An MSR-Focused REIT Fourth Quarter Earnings Call Presentation February 3, 2026

Safe Harbor Statement 2 FORWARD-LOOKING STATEMENTS This presentation of Two Harbors Investment Corp., or TWO, includes “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Actual results may differ from expectations, estimates and projections and, consequently, readers should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “target,” “assume,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believe,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from expected results, including, among other things, those described in our Annual Report on Form 10-K for the year ended 2024, and any subsequent Quarterly Reports on Form 10-Q, under the caption “Risk Factors.” Factors that could cause actual results to differ include, but are not limited to: the state of credit markets and general economic conditions; changes in interest rates and the market value of our assets; changes in prepayment rates of mortgages underlying our target assets; the rates of default or decreased recovery on the mortgages underlying our target assets; declines in home prices; our ability to establish, adjust and maintain appropriate hedges for the risks in our portfolio; the availability and cost of our target assets; the availability and cost of financing; changes in the competitive landscape within our industry; our ability to effectively execute and to realize the benefits of strategic transactions and initiatives we have pursued or may in the future pursue; our entry into a merger agreement with UWM Holdings Corporation and the ability to realize the potential benefits and synergies of the proposed transaction; our ability to manage various operational risks and costs associated with our business, including the risks associated with operating a mortgage loan servicer and originator; interruptions in or impairments to our communications and information technology systems; our ability to acquire mortgage servicing rights (MSR) and to maintain our MSR portfolio; our exposure to legal and regulatory claims; legislative and regulatory actions affecting our business; our ability to maintain our REIT qualification; and limitations imposed on our business due to our REIT status and our exempt status under the Investment Company Act of 1940. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. TWO does not undertake or accept any obligation to release publicly any updates or revisions to any forward-looking statement to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Additional information concerning these and other risk factors is contained in TWO’s most recent filings with the Securities and Exchange Commission (SEC). All subsequent written and oral forward- looking statements concerning TWO or matters attributable to TWO or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. This presentation may include industry and market data obtained through research, surveys, and studies conducted by third parties and industry publications. We have not independently verified any such market and industry data from third-party sources. This presentation is provided for discussion purposes only and may not be relied upon as legal or investment advice, nor is it intended to be inclusive of all the risks and uncertainties that should be considered. This presentation does not constitute an offer to purchase or sell any securities, nor shall it be construed to be indicative of the terms of an offer that the parties or their respective affiliates would accept. Readers are advised that the financial information in this presentation is based on company data available at the time of this presentation and, in certain circumstances, may not have been audited by the company’s independent auditors.

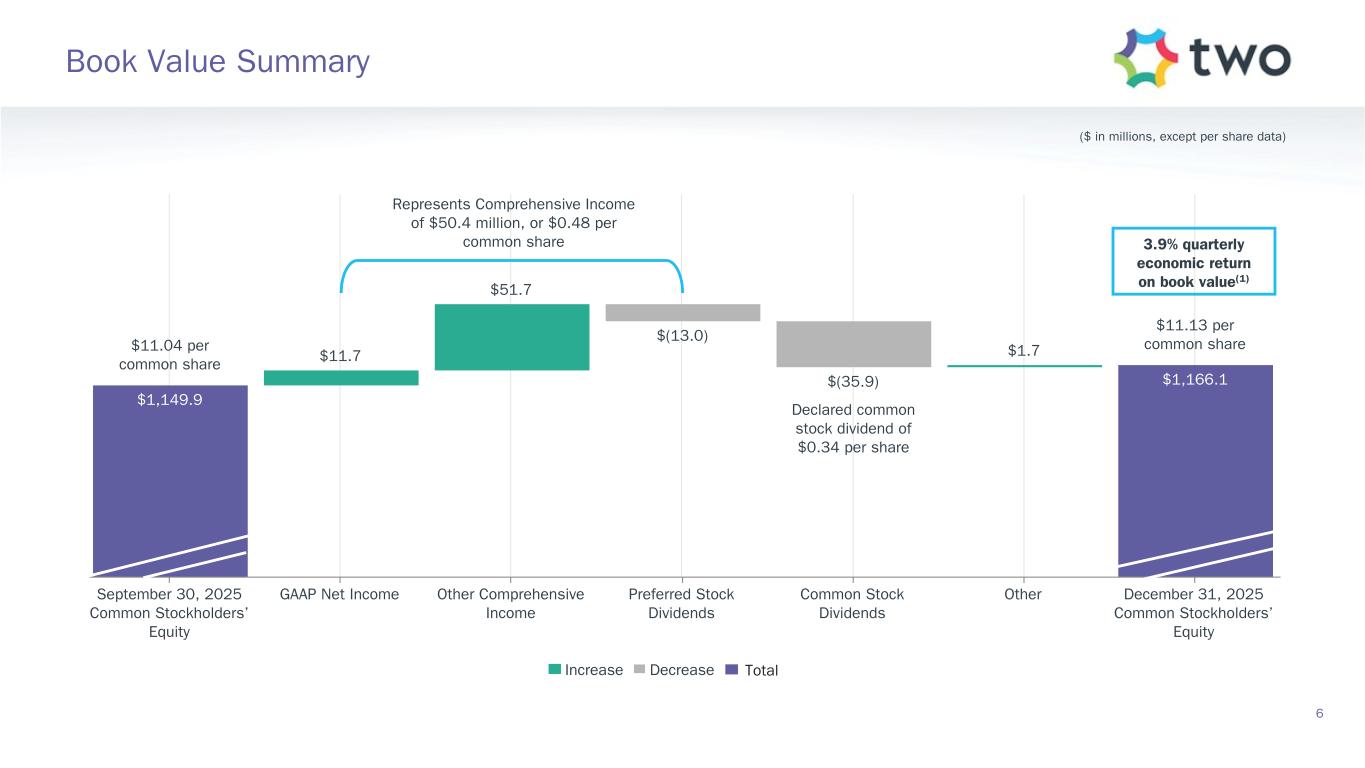

Common Stock Dividend $0.34 Comprehensive Income per Share $0.48 Investment Portfolio(2) $13.2b Quarter-End Economic Debt-to-Equity(3) 7.0x Note: Financial data throughout this presentation is as of or for the quarter ended December 31, 2025, unless otherwise noted. Per share metrics utilize basic common shares as the denominator. The End Notes are an integral part of this presentation. See slides 30 through 35 at the back of this presentation for information related to certain financial metrics and defined terms used herein. Quarterly Financials Overview 3 Book Value per Share $11.13 Economic Return on Book Value(1) 3.9%

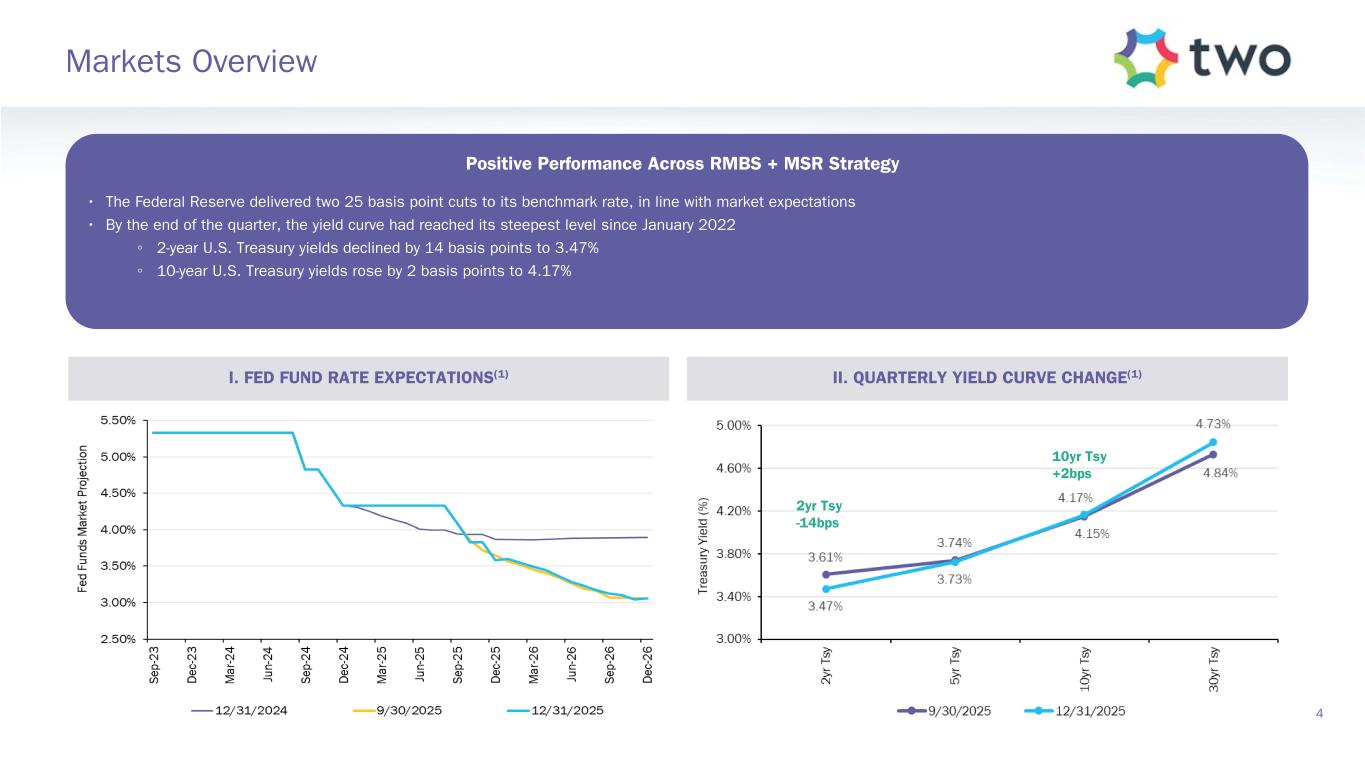

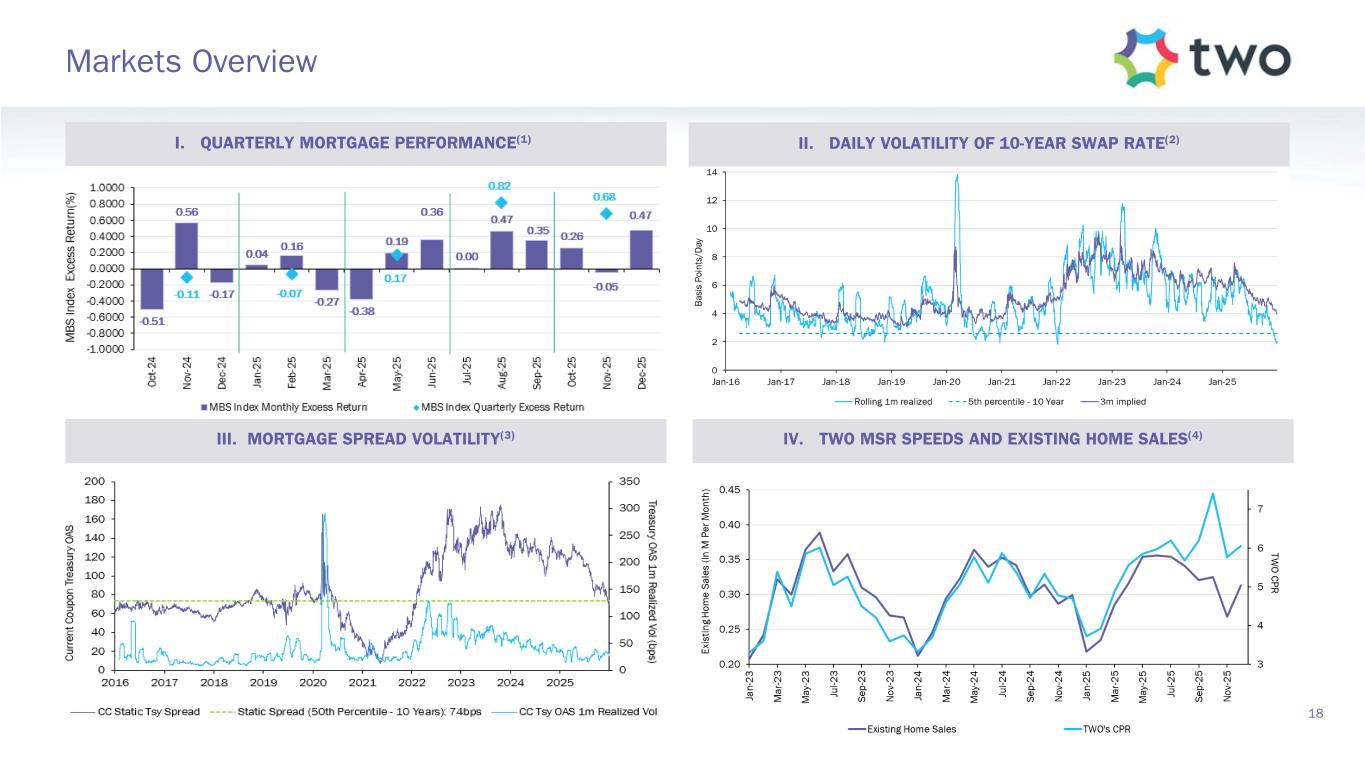

4 Markets Overview Positive Performance Across RMBS + MSR Strategy • The Federal Reserve delivered two 25 basis point cuts to its benchmark rate, in line with market expectations • By the end of the quarter, the yield curve had reached its steepest level since January 2022 ◦ 2-year U.S. Treasury yields declined by 14 basis points to 3.47% ◦ 10-year U.S. Treasury yields rose by 2 basis points to 4.17% I. FED FUND RATE EXPECTATIONS(1) II. QUARTERLY YIELD CURVE CHANGE(1) 2yr Tsy -14bps 10yr Tsy +2bps

