendations with respect to those controls; |

| • | meeting periodically with management to review and assess our enterprise risk exposures and the manner in which those risks are being monitored and controlled; |

| • | overseeing the performance of the Company’s internal audit function; |

| • | establishing procedures for the receipt, retention and treatment of complaints regarding internal accounting controls or auditing matters and, if applicable, submissions by employees of concerns regarding questionable accounting or auditing matters; |

| • | reviewing and approving all related party transactions; |

| 12

|

|

● 2020 Proxy Statement

|

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

| • | understanding the impact of our operating and control environment on our financial reporting and overseeing our plan for remediating our material weaknesses in our internal control over financial reporting; |

| • | overseeing our implementation of new GAAP standards and use of non-GAAP financial measures; and |

| • | reviewing any material charges under GAAP and the facts and circumstances supporting the relevant analysis. |

Compensation Committee—Our Compensation Committee is responsible for overseeing matters relating to the compensation of our Company’s Executive Chairman, CEO and other executive officers as well as the administration of our incentive-based plans for those officers and of our equity-based compensation plans. The functions of our Compensation Committee include:

| • | determining and reviewing, on an annual basis, our compensation philosophy and policies; |

| • | determining the compensation of our Company’s Executive Chairman and our CEO (who are not present during that determination) and our other executive officers; |

| • | determining, or recommending to our Board for determination, the compensation of members of our Board and other committees thereof in connection with Board and committee service; |

| • | reviewing and discussing the “Compensation Discussion and Analysis” and related disclosure (to the extent we are required to include it in our annual proxy statement) with management, recommending to the Board its inclusion in our annual proxy statement and preparing a report for inclusion in our proxy statement that certifies that the Compensation Committee has discharged this duty; and |

| • | reviewing our compensation practices and the relationship among risk, risk management and compensation in light of our objectives, including the design of compensation practices to avoid encouraging excessive risk-taking. |

Governance Committee—Our Governance Committee is responsible for overseeing the selection of persons to be nominated to serve on our Board and for assisting our Board in developing and ensuring compliance with our foundational and corporate-governance policies and documents. The functions of our Governance Committee include:

| • | identifying and recommending to our Board individuals qualified to serve as directors of the Company; |

| • | advising our Board with respect to its composition, procedures and committees, including establishing criteria for annual performance evaluations of our Board committees and our Board; |

| • | advising our Board with respect to proposed changes to the Company’s certificate of incorporation, by-laws and corporate-governance policies; and |

| • | advising our Board with respect to communications with our stockholders. |

Our Governance Committee has the responsibility of identifying, assessing and recommending potential director candidates to our Board. Potential candidates are generally interviewed by our Board Chair and the Chair of our Governance Committee prior to their nomination, and may be interviewed by other directors and members of senior management. The Governance Committee then meets to consider and approve the final candidates, and makes its recommendation to the Board for a candidate’s appointment or election to the Board.

Our Governance Committee considers the following criteria when evaluating director candidates: (i) senior-level management and decision-making experience; (ii) a reputation for integrity and abiding by exemplary standards of

|

● 2020 Proxy Statement

|

13

|

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

business and professional conduct; (iii) ability to devote time and attention necessary to fulfill the duties and responsibilities of a director; (iv) a record of accomplishment in his or her respective fields, with leadership experience in a corporation or other complex organization, including government, educational and military institutions; (v) independence and the ability to represent all of our stockholders; (vi) compliance with legal and Nasdaq listing requirements; (vii) sound business judgment; (viii) reputation for candor and integrity; (ix) judgment, skills, geography and other measures to ensure that the Board as a whole reflects a range of viewpoints, backgrounds, skills, experience and expertise; (x) maritime, government and digital media experience; and (xi) the needs of the Board. Although the Governance Committee does not have a formal policy regarding diversity in making its recommendations, the Governance Committee respects that a board of directors should reflect diversity in background, education, business experience, gender, race, ethnicity, culture, skills, business relationships and associations and other factors that will contribute to the highest standards of governance of the Company, and reviews its effectiveness in achieving that diversity when assessing the composition of the Board from time to time.

