false0001901799DEF 14A00019017992024-01-012024-12-31

United States

Securities and Exchange Commission

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐

Preliminary Proxy Statement

☐

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒

Definitive Proxy Statement

☐

Definitive Additional Materials

☐

Soliciting Materials under § 240.14a-12

BITCOIN DEPOT INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒

No fee required.

☐

Fee paid previously with preliminary materials.

☐

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

BITCOIN DEPOT INC.

3343 Peachtree Road NE, Suite 750

Atlanta, GA 30326

(678) 435-9604

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held on December 12, 2025

To the Stockholders of Bitcoin Depot Inc.,

You are cordially invited to attend the 2025 Annual Meeting of Stockholders (the “Annual Meeting”) of Bitcoin Depot Inc. (“Bitcoin Depot” or the “Company”) to be held on December 12, 2025 at 1:45 p.m. Eastern Time. We are planning to hold the Annual Meeting virtually via the Internet at www.proxydocs.com/BTM. You will not be able to attend the Annual Meeting at a physical location. At the Annual Meeting, stockholders will act on the following matters:

•To elect seven director nominees to serve as directors until the next Annual Meeting;

•To ratify the appointment of Wolf & Company, P.C. as our independent registered public accounting firm for the year ending December 31, 2025; and

•To consider any other matters that may properly come before the Annual Meeting, including any adjournment or postponement thereof.

The record date for the meeting will be November 14, 2025 (the “Record Date”). Only holders of record of our Class A common stock and Class M common stock, which we refer to collectively as our “Voting Common Stock,” at the close of business on the Record Date are entitled to receive notice of and to vote at the Annual Meeting or any postponement or adjournment thereof. Holders of Voting Common Stock vote together as a single class on all matters on which stockholders are generally entitled to vote.

In accordance with the rules of the Securities and Exchange Commission, we are advising our stockholders of the availability on the Internet of our proxy materials related to our forthcoming Annual Meeting. These rules allow companies to provide access to proxy materials in one of two ways. Because we have elected to utilize the “full set delivery” option, we are delivering paper copies of all proxy materials to each stockholder, as well as providing access to those proxy materials on a publicly accessible website. Beginning on November 25, 2025, you may read, print and download our 2024 Annual Report to Stockholders on Form 10-K and our Proxy Statement at www.proxydocs.com/BTM.

Your vote is important. Whether or not you plan to attend the Annual Meeting, please submit your proxy to vote electronically via the Internet or by telephone, or please complete, sign, date and return the accompanying proxy card or voting instruction card in the enclosed postage-paid envelope. If you attend the Annual Meeting and prefer to vote during the Annual Meeting, you may do so even if you have already submitted a proxy to vote your shares. You may revoke your proxy in the manner described in the proxy statement at any time before it has been voted at the Annual Meeting.

By Order of the Board of Directors,

/s/ Christopher Ryan

Christopher Ryan

Chief Legal Officer and Corporate Secretary

November 25, 2025

Atlanta, Georgia

PROXY STATEMENT TABLE OF CONTENTS

|

|

|

Page |

ABOUT THE MEETING |

2 |

PROPOSAL 1: ELECTION OF DIRECTORS |

7 |

Nominees for Election Until the Next Annual Meeting |

7 |

CORPORATE GOVERNANCE |

10 |

Board of Directors Composition |

10 |

Controlled Company Status and Director Independence |

10 |

Information Regarding Committees of the Board of Directors |

10 |

Audit Committee |

10 |

Compensation Committee |

11 |

Nominating and Corporate Governance Committee |

11 |

Code of Ethics |

12 |

Compensation Committee Interlocks and Insider Participation |

12 |

Limitations on Liability and Indemnification of Officers and Directors |

12 |

Stockholder Nominations for Directorships |

12 |

Board Leadership Structure and Role in Risk Oversight |

13 |

Board Meetings and Attendance |

14 |

Stockholder Communications |

14 |

Anti-Hedging and Anti-Pledging Policy |

14 |

Insider Trading Policy |

14 |

INFORMATION CONCERNING EXECUTIVE OFFICERS |

16 |

EXECUTIVE COMPENSATION |

18 |

Summary Compensation Table |

18 |

Narrative Disclosure to Summary Compensation Table |

19 |

Additional Narrative Disclosure |

20 |

Employee and Retirement Benefits |

21 |

Outstanding Equity Awards at December 31, 2024 |

21 |

Clawback Policy |

22 |

Policies and Practices Related to the Grant of Certain Equity Awards Close in Time to the Release of Material Nonpublic Information |

22 |

2025 and 2026 Planned Executive Transitions |

22 |

DIRECTOR COMPENSATION |

24 |

REPORT OF THE AUDIT COMMITTEE* |

25 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

26 |

TRANSACTIONS WITH RELATED PERSONS |

28 |

Up-C Restructuring |

28 |

Tax Receivable Agreement |

29 |

BT HoldCo Amended and Restated Limited Liability Company Agreement |

30 |

Amended and Restated Registration Rights Agreement |

32 |

Preferred Sale Registration Rights Agreement |

33 |

Kiosk Service Agreement |

33 |

Indemnification Agreements |

33 |

Policies and Procedures for Related Person Transactions |

33 |

PROPOSAL 2: RATIFY THE APPOINTMENT OF WOLF & COMPANY, P.C. AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE YEAR ENDING DECEMBER 31, 2024 |

35 |

Change in Auditors |

35 |

Principal Accountant Fees and Services |

35 |

Procedures for Approval of Fees |

36 |

Attendance at Annual Meeting |

36 |

STOCKHOLDER PROPOSALS |

37 |

Shareholder Proposals under Rule 14a-8 for 2026 Annual Meeting |

37 |

Stockholder Proposals for 2026 Annual Meeting |

37 |

ANNUAL REPORT |

38 |

HOUSEHOLDING OF ANNUAL MEETING MATERIALS |

39 |

OTHER MATTERS |

40 |

BITCOIN DEPOT INC.