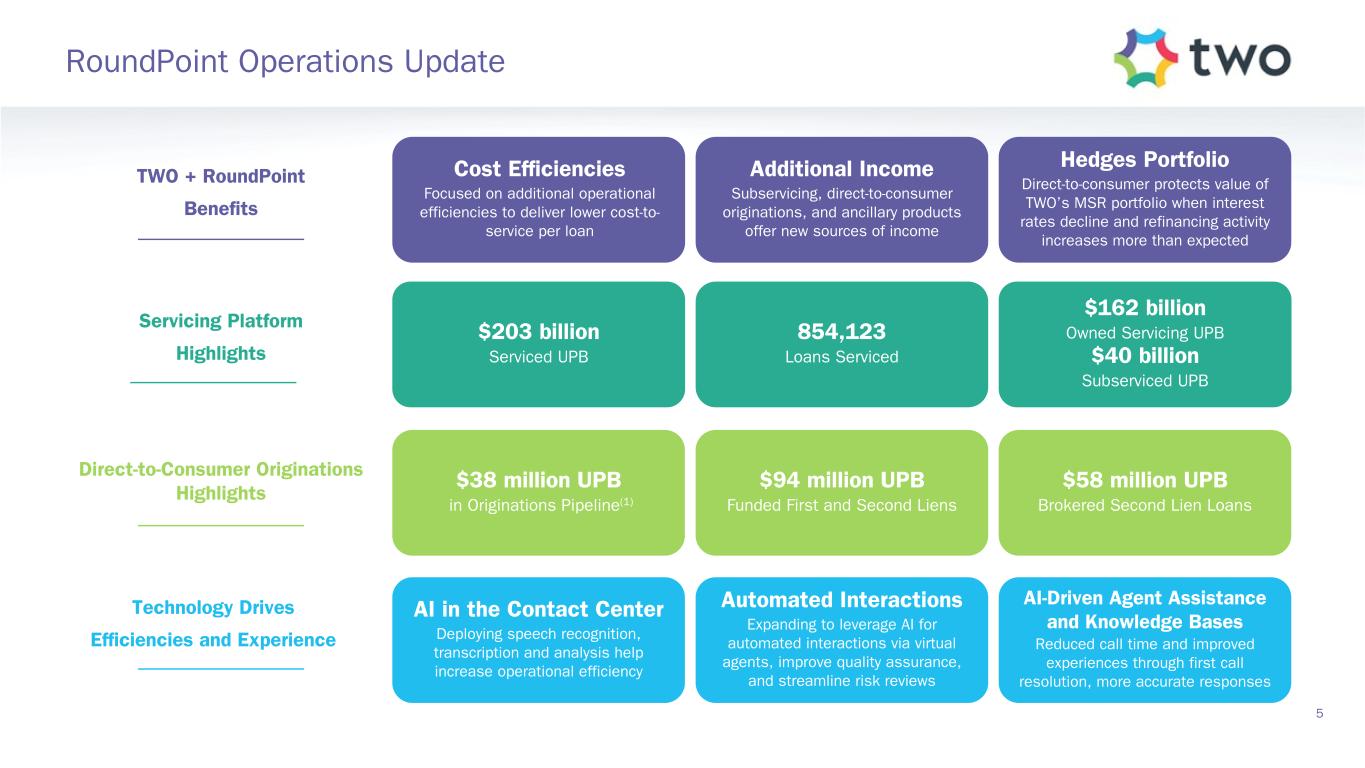

$38 million UPB in Originations Pipeline(1) $203 billion Serviced UPB 854,123 Loans Serviced Hedges Portfolio Direct-to-consumer protects value of TWO’s MSR portfolio when interest rates decline and refinancing activity increases more than expected Cost Efficiencies Focused on additional operational efficiencies to deliver lower cost-to- service per loan Additional Income Subservicing, direct-to-consumer originations, and ancillary products offer new sources of income RoundPoint Operations Update 5 $94 million UPB Funded First and Second Liens Direct-to-Consumer Originations Highlights Servicing Platform Highlights TWO + RoundPoint Benefits $58 million UPB Brokered Second Lien Loans $162 billion Owned Servicing UPB $40 billion Subserviced UPB Technology Drives Efficiencies and Experience AI in the Contact Center Deploying speech recognition, transcription and analysis help increase operational efficiency Automated Interactions Expanding to leverage AI for automated interactions via virtual agents, improve quality assurance, and streamline risk reviews AI-Driven Agent Assistance and Knowledge Bases Reduced call time and improved experiences through first call resolution, more accurate responses

$1,149.9 $11.7 $51.7 $(13.0) $(35.9) $1.7 $1,166.1 September 30, 2025 Common Stockholders’ Equity GAAP Net Income Other Comprehensive Income Preferred Stock Dividends Common Stock Dividends Other December 31, 2025 Common Stockholders’ Equity ($ in millions, except per share data) $11.04 per common share $11.13 per common share Represents Comprehensive Income of $50.4 million, or $0.48 per common share Declared common stock dividend of $0.34 per share Increase Decrease Total Book Value Summary 6 3.9% quarterly economic return on book value(1)

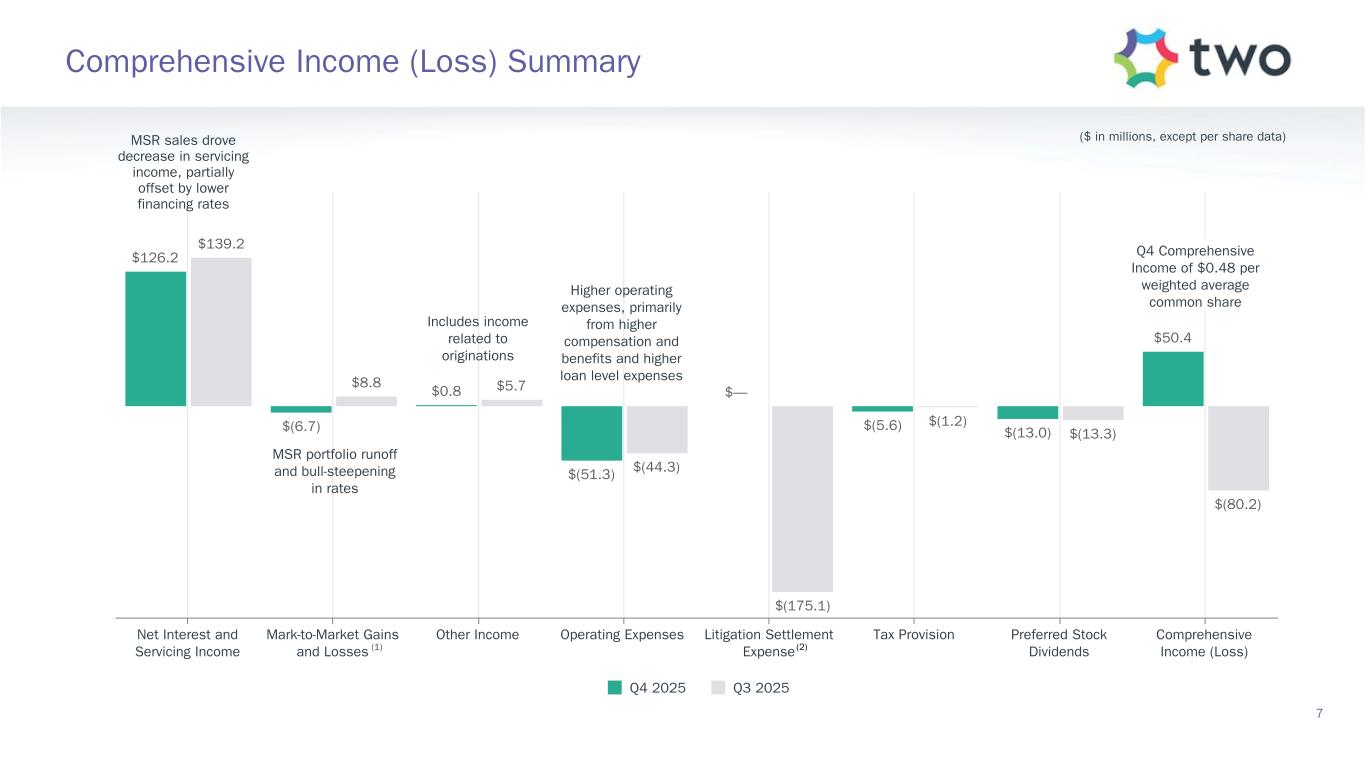

$126.2 $(6.7) $0.8 $(51.3) $— $(5.6) $(13.0) $50.4 $139.2 $8.8 $5.7 $(44.3) $(175.1) $(1.2) $(13.3) $(80.2) Q4 2025 Q3 2025 Net Interest and Servicing Income Mark-to-Market Gains and Losses Other Income Operating Expenses Litigation Settlement Expense Tax Provision Preferred Stock Dividends Comprehensive Income (Loss) Comprehensive Income (Loss) Summary 7 ($ in millions, except per share data) Q4 Comprehensive Income of $0.48 per weighted average common share Higher operating expenses, primarily from higher compensation and benefits and higher loan level expenses Includes income related to originations MSR portfolio runoff and bull-steepening in rates MSR sales drove decrease in servicing income, partially offset by lower financing rates (1) (2)

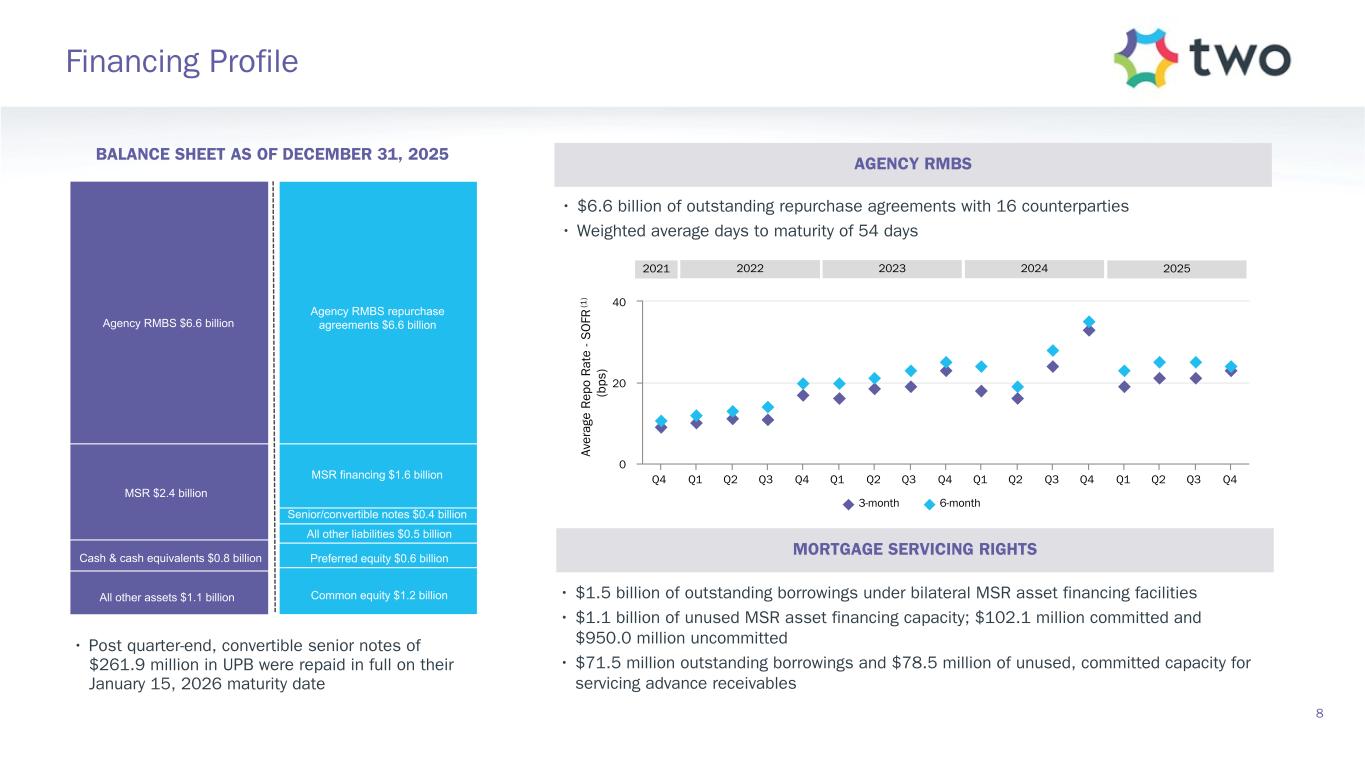

• $1.5 billion of outstanding borrowings under bilateral MSR asset financing facilities • $1.1 billion of unused MSR asset financing capacity; $102.1 million committed and $950.0 million uncommitted • $71.5 million outstanding borrowings and $78.5 million of unused, committed capacity for servicing advance receivables BALANCE SHEET AS OF DECEMBER 31, 2025 • $6.6 billion of outstanding repurchase agreements with 16 counterparties • Weighted average days to maturity of 54 days Av er ag e R ep o R at e - S O FR (b ps ) 3-month 6-month Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 0 20 40(1 ) Agency RMBS $6.6 billion MSR $2.4 billion Cash & cash equivalents $0.8 billion All other assets $1.1 billion Agency RMBS repurchase agreements $6.6 billion MSR financing $1.6 billion All other liabilities $0.5 billion Preferred equity $0.6 billion Common equity $1.2 billion Senior/convertible notes $0.4 billion 2021 2022 2023 2024 Financing Profile 8 AGENCY RMBS MORTGAGE SERVICING RIGHTS 2025 • Post quarter-end, convertible senior notes of $261.9 million in UPB were repaid in full on their January 15, 2026 maturity date

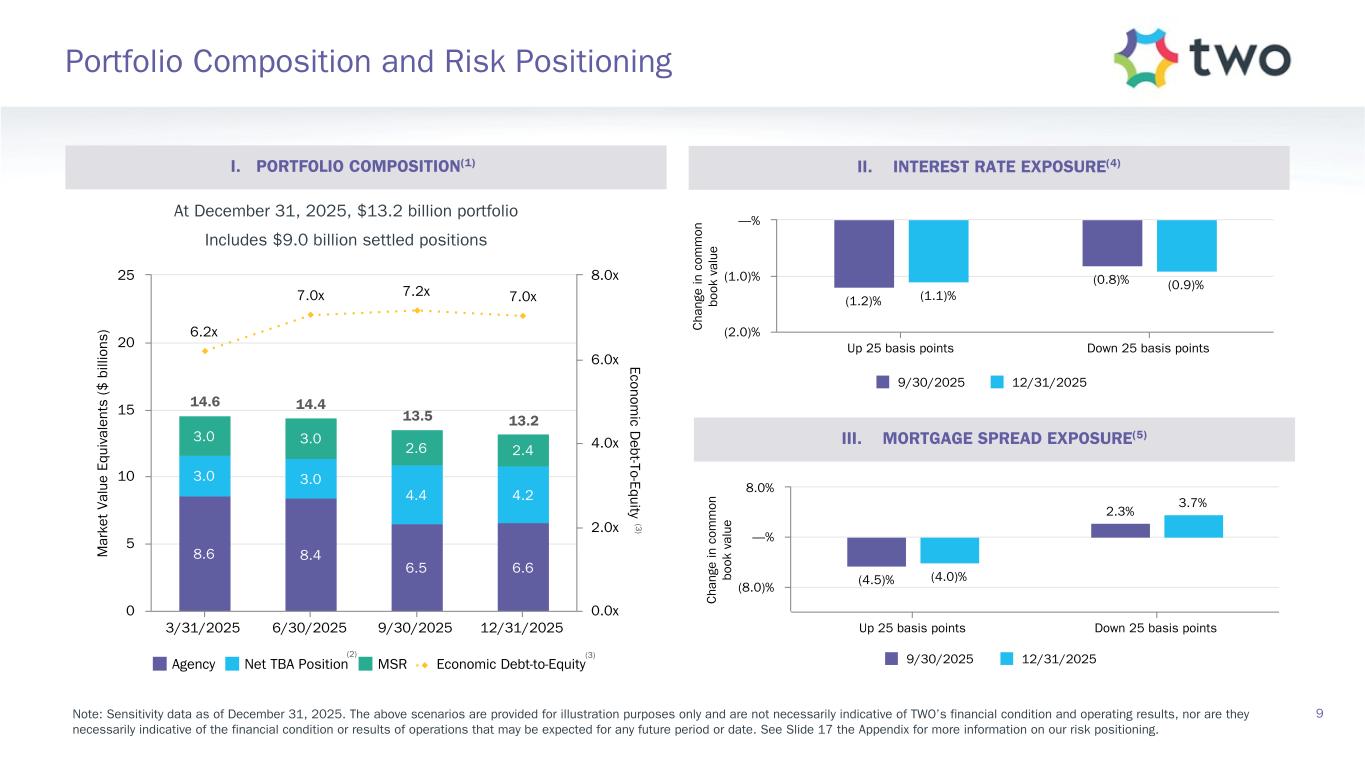

At December 31, 2025, $13.2 billion portfolio Includes $9.0 billion settled positions M ar ke t Va lu e Eq ui va le nt s ($ b ill io ns ) Econom ic D ebt-To-Equity 8.6 8.4 6.5 6.6 3.0 3.0 4.4 4.2 3.0 3.0 2.6 2.4 6.2x 7.0x 7.2x 7.0x Agency Net TBA Position MSR Economic Debt-to-Equity 3/31/2025 6/30/2025 9/30/2025 12/31/2025 0 5 10 15 20 25 0.0x 2.0x 4.0x 6.0x 8.0x (3) (3 ) (2) 13.213.5 14.6 14.4 Note: Sensitivity data as of December 31, 2025. The above scenarios are provided for illustration purposes only and are not necessarily indicative of TWO’s financial condition and operating results, nor are they necessarily indicative of the financial condition or results of operations that may be expected for any future period or date. See Slide 17 the Appendix for more information on our risk positioning. C ha ng e in c om m on bo ok v al ue (1.2)% (0.8)% (1.1)% (0.9)% 9/30/2025 12/31/2025 Up 25 basis points Down 25 basis points (2.0)% (1.0)% —% C ha ng e in c om m on bo ok v al ue (4.5)% 2.3% (4.0)% 3.7% 9/30/2025 12/31/2025 Up 25 basis points Down 25 basis points (8.0)% —% 8.0% 9 Portfolio Composition and Risk Positioning I. PORTFOLIO COMPOSITION(1) II. INTEREST RATE EXPOSURE(4) III. MORTGAGE SPREAD EXPOSURE(5)