The Governance Committee also considers candidates that our stockholders propose as potential director nominees. We did not make any material changes in 2019 or 2020 to the procedures by which stockholders may recommend nominees to our Board.

Majority Voting to Elect Directors

Our by-laws have a “majority vote” requirement in uncontested elections. Under this requirement, in order for a nominee to be elected in an uncontested election, the nominee must receive the affirmative vote of a majority of the votes cast on his or her election (i.e., the votes cast “FOR” a nominee must exceed the votes cast as “AGAINST”). Votes to “ABSTAIN” with respect to a nominee and broker non-votes are not considered “votes cast,” and so will not affect the outcome of the nominee’s election. See “Other Matters—What are ‘broker non-votes’?” on page 39.

The Company maintains a plurality vote standard in contested director elections (i.e., where the number of nominees exceeds the number of directors to be elected).

Director Resignation Policy Upon Change of Employment

Our Board’s Corporate Governance Guidelines require that our directors offer to resign (subject to our Board accepting it) upon a change of their employment. The Governance Committee will then consider whether the change in employment has any bearing on the director’s ability to serve on our Board, and will make a recommendation to the Board regarding whether to accept the offer to resign. Our Board will then determine whether to accept or reject the offer to resign.

Stockholder Communications with the Board of Directors

Stockholders who wish to communicate with the Board or an individual director may send a written communication to the Board or the director addressed to our Corporate Secretary at 6080 Center Drive, Suite 1200, Los Angeles, California 90045. Each communication must set forth the name and address of the stockholder on whose behalf the communication is sent and the number of our shares that the stockholder beneficially owns on the date of the communication.

Our Corporate Secretary will review the communication to determine whether it is appropriate for presentation to the Board or the director. Examples of inappropriate communications include advertisements, solicitations or hostile communications. Our Corporate Secretary will submit appropriate communications to the Board through the Board Chair, or directly to the full Board or the director, on a periodic basis.

| 14

|

|

● 2020 Proxy Statement

|

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Director Compensation

Members of our Board who are not employees (“outside directors”) are provided compensation for their service. We have an Outside Director Compensation Program that is intended to compensate fairly each outside director with cash and equity compensation for the time and effort required to serve as a member of our Board. Our Compensation Committee periodically evaluates market data provided by its independent compensation consultant, Frederic W. Cook & Co., Inc., (“FW Cook”) to determine the appropriate total compensation of our outside directors and structure of the compensation program. In addition, our equity incentive plan places an annual limit of $400,000 on cash and equity compensation that we may provide to our outside directors.

In June 2018, based on benchmarking information that FW Cook provided, our Compensation Committee determined that our total outside director compensation was near the 25th percentile of our comparator group.

Annual Cash Retainer and Cash Chair Fees. Each outside director receives a cash retainer of $75,000 per calendar year for his or her service on the Board. In addition, if our Board Chair is a non-management director, he or she receives an additional $25,000 per calendar year for his or her service as Board Chair; the Chair of our Audit Committee receives an additional $25,000 per calendar year for his or her service as Chair of that committee; the Lead Independent Director, if any, receives an additional $15,000 per year for his or her service as Lead Independent Director; and the Chair of our Compensation Committee receives an additional $10,000 per calendar year for his or her service as Chair of that committee.

Equity Compensation. Under our Outside Director Compensation Program, on the date of each annual stockholders’ meeting, each continuing outside director is provided equity compensation with a grant date fair value of $100,000, or lesser amount as determined by the Compensation Committee. In June 2019, the Compensation Committee approved awards for each continuing director of 37,736 options, which vest on the earlier of the one-year anniversary of the grant date and the next annual stockholders’ meeting.

