UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

OLAPLEX HOLDINGS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required.

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

| | | | | |

| Olaplex Holdings, Inc. 1187 Coast Village Rd, Suite 1-520 Santa Barbara, CA 93108 |

April 19, 2022

Dear Stockholder:

We cordially invite you to attend our 2022 Annual Meeting of Stockholders (the “Annual Meeting”) on Wednesday, June 1, 2022, at 11:00 a.m. (Eastern Time), to be conducted exclusively via live webcast at www.virtualshareholdermeeting.com/OLPX2022.

The proxy statement accompanying this letter (the “Proxy Statement”) describes the business we will consider at the Annual Meeting. Your vote is important regardless of the number of shares you own. Whether or not you plan to attend the Annual Meeting online, we encourage you to consider the matters presented in the Proxy Statement and vote as soon as possible. Instructions for Internet and telephone