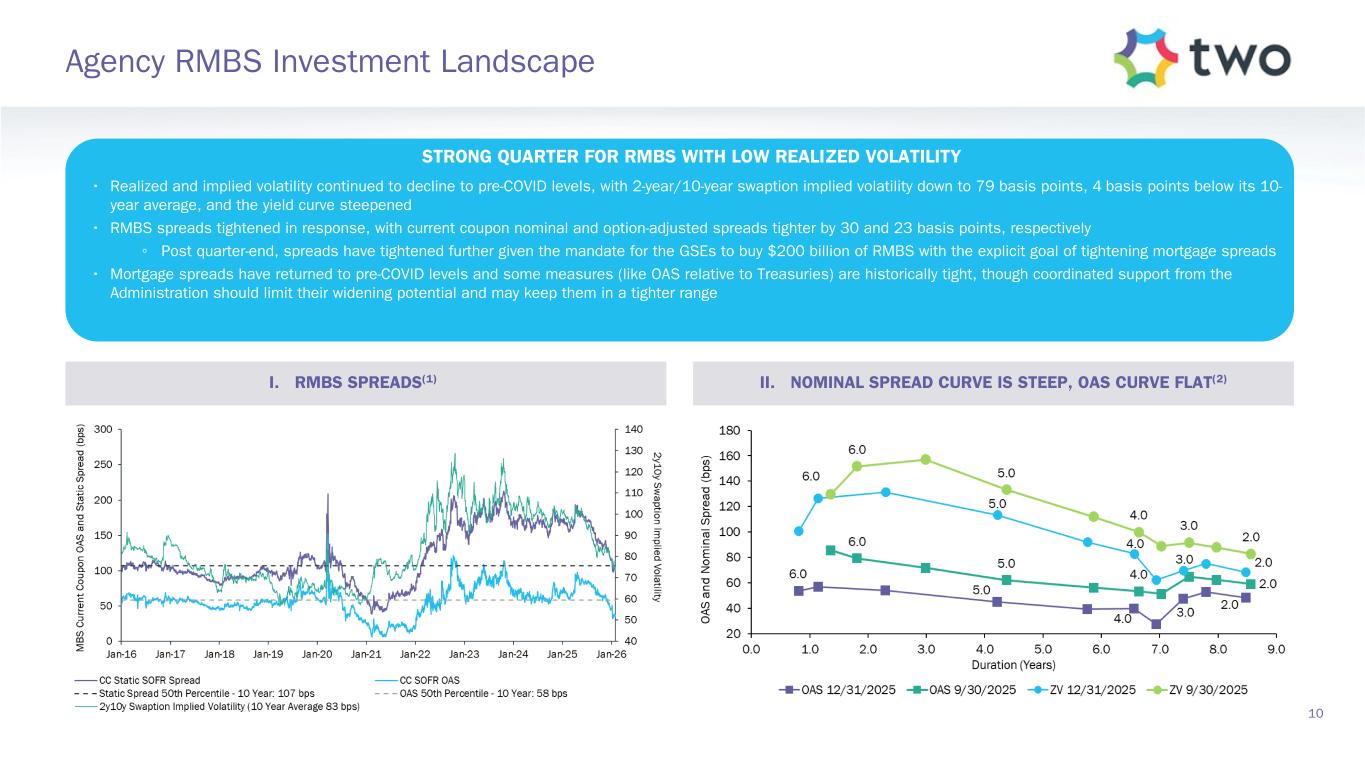

10 Agency RMBS Investment Landscape STRONG QUARTER FOR RMBS WITH LOW REALIZED VOLATILITY • Realized and implied volatility continued to decline to pre-COVID levels, with 2-year/10-year swaption implied volatility down to 79 basis points, 4 basis points below its 10- year average, and the yield curve steepened • RMBS spreads tightened in response, with current coupon nominal and option-adjusted spreads tighter by 30 and 23 basis points, respectively ◦ Post quarter-end, spreads have tightened further given the mandate for the GSEs to buy $200 billion of RMBS with the explicit goal of tightening mortgage spreads • Mortgage spreads have returned to pre-COVID levels and some measures (like OAS relative to Treasuries) are historically tight, though coordinated support from the Administration should limit their widening potential and may keep them in a tighter range I. RMBS SPREADS(1) II. NOMINAL SPREAD CURVE IS STEEP, OAS CURVE FLAT(2)

Coupon Ti ck s (3 2 nd s) TBAs TWO Specified Pools 3.0 3.5 4.0 4.5 5.0 5.5 6 6.5 0 10 20 30 40 50 60 70 TWO Specified Pools (Q4-2025)TBAs (Q4-2025)(5) TBAs (Q3-2025)(5) TWO Specified Pools (Q3-2025) Market Value(4) ($ billions) $— $— $— $1.07 $1.44 $0.80 $1.79 $0.54 11 Agency RMBS Portfolio I. RMBS QUARTERLY PERFORMANCE II. SPECIFIED POOL PREPAYMENT SPEEDS(1) (2) (3) QUARTERLY HIGHLIGHTS • Hedged performance for Agency RMBS across the stack was positive in the fourth quarter • For the coupons that TWO owned, specified pools outperformed TBAs led by 4.5s and 5.0s, where we have our largest pool exposure • Agency RMBS pass-through position was largely stable quarter over quarter, with over 90% of pool holdings in prepayment protected securities • Higher coupon speeds increased reflecting the drop in mortgage rates in the third quarter to around 6.25%, where they stabilized in the fourth quarter • Weighted average specified pool portfolio prepayment speeds increased to 8.6%, compared to 8.3% in the third quarter(1)

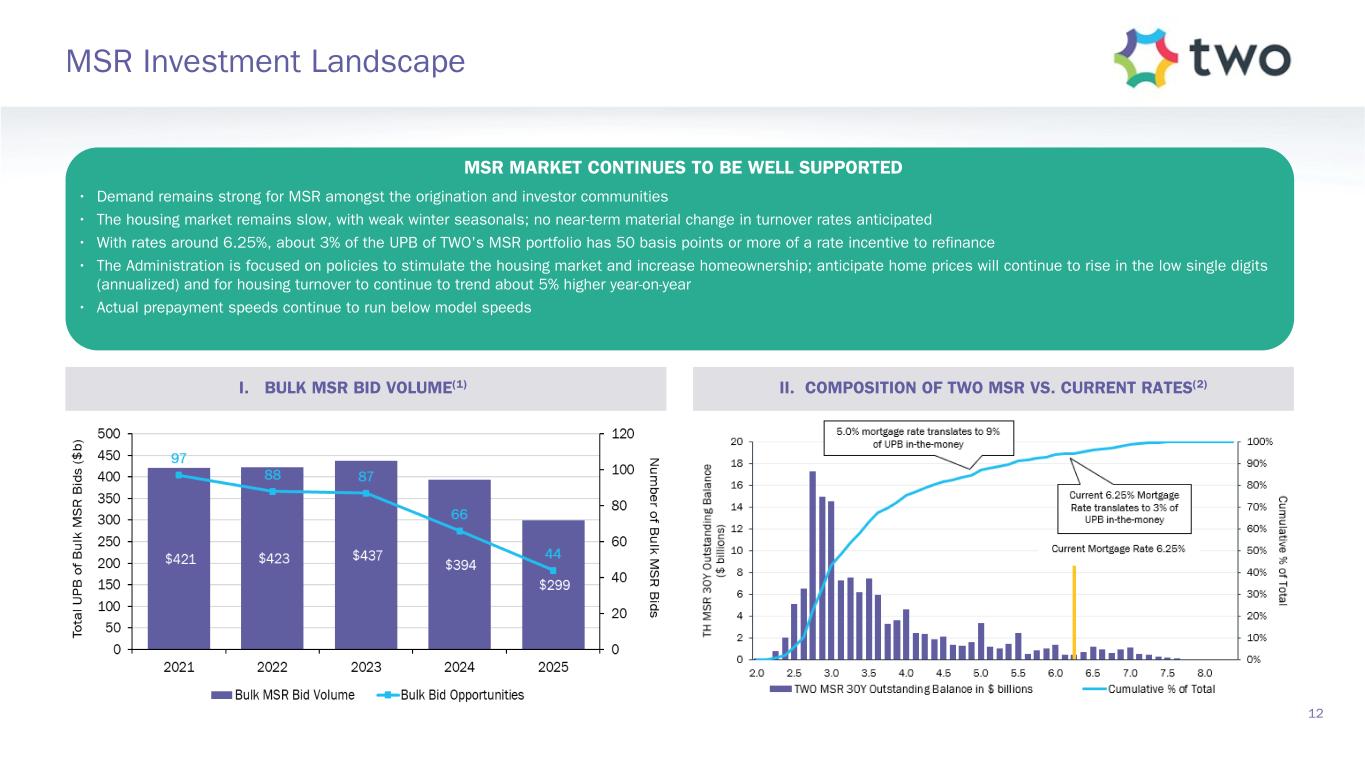

12 MSR Investment Landscape MSR MARKET CONTINUES TO BE WELL SUPPORTED • Demand remains strong for MSR amongst the origination and investor communities • The housing market remains slow, with weak winter seasonals; no near-term material change in turnover rates anticipated • With rates around 6.25%, about 3% of the UPB of TWO's MSR portfolio has 50 basis points or more of a rate incentive to refinance • The Administration is focused on policies to stimulate the housing market and increase homeownership; anticipate home prices will continue to rise in the low single digits (annualized) and for housing turnover to continue to trend about 5% higher year-on-year • Actual prepayment speeds continue to run below model speeds I. BULK MSR BID VOLUME(1) II. COMPOSITION OF TWO MSR VS. CURRENT RATES(2)

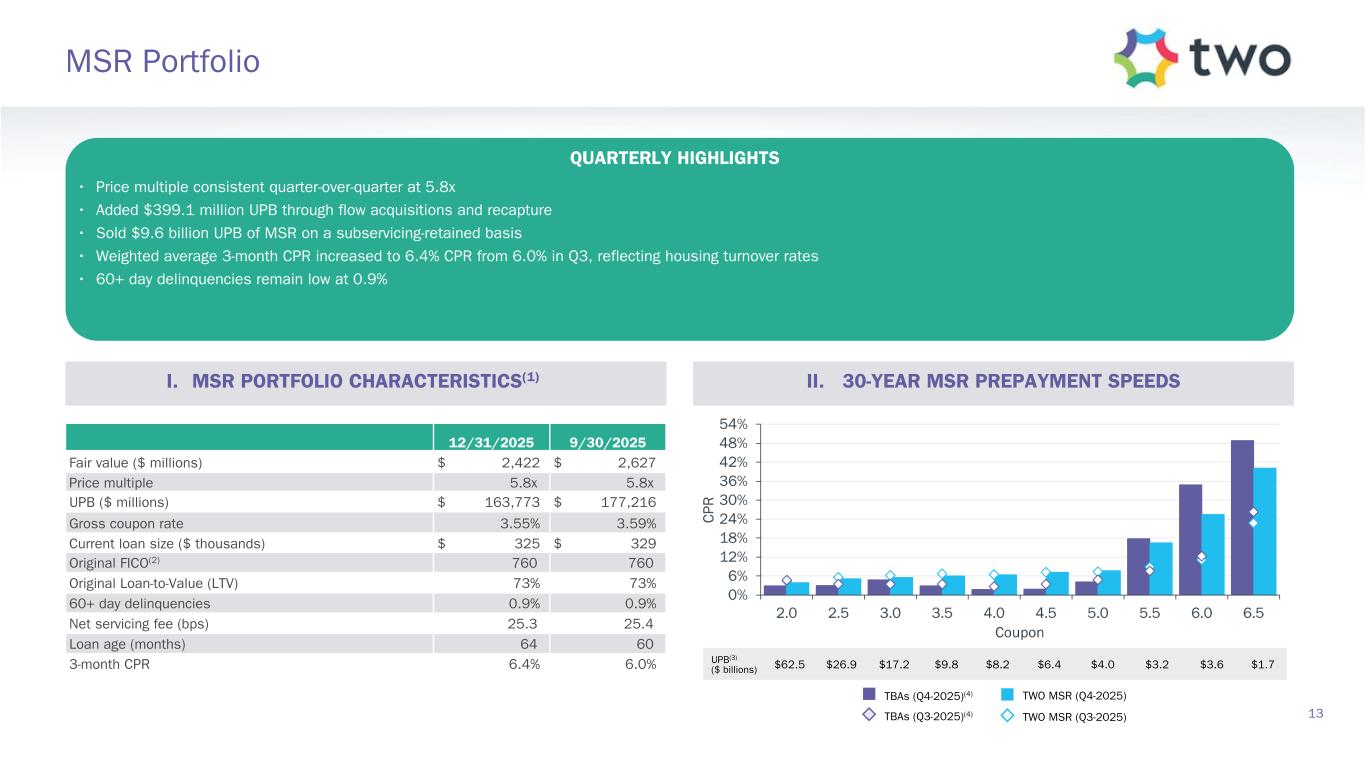

UPB(3) ($ billions) $62.5 $26.9 $17.2 $9.8 $8.2 $6.4 $4.0 $3.2 $3.6 $1.7 QUARTERLY HIGHLIGHTS • Price multiple consistent quarter-over-quarter at 5.8x • Added $399.1 million UPB through flow acquisitions and recapture • Sold $9.6 billion UPB of MSR on a subservicing-retained basis • Weighted average 3-month CPR increased to 6.4% CPR from 6.0% in Q3, reflecting housing turnover rates • 60+ day delinquencies remain low at 0.9% 12/31/2025 9/30/2025 Fair value ($ millions) $ 2,422 $ 2,627 Price multiple 5.8x 5.8x UPB ($ millions) $ 163,773 $ 177,216 Gross coupon rate 3.55 % 3.59 % Current loan size ($ thousands) $ 325 $ 329 Original FICO(2) 760 760 Original Loan-to-Value (LTV) 73 % 73 % 60+ day delinquencies 0.9 % 0.9 % Net servicing fee (bps) 25.3 25.4 Loan age (months) 64 60 3-month CPR 6.4 % 6.0 % TWO MSR (Q4-2025)TBAs (Q4-2025)(4) TBAs (Q3-2025)(4) TWO MSR (Q3-2025) 13 MSR Portfolio I. MSR PORTFOLIO CHARACTERISTICS(1) II. 30-YEAR MSR PREPAYMENT SPEEDS