3343 PEACHTREE ROAD NE, SUITE 750

ATLANTA, GA 30326

PROXY STATEMENT

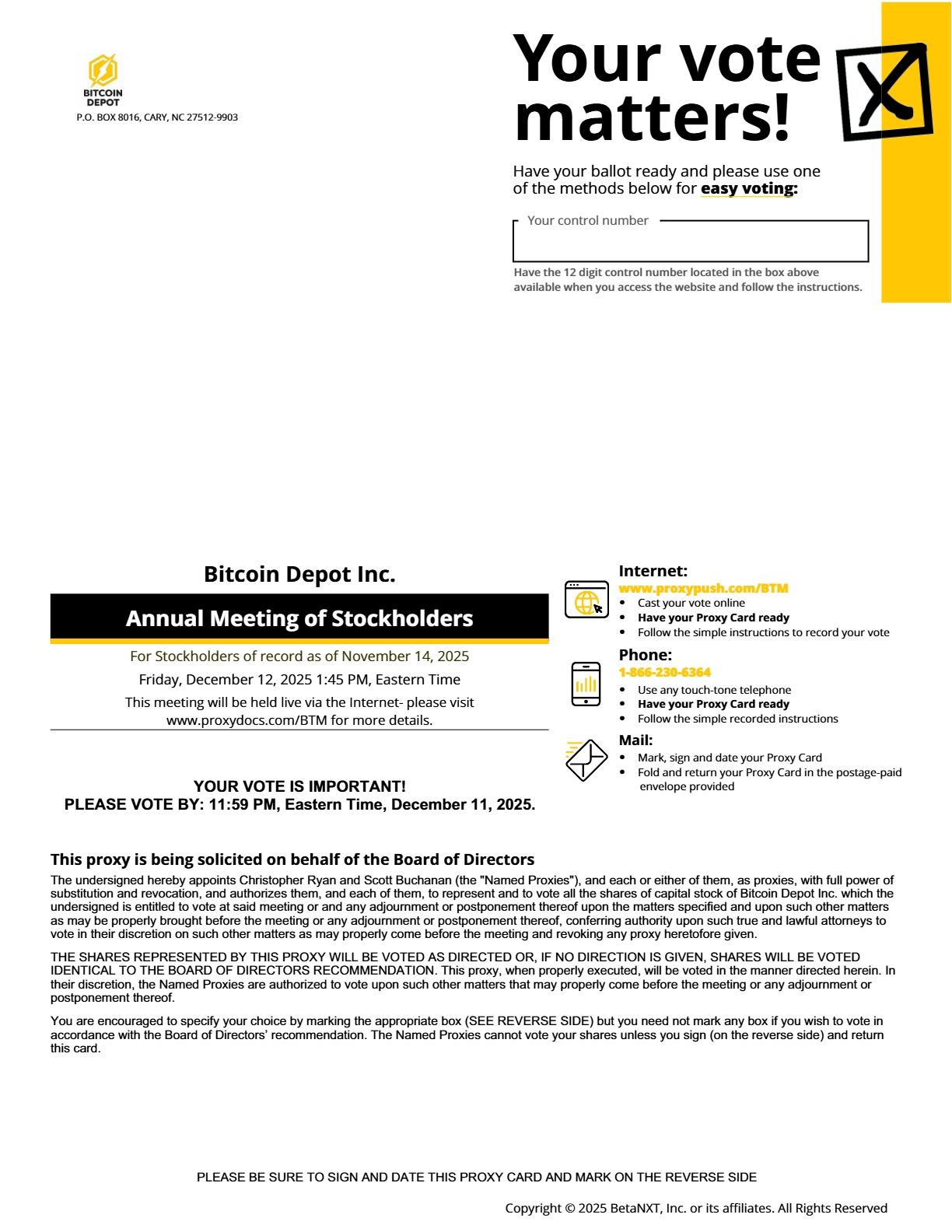

This proxy statement (this “Proxy Statement”) contains information related to the Annual Meeting to be held on December 12, 2025 at 1:45 p.m. Eastern Time. We are planning to hold the Annual Meeting virtually via the Internet, or at such other time and place to which the Annual Meeting may be adjourned or postponed. In order to attend our Annual Meeting, you must log in to www.proxydocs.com/BTM using the 16-digit control number on the proxy card that accompanied the proxy materials. In addition, unless the context otherwise requires, references to our “Voting Common Stock” are to our Class A common stock, par value $0.0001 per share (“Class A common stock”), Class B common stock, par value $0.0001 per share (“Class B common stock”), Class M common stock, par value $0.0001 per share (“Class M common stock”), and Class O common stock, par value $0.0001 per share (“Class O common stock”), and references to our “stockholders” are to the holders of our Voting Common Stock. Our Class E Common Stock is not entitled to vote on any proposal submitted to our stockholders at the Annual Meeting. As of the Record Date, we had no shares of Class B, Class E or Class O outstanding.

Proxies for the Annual Meeting are being solicited by the Board of Directors (the “Board”) of Bitcoin Depot Inc. This Proxy Statement is first being made available to stockholders on or about November 25, 2025. A list of record holders of the Company’s common stock entitled to vote at the Annual Meeting will be available for examination by any stockholder, for any purpose germane to the Annual Meeting, at our principal offices at 3343 Peachtree Road NE, Suite 750, Atlanta, GA 30326, during normal business hours for ten days prior to the Annual Meeting and available during the Annual Meeting.

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting To Be Held on December 12, 2025.

Our proxy materials including the Proxy Statement for the Annual Meeting, our annual report for the fiscal year ended December 31, 2024 and the proxy card are available on the Internet at www.proxydocs.com/BTM. Under Securities and Exchange Commission (the “SEC”) rules, we are providing access to our proxy materials by notifying you of the availability of our proxy materials on the Internet.

In connection with our 2025 Annual Meeting, we have elected to utilize the "full set delivery" option, pursuant to which we deliver all proxy materials to our stockholders by mail. These proxy materials include the Notice of 2025 Annual Meeting of Stockholders, Proxy Statement, proxy card and our Annual Report on Form 10-K. In addition to delivery of proxy materials to stockholders, we are also posting all proxy materials on a publicly accessible website and providing the information above to stockholders about how to access the website.

When is the Annual Meeting?

The annual meeting of holders of our Voting Common Stock will be held on December 12, 2025.

Why are we calling this Annual Meeting?

We are calling the Annual Meeting to seek the approval of our stockholders:

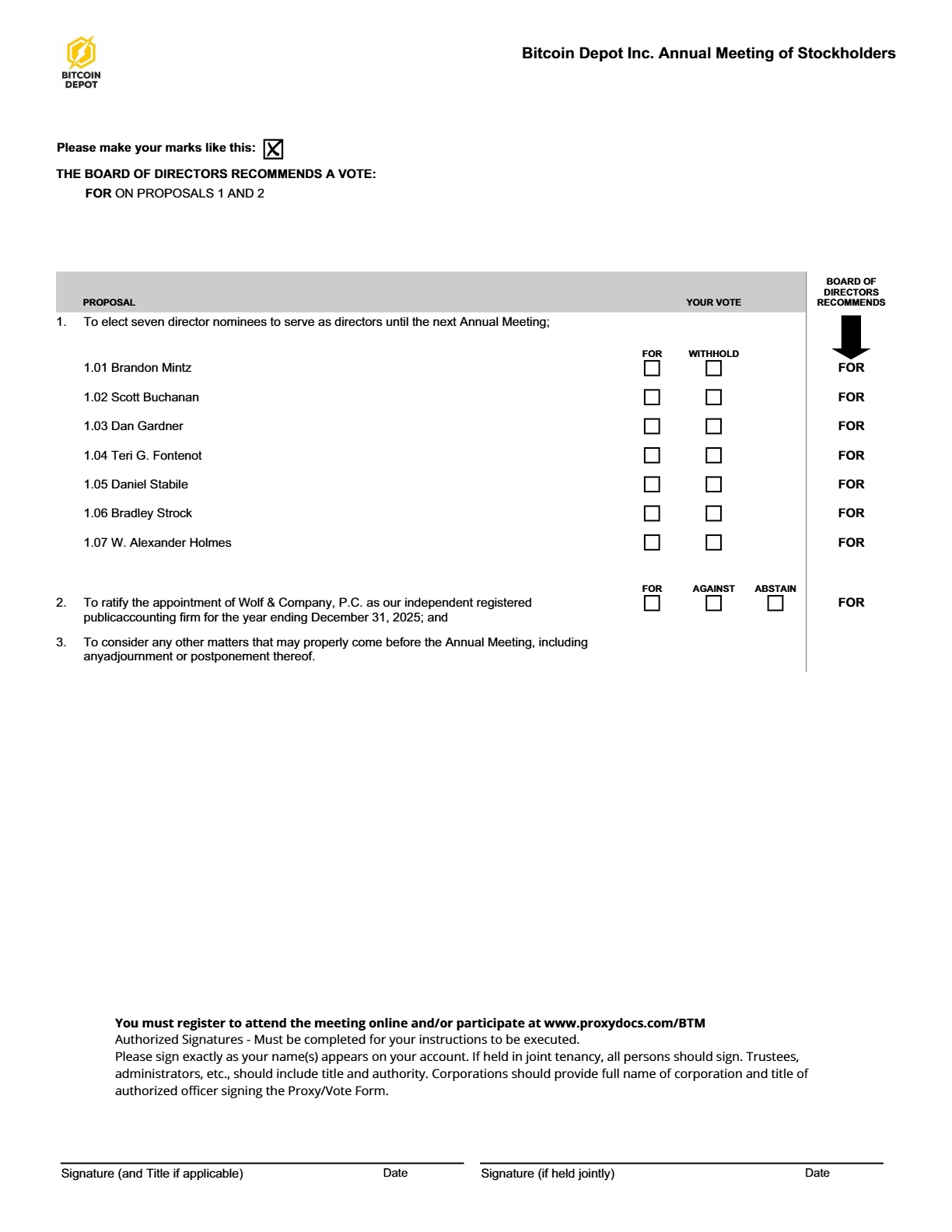

•To elect seven director nominees to serve as directors until the next Annual Meeting;

•To ratify the appointment of Wolf & Company, P.C. as our independent registered public accounting firm for the year ending December 31, 2025; and

•To consider any other matters that may properly come before the Annual Meeting, including any adjournment or postponement thereof.

Who is entitled to vote at the meeting?

Only stockholders of record of our Voting Common Stock at the close of business on the record date, November 14, 2025 (the “Record Date”), are entitled to receive notice of the Annual Meeting and to vote the shares that they held on that date at the Annual Meeting, or any postponement or adjournment of the Annual Meeting. Our Voting Common Stock consists of:

•Class A common stock entitling the holder thereof to one vote for each share held of record;

•Class B common stock entitling the holder thereof to one vote for each share held of record;

•Class M common stock entitling the holder thereof to ten votes for each share held of record;

•Class O common stock entitling the holder thereof to one vote for each share held of record; and

Holders of our Voting Common Stock vote together as a single class on all matters on which stockholders are generally entitled to vote. As a result, holders of record of each class of our Voting Common Stock have the right to vote on all matters brought before the Annual Meeting.

As of the Record Date, we had:

•35,360,672 shares of Class A common stock outstanding, representing 8.54% of the votes entitled to be cast at the meeting;

•37,846,102 shares of Class M common stock outstanding, representing 91.46% of the votes entitled to be cast at the meeting.