Effective as of April 15, 2020, we effected a reverse stock split of our common stock at a ratio of 1-for-25 (the “Reverse Stock Split”). The amounts set forth in this disclosure regarding Director Compensation and Executive Compensation, which are presented as of December 31, 2019, do not give effect to the Reverse Stock Split.

The table below provides summary information concerning compensation paid or accrued by us during 2019 to or on behalf of our then-outside directors for services rendered as directors during 2019.

|

Name of Outside Director

|

Cash

|

Stock Option ($)

|

RSU

|

Other

|

Total ($)

|

|||||||||||||||

|

Robert W. Reding

|

|

85,000

|

(1)

|

|

15,849

|

|

|

—

|

|

|

—

|

|

|

100,849

|

| |||||

|

Harry E. Sloan

|

|

75,000

|

|

|

15,849

|

|

|

—

|

|

|

—

|

|

|

90,849

|

| |||||

|

Jeff Sagansky

|

|

37,192

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

37,192

|

| |||||

|

Leslie Ferraro

|

|

39,247

|

(2)

|

|

15,849

|

|

|

—

|

|

|

—

|

|

|

55,096

|

| |||||

|

Eric Sondag

|

|

75,000

|

|

|

15,849

|

|

|

—

|

|

|

—

|

|

|

90,849

|

| |||||

|

Eric Zinterhofer

|

|

75,000

|

|

|

15,849

|

|

|

—

|

|

|

—

|

|

|

90,849

|

| |||||

|

Edward L. Shapiro

|

|

44,630

|

(3)

|

|

—

|

|

|

—

|

|

|

—

|

|

|

44,630

|

| |||||

|

Stephen Hasker

|

|

79,110

|

(4)

|

|

15,849

|

|

|

—

|

|

|

—

|

|

|

94,959

|

| |||||

|

Ronald Steger

|

|

100,000

|

(5)

|

|

15,849

|

|

|

—

|

|

|

—

|

|

|

115,849

|

| |||||

| (1) | Mr. Reding received an additional fee for service as Chair of the Compensation Committee in 2019. |

| (2) | Ms. Ferraro joined our Board in June 2019 and received prorated cash compensation for her director services in 2019. |

|

● 2020 Proxy Statement

|

15

|

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

| (3) | Mr. Shapiro received an additional fee for his service as Lead Independent Director of the Board for the period through June 2019. |

| (4) | Mr. Hasker received an additional fee for his service as Lead Independent Director of the Board from September 2019 to December 2019. |

| (5) | Mr. Steger received an additional fee for his service as Chair of the Audit Committee in 2019. |

| (6) | Amounts set forth in this column represent the grant date fair value of stock option awards granted during the year computed in accordance with Accounting Standards Codification Topic No. 718, “Compensation-Stock Compensation” (“ASC 718”). For 2019, we determined the aggregate grant date fair value of the stock option awards reflected in this column using the valuation methodology and assumptions set forth in Note 13, Equity Transactions to our consolidated financial statements in our 2019 Annual Report on Form 10-K (“2019 Form 10-K”). As of December 31, 2019, our outside directors held the following equity awards, which do not give effect to the Reverse Stock Split: |