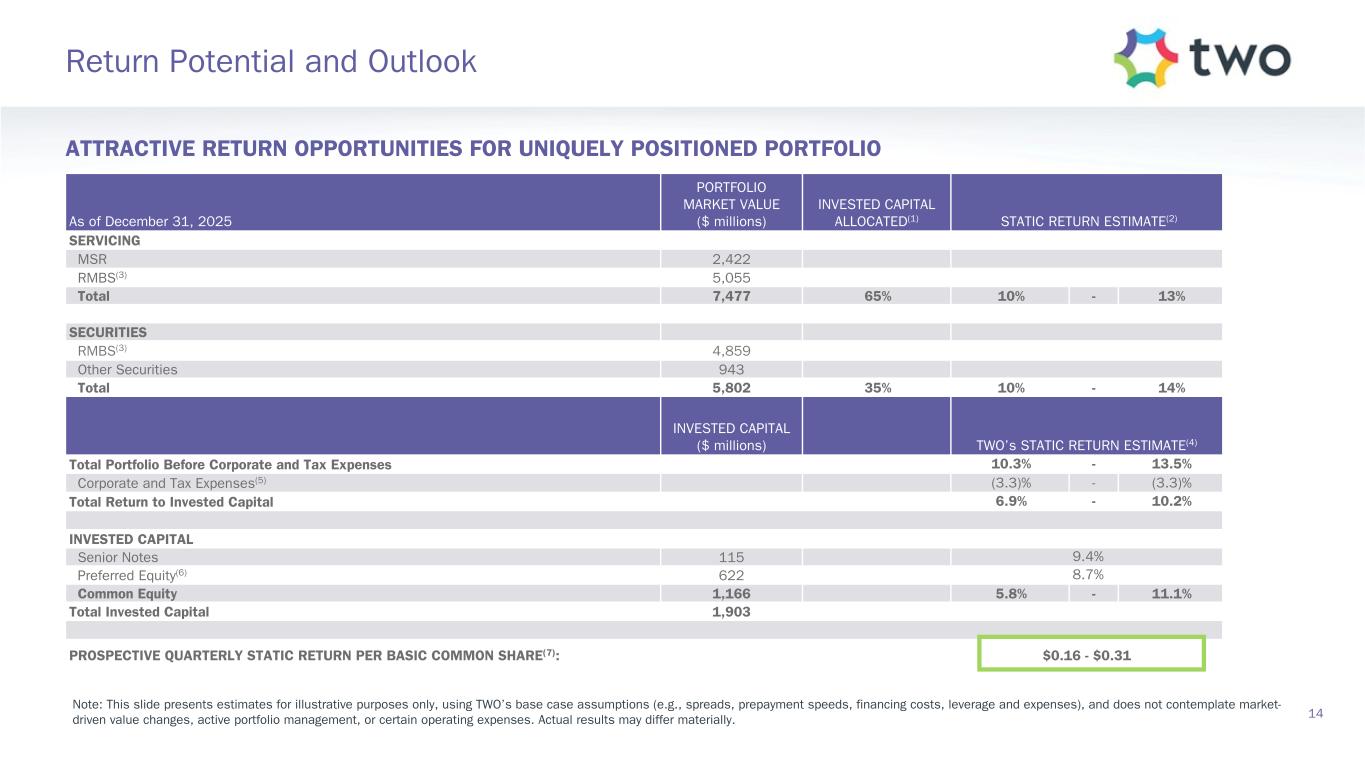

14 Return Potential and Outlook ATTRACTIVE RETURN OPPORTUNITIES FOR UNIQUELY POSITIONED PORTFOLIO As of December 31, 2025 PORTFOLIO MARKET VALUE ($ millions) INVESTED CAPITAL ALLOCATED(1) STATIC RETURN ESTIMATE(2) SERVICING MSR 2,422 RMBS(3) 5,055 Total 7,477 65% 10% - 13% SECURITIES RMBS(3) 4,859 Other Securities 943 Total 5,802 35% 10% - 14% INVESTED CAPITAL ($ millions) TWO’s STATIC RETURN ESTIMATE(4) Total Portfolio Before Corporate and Tax Expenses 10.3% - 13.5% Corporate and Tax Expenses(5) (3.3)% - (3.3)% Total Return to Invested Capital 6.9% - 10.2% INVESTED CAPITAL Senior Notes 115 9.4% Preferred Equity(6) 622 8.7% Common Equity 1,166 5.8% - 11.1% Total Invested Capital 1,903 PROSPECTIVE QUARTERLY STATIC RETURN PER BASIC COMMON SHARE(7): $0.16 - $0.31 Note: This slide presents estimates for illustrative purposes only, using TWO’s base case assumptions (e.g., spreads, prepayment speeds, financing costs, leverage and expenses), and does not contemplate market- driven value changes, active portfolio management, or certain operating expenses. Actual results may differ materially.

Appendix

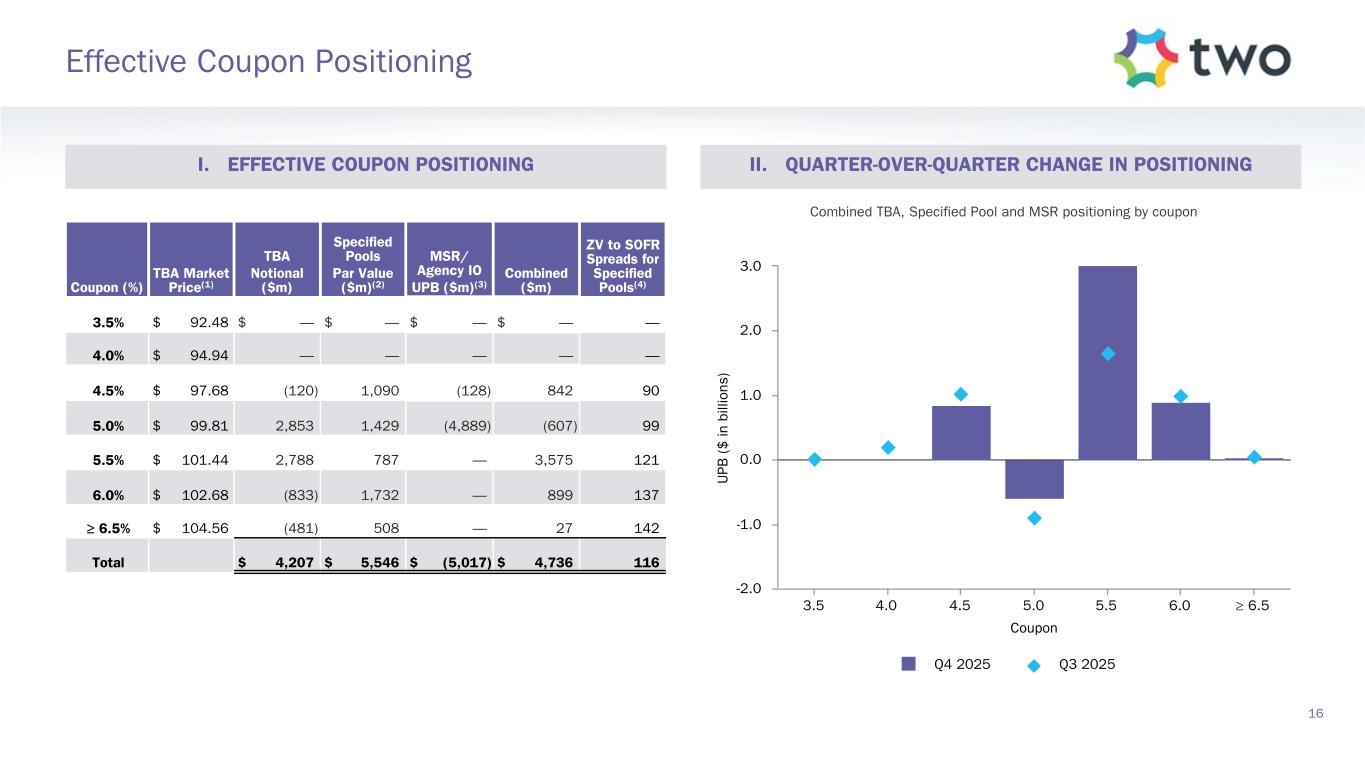

Coupon (%) TBA Market Price(1) TBA Notional ($m) Specified Pools Par Value ($m)(2) MSR/ Agency IO UPB ($m)(3) Combined ($m) ZV to SOFR Spreads for Specified Pools(4) 3.5% $ 92.48 $ — $ — $ — $ — — 4.0% $ 94.94 — — — — — 4.5% $ 97.68 (120) 1,090 (128) 842 90 5.0% $ 99.81 2,853 1,429 (4,889) (607) 99 5.5% $ 101.44 2,788 787 — 3,575 121 6.0% $ 102.68 (833) 1,732 — 899 137 ≥ 6.5% $ 104.56 (481) 508 — 27 142 Total $ 4,207 $ 5,546 $ (5,017) $ 4,736 116 16 Effective Coupon Positioning Coupon U PB ( $ in b ill io ns ) Q4 2025 Q3 2025 3.5 4.0 4.5 5.0 5.5 6.0 ≥ 6.5 -2.0 -1.0 0.0 1.0 2.0 3.0 II. QUARTER-OVER-QUARTER CHANGE IN POSITIONINGI. EFFECTIVE COUPON POSITIONING Combined TBA, Specified Pool and MSR positioning by coupon

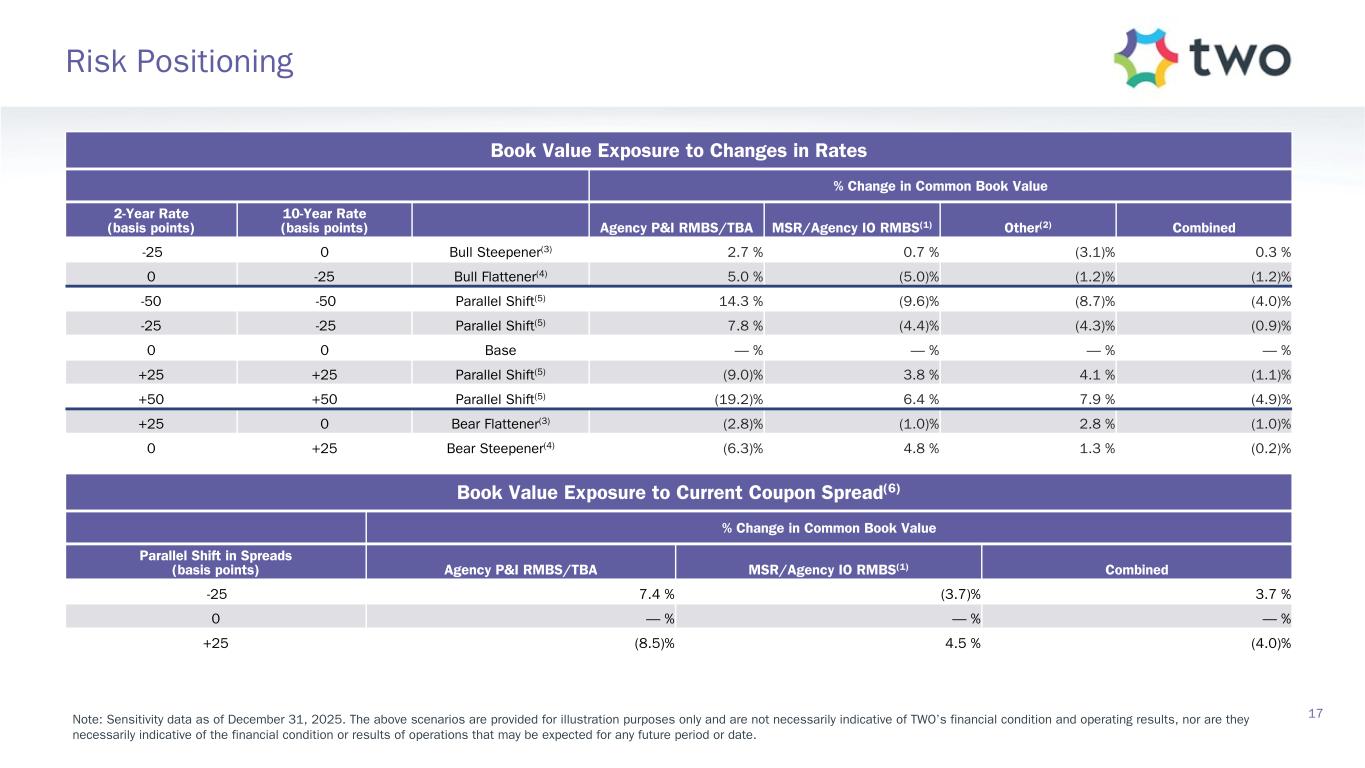

Note: Sensitivity data as of December 31, 2025. The above scenarios are provided for illustration purposes only and are not necessarily indicative of TWO’s financial condition and operating results, nor are they necessarily indicative of the financial condition or results of operations that may be expected for any future period or date. Book Value Exposure to Changes in Rates % Change in Common Book Value 2-Year Rate (basis points) 10-Year Rate (basis points) Agency P&I RMBS/TBA MSR/Agency IO RMBS(1) Other(2) Combined -25 0 Bull Steepener(3) 2.7 % 0.7 % (3.1) % 0.3 % 0 -25 Bull Flattener(4) 5.0 % (5.0) % (1.2) % (1.2) % -50 -50 Parallel Shift(5) 14.3 % (9.6) % (8.7) % (4.0) % -25 -25 Parallel Shift(5) 7.8 % (4.4) % (4.3) % (0.9) % 0 0 Base — % — % — % — % +25 +25 Parallel Shift(5) (9.0) % 3.8 % 4.1 % (1.1) % +50 +50 Parallel Shift(5) (19.2) % 6.4 % 7.9 % (4.9) % +25 0 Bear Flattener(3) (2.8) % (1.0) % 2.8 % (1.0) % 0 +25 Bear Steepener(4) (6.3) % 4.8 % 1.3 % (0.2) % Book Value Exposure to Current Coupon Spread(6) % Change in Common Book Value Parallel Shift in Spreads (basis points) Agency P&I RMBS/TBA MSR/Agency IO RMBS(1) Combined -25 7.4 % (3.7) % 3.7 % 0 — % — % — % +25 (8.5) % 4.5 % (4.0) % 17 Risk Positioning

18 Markets Overview I. QUARTERLY MORTGAGE PERFORMANCE(1) II. DAILY VOLATILITY OF 10-YEAR SWAP RATE(2) III. MORTGAGE SPREAD VOLATILITY(3) IV. TWO MSR SPEEDS AND EXISTING HOME SALES(4)