As of the Record Date, we did not have any shares of Class B common stock or Class O common stock outstanding.

As of the Record Date, Brandon Mintz, our Chairman and Chief Executive Officer, indirectly through BD Investment Holdings II, an entity of which he is the sole managing member, held a number of shares of our Class M common stock representing an aggregate 91.46% of the vote of our Voting Common Stock.

Who can attend the meeting?

All holders of our Voting Common Stock as of the Record Date, or their duly appointed proxies, may attend the Annual Meeting. Attendance at the Annual Meeting shall solely be via the Internet at www.proxydocs.com/BTM using the 16-digit control number on the proxy card that accompanied the proxy materials. Stockholders will not be able to attend the Annual Meeting at a physical location.

The live webcast of the Annual Meeting will begin promptly at 1:45 p.m. Eastern Time on December 12, 2025. Online access to the webcast will open approximately 15 minutes prior to the start of the Annual Meeting to allow time for our stockholders to log in and test their devices’ audio system. We encourage our stockholders to access the Annual Meeting in advance of the designated start time.

An online portal will be available to our stockholders at www.proxydocs.com/BTM commencing on or about November 25, 2025. By accessing this portal, stockholders will be able to submit a proxy to vote in advance of the Annual Meeting. Stockholders may also vote and submit questions during the Annual Meeting at www.proxydocs.com/BTM. To demonstrate proof of stock ownership, you will need to enter the 16-digit control number received with your proxy card to submit questions and vote at our Annual Meeting. If you hold your shares in “street name” (that is, through a broker or other nominee), you will need authorization from your broker or nominee in order to vote at the Annual Meeting. We intend to answer questions submitted during the Annual Meeting that are pertinent to the Company and the items being brought for stockholder vote at the Annual Meeting, as time permits, and in accordance with the rules of conduct for the Annual Meeting which are posted on the Annual Meeting website at www.proxydocs.com/BTM. We reserve the right to exclude questions regarding topics that are not pertinent to Annual Meeting matters or otherwise violate the rules of conduct. We have retained Beta NXT Inc. to host our virtual Annual Meeting and to distribute proxies and receive, count and tabulate votes.

What constitutes a quorum?

The presence at the Annual Meeting, in person or by proxy, of the holders of a majority of the voting power of all issued and outstanding shares of our Voting Common Stock will constitute a quorum for the Annual Meeting. Pursuant to the General Corporation Law of the State of Delaware (the “DGCL”), abstentions will be counted for the purpose of determining whether a quorum is present. If brokers have, and exercise, discretionary authority on at least one item on the agenda for the Annual Meeting, uninstructed shares for which broker non-votes occur will constitute voting power present for the discretionary matter and will therefore count towards the quorum.

How do I vote or submit a proxy to vote?

You may submit your proxy to vote on the Internet, by telephone, by mail or may vote electronically during the Annual Meeting, all as described below. The Internet and telephone proxy submission procedures are designed to authenticate stockholders by use of a control number and to allow you to confirm that your instructions have been properly recorded. If you vote by telephone or on the Internet, you do not need to return your proxy card or voting instruction card.

Submit a Proxy to Vote on the Internet

If you are a stockholder of record, you may submit your proxy by going to www.proxydocs.com/BTM, and following the instructions provided in the proxy card that accompanied the proxy materials. Have your proxy card in hand when you access the voting website. On the Internet voting site, you can confirm that your instructions have been properly recorded. If you submit a proxy to vote on the Internet, you can also request electronic delivery of future proxy materials. Internet voting facilities are available now and will be available 24 hours a day until 11:59 p.m., Eastern Time, on December 11, 2025. If your shares are held with a stockbroker, bank or other nominee, you can submit a proxy to vote by Internet by following the instructions specified on your voting instruction card sent by your stockbroker, bank or other nominee.

Submit a Proxy to Vote by Telephone

If you are a stockholder of record, you can also submit a proxy to vote by telephone by dialing 866-230-6364. Have your proxy card or voting instruction card in hand when you call. Telephone voting facilities are

available now and will be available 24 hours a day until 11:59 p.m., Eastern Time, on December 11, 2025. If your shares are held with a stockbroker, bank or other nominee, you can submit a proxy to vote by telephone by dialing the number specified on your voting instruction card sent by your stockbroker, bank or other nominee.

Submit a Proxy to Vote by Mail

You may choose to submit a proxy to vote by mail, by marking your proxy card or voting instruction card, dating and signing it, and returning it in the postage-paid envelope provided. If the envelope is missing and you are a stockholder of record, please mail your completed proxy card to Vote Processing, c/o BetaNxt, P.O. BOX 8016, CARY, NC 27512-9903. If the envelope is missing and your shares are held with a broker, please mail your completed voting instruction card to the address specified therein. Please allow sufficient time for mailing if you decide to submit a proxy to vote by mail as it must be received by 11:59 p.m., Eastern Time, on December 11, 2025.

Vote at the Annual Meeting

If you are a holder of record of our Voting Common Stock, you will have the right to vote during the Annual Meeting on www.proxydocs.com/BTM. To demonstrate proof of stock ownership, you will need to enter the 16-digit control number received with your proxy card to vote at our Annual Meeting. If you hold your shares in “street name” (that is, through a broker or other nominee), you will need authorization from your broker or nominee in order to vote at the Annual Meeting.

Even if you plan to attend our Annual Meeting, we recommend that you also submit your proxy as described above so that your vote will be counted if you later decide not to attend our Annual Meeting.

The proxies to vote that are submitted electronically, telephonically or represented by the proxy cards received, properly marked, dated, signed and not revoked, will be voted at the Annual Meeting.

What if I vote and then change my mind?

You may revoke your proxy at any time before it is exercised by:

•filing with the Secretary of the Company a notice of revocation;

•submitting a later-dated proxy to vote by telephone or on the Internet;

•sending in another duly executed proxy bearing a later date; or

•attending the Annual Meeting remotely and casting your vote in the manner set forth above.

Your latest proxy or vote will be the vote that is counted.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

Many of our stockholders hold their shares through a stockbroker, bank or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

If your shares are registered directly in your name with our transfer agent, Continental Stock Transfer and Trust Company, you are considered, with respect to those shares, the stockholder of record. As the stockholder of record, you have the right to directly grant your voting proxy in any of the manners set forth above or to vote at the Annual Meeting.

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in street name, and these proxy materials are being forwarded to you by your broker, bank or nominee which is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker as to how to vote and are also invited to attend the Annual Meeting. However, because you are not the stockholder of record, you may not vote these shares unless you obtain a signed proxy from the record holder giving you the right to vote the shares. Please follow the instructions provided to you by your broker, bank or other nominee in order to vote your Voting Common Stock. If you do not provide the stockholder of record with voting instructions or otherwise obtain a signed proxy from the record holder giving you the right to vote the shares, broker non-votes may occur for the shares that you beneficially own. The effect of broker non-votes is more specifically described in “What vote is required to approve each proposal?” below.

What vote is required to approve each proposal?

Assuming that a quorum is present, the following votes will be required:

•With respect to the first proposal (election of directors, “Proposal 1”), the directors are elected by a plurality of the votes cast by holders of our Voting Common Stock present in person or represented by proxy and entitled to vote. As a result, withheld votes and broker non-votes (see below), if any, will not affect the outcome of the vote on this proposal.

•The second proposal, to ratify the appointment of Wolf & Company, P.C. as our independent registered public accounting firm for the year ending December 31, 2025 (“Proposal 2”), requires the affirmative vote of a majority in voting power of the shares present in person or represented by proxy and entitled to vote thereon. As a result, marked abstentions, if any, have the same effect as a vote “against” this matter. Because this proposal is considered “routine” under New York Stock Exchange Rule 452, brokers and custodians have discretion to vote uninstructed shares on this proposal.

•With respect to any other matter that may properly come before the Annual Meeting, the affirmative vote of a majority in voting power of the shares present in person or represented by proxy and entitled to vote thereon, is required to approve such proposals, except as required by law.

As of the Record Date, Brandon Mintz, our Chairman and Chief Executive Officer, held all of our Class M common stock (through BD Investment Holdings II LLC of which he is the sole managing member) and controlled 91.46%% of the vote of our Voting Common Stock. Mr. Mintz has indicated an intent to vote in accordance with the recommendations of the Board of Directors and, therefore, we expect each of the proposals will be approved by our stockholders.

What are the Board’s recommendations?