| Director |

Deferred RSUs (#) |

Unvested Stock Options (#) |

Vested

but (#) |

|||||||||

| Robert W. Reding |

9,090 | 37,736 | 81,727 | |||||||||

| Harry E. Sloan |

9,090 | 37,736 | 81,727 | |||||||||

| Jeff Sagansky |

— | — | — | |||||||||

| Leslie Ferraro |

— | 37,736 | — | |||||||||

| Eric Sondag |

— | 37,736 | 21,044 | |||||||||

| Eric Zinterhofer |

— | 37,736 | 21,044 | |||||||||

| Edward L. Shapiro |

— | — | — | |||||||||

| Stephen Hasker |

8,169 | 37,736 | 58,027 | |||||||||

| Ronald Steger |

— | 37,736 | 24,230 | |||||||||

Outside Director Stock Ownership Requirements

To align the interests of our Board members with the interests of our stockholders, our Board’s Governance Committee has adopted Stock Ownership Guidelines for our Outside Directors. Under the current Guidelines, as revised on March 18, 2019, each outside director must retain ownership of our stock equal to three times the value of the annual cash retainer paid for Board service pursuant to our Outside Director Compensation Program as in effect from time to time. If at any time an outside director has not satisfied the required ownership level under these Guidelines, the director must retain 100% of the shares remaining after payment of the exercise price and taxes owed upon the exercise of stock options, the vesting of restricted stock or the settlement of vested restricted stock units. We count toward with the required ownership level under the Guidelines (a) shares of the Company’s common stock that are owned outright by the Outside Director (either directly or beneficially, e.g., through a family trust), (b) vested restricted stock or restricted stock units or (c) one-half (1/2) of each share of the Company’s common stock that is subject to outstanding vested but unexercised stock options (other than cash-settled stock options) for which the fair market value of the underlying shares exceeds the applicable exercise price. We do not count toward the required ownership level under the Guidelines (i) any shares held by mutual, hedge or other investment funds in which the outside director is a general partner, limited partner or investor, (ii) except as provided for above, outstanding but unexercised stock options, (iii) unvested/unearned restricted stock or restricted stock units and (iv) shares transferred or paid to an outside director’s employer pursuant to that employer’s policies.

Although the Outside Director Stock Ownership Guidelines are not applicable to our CEO or Executive Chairman because they are employee directors (and as such are not “outside directors”), we have also adopted Stock Ownership Guidelines applicable to our CEO and Executive Chairman. In addition, our Governance Committee has the authority to waive application of the Outside Director Stock Ownership Guidelines and has waived these Guidelines with respect to Messrs. Sondag and Zinterhofer, whose awards for director service will be transferred to an account controlled by their employer upon vesting.

| 16

|

|

● 2020 Proxy Statement

|

For the 2019 fiscal year, our “named executive officers” (“NEOs”) (as defined under SEC rules) were the following executive officers:

|

Name |

Current Title (as of April 2020) | |

| Josh Marks |

Chief Executive Officer | |

| Christian Mezger |

Chief Financial Officer | |

| Per Norén |

President | |

| Paul Rainey |

Former Chief Financial Officer | |

|

● 2020 Proxy Statement

|

17

|

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table shows the compensation earned in respect of 2019 and 2018 by each of our 2019 NEOs for the years in which they were NEOs (as determined pursuant to the SEC’s disclosure requirements for executive compensation in Item 402 of Regulation S-K).

| Name and Current Principal Position (unless otherwise indicated)

|

Year

|

Salary(1)

|

Bonus

|

Stock

|

Option

|

Non-Equity

|

All Other

|

Total ($)

|

||||||||||||||||||||||||

| Josh Marks CEO |

2019 | 500,000 | — | — | — | — | 21,914 | 521,914 | ||||||||||||||||||||||||

| 2018 | 471,250 | — | 2,558,500 | 1,480,049 | — | 47,894 | 4,557,693 | |||||||||||||||||||||||||

| Christian Mezger(6) Chief Financial Officer |

2019 | 265,625 | — | 334,500 | 182,813 | — | 20,547 | 803,485 | ||||||||||||||||||||||||

| Per Norén President |

2019 | 400,000 | — | — | — | — | 8,400 | 408,400 | ||||||||||||||||||||||||

| 2018 | 365,000 | — | 1,218,333 | 704,785 | — | 30,185 | 2,318,303 | |||||||||||||||||||||||||

| Paul Rainey(7) Former Chief Financial Officer |

2019 | 160,156 | — | — | — | — | 387,578 | 547,734 | ||||||||||||||||||||||||

| (1) | Amounts set forth in this column reflect the amounts received by the NEO as salary payments in respect of his service during 2019, and therefore represent a blend of the salary rates applicable to the NEO throughout the year where the NEO experienced a salary change mid-year. |