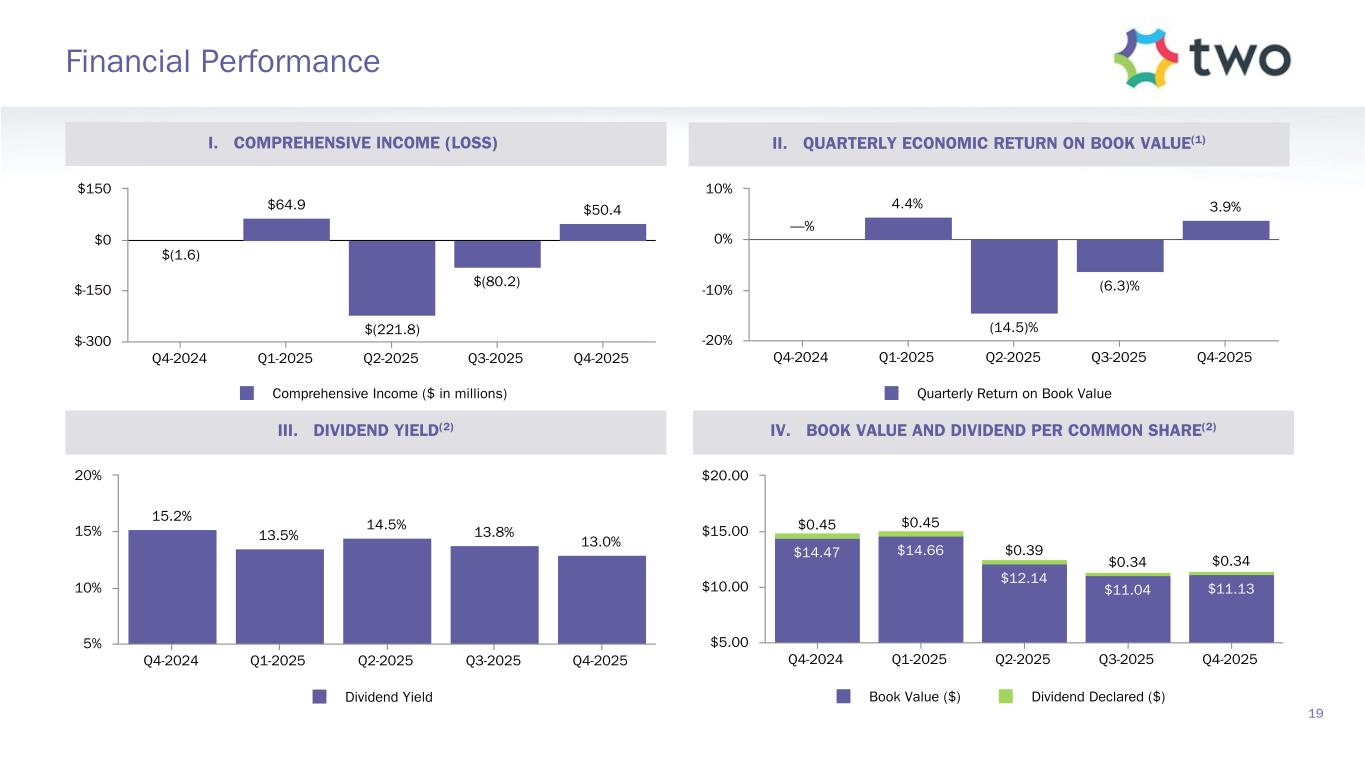

$(1.6) $64.9 $(221.8) $(80.2) $50.4 Comprehensive Income ($ in millions) Q4-2024 Q1-2025 Q2-2025 Q3-2025 Q4-2025 $-300 $-150 $0 $150 $14.47 $14.66 $12.14 $11.04 $11.13 $0.45 $0.45 $0.39 $0.34 $0.34 Book Value ($) Dividend Declared ($) Q4-2024 Q1-2025 Q2-2025 Q3-2025 Q4-2025 $5.00 $10.00 $15.00 $20.00 —% 4.4% (14.5)% (6.3)% 3.9% Quarterly Return on Book Value Q4-2024 Q1-2025 Q2-2025 Q3-2025 Q4-2025 -20% -10% 0% 10% 15.2% 13.5% 14.5% 13.8% 13.0% Dividend Yield Q4-2024 Q1-2025 Q2-2025 Q3-2025 Q4-2025 5% 10% 15% 20% 19 Financial Performance I. COMPREHENSIVE INCOME (LOSS) II. QUARTERLY ECONOMIC RETURN ON BOOK VALUE(1) III. DIVIDEND YIELD(2) IV. BOOK VALUE AND DIVIDEND PER COMMON SHARE(2)

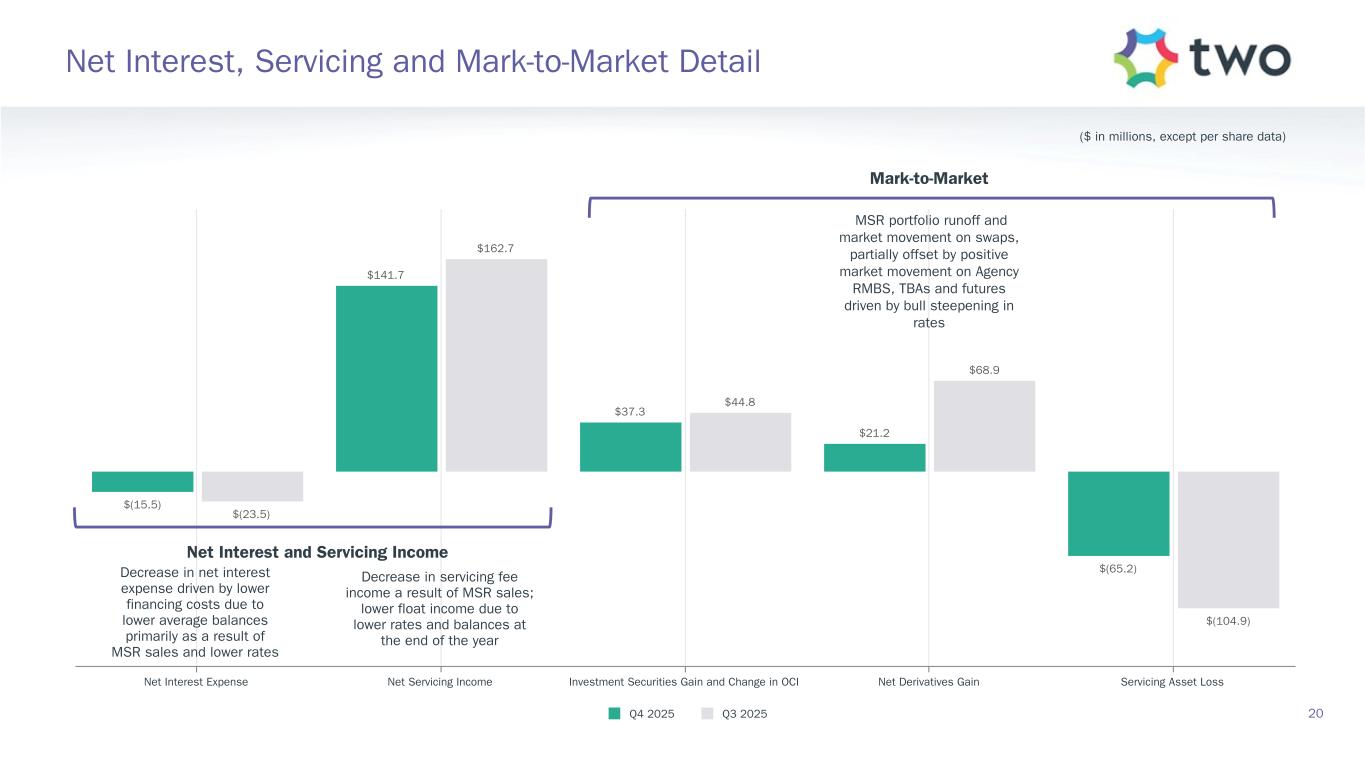

$(15.5) $141.7 $37.3 $21.2 $(65.2) $(23.5) $162.7 $44.8 $68.9 $(104.9) Q4 2025 Q3 2025 Net Interest Expense Net Servicing Income Investment Securities Gain and Change in OCI Net Derivatives Gain Servicing Asset Loss Net Interest and Servicing Income Net Interest, Servicing and Mark-to-Market Detail 20 ($ in millions, except per share data) Mark-to-Market Decrease in net interest expense driven by lower financing costs due to lower average balances primarily as a result of MSR sales and lower rates MSR portfolio runoff and market movement on swaps, partially offset by positive market movement on Agency RMBS, TBAs and futures driven by bull steepening in rates Decrease in servicing fee income a result of MSR sales; lower float income due to lower rates and balances at the end of the year

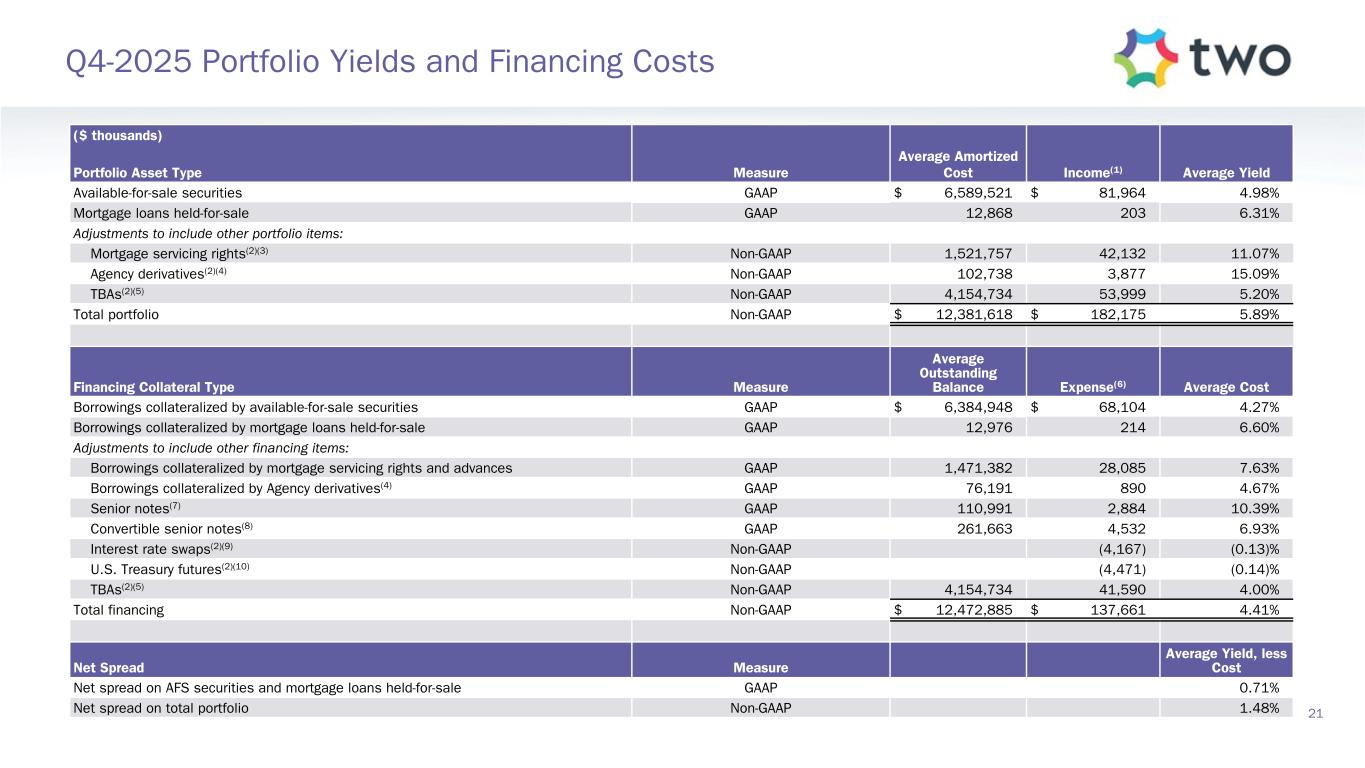

($ thousands) Portfolio Asset Type Measure Average Amortized Cost Income(1) Average Yield Available-for-sale securities GAAP $ 6,589,521 $ 81,964 4.98% Mortgage loans held-for-sale GAAP 12,868 203 6.31% Adjustments to include other portfolio items: Mortgage servicing rights(2)(3) Non-GAAP 1,521,757 42,132 11.07% Agency derivatives(2)(4) Non-GAAP 102,738 3,877 15.09 % TBAs(2)(5) Non-GAAP 4,154,734 53,999 5.20 % Total portfolio Non-GAAP $ 12,381,618 $ 182,175 5.89% Financing Collateral Type Measure Average Outstanding Balance Expense(6) Average Cost Borrowings collateralized by available-for-sale securities GAAP $ 6,384,948 $ 68,104 4.27% Borrowings collateralized by mortgage loans held-for-sale GAAP 12,976 214 6.60 % Adjustments to include other financing items: Borrowings collateralized by mortgage servicing rights and advances GAAP 1,471,382 28,085 7.63 % Borrowings collateralized by Agency derivatives(4) GAAP 76,191 890 4.67 % Senior notes(7) GAAP 110,991 2,884 10.39 % Convertible senior notes(8) GAAP 261,663 4,532 6.93 % Interest rate swaps(2)(9) Non-GAAP (4,167) (0.13) % U.S. Treasury futures(2)(10) Non-GAAP (4,471) (0.14) % TBAs(2)(5) Non-GAAP 4,154,734 41,590 4.00 % Total financing Non-GAAP $ 12,472,885 $ 137,661 4.41 % Net Spread Measure Average Yield, less Cost Net spread on AFS securities and mortgage loans held-for-sale GAAP 0.71% Net spread on total portfolio Non-GAAP 1.48% 21 Q4-2025 Portfolio Yields and Financing Costs