Our Board believes that the election of the director nominees identified herein and the ratification of the appointment of Wolf & Company, P.C. as our independent registered public accounting firm for the year ending December 31, 2025 are advisable and in the best interests of the Company and its stockholders and recommends that you vote FOR each director nominee and FOR the ratification of the appointment of Wolf & Company, P.C. as our independent registered public accounting firm for the year ending December 31, 2025. If you are a stockholder of record and you return a properly executed proxy card or submit a proxy to vote over the Internet but do not mark the boxes showing how you wish to vote, your shares will be voted in accordance with the recommendations of the Board, as set forth above. With respect to any other matter that properly comes before our Annual Meeting, the proxy holders will vote as recommended by the Board or, if no recommendation is given, at their own discretion.

Are dissenters’ rights available?

Under the General Corporation Law of the State of Delaware, our stockholders will not have any dissenters’ rights of appraisal in connection with any of the matters to be voted on at the Annual Meeting.

What are “broker non-votes”?

Generally, a broker non-vote occurs when shares held by a bank, broker or other nominee for a beneficial owner are not voted with respect to a particular proposal because (i) the nominee has not received voting instructions from the beneficial owner and (ii) the nominee lacks discretionary voting power to vote such shares. Under New York Stock Exchange Rule 452, banks, brokers and other nominees who hold shares of the Voting Common Stock for beneficial owners have the discretion to vote on routine matters when they have not received voting instructions from those beneficial owners. On a non-routine matter, banks, brokers and other nominees do not have the discretion to direct the voting of the beneficial owners’ shares (as they do on a routine matter), and, if the beneficial owner has not provided voting instructions with respect to that matter, there will be a “broker non-vote” on the matter. We urge you to provide instructions to your bank, broker or other nominee so that your votes may be counted for each proposal to be voted upon. You should provide voting instructions for your shares by following the instructions provided on the voting instruction form that you receive from your bank, broker or other nominee.

The election of directors (Proposal 1) is generally not considered to be a “routine” matter and banks or brokers are not permitted to vote on these matters if the bank or broker has not received instructions from the beneficial owner. The ratification of our independent registered public accounting firm (Proposal 2) is generally considered to be a “routine” matter, and therefore, a bank or broker may be able to vote on Proposal 2 even if it does not receive instructions from you, so long as it holds your shares in its name.

How are we soliciting this proxy?

We are soliciting this proxy on behalf of our Board and will pay all expenses associated therewith. Some of our officers, directors and other employees also may, but without compensation other than their regular compensation, solicit proxies by further mailing or personal conversations, or by telephone, facsimile or other electronic means.

We will also, upon request, reimburse brokers and other persons holding stock in their names, or in the names of nominees, for their reasonable out-of-pocket expenses for forwarding proxy materials to the beneficial owners of the capital stock and to obtain proxies.

Implications of Being a “Smaller Reporting Company” and “Emerging Growth Company”

We qualify as a “smaller reporting company” and as an “emerging growth company” as such terms are defined in Rule 405 of the Securities Act of 1933, as amended (the “Securities Act”), and Item 10 of Regulation S-K. Accordingly, and in accordance with relevant SEC rules and guidance, we are allowed to and have taken advantage of specified exemptions and reduced disclosure obligations, including with respect to executive compensation disclosure, in our periodic reports and proxy statements, and with respect to the requirement to hold a vote on the stockholder approval of our executive compensation.

PROPOSAL 1: ELECTION OF DIRECTORS

Our Board is currently composed of seven directors, all of whom are being nominated for re-election at this Annual Meeting.

Directors are elected by a plurality of the votes cast. The nominees receiving the highest number of affirmative votes will be elected. Since we have nominated only seven individuals to serve as directors and Mr. Mintz will vote in accordance with the recommendation of the Board, all of the nominees should be elected to continue serving as members of our Board of Directors. If any director nominee becomes unavailable for election as a result of an unexpected occurrence, shares that would have been voted for that nominee will instead be voted for the election of a substitute nominee proposed by our Board. Each person nominated for election has agreed to serve if elected. Our management has no reason to believe that any nominee will be unable to serve.

Vacancies on the Board may be filled only with persons elected by a majority of the remaining directors or by a sole remaining director. A director elected by the Board to fill a vacancy, including vacancies created by an increase in the number of directors, shall serve for the remainder of the full term of that director for which the vacancy was created and until the director’s successor is duly elected and qualified.

Nominees for Election Until the Next Annual Meeting

The following table sets forth the name, age, position and tenure of the individuals nominated at the Annual Meeting:

|

|

|

|

Name |

Age |

Position |

Served as a

Director Since |

Brandon Mintz |

31 |

Chief Executive Officer and Chairman of the Board (1) |

2023 |

Scott Buchanan |

34 |

President and Chief Operating Officer, Director (2) |

2023 |

Dan Gardner |

43 |

Director |

2023 |

Teri G. Fontenot |

72 |

Director |

2024 |

Daniel Stabile |

42 |

Director |

2023 |

Bradley Strock |

62 |

Director |

2023 |

W. Alexander Holmes |

51 |

Director |

2025 |

(1) Effective January 1, 2026, Brandon Mintz will move from the role of Chief Executive Officer to Executive Chairman, a newly created role in which Mr. Mintz will focus on strategic opportunities and growth initiatives for the Company. He will continue to act in his capacity as Chairman of the Board.

(2) Effective January 1, 2026, Scott Buchanan will become Chief Executive Officer of the Company. He will continue to serve as a member of the Board.

The following includes a brief biography of each of the nominees standing for election to the Board at the Annual Meeting, based on information furnished to us by each of them, with such biography including information regarding the experiences, qualifications, attributes or skills that caused our Nominating and Corporate Governance Committee and the Board to determine that each of them should continue to serve as members of our Board.

Brandon Mintz Brandon Mintz has served as President, Chief Executive Officer, and Chairman of the board of directors of Bitcoin Depot since the closing of the Company’s de-SPAC transaction (the “Business Combination”) on June 30, 2023. On August 28, 2025, Scott Buchanan was appointed as the President of the Company, effective that date, and Mr. Mintz has continued to serve as Chief Executive Officer and Chairman. Mr. Mintz founded and has served as the President and Chief Executive Officer of Bitcoin Depot since its inception in June 2016. Prior to founding Bitcoin Depot, Mr. Mintz founded and served as Chief Executive Officer of Premier Technologies, LLC beginning in November 2013. Mr. Mintz holds a B.B.A. in Marketing from the University of Georgia. Mr. Mintz was recognized by Ernst & Young as a finalist for the 2021 Southeast Entrepreneur of the Year. As the founder of Bitcoin Depot, we believe Mr. Mintz is qualified to serve as a director because of his historical

knowledge about the cryptocurrency industry, deep understanding of our business and entrepreneurial spirit and leadership.

Scott Buchanan Scott Buchanan has served as President and Chief Operating Officer since August 28, 2025. He has served as a director and Chief Operating Officer of Bitcoin Depot since the closing of the Business Combination. Mr. Buchanan has served as Bitcoin Depot’s Chief Operating Officer since March 2022, and also served as Bitcoin Depot’s Chief Financial Officer from August 2020 to January 2023. From June 2019 to August 2020, Mr. Buchanan served as Bitcoin Depot’s Vice President of Finance/HR. Before his tenure at Bitcoin Depot, Mr. Buchanan worked at Acuity Brands (NYSE: AYI) in different finance-related roles beginning in December 2015. Mr. Buchanan holds a B.S. in Accounting from North Carolina State University and a Masters of Science in Accountancy from Wake Forest School of Business. Mr. Buchanan is a certified public accountant. We believe Mr. Buchanan is qualified to serve on Bitcoin Depot’s board of directors because of his finance-related expertise and credentials and his deep understanding of our business and operations.

Dan Gardner Dan Gardner has served as a director of Bitcoin Depot since the closing of the business Combination. Mr. Gardner founded Gardner Capital Group, a diversified holding company, and has served as its Chief Executive Officer since November 2020. In April 2019 Mr. Gardner co-founded GPF Holdings. From February 2013 to November 2020, Mr. Gardner worked in the private equity industry focusing largely on buyside M&A deals. In 2006 Mr. Gardner co-founded Select-A-Branch, an ATM software company, where he developed patented software capable of delivering branded, surcharge-free ATM transactions for an unlimited number of financial institutions at each ATM. Select-A-Branch was acquired in February 2013 by Seven Bank, Ltd. Mr. Gardner has served as Senior Advisor at CentSai, Inc. since August 2020, and has been an advisory board member of Univest Bank & Trust since April 2022. Mr. Gardner also serves on the boards of two Philadelphia non-profit organizations: Impact Services Corporation and Startup Leaders. Impact Services Corporation is a community development organization focused on providing affordable housing and workforce development in Philadelphia. Mr. Gardner chairs the finance committee and is the acting treasurer of Impact Services. Mr. Gardner holds a Bachelor of Science in Business Administration and Management from the College of Charleston.