| (2) | Amounts set forth in this column represent the grant date fair value of stock-based awards (RSUs and PSUs) granted during the year computed in accordance with Accounting Standards Codification Topic No. 718, “Compensation—Stock Compensation” (“ASC 718”). For 2019, we determined the aggregate grant date fair value of the stock awards reflected in these columns using the valuation methodology and assumptions set forth in Note 13. Equity Transactions to our consolidated financial statements in our 2019 Form 10-K. |

| (3) | Amounts set forth in this column represent the grant date fair value of cash-settled stock options (referred to as “phantom” options) awards granted during the year computed in accordance with ASC 718. For 2019, we determined the aggregate grant date fair value of the phantom stock option awards reflected in these columns using the valuation methodology and assumptions set forth in our 2019 Form 10-K. |

| (4) | None of our NEOs received payments under the AIP in respect of service during 2019. |

| (5) | Amounts set forth in this column for 2019 include: (1) for Mr. Marks, approximately $5,285 for 401(k) employer matching contributions and approximately $16,629 for a temporary living allowance; (2) for Mr. Mezger, approximately $4,250 for 401(k) employer matching and approximately $16,297 for a temporary living allowance; (3) for Per Norén, approximately $8,400 for 401(k) employer matching contributions; and (4) for Paul Rainey, approximately $3,203 for 401(k) employer matching contributions and $384,375 in severance payments in connection with the termination of his employment. |

| (6) | Mr. Mezger became our Chief Financial Officer on May 16, 2019. |

(7) Mr. Rainey ceased serving as Chief Financial Officer, effective May 16, 2019, remaining an employee of the Company through May 31, 2019.

| 18

|

|

● 2020 Proxy Statement

|

EXECUTIVE COMPENSATION

Outstanding Equity Awards at 2019 Year-End

The following table sets forth the equity-based awards held by our 2019 NEOs that were outstanding on December 31, 2019. The amounts set forth in the following table do not give effect to the Reverse Stock Split:

| Option/Stock Appreciation Awards | Stock Awards | |||||||||||||||||||||||||||||||||||

|

Name(18) |

Grant Date | Number of Securities Underlying Unexercised Options Exercisable (#) |

Number of Securities Underlying Unexercised Options Unexercisable (#) |

Option Exercise Price ($) |

Option Expiration Date |

Equity Incentive Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) |

Equity Incentive Awards: Market Value of Unearned Shares, Units or Other Rights Not Vested ($)(17) |

RSUs: Number of Shares or Units of Stock That Have Not Vested (#) |

RSUs: Market Value of Shares or Units of Stock That Have Not Vested ($)(17) |

|||||||||||||||||||||||||||

| Josh Marks |

8/3/2015 | 185,000 | (7) | — | 12.51 | 8/3/2020 | — | — | — | — | ||||||||||||||||||||||||||

| 12/21/2017 | (1) | — | — | — | — | — | — | 89,952 | (8) | 44,976 | ||||||||||||||||||||||||||

| 12/21/2017 | (1) | — | — | — | — | 59,962 | (9) | 29,981 | — | — | ||||||||||||||||||||||||||

| 6/25/2018 | (2) | — | 461,794 | (3) | 2.65 | 6/25/2023 | — | — | — | — | ||||||||||||||||||||||||||

| 6/25/2018 | (2) | — | 923,587 | (4) | 2.65 | 6/25/2025 | — | — | — | — | ||||||||||||||||||||||||||

| 6/25/2018 | (2) | — | — | — | — | — | — | 700,000 | (5) | 350,000 | ||||||||||||||||||||||||||

| 6/25/2018 | (2) | — | — | — | — | 350,000 | (6) | 175,000 | — | — | ||||||||||||||||||||||||||