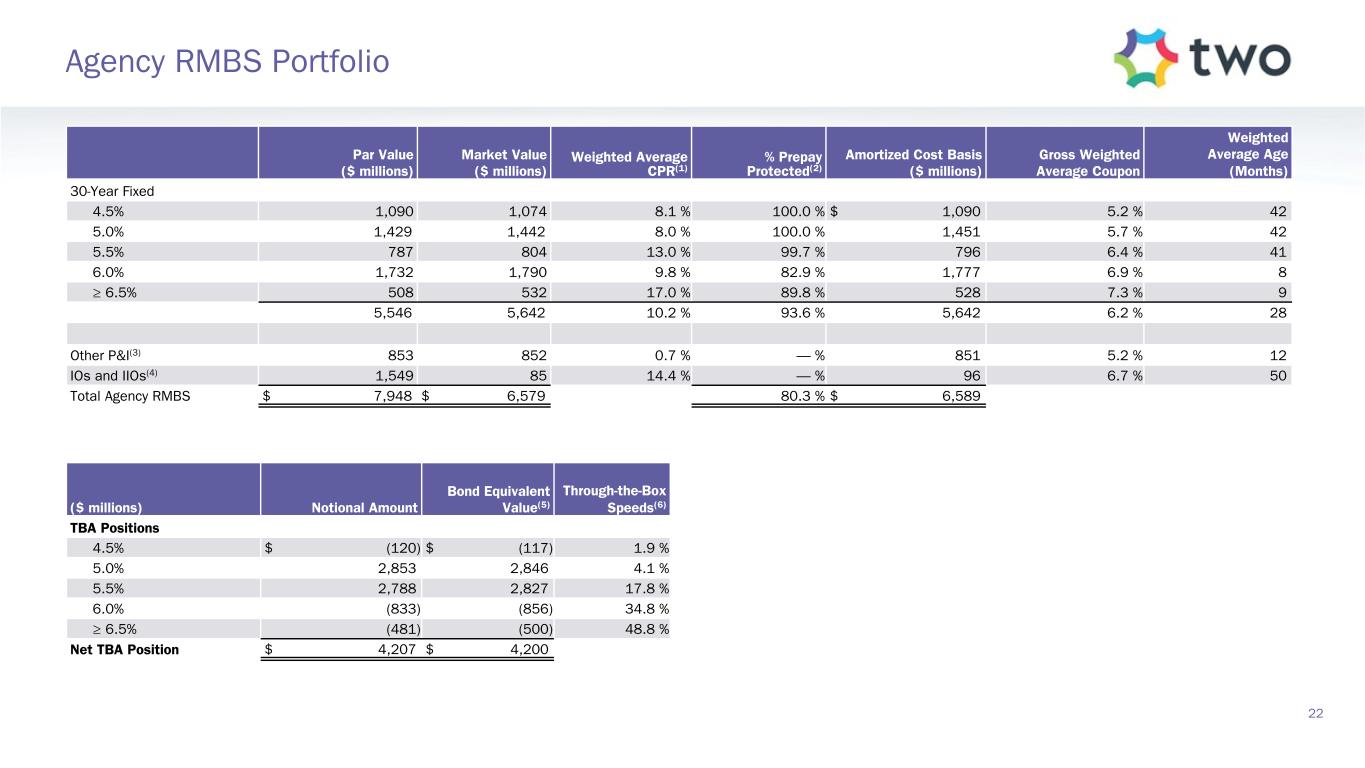

Par Value ($ millions) Market Value ($ millions) Weighted Average CPR(1) % Prepay Protected(2) Amortized Cost Basis ($ millions) Gross Weighted Average Coupon Weighted Average Age (Months) 30-Year Fixed 4.5% 1,090 1,074 8.1 % 100.0 % $ 1,090 5.2 % 42 5.0% 1,429 1,442 8.0 % 100.0 % 1,451 5.7 % 42 5.5% 787 804 13.0 % 99.7 % 796 6.4 % 41 6.0% 1,732 1,790 9.8 % 82.9 % 1,777 6.9 % 8 ≥ 6.5% 508 532 17.0 % 89.8 % 528 7.3 % 9 5,546 5,642 10.2 % 93.6 % 5,642 6.2 % 28 Other P&I(3) 853 852 0.7 % — % 851 5.2 % 12 IOs and IIOs(4) 1,549 85 14.4 % — % 96 6.7 % 50 Total Agency RMBS $ 7,948 $ 6,579 80.3 % $ 6,589 ($ millions) Notional Amount Bond Equivalent Value(5) Through-the-Box Speeds(6) TBA Positions 4.5% $ (120) $ (117) 1.9 % 5.0% 2,853 2,846 4.1 % 5.5% 2,788 2,827 17.8 % 6.0% (833) (856) 34.8 % ≥ 6.5% (481) (500) 48.8 % Net TBA Position $ 4,207 $ 4,200 22 Agency RMBS Portfolio

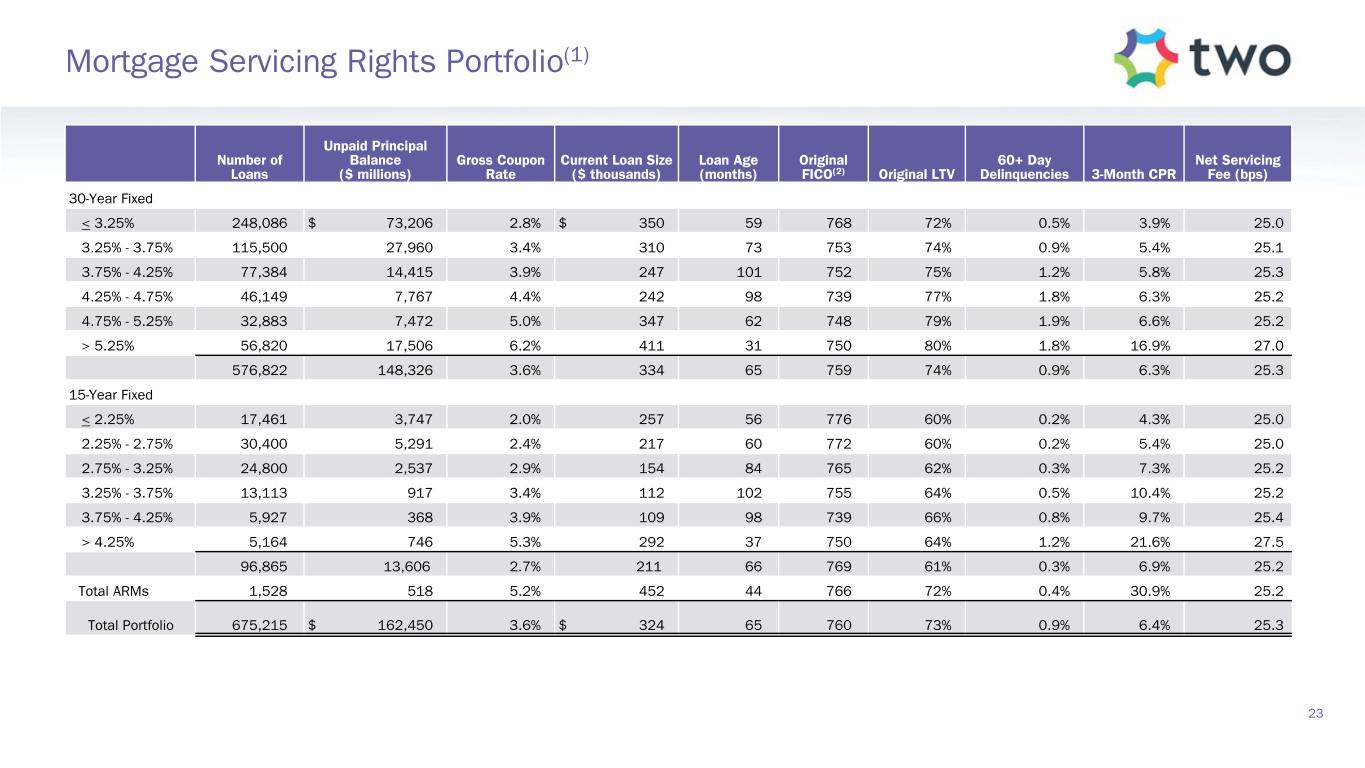

Number of Loans Unpaid Principal Balance ($ millions) Gross Coupon Rate Current Loan Size ($ thousands) Loan Age (months) Original FICO(2) Original LTV 60+ Day Delinquencies 3-Month CPR Net Servicing Fee (bps) 30-Year Fixed < 3.25% 248,086 $ 73,206 2.8% $ 350 59 768 72% 0.5% 3.9% 25.0 3.25% - 3.75% 115,500 27,960 3.4% 310 73 753 74% 0.9% 5.4% 25.1 3.75% - 4.25% 77,384 14,415 3.9 % 247 101 752 75 % 1.2 % 5.8 % 25.3 4.25% - 4.75% 46,149 7,767 4.4 % 242 98 739 77 % 1.8 % 6.3 % 25.2 4.75% - 5.25% 32,883 7,472 5.0 % 347 62 748 79 % 1.9 % 6.6 % 25.2 > 5.25% 56,820 17,506 6.2 % 411 31 750 80 % 1.8 % 16.9 % 27.0 576,822 148,326 3.6 % 334 65 759 74 % 0.9 % 6.3 % 25.3 15-Year Fixed < 2.25% 17,461 3,747 2.0 % 257 56 776 60 % 0.2 % 4.3 % 25.0 2.25% - 2.75% 30,400 5,291 2.4 % 217 60 772 60 % 0.2 % 5.4 % 25.0 2.75% - 3.25% 24,800 2,537 2.9 % 154 84 765 62 % 0.3 % 7.3 % 25.2 3.25% - 3.75% 13,113 917 3.4 % 112 102 755 64 % 0.5 % 10.4 % 25.2 3.75% - 4.25% 5,927 368 3.9 % 109 98 739 66 % 0.8 % 9.7 % 25.4 > 4.25% 5,164 746 5.3 % 292 37 750 64 % 1.2 % 21.6 % 27.5 96,865 13,606 2.7 % 211 66 769 61 % 0.3 % 6.9 % 25.2 Total ARMs 1,528 518 5.2 % 452 44 766 72 % 0.4 % 30.9 % 25.2 Total Portfolio 675,215 $ 162,450 3.6 % $ 324 65 760 73 % 0.9 % 6.4 % 25.3 23 Mortgage Servicing Rights Portfolio(1)

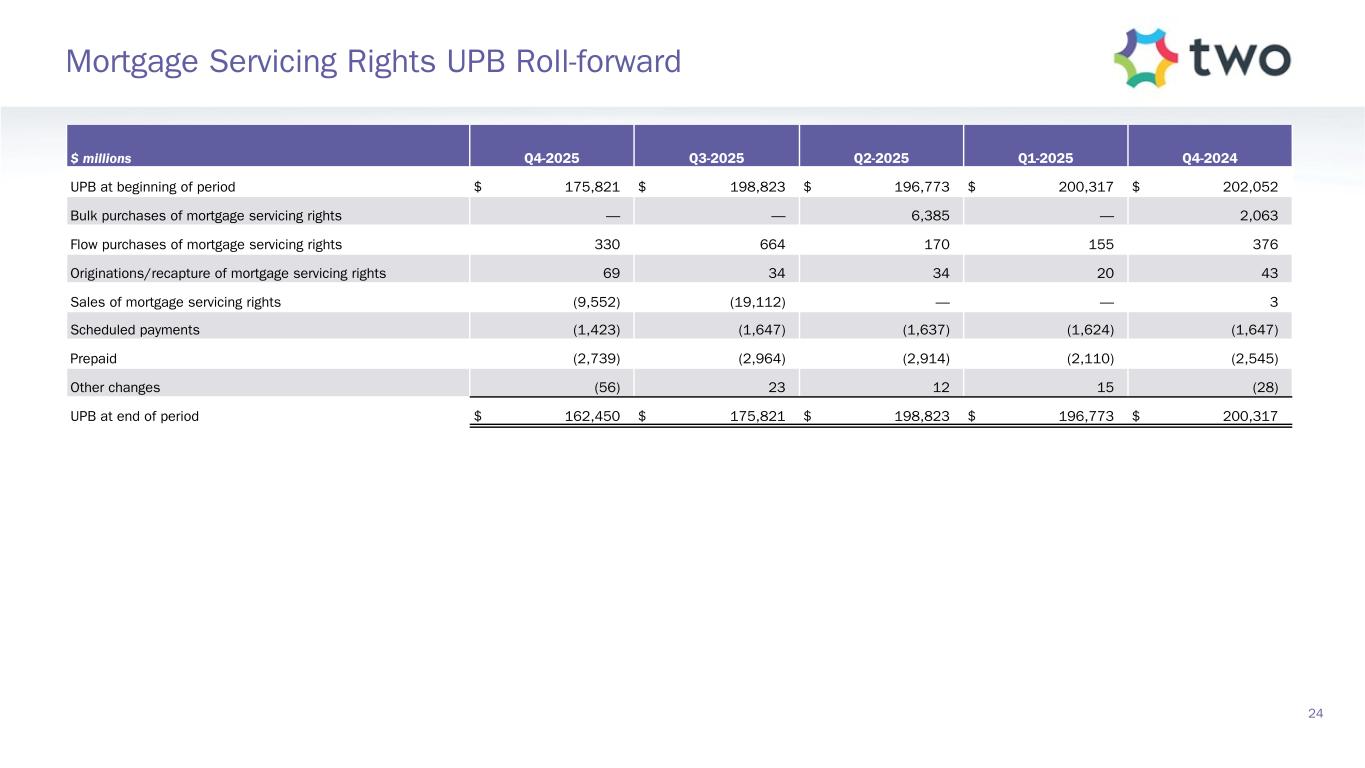

$ millions Q4-2025 Q3-2025 Q2-2025 Q1-2025 Q4-2024 UPB at beginning of period $ 175,821 $ 198,823 $ 196,773 $ 200,317 $ 202,052 Bulk purchases of mortgage servicing rights — — 6,385 — 2,063 Flow purchases of mortgage servicing rights 330 664 170 155 376 Originations/recapture of mortgage servicing rights 69 34 34 20 43 Sales of mortgage servicing rights (9,552) (19,112) — — 3 Scheduled payments (1,423) (1,647) (1,637) (1,624) (1,647) Prepaid (2,739) (2,964) (2,914) (2,110) (2,545) Other changes (56) 23 12 15 (28) UPB at end of period $ 162,450 $ 175,821 $ 198,823 $ 196,773 $ 200,317 24 Mortgage Servicing Rights UPB Roll-forward

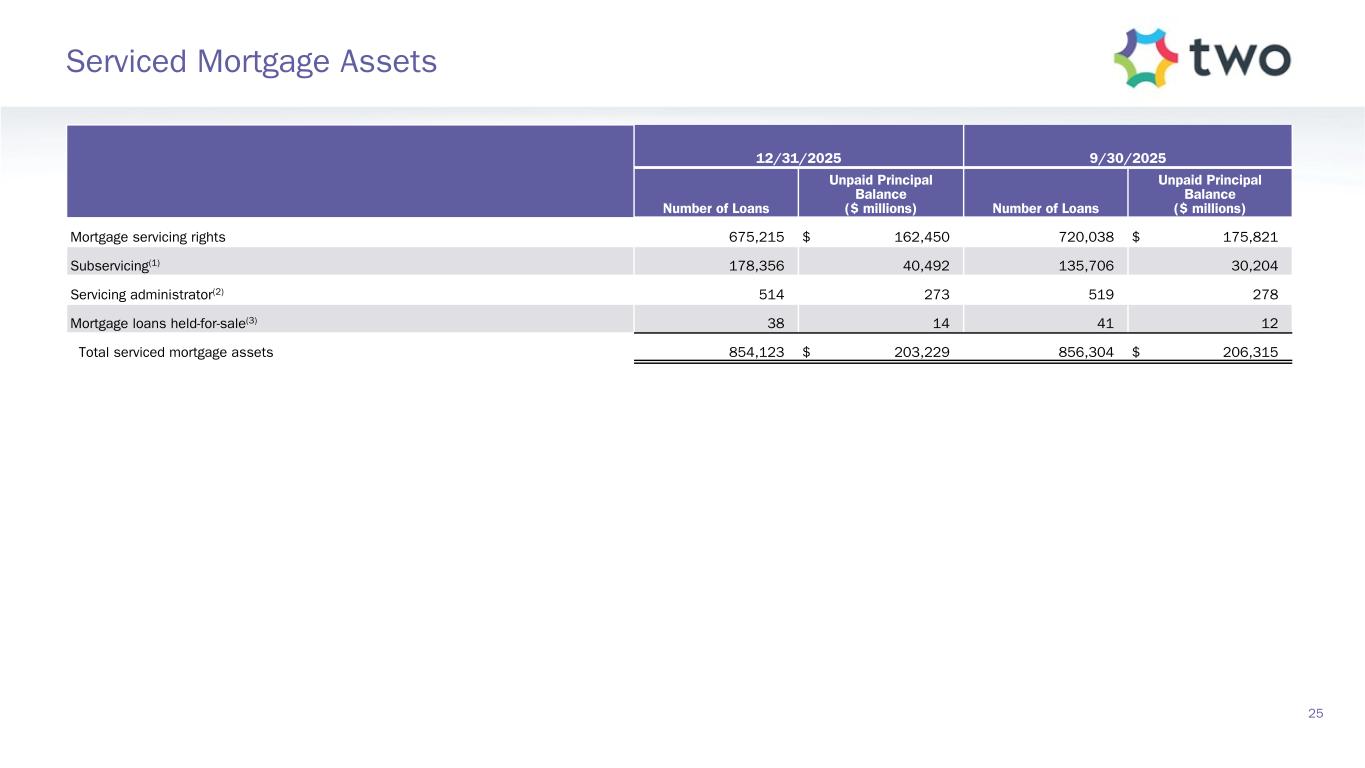

12/31/2025 9/30/2025 Number of Loans Unpaid Principal Balance ($ millions) Number of Loans Unpaid Principal Balance ($ millions) Mortgage servicing rights 675,215 $ 162,450 720,038 $ 175,821 Subservicing(1) 178,356 40,492 135,706 30,204 Servicing administrator(2) 514 273 519 278 Mortgage loans held-for-sale(3) 38 14 41 12 Total serviced mortgage assets 854,123 $ 203,229 856,304 $ 206,315 25 Serviced Mortgage Assets