Teri Fontenot Teri Fontenot has served as a director of Bitcoin Depot since July 1, 2024. Ms. Fontenot is CEO Emeritus of Woman’s Hospital in Baton Rouge, Louisiana, one of the nation’s largest and preeminent women’s specialty hospitals. Her leadership service includes serving as President and CEO of Woman’s Hospital for more than 23 years. After serving as chief financial officer at three health systems, Ms. Fontenot, a Fellow of the American College of Healthcare Executives (FACHE), joined Woman’s Hospital in 1992 as CFO and became CEO in 1996. Under her leadership, Woman’s Hospital became the largest birthing hospital and neonatal intensive care unit in Louisiana. It is also the only independent, nonprofit women’s hospital in the country. Her leadership service includes numerous state and national healthcare boards, including terms as Chair of the American Hospital Association and the Louisiana Hospital Association. Ms. Fontenot currently serves as an independent director and member of the Audit Committee of each of Amerisafe, Inc. and AMN Healthcare Services Inc. She is a Certified Public Accountant (inactive) and holds a BBA in Accountancy from the University of Mississippi and an MBA from Northeast Louisiana University. Ms. Fontenot is also a Fellow of the American College of Healthcare Executives.

Daniel Stabile Daniel Stabile has served as a director of Bitcoin Depot since the closing of the Business Combination. Mr. Stabile has been a Partner at Winston & Strawn LLP since May 2022, serving as a co-chair of the firm’s Digital Assets and Blockchain Technology Group. Mr. Stabile also served as a vice chairperson of the Miami-Dade County Cryptocurrency Task Force. Prior to his tenure at Winston, he was an attorney at Shutts & Bowen from March 2012 to May 2022, and at Dewey & LeBoeuff LLP from September 2008 to March 2012. Mr. Stabile has over 10 years of experience as an attorney with expertise in the distributed ledger, blockchain and digital asset sector. Mr. Stabile has advised banks, broker-dealers, FinTech companies and other businesses regarding their implementation of blockchain technology, as well as government officials and regulators on digital asset technology and regulation. He has also represented financial institutions and other businesses in contentious matters and disputes, including government investigations and enforcement actions, arbitrations and civil litigations. Mr. Stabile holds both a BA in Philosophy from the University of Virginia and a JD from The George Washington University Law School. We believe Mr. Stabile is uniquely qualified to serve on Bitcoin Depot’s board of directors because of his crypto regulatory industry related expertise and his legal expertise related to digital assets.

Bradley Strock Bradley Strock has served as a director of Bitcoin Depot since the closing of the Business Combination. Mr. Strock has served as President of Klaxon Holdings, LLC since January 2019. Mr. Strock served as Chief Information Officer at PayPal from October 2014 to December 2018, and from March 2011 to October 2014 he served as PayPal’s Vice President of Global Operations Technology. Prior to joining PayPal in 2011, Mr. Strock held several senior executive roles at Bank of America and at JP Morgan Chase. Mr. Strock served on the board of directors of Elevate Credit, Inc. from January 2018 to February 2023, and was a member of Elevate’s Compensation Committee and Chairperson of its Risk Committee. Mr. Strock has also served on the board of Ascensus, LLC, a financial services and technology company, since February of 2023. Mr. Strock has also served on the board of Kiavi, Inc., one of the nation’s largest lenders to real estate investors, from December 2021 to September 2022. Mr. Strock also serves on the board of Hiigna, Inc., a non-profit organization providing micro-finance loans in Africa. He received his MSM (MBA) from the Krannert School of Management at Purdue University, along with a BS in Mechanical Engineering from Purdue. We believe Mr. Strock is qualified to serve on Bitcoin Depot’s board of directors because of his experience in transformative technology, information security, growth strategies and advanced analytics as a senior executive.

W. Alexander Holmes Alex Holmes has served as a director of Bitcoin Depot since August 20, 2025. He currently serves as Executive Vice Chairman of United Texas Bank and as a Strategic Advisor to web3 ventures Orobit.ai and Trueio.io. In addition to Bitcoin Depot and United Texas Bank, Mr. Holmes also serves on the Board of Jingle Pay Group in Dubai. From 2016 to 2024, Mr. Holmes was Chairman and CEO of MoneyGram International Inc., where he transformed the company into a global fintech powerhouse operating in over 200 countries and territories. Over his sixteen years at MoneyGram, he also held senior roles as CFO and COO, building a reputation for operational excellence, disciplined risk management and deep expertise in global regulatory compliance. During his tenure, he set new industry standards while driving innovation in cross-border payments. A pioneer in blockchain adoption, he led MoneyGram’s integration of stablecoins and distributed ledger technology, launched the MoneyGram Haas F1 Team sponsorship and oversaw the company’s $2 billion sale to Madison Dearborn Partners. Mr. Holmes holds both a BS in Accounting from the University of Colorado and an MS in Information Technology from the University of Colorado – Denver. He also serves on the non-profit board of Vogel Alcove and is a member of YPO Global One Chapter.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE ELECTION OF ALL DIRECTOR NOMINEES.

Board of Directors Composition

Our business and affairs are organized under the direction of our Board. Our Board meets on a regular basis and additionally as required. In accordance with the terms of the Bylaws, our Board may establish the authorized number of directors from time to time by resolution. Our Board currently consists of seven directors. Our directors hold office until their successors have been elected and qualified or until the earlier of their resignation or removal.

The Board of Directors believes that diversity, including, brings a diversity of viewpoints that is important to the effectiveness of the Board of Directors’ oversight function. Our priority in selection of Board members is identification of members who will further the interests of our stockholders through their established record of professional accomplishment, the ability to contribute positively to the collaborative culture among Board members, knowledge of our business and understanding of the competitive landscape.

Controlled Company Status and Director Independence

The Nasdaq rules generally require that independent directors must comprise a majority of a listed company’s board of directors. However, BD Investment Holdings II LLC, an entity owned by Brandon Mintz, our Chairman, President and CEO, beneficially owns a majority of the voting power of all outstanding shares of the Company’s Voting Common Stock. As a result, the Company is a “controlled company” within the meaning of the Nasdaq listing rules. Under the Nasdaq listing rules, a company of which more than 50% of the voting power for the election of directors is held by an individual, group or another company is a “controlled company” and may elect not to comply with certain corporate governance standards, including the requirements (i) that a majority of its board of directors consist of independent directors, (ii) that its board of directors have a compensation committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities and (iii) that director nominees must either be selected, or recommended for the board of directors’ selection, either by independent directors constituting a majority of the board’s independent directors in a vote in which only independent directors participate, or a nominating and corporate governance committee composed solely of independent directors with a written charter addressing the committee’s purpose and responsibilities.

Under the rules of Nasdaq, a director will only qualify as an “independent director” if, in the opinion of that company’s board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director, and that person meets the categorical standards evaluated by the Nasdaq. Based upon information requested from and provided by each director concerning his or her background, employment and affiliations, including family relationships, the Board has determined that Ms. Fontenot and Messrs. Gardner, Stabile, Strock and Holmes are “independent” as that term is defined under the applicable rules and regulations of the SEC and the listing requirements and rules of Nasdaq. While the Board of Directors is composed of a majority of independent directors and therefore does not avail itself of the exemption described in clause (i) of the prior paragraph, the Company currently avails itself of the exemptions described in clauses (ii) and (iii) of the prior paragraph.

Information Regarding Committees of the Board of Directors

Our Board has three standing committees: an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. Each of these committees has authority to engage legal counsel or other experts or consultants at the expense of the Company, as it deems appropriate to carry out its responsibilities. Copies of the committee charters are available on the investor relations page of our website, www.BitcoinDepot.com. The information on our website is not part of this Proxy Statement. The composition and function of each of these committees are described below.

The rules of the SEC and listing standards of Nasdaq require that the audit committee of the Company (the “Audit Committee”) be composed of at least three directors who meet the enhanced independence and experience standards established by Nasdaq and the Exchange Act as they relate to audit committees. Our Audit Committee consists of Ms. Fontenot, Mr. Strock and Mr. Holmes, with Ms. Fontenot serving as the chair of the Audit Committee. Each member of the Audit Committee is independent and financially literate, in each case, as required by the rules of the SEC and Nasdaq, and the Board has determined that Ms. Fontenot and Mr. Holmes each qualify as an “audit committee financial expert” and meet the standard of "financial sophistication" as defined in applicable SEC and Nasdaq rules.