| Per Norén |

3/30/2017 | — | — | — | — | — | — | 54,516 | (10) | 27,258 | ||||||||||||||||||||||||||

| 3/30/2017 | — | — | — | — | — | — | 22,714 | (10) | 11,357 | |||||||||||||||||||||||||||

| 3/30/2017 | 71,577 | (11) | 32,535 | 3.21 | 3/30/2024 | — | — | — | — | |||||||||||||||||||||||||||

| 9/18/2017 | — | — | — | 45,430 | (9) | 22,715 | — | — | ||||||||||||||||||||||||||||

| 6/25/2018 | (2) | — | 219,902 | (3) | 2.65 | 6/25/2023 | — | — | — | — | ||||||||||||||||||||||||||

| 6/25/2018 | (2) | — | 439,803 | (4) | 2.65 | 6/25/2025 | — | — | — | — | ||||||||||||||||||||||||||

| 6/25/2018 | (2) | — | — | — | — | — | — | 333,333 | (5) | 166,667 | ||||||||||||||||||||||||||

| 6/25/2018 | (2) | — | — | — | — | 166,667 | (6) | 83,334 | — | — | ||||||||||||||||||||||||||

| Christian Mezger |

5/8/2019 | (12) | — | 138,994 | (13) | 0.87 | 5/8/2024 | — | — | — | — | |||||||||||||||||||||||||

| 5/8/2019 | (12) | — | 347,586 | (14) | 0.87 | 5/8/2026 | — | — | — | — | ||||||||||||||||||||||||||

| 5/8/2019 | (12) | — | — | — | — | — | — | 300,000 | (15) | 150,000 | ||||||||||||||||||||||||||

| 5/8/2019 | (12) | — | — | — | — | 150,000 | (16) | 75,000 | — | — | ||||||||||||||||||||||||||

| * | The closing price of a share of our common stock on December 31, 2019 (the last Nasdaq trading day in 2019) was $0.50, and we have used that per-share price for purposes of determining market values in this table. |

| (1) | Our Compensation Committee approved this equity award in early 2017. However, given the lack of remaining share availability at that time under our former equity plan, we deferred the issuance of this award until our stockholders approved our 2017 Omnibus Long-Term Incentive Plan at our 2017 Annual Meeting on December 21, 2017. |

| (2) | Our Compensation Committee approved this equity award at its June 25, 2018 meeting. |

| (3) | Represents stock options that vest and become exercisable with respect to 50% on March 27, 2020, with respect to 25% on March 27, 2021, and with respect to 25% on March 27, 2022, subject to continuous employment on each vesting date and that the Company’s average volume-weighted average price per share of common stock (“VWAP”) equals or exceeds $4.00 for 45 consecutive trading days at any time on or prior to June 25, 2023. |

| (4) | Represents stock options that vest and become exercisable with respect to 50% on March 27, 2020 and with respect to 50% on March 27, 2021, subject to continuous employment on each vesting date and that the Company’s VWAP equals or exceeds $8.00 for 45 consecutive trading days at any time on or prior to June 25, 2025. |

| (5) | Represents restricted stock units that vest with respect to 50% on March 27, 2020, with respect to 25% on March 27, 2021, and with respect to 25% on March 27, 2022, subject to continuous employment through each applicable vesting date. |

|

● 2020 Proxy Statement

|

19

|

EXECUTIVE COMPENSATION

| (6) | Represents PSUs that vest with respect to 50% on March 27, 2020, with respect to 25% on March 27, 2021, and with respect to 25% on March 27, 2022, subject to continuous employment through each vesting date and that the Company’s VWAP equals or exceeds $4.00 for 45 consecutive trading days on or prior to June 25, 2023. |

| (7) | Represents stock options that vest and become exercisable with respect to 25% of their underlying shares on the first anniversary of their grant date and vest with respect to the remaining 75% of their underlying shares on a monthly basis over the following three years until fully vested, subject to continuous employment on each vesting date. |