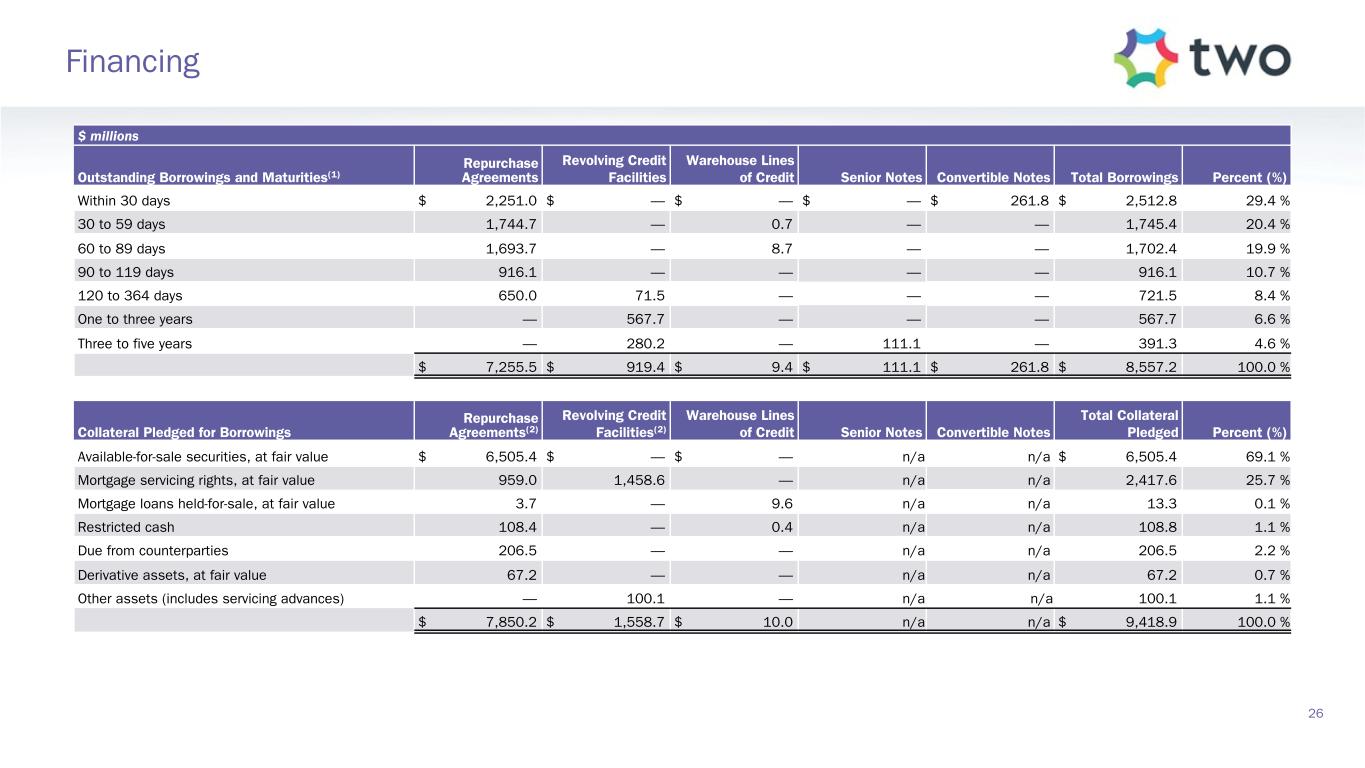

$ millions Outstanding Borrowings and Maturities(1) Repurchase Agreements Revolving Credit Facilities Warehouse Lines of Credit Senior Notes Convertible Notes Total Borrowings Percent (%) Within 30 days $ 2,251.0 $ — $ — $ — $ 261.8 $ 2,512.8 29.4 % 30 to 59 days 1,744.7 — 0.7 — — 1,745.4 20.4 % 60 to 89 days 1,693.7 — 8.7 — — 1,702.4 19.9 % 90 to 119 days 916.1 — — — — 916.1 10.7 % 120 to 364 days 650.0 71.5 — — — 721.5 8.4 % One to three years — 567.7 — — — 567.7 6.6 % Three to five years — 280.2 — 111.1 — 391.3 4.6 % $ 7,255.5 $ 919.4 $ 9.4 $ 111.1 $ 261.8 $ 8,557.2 100.0 % Collateral Pledged for Borrowings Repurchase Agreements(2) Revolving Credit Facilities(2) Warehouse Lines of Credit Senior Notes Convertible Notes Total Collateral Pledged Percent (%) Available-for-sale securities, at fair value $ 6,505.4 $ — $ — n/a n/a $ 6,505.4 69.1 % Mortgage servicing rights, at fair value 959.0 1,458.6 — n/a n/a 2,417.6 25.7 % Mortgage loans held-for-sale, at fair value 3.7 — 9.6 n/a n/a 13.3 0.1 % Restricted cash 108.4 — 0.4 n/a n/a 108.8 1.1 % Due from counterparties 206.5 — — n/a n/a 206.5 2.2 % Derivative assets, at fair value 67.2 — — n/a n/a 67.2 0.7 % Other assets (includes servicing advances) — 100.1 — n/a n/a 100.1 1.1 % $ 7,850.2 $ 1,558.7 $ 10.0 n/a n/a $ 9,418.9 100.0 % 26 Financing

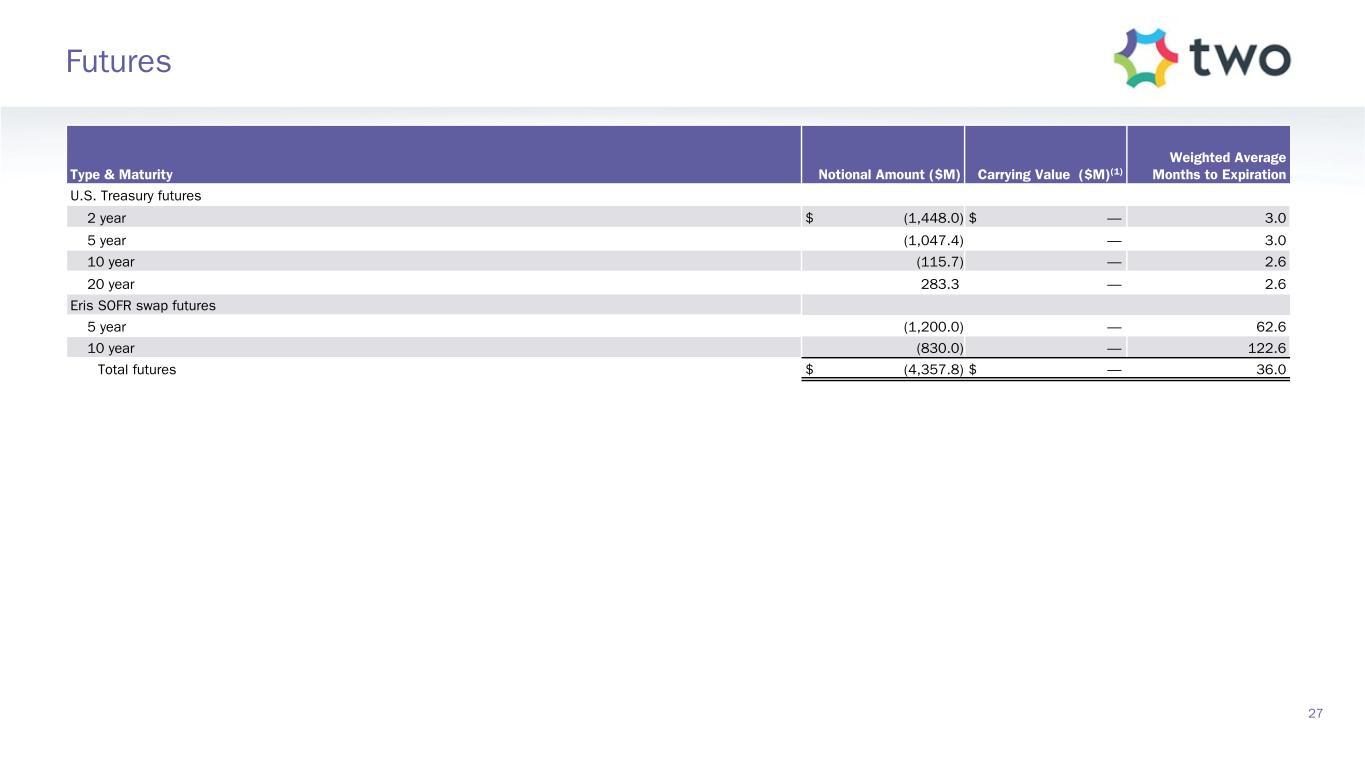

Type & Maturity Notional Amount ($M) Carrying Value ($M)(1) Weighted Average Months to Expiration U.S. Treasury futures 2 year $ (1,448.0) $ — 3.0 5 year (1,047.4) — 3.0 10 year (115.7) — 2.6 20 year 283.3 — 2.6 Eris SOFR swap futures 5 year (1,200.0) — 62.6 10 year (830.0) — 122.6 Total futures $ (4,357.8) $ — 36.0 27 Futures

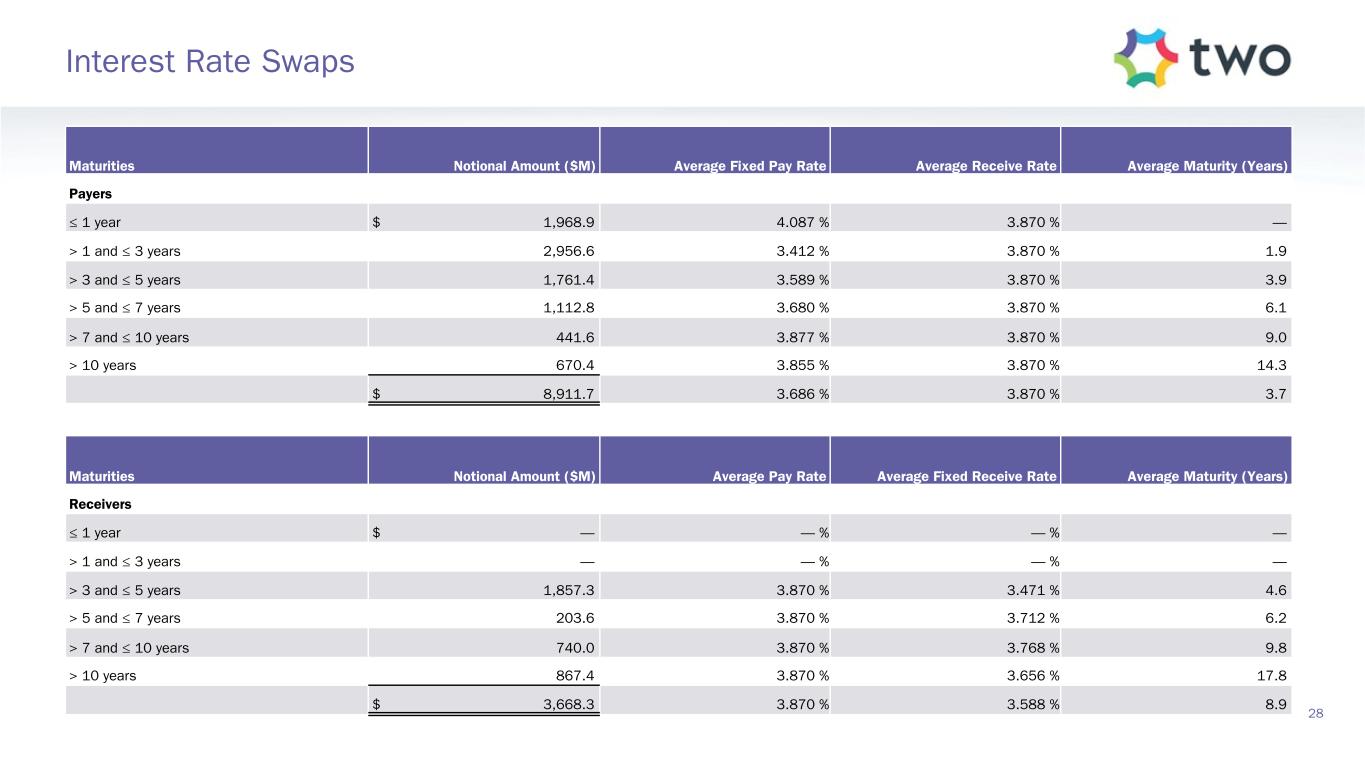

Maturities Notional Amount ($M) Average Fixed Pay Rate Average Receive Rate Average Maturity (Years) Payers ≤ 1 year $ 1,968.9 4.087 % 3.870 % — > 1 and ≤ 3 years 2,956.6 3.412 % 3.870 % 1.9 > 3 and ≤ 5 years 1,761.4 3.589 % 3.870 % 3.9 > 5 and ≤ 7 years 1,112.8 3.680 % 3.870 % 6.1 > 7 and ≤ 10 years 441.6 3.877 % 3.870 % 9.0 > 10 years 670.4 3.855 % 3.870 % 14.3 $ 8,911.7 3.686 % 3.870 % 3.7 Maturities Notional Amount ($M) Average Pay Rate Average Fixed Receive Rate Average Maturity (Years) Receivers ≤ 1 year $ — — % — % — > 1 and ≤ 3 years — — % — % — > 3 and ≤ 5 years 1,857.3 3.870 % 3.471 % 4.6 > 5 and ≤ 7 years 203.6 3.870 % 3.712 % 6.2 > 7 and ≤ 10 years 740.0 3.870 % 3.768 % 9.8 > 10 years 867.4 3.870 % 3.656 % 17.8 $ 3,668.3 3.870 % 3.588 % 8.9 28 Interest Rate Swaps

29 Tax Characterization of Dividends in 2025 • Generated REIT taxable loss of $(76.3) million, before dividend distributions and net operating loss deductions ◦ Current year taxable loss created net operating loss, which can be carried forward indefinitely to offset future taxable income • 2025 distributions for tax purposes totaled $221.1 million – Consisted of distributions to common shares of $169.5 million and distributions to preferred shares of $51.5 million – Q4 2024 common stock distribution payable to shareholders on January 29, 2025 with a record date of January 3, 2025 was treated as a 2025 distribution for tax purposes – Q4 2025 common stock distribution payable to shareholders on January 29, 2026 with a record date of January 5, 2026 will be treated as a 2026 distribution for tax purposes – No convertible note deemed distributions occurred in 2025 • 2025 common distributions were characterized for tax purposes as 0% taxable ordinary dividends and 100% nontaxable distributions (i.e., return of capital)(1) • 2025 preferred distributions were characterized for tax purposes as 0% taxable ordinary dividends and 100% nontaxable distributions (i.e., return of capital)(1) Full Year 2025 Distribution Summary