The Audit Committee oversees, reviews, acts on and reports on various auditing and accounting matters to the Bitcoin Depot board of directors, including: the integrity of our financial statements, including the financial reporting process and systems of internal controls regarding finance, accounting, and legal compliance, the qualification, independence and selection of Bitcoin Depot’s independent registered public accounting firm, the scope of Bitcoin Depot’s annual audits and other work performed by the independent registered public accounting firm, pre-approval of fees to be paid to the independent registered public accounting firm and overseeing the work of the internal auditors. In addition, the Audit Committee oversees Bitcoin Depot’s compliance programs relating to legal and regulatory requirements. The Audit Committee also reviews and approves or disapproves of related party transactions. The purpose and responsibilities of our Audit Committee are set forth in the Audit Committee Charter which is available in the “Corporate Governance” section of the Company's website at https://ir.bitcoindepot.com/corporate-governance.

The Audit Committee’s role is one of oversight. Management is responsible for preparing the Company’s financial statements and the independent registered public accounting firm is responsible for auditing those financial statements. Management, including the outside provider of internal audit, and the independent registered public accounting firm have more time, knowledge and detailed information about the Company than do Audit Committee members. Consequently, in carrying out its oversight responsibilities, the Audit Committee will not provide any expert or special assurance as to the Company’s financial statements or any professional certification as to the independent registered public accounting firm’s work.

Because the Company is a “controlled company” within the meaning of the Nasdaq corporate governance rules, we are not currently required to have a fully independent compensation committee. Our compensation committee (the “Compensation Committee”) currently consists of Mr. Gardner, Mr. Mintz and Mr. Stabile, with Mr. Mintz serving as the chair of the Compensation Committee.

The Compensation Committee reviews and approves, or recommends that our Board approve, the compensation of Bitcoin Depot’s chief executive officer, reviews and recommends to the Board the compensation of Bitcoin Depot’s non-employee directors, reviews and approves, or recommends that the Board approve, the terms of compensatory arrangements with Bitcoin Depot’s executive officers, administers Bitcoin Depot’s incentive compensation and benefit plans, selects and retains independent compensation consultants and assesses whether any of Bitcoin Depot’s compensation policies and programs has the potential to encourage excessive risk-taking. The purpose and responsibilities of our Compensation Committee are set forth in the Compensation Committee Charter which is available in the “Corporate Governance” section of the Company's website at https://ir.bitcoindepot.com/corporate-governance.

Nominating and Corporate Governance Committee

Because the Company is a “controlled company” within the meaning of the Nasdaq corporate governance rules, we are not currently required to have a fully independent nominating and corporate governance committee (the “NCG Committee”). Our NCG Committee currently consists of Mr. Mintz, Mr. Stabile and Mr. Strock, with Mr. Mintz serving as the chair of the NCG Committee.

The NCG Committee identifies, evaluates and recommends qualified nominees to serve on the Board, considers and makes recommendations to the Board regarding the composition of the Board and its committees, oversees Bitcoin Depot’s internal corporate governance processes, maintains a management succession plan and

oversees an annual evaluation of the Board’s performance. The criteria the Board considers in recommending director candidates to the Board include reputation and character, conflicts of interest, independence, business and professional activities, educational background, experience, qualifications, skills, time and willingness to carry out duties, the number of other boards on which the nominee serves, and diversity. The purpose and responsibilities of our NCG Committee are set forth in the NCG Committee Charter which is available in the “Corporate Governance” section of the Company's website at https://ir.bitcoindepot.com/corporate-governance.

The Board approved and adopted a new Code of Business Conduct and Ethics (the “Code of Conduct”) applicable to our CEO, CFO and all other employees, officers and directors of the Company. A copy of the Code of Conduct can be found in the Investor Relations section of the Company’s website at https://bitcoindepot.com/investor-relations. In accordance with Nasdaq and SEC rules, we intend to disclose on our website any future amendments to our Code of Conduct, or waivers from our Code of Conduct for our Chief Executive Officer or Chief Financial Officer.

Compensation Committee Interlocks and Insider Participation

Brandon Mintz served as Chair of the Compensation Committee and also served as our President and Chief Executive Officer during 2024. None of our executive officers served on the compensation committee or board of any company that employed any member of the Compensation Committee or our Board.

Limitations on Liability and Indemnification of Officers and Directors

The Company’s Second Amended and Restated Certificate of Incorporation (the “Charter”) limits the liability of the directors and officers to the fullest extent permitted by the DGCL and provides that Bitcoin Depot will provide them with customary indemnification and advancement of expenses.

In addition, we have entered into separate indemnification agreements with our directors and officers. These agreements, among other things, require us to indemnify our directors and officers for certain expenses, including attorneys’ fees, judgments, fines and settlement amounts incurred by a director or officer in any action or proceeding arising out of their services as one of our directors or officers or any other company or enterprise to which the person provides services at its request.

We maintain a directors’ and officers’ insurance policy pursuant to which our directors and officers are insured against liability for actions taken in their capacities as directors and officers. We believe these provisions in the Charter and the Bylaws and these indemnification agreements are necessary to attract and retain qualified persons as directors and officers.

Stockholder Nominations for Directorships

Stockholders may recommend individuals to the NCG Committee for consideration as potential director candidates by submitting their names and background to the Secretary of the Company at the address set forth below under “Stockholder Communications” in accordance with the provisions set forth in our bylaws. All security holder recommendations for director candidates must be received by the Company in the timeframe(s) set forth under the heading “Stockholder Proposals” below. All such recommendations will be forwarded to our NCG Committee, which will review and only consider such recommendations if appropriate biographical and other information is provided, including, but not limited to, the items listed below, on a timely basis:

•the name and address of record of the security holder;

•the class and series and number of shares of stock of the Company that are beneficially owned by the security holder;

•a representation that the security holder is a record holder of the Company’s securities as of the date of the recommendation and as of the Record Date, or if the security holder is not a record holder, evidence of ownership in accordance with Rule 14a-8(b)(2) of the Securities Exchange Act of 1934 (the “Exchange Act”);

•the name, age, business and residential address, educational background, current principal occupation or employment and principal occupation or employment for the preceding five (5) full fiscal years of the proposed director candidate;

•a description of the qualifications and background of the proposed director candidate and a representation that the proposed director candidate meets applicable independence requirements;

•a description of any arrangements or understandings between the security holder and the proposed director candidate;

•the consent of the proposed director candidate to be named in the proxy statement relating to the Company’s annual meeting of stockholders and to serve as a director if elected at such annual meeting; and

•a representation that the security holder intends to appear in person or by proxy at the Annual Meeting to nominate the proposed director candidate.

Assuming that appropriate information is provided for candidates recommended by stockholders, the NCG Committee will evaluate those candidates by following substantially the same process, and applying substantially the same criteria, as for candidates submitted by members of the Board or other persons, as described above and as set forth in its written charter. There have been no changes to the procedures by which stockholders may recommend nominees to our Board.

Board Leadership Structure and Role in Risk Oversight

The chief executive officer and chairman positions are held by Brandon Mintz. Mr. Mintz also beneficially owns approximately 91.46% of the voting power of our Voting Common Stock as of November 14, 2025. Bradley Strock serves as the lead independent director of our Board. Periodically, our Board assesses these roles and the Board leadership structure to ensure the interests of the Company and our stockholders are best served. Our Board believes that the combination of the chief executive officer and chairman roles with an experienced, lead independent director creates the most effective and balanced board leadership structure for the Company at this time. The Board believes that Mr. Mintz is best positioned to chair regular board meetings because of his primary responsibility for the Company’s day-to-day operations and his extensive knowledge and understanding of our industry and all aspects of the Company, our business and risks, and our customers. The Board’s current view is that a combined chief executive officer and chairman position, together with non-executive independent directors and an engaged lead independent director, promotes responsible corporate governance and the appropriate oversight for our Company. As lead independent director, Mr. Strock presides over periodic meetings of our independent directors, serves as a liaison between the Chairman of our Board and the independent directors and performs such additional duties as the Board may otherwise determine and delegate.

Our Audit Committee is primarily responsible for overseeing our risk management processes. The Audit Committee receives and reviews periodic reports from management, auditors, legal counsel and others, as considered appropriate regarding the Company’s assessment of risks. The Board focuses on the most significant risks facing the Company and the Company’s general risk management strategy, and also ensures that risks undertaken by the Company are consistent with the Board’s risk strategy. While the Audit Committee oversees the Company’s risk management, management is responsible for day-to-day risk management processes. We believe this division of responsibilities is the most effective approach for addressing the risks facing the Company and that our Board leadership structure supports this approach.

Our Compensation Committee generally oversees risks associated with our executive compensation program.

In recognition of the unique and evolving risks posed by cybersecurity and data protection, the Board determined to delegate to the Audit Committee the responsibility of overseeing risks related to cybersecurity, data protection (including confidential, proprietary and personal information, reputation and goodwill in all forms) and other similar risks. The Audit Committee is also responsible for overseeing and assisting in the establishment of policies and procedures to mitigate such risks. For instance, the Company maintains a global set of security policies and standards and regularly evaluates response readiness, disaster recovery or business continuity considerations. In addition, all employees receive annual cybersecurity training.

We believe the division of risk management responsibilities described above is an effective approach for addressing the risks facing the Company and that our Board leadership structure supports this approach.

Board Meetings and Attendance

The Board held 5 meetings in fiscal year 2024. In addition, the Audit Committee held 11 meetings, the Compensation Committee held 2 meetings and the NCG Committee held 2 meetings during the same period. Board members are expected to devote sufficient time and attention to prepare for, attend and participate in Board meetings and meetings of committees on which they serve, including advance review of meeting materials that may be circulated prior to each meeting. All directors who served on the Board during fiscal year 2024 attended at least 75% of the Board and committee meetings on which he or she served held during the year.

Stockholder Communications

Our Board will give appropriate attention to written communications that are submitted by stockholders, and will respond if and as appropriate. Absent unusual circumstances or as contemplated by committee charters, and subject to advice from legal counsel, the Secretary of the Company is primarily responsible for monitoring communications from stockholders and for providing copies or summaries of such communications to the Board as the Secretary considers appropriate.

Communications from stockholders will be forwarded to all directors if they relate to important substantive matters or if they include suggestions or comments that the Secretary considers to be important for the Board to know. Communication relating to corporate governance and corporate strategy are more likely to be forwarded to the Board than communications regarding personal grievances, ordinary business matters, and matters as to which the Company tends to receive repetitive or duplicative communications. Stockholders who wish to send communications to the Board should address such communications to: The Board of Directors, Bitcoin Depot Inc., 3343 Peachtree Road NE, Suite 750, Atlanta, GA 30326, Attention: Secretary.

Anti-Hedging and Anti-Pledging Policy

Under the terms of our insider trading policy, we prohibit each officer, director and employee, and each of their family members and controlled entities, from engaging in certain forms of hedging or monetization transactions. Such transactions include those, such as zero-cost collars and forward sale contracts, that would allow them to lock in much of the value of their stock holdings, often in exchange for all or part of the potential for upside appreciation in the stock, and to continue to own the covered securities but without the full risks and rewards of ownership. Our insider trading policy also prohibits directors, officers and other employees from holding Company securities in a margin account or otherwise pledging Company securities as collateral for a loan.

We have adopted an insider trading policy that is designed to promote compliance with insider trading laws, rules and regulations and any applicable listing standards. Under the terms of our insider trading policy, we prohibit each officer, director and employee, and each of their family members and controlled entities, who is aware of material nonpublic information relating to the Company from directly, or indirectly through family members or other persons or entities from:

•engaging in transactions in Company securities, except as specified in the insider trading policy;

•recommending the purchase or sale of any Company securities;

•disclosing material nonpublic information to persons within the Company whose jobs do not require them to have that information, or outside of the Company to other persons, unless any such disclosure is made in accordance with the Company’s policies regarding the protection or authorized external disclosure of information; or

•assisting anyone engaged in the above activities.

Our insider trading policy is available as Exhibit 19 to Amendment No. 1 to our Annual Report on Form 10-K for the year-ended December 31, 2024.

INFORMATION CONCERNING EXECUTIVE OFFICERS

The following table sets forth certain information regarding our executive officers as of the date of this Proxy Statement.

|

|

|

|

Name |

Age |

Position(s) |

Serving in

Position

Since |

Brandon Mintz |

31 |

President, Chief Executive Officer and Chairman of the Board (1) |

2016 |

Scott Buchanan |

34 |

Chief Operating Officer, Director (2) |

2022 |

Elizabeth Simer |

41 |

Chief Operating Officer |

2025 |

David Gray |

56 |

Chief Financial Officer |

2025 |

Christopher Ryan |

44 |

Chief Legal Officer |

2025 |

Philip Brown |

40 |

Chief Compliance Officer |

2025 |

(1) Effective January 1, 2026, Brandon Mintz will move from the role of Chief Executive Officer to Executive Chairman, a newly created role in which Mr. Mintz will focus on strategic opportunities and growth initiatives for the Company. He will continue to act in his capacity as Chairman of the Board.

(2) Effective January 1, 2026, Scott Buchanan will become Chief Executive Officer of the Company. He will continue to serve as a member of the Board.

Our executive officers are elected by, and serve at the discretion of, our Board. The business experience for the past five years, and in some instances, for prior years, of each of our executive officers is as follows (for information about Mr. Mintz and Mr. Buchanan, see “Proposal 1 – Election of Directors” above):

David Gray. Mr. Gray has served as Bitcoin Depot’s Chief Financial Officer since March 2025. Prior to joining the Company, Mr. Gray served as Chief Financial Officer of Aviat Networks (NASDAQ: AVNW), from October of 2021 until May of 2024. Prior to that, Mr. Gray served in various corporate finance and treasury roles of Superior Essex from 2014 to 2021, most recently as Chief Financial Officer and Treasurer since 2017. Mr. Gray holds a Bachelor of Science in Accounting from Penn State University and is a Certified Public Accountant (CPA) and Certified Management Accountant (CMA).

Christopher Ryan. Mr. Ryan has served as Bitcoin Depot's Chief Legal Officer since January 2025. Before joining Bitcoin Depot, Mr. Ryan served as Deputy General Counsel at MoneyGram International, Inc. where he worked from June 2017 to January 2025. At MoneyGram, Mr. Ryan led global legal teams working on cryptocurrency initiatives, regulatory strategy, and commercial partnerships across North America, Latin America, Europe and Africa. Prior to MoneyGram, he worked as an in-house commercial attorney at two other consumer-focused fintech companies and also served as an Assistant Prosecutor for the City of Cincinnati. Mr. Ryan holds a J.D. from the Florida Coastal School of Law and a B.S. in Political Science from the University of Dayton.

Elizabeth Simer. Mrs. Simer joined the Company as Chief Operating Officer in November 2025. Prior to joining Bitcoin Depot, she served as Chief Operating Officer of Slickdeals, LLC from March of 2025 until July of 2025 and Chief Business Officer of Slickdeals, LLC from October of 2023 until March of 2025. Prior to that, Mrs. Simer served as Chief Strategy Officer of Opportunity Financial, LLC (NYSE: OPFI) from January of 2022 until September of 2023 and as a General Manager for Opportunity Financial, LLC from November of 2020 to January of 2022. From 2011 to 2020, Mrs. Simer held various product, marketing, and strategy roles at Fortune 500 companies. Mrs. Simer holds a Master of Business Administration and a Bachelor of Science in Business from Indiana University.

Philip Brown. Mr. Brown joined the Company as Chief Operating Officer in July of 2025. Before joining Bitcoin Depot, Mr. Brown served as Banxa’s director of compliance and chief compliance officer for North America from September 2023 to June 2025, where he played a pivotal role in building and operationalizing its global

compliance framework and navigating complex virtual asset regulations in both emerging and established markets. Prior to Banxa, Mr. Brown served as chief compliance officer at Alliance Trust from January 2010 through June 2022 where he gained deep insights into traditional financial services compliance, particularly around fiduciary obligations and risk management. Mr. Brown holds a B.S in Finance from the University of Nevada, Reno.

This section discusses the material components of our executive compensation program for our Named Executive Officers during our fiscal years ended December 31, 2024 and December 31, 2023. As a "smaller reporting company" and as an “emerging growth company” we are required to provide executive compensation information for the following individuals: (i) all individuals who served as the Company's principal executive officer ("PEO"), during the last completed fiscal year, regardless of compensation; (ii) the two most highly compensated executive officers (other than the PEO) who were serving as executive officers of the Company at the end of the last completed fiscal year and whose total compensation was greater than $100,000; and (iii) up to two additional persons who served as executive officers (other than as the PEO) during the last completed fiscal year but were not serving in that capacity at the end of the fiscal year, if their total compensation is higher than any of the other two Named Executive Officers in the preceding group.

Our Named Executive Officers (or “NEOs”) and their positions during the fiscal year ended December 31, 2024 were as follows:

Executive Principal Position

Brandon Mintz . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . President and Chief Executive Officer

Scott Buchanan . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Chief Operating Officer (1)

Mark Smalley. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . former Chief Compliance Officer (2)

Glen Leibowitz . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . former Chief Financial Officer (3)

(1) Mr. Buchanan served as Acting Chief Financial Officer from November 15, 2024 through March 24, 2025. Additionally, Mr. Buchanan was appointed as our President, in addition to continuing to serve in his prior role as Chief Operating Officer, on August 28, 2025.

(2) Mr. Smalley’s employment with the Company ended on June 19, 2025. As such, he was an executive officer of the Company as of December 31, 2024.

(3) Mr. Leibowitz’s employment with the Company ended on November 15, 2024.

Please see the section below entitled “2025 and 2026 Planned Executive Transitions” for information regarding the Company’s near-term succession plan and impending changes to the roles of some of the Named Executive Officers later in 2025 and 2026.

Summary Compensation Table

The following table summarizes the compensation awarded to or earned by or paid to our Named Executive Officers for the fiscal year ended December 31, 2024 and the fiscal year ended December 31, 2023.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and Principal Position |

Year |

|

Salary ($)(1) |

|

Bonus ($)(2) |

|

Stock Awards ($)(3) |

|

Non-Equity Incentive Plan Compensation ($)(4) |

|

All Other Compensation ($)(5) |

|

Total ($) |

Brandon Mintz . . . . . . . . . . . . . . . . . . . . |

2024 |

|

894,231 |

|

35,625 |

|

741,521 |

|

35,625 |

|

10,386 |

|

1,717,388 |

Chairman and Chief Executive Officer |

2023 |

|

688,188 |

|

-- |

|

1,516,955 |

|

-- |

|

9,930 |

|

2,215,073 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Scott Buchanan . . . . . . . . . . . . . . . . . . . |

2024 |

|

342,500 |

|

47,750 |

|

285,074 |

|

648,750 |

|

9,786 |

|

1,333,860 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

President and Chief Operating Officer . . . . . . . . . . . . . |

2023 |

|

305,730 |

|

50,000 |

|

996,934 |

|

875,000 |

|

8,858 |

|

2,236,522 |

Mark Smalley |

2024 |

|

184,569 |

|

25,869 |

|

$82,391 |

|

|

|

6,360 |

|

299,189 |

former Chief Compliance Officer . . . . . . . . . . . . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

Glen Leibowitz . . . . . . . . . . . . . . . . . . . |

2024 |

|

276,923 |

|

-- |

|

185,380 |

|

-- |

|

10,406 |

|

472,709 |

former Chief Financial Officer . . . . . . . . . . . . . |

2023 |

|

275,687 |

|

48,750 |

|

176,584 |

|

48,750 |

|

8,222 |

|

557,993 |

(1) The amount in this column reflects the base salary actually earned by each Named Executive Officer during each of fiscal year 2024 and 2023.

(2) The amount in this column reflects the discretionary portion of the annual cash bonus paid to each NEO for the year reported. For Mr. Buchanan in fiscal year 2024 it also includes a $24,000 bonus for serving as the Company's Acting Chief Financial Officer from November 15, 2024 through December 31, 2024 .

(3) The amounts disclosed represent the aggregate grant date fair value of RSU and PSU awards as calculated in accordance with the provisions of Financial Accounting Standards Board Accounting Standards Codification Topic 718 (“ASC 718”), without regard to forfeitures, and based on probable outcome at the date of grant for PSUs. The assumptions used in calculating the grant date fair value of the award disclosed in this column can be found in Note 2(o) to our audited financial statements for the year ended December 31, 2024, included in our Annual Report on Form 10-K filed with the SEC on March 24, 2025. The value of the PSUs awarded in 2024 assuming the highest level of performance at the grant date was $463,451 for Mr. Mintz, $178,170 for Mr. Buchanan, $55,494 for Mr. Smalley, and $115,863 for Mr. Leibowitz.

(4) The amount in this column reflects the portion of the annual cash bonus paid to each NEO for the year reported that was determined based on performance against pre-established metrics. For Mr. Buchanan, this column also includes $625,000 earned in 2024 and $825,000 earned in 2023 pursuant to Mr. Buchanan's Sale Bonus Agreement described below under “Additional Narrative Disclosure”.

(5) The amounts reported in this column include the dollar value of employer 401(k) matching contributions paid to each participating named executive officer and amounts paid with respect to life insurance premiums for each named executive officer.

Narrative Disclosure to Summary Compensation Table

Compensation Letter Agreements

Mr. Buchanan’s most recent employment letter effective November of 2025, provides for an annual base salary of $350,000, as well as eligibility for Mr. Buchanan to earn an annual cash bonus as described below in the “Non-Equity Incentive Plan Compensation” section. Mr. Buchanan is also eligible for paid time off, reimbursement of business expenses, and participation in any health, dental and vision benefits provided to similarly situated employees.

We enter into standard letter agreements with our other Named Executive Officers that set forth the terms of their employment, including base salary, bonus and equity award eligibility. The letters also provide for payments upon termination of employment under certain circumstances and also include separate non-disclosure and restrictive covenant agreements that provide for the following restrictive covenants: (i) non-competition and non-solicitation of customers and employees or service providers, during employment and for two years thereafter, in the case of Mr. Buchanan, and nine months, in the case of our other Named Executive Officers, following termination and (ii) perpetual non-disclosure of confidential information.

Base Salary

The base salaries of our Named Executive Officers are paid to retain qualified talent and are set at a level that is commensurate with the Named Executive Officer’s duties and authorities.

For fiscal year 2024, Mr. Mintz’s base salary was $900,000. Mr. Buchanan’s base salary was $320,000 until it was increased to $335,000, effective February 12, 2024 and then increased to $350,000, effective November 18, 2024, upon beginning to serve as Acting Chief Financial Officer. In addition, the Company agreed to pay Mr. Buchanan a biweekly bonus of $8,000 for as long as he served as interim Chief Financial Officer. Mr. Leibowitz's annual 2024 base salary was $300,000. Mr. Smalley's 2024 annual base salary was $185,000.

We expect to further evaluate the base salaries of our executive officers, including our Named Executive Officers, in consultation with the Compensation Committee, periodically.

Non-Equity Incentive Plan Compensation

With respect to fiscal years 2024 and 2023, our named executive officers were eligible to receive annual bonuses based (i) 50% on the achievement of net profit goals for BT OpCo and personal performance goals and (ii) 50% on individual performance, as determined by the Board or the Compensation Committee in its discretion, except for Mr. Smalley, whose bonus was 100% discretionary. The annual bonuses for fiscal year 2024 were earned at 50% of target for the Named Executive Officers other than Mr. Leibowitz, who was not eligible for a 2024 annual bonus because he was not employed through the end of 2024, based on the achievement of BT OpCo net profit goals and personal performance goals.

Equity Incentive Compensation and Long-Term Incentive Plan

Effective with the Merger, the Company and its Board of Directors adopted the Bitcoin Depot Inc. 2023 Omnibus Incentive Equity Plan (the “Incentive Equity Plan”). The aggregate number of shares of PubCo Class A common stock that may be issued or used for reference purposes or with respect to which awards may be granted under the Incentive Equity Plan shall not exceed an amount equal to the sum of (i) ten percent (10%) of the number of shares of PubCo common stock outstanding as of immediately following the Closing of the business combination, plus (ii) the aggregate number of shares of PubCo Class A common stock issuable upon settlement of the Phantom Equity Awards or the BT Transaction Bonus Payments in accordance with the Transaction Agreement (in each case, subject to adjustment in the event of certain transactions or changes of capitalization in accordance with the Incentive Equity Plan) (together, the “Initial Share Reserve”).

The number of shares available for issuance under the Incentive Equity Plan is subject to an annual increase on the first day of each calendar year beginning January 1, 2023 and ending and including January 1, 2032, equal to the lesser of (i) four percent (4%) of the aggregate number of shares of PubCo Class A common stock outstanding on the final day of the immediately preceding calendar year and (ii) any such smaller number of shares as is determined by our board of directors. The aggregate number of shares that may be issued or used under the Incentive Equity Plan pursuant to incentive stock options (“ISOs”) shall not exceed the Initial Share Reserve. Shares of PubCo Class A common stock subject to an award that expires or is canceled, forfeited or otherwise terminated without delivery of shares, shares tendered in payment of an option, shares covered by a stock-settled SAR (as defined below) or other award that were not issued upon settlement, and shares delivered or withheld to satisfy any tax withholding obligations will again be available for delivery pursuant to other awards under the Incentive Equity Plan. The number of shares available for issuance under the Incentive Equity Plan will not be reduced by shares issued pursuant to awards issued or assumed in connection with a merger or acquisition as contemplated by applicable stock exchange rules.

Additional Narrative Disclosure

Scott Buchanan Sale Bonus Agreement

On July 21, 2020, BT OpCo entered into a sale bonus agreement with Mr. Buchanan, as modified by a letter from BT OpCo dated August 24, 2022 (collectively, the “Sale Bonus Agreement”). Pursuant to the Sale Bonus Agreement, upon a Sale Transaction (as defined in the Sale Bonus Agreement, which includes the business