PAGE 3 - Quarterly Financials Overview 1. Economic return on book value is defined as the increase (decrease) in common book value from the beginning to the end of the given period, plus dividends declared to common stockholders in the period, divided by common book value as of the beginning of the period. 2. Includes $9.0 billion in settled positions and $4.2 billion net TBA position, which represents the bond equivalent value of the company’s TBA position. Bond equivalent value is defined as notional amount multiplied by market price. TBA contracts accounted for as derivative instruments in accordance with GAAP. For additional detail on the portfolio, see slides 11 and 13, and Appendix slides 22 and 23. 3. Economic debt-to-equity is defined as total borrowings to fund Agency and non-Agency investment securities, MSR and related servicing advances and mortgage loans held-for-sale, plus the implied debt on net TBA cost basis and net payable (receivable) for unsettled RMBS, divided by total equity. PAGE 4 - Markets Overview 1. Source: Bloomberg, as of the dates noted. PAGE 5 - RoundPoint Operations Update 1. Number represents approximate pull-through adjusted UPB in originations pipeline as of December 31, 2025. PAGE 6 - Book Value Summary 1. Economic return on book value is defined as the increase (decrease) in common book value from the beginning to the end of the given period, plus dividends declared to common stockholders in the period, divided by common book value as of the beginning of the period. PAGE 7 - Comprehensive Income (Loss) Summary 1. Mark-to-Market Gains and Losses represents the sum of investment securities gain (loss) and change in accumulated other comprehensive income (OCI), net swap and other derivative gains (losses), and servicing asset gains (losses). See Appendix slide 20 for more detail. 2. During the quarter ended September 30, 2025, the company recognized litigation settlement expense of $175.1 million related to the settlement agreement with the company’s former external manager, which is the difference between the $375.0 million cash payment made to the company’s former external manager, less the related loss contingency accrual recorded in the second quarter of $199.9 million. PAGE 8 - Financing Profile 1. Source: Bloomberg. Represents the average spread between repurchase rates and the Secured Overnight Financing Rate (SOFR) over trailing three-month and six-month periods between Q4 2022 and Q4 2025 (as of December 31, 2025). PAGE 9 - Portfolio Composition and Risk Positioning 1. For additional detail on the portfolio, see slides 11 and 13, and Appendix slides 22 and 23. 2. Net TBA position represents the bond equivalent value of the company’s TBA position. Bond equivalent value is defined as notional amount multiplied by market price. TBA contracts are accounted for as derivative instruments in accordance with GAAP. 3. Economic debt-to-equity is defined as total borrowings to fund Agency and non-Agency investment securities, MSR and related servicing advances and mortgage loans held-for-sale, plus the implied debt on net TBA cost basis and net payable (receivable) for unsettled RMBS, divided by total equity. 4. Interest rate exposure represents estimated change in common book value for theoretical parallel shift in interest rates. 5. Spread exposure represents estimated change in common book value for theoretical parallel shifts in spreads. 30 End Notes

PAGE 10 - Agency RMBS Investment Landscape 1. Source: J.P. Morgan DataQuery. Data is model-based and represents universal mortgage-backed securities (UMBS) generic TBA spreads as of the dates noted. In 2023, J.P. Morgan updated their model affecting only 2023 data. Data as of January 29, 2026. 2. Spreads produced using prepayment speeds generated with The Yield Book® Software using internally calibrated prepayment dials. Data as of December 31, 2025. ZV Spread stands for zero volatility spread. PAGE 11 - Agency RMBS Portfolio 1. Specified pools include securities with implicit or explicit prepayment protection, including lower loan balances (securities collateralized by loans less than or equal to $300K of initial principal balance), higher LTVs (securities collateralized by loans with greater than or equal to 80% LTV), certain geographic concentrations, loans secured by investor-owned properties, and lower FICO scores, as well as securities without such protection, including large bank-serviced and others. 2. Represents UMBS generic TBA performance during the quarter. 3. Specified pool performance excludes (1) certain coupons in which we were not invested for the full duration of the quarter and (2) certain coupons with de minimis balances. 4. Specified pool market value by coupon as of December 31, 2025. 5. Three-month prepayment speeds of delivered TBA contracts; average of J.P. Morgan, Bank of America, and Citi data. PAGE 12 - MSR Investment Landscape 1. Source: RiskSpan and TWO’s internal estimates as of December 31, 2025. 2. TWO MSR 30-year fixed-rate UPB as of December 31, 2025 factor date; Freddie Mac’s Primary Mortgage Market Survey (PMMS) as of December 31, 2025. MSR portfolio based on the prior month-end's principal balance of the loans underlying the company's MSR, increased for current month purchases and excluding unsettled MSR on loans for which the company is the named servicer as well as MSR on loans recently settled for which transfer to the company is not yet complete. PAGE 13 - MSR Portfolio 1. MSR portfolio based on the prior month-end's principal balance of the loans underlying the company's MSR, increased for current month purchases. Portfolio metrics, other than fair value and UPB, represent averages weighted by UPB. 2. FICO represents a mortgage industry accepted credit score of a borrower. 3. MSR portfolio based on the prior month-end's principal balance of the loans underlying the company's MSR, increased for current month purchases and excluding unsettled MSR on loans for which the company is the named servicer as well as MSR on loans recently settled for which transfer to the company is not yet complete. 4. Three-month prepayment speeds of delivered TBA contracts; average of J.P. Morgan, Bank of America, and Citi data. PAGE 14 - Return Potential and Outlook 1. Capital allocated represents management’s internal allocation. Certain financing balances and associated interest expenses are allocated between investments based on management’s assessment of leverage ratios and required capital or liquidity to support the investment. 2. Market return estimates reflect static assumptions using quarter-end spreads and market data. 3. Includes Agency pools and TBA positions. TBA contracts accounted for as derivative instruments in accordance with GAAP. 4. Estimated return on invested capital reflects static return assumptions using quarter-end portfolio valuations. 5. Total expenses includes operating expenses and tax expenses within the company’s taxable REIT subsidiaries. 6. Preferred equity coupon represents the 5-year yield along the forward curve to account for floating rate resets. 7. Prospective quarterly static return estimate per basic common share reflects portfolio performance expectations given current market conditions and represents the comprehensive income attributable to common stockholders (net of dividends on preferred stock). 31 End Notes (continued)

PAGE 16 - Effective Coupon Positioning 1. Represents UMBS TBA market prices as of December 31, 2025. 2. Specified pools include securities with implicit or explicit prepayment protection, including lower loan balances (securities collateralized by loans less than or equal to $300K of initial principal balance), higher LTVs (securities collateralized by loans with greater than or equal to 80% LTV), certain geographic concentrations, loans secured by investor-owned properties, and lower FICO scores, as well as securities without such protection, including large bank-serviced and others. 3. MSR/Agency IO represents an internally calculated exposure of a synthetic TBA position and the current coupon equivalents of our MSR, including the effect of unsettled MSR, and Agency IO RMBS. 4. Spreads generated with The Yield Book® Software using internally calibrated dials. PAGE 17 - Risk Positioning 1. MSR/Agency IO RMBS includes the effect of unsettled MSR. 2. Other includes all other derivative assets and liabilities and borrowings. Other excludes TBAs, which are included in the Agency P&I RMBS/TBA category. 3. Bull Steepener/Bear Flattener is a shift in short-term rates that represents estimated change in common book value for theoretical non-parallel shifts in the yield curve. Analysis uses a +/- 25 basis point shift in 2- year rates while holding long-term rates constant. 4. Bull Flattener/Bear Steepener is a shift in long-term rates that represents estimated change in common book value for theoretical non-parallel shifts in the yield curve. Analysis uses a +/- 25 basis point shift in 10-year rates while holding short-term rates constant. 5. Parallel shift represents estimated change in common book value for theoretical parallel shift in interest rates. 6. Book value exposure to current coupon spread represents estimated change in common book value for theoretical parallel shifts in spreads. PAGE 18 - Markets Overview 1. Source: Bloomberg, US MBS Index Monthly Treasury Excess Return data as of dates noted. 2. Source: Bloomberg, as of dates noted. 3. Source: J.P. Morgan DataQuery. 4. Monthly prepay speeds from National Association of Realtors via Bloomberg and RiskSpan as of December 31, 2025. MSR portfolio based on the prior month-end's principal balance of the loans underlying the company's MSR, increased for current month purchases and excluding unsettled MSR on loans for which the company is the named servicer as well as MSR on loans recently settled for which transfer to the company is not yet complete. PAGE 19 - Financial Performance 1. Economic return on book value is defined as the increase (decrease) in common book value from the beginning to the end of the given period, plus dividends declared to common stockholders in the period, divided by the common book value as of the beginning of the period. 2. Historical dividends may not be indicative of future dividend distributions. The company ultimately distributes dividends based on its taxable income per common share, not GAAP earnings. The annualized dividend yield on the company’s common stock is calculated based on the closing price of the last trading day of the relevant quarter. 32 End Notes (continued)

PAGE 21 - Q3-2025 Portfolio Yields and Financing Costs 1. Includes interest income, net of premium amortization/discount accretion, on Agency and non-Agency investment securities, servicing income, net of estimated amortization and servicing expenses, on MSR, and the implied asset yield portion of dollar roll income on TBAs. Amortization on MSR refers to the portion of change in fair value of MSR primarily attributed to the realization of expected cash flows (runoff) of the portfolio, which is deemed a non-GAAP measure due to the company’s decision to account for MSR at fair value. TBA dollar roll income is the non-GAAP economic equivalent to holding and financing Agency RMBS using short-term repurchase agreements. 2. As reported elsewhere in the company’s filings with the Securities and Exchange Commission, MSR, Agency derivatives, TBA, interest rate swap agreements and U.S. Treasury futures are reported at fair value in the company’s consolidated financial statements in accordance with GAAP, and the GAAP presentation and disclosure requirements for these items do not define or include the concepts of yield or cost of financing, amortized cost, or outstanding borrowings. 3. Amortized cost on MSR for a given period equals the net present value of the remaining future cash flows (obtained by applying original prepayment assumptions to the actual unpaid principal balance at the start of the period) using a discount rate equal to the original pricing yield. Original pricing yield is the discount rate which makes the net present value of the cash flows projected at purchase equal to the purchase price. MSR amortized cost is deemed a non-GAAP measure due to the company’s decision to account for MSR at fair value. 4. Represents inverse interest-only Agency RMBS which are accounted for as derivative instruments in accordance with GAAP. 5. Both the implied asset yield and implied financing benefit/cost of dollar roll income on TBAs are calculated using the average cost basis of TBAs as the denominator. TBA dollar roll income is the non-GAAP economic equivalent to holding and financing Agency RMBS using short-term repurchase agreements. TBAs are accounted for as derivative instruments in accordance with GAAP. 6. Includes interest expense and amortization of deferred debt issuance costs on borrowings under repurchase agreements (excluding those collateralized by U.S. Treasuries), revolving credit facilities, senior notes and convertible senior notes, interest spread income/expense and amortization of upfront payments made or received upon entering into interest rate swap agreements, and the implied financing benefit/cost portion of dollar roll income on TBAs. TBA dollar roll income is the non-GAAP economic equivalent to holding and financing Agency RMBS using short-term repurchase agreements. 7. Unsecured senior notes. 8. Unsecured convertible senior notes. 9. The cost of financing on interest rate swaps held to mitigate interest rate risk associated with the company’s outstanding borrowings is calculated using average borrowings balance as the denominator. 10. The cost of financing on U.S. Treasury futures held to mitigate interest rate risk associated with the company’s outstanding borrowings is calculated using average borrowings balance as the denominator. U.S. Treasury futures income is the economic equivalent to holding and financing a relevant cheapest-to-deliver U.S. Treasury note or bond using short-term repurchase agreements. PAGE 22 - Agency RMBS Portfolio 1. Weighted average actual one-month CPR released at the beginning of the following month based on RMBS held as of the preceding month-end. 2. Determination of the percentage of prepay protected 30-year fixed Agency RMBS includes securities with implicit or explicit prepayment protection, including lower loan balances (securities collateralized by loans less than or equal to $300K of initial principal balance), higher LTVs (securities collateralized by loans with greater than or equal to 80% LTV), certain geographic concentrations, loans secured by investor-owned properties, and lower FICO scores. 3. Other P&I includes 15-year fixed, Hybrid ARMs, CMO and DUS pools. 4. IOs and IIOs represent market value of $67.9 million of Agency derivatives and $16.9 million of interest-only Agency RMBS. Agency derivatives are inverse interest-only Agency RMBS, which are accounted for as derivative instruments in accordance with GAAP. 5. Bond equivalent value is defined as the notional amount multiplied by market price. TBA contracts accounted for as derivative instruments in accordance with GAAP. 6. Three-month prepayment speeds of delivered TBA contracts; average of J.P. Morgan, Bank of America, and Citi data. PAGE 23 - Mortgage Servicing Rights Portfolio 1. MSR portfolio excludes residential mortgage loans for which the company is the named servicing administrator. Portfolio metrics, other than fair value and UPB, represent averages weighted by UPB. 2. FICO represents a mortgage industry-accepted credit score of a borrower. 33 End Notes (continued)

PAGE 25 - Serviced Mortgage Assets 1. Off-balance sheet mortgage loans owned by third parties and subserviced by the Company. 2. Off-balance sheet mortgage loans owned by third parties for which the Company acts as servicing administrator (subserviced by appropriately licensed third-party subservicers). 3. Originated or purchased mortgage loans held-for-sale at period-end. PAGE 26 - Financing 1. As of December 31, 2025, outstanding borrowings had a weighted average of 4.9 months to maturity. 2. Repurchase agreements and revolving credit facilities secured by MSR and/or other assets may be over-collateralized due to operational considerations. PAGE 27 - Futures 1. Exchange-traded derivative instruments (futures and options on futures) require the posting of an “initial margin” amount determined by the clearing exchange, which is generally intended to be set at a level sufficient to protect the exchange from the derivative instrument’s maximum estimated single-day price movement. The company also exchanges “variation margin” based upon daily changes in fair value, as measured by the exchange. The exchange of variation margin is considered a settlement of the derivative instrument, as opposed to pledged collateral. Accordingly, the receipt or payment of variation margin is accounted for as a direct reduction to the carrying value of the exchange-traded derivative asset or liability. PAGE 29 - Tax Characterization of Dividends in 2025 1. The U.S. federal income tax treatment of holding TWO stock to any particular stockholder will depend on the stockholder’s particular tax circumstances. You are urged to consult your tax advisor regarding the U.S. federal, state, local and foreign income and other tax consequences to you, in light of your particular investment or tax circumstances, of acquiring, holding and disposing of TWO stock. TWO does not provide tax, accounting or legal advice. Any tax statements contained herein were not intended or written to be used and cannot be used for the purpose of avoiding U.S., federal, state or local tax penalties. Please consult your advisor as to any tax, accounting or legal statements made herein. 34 End Notes (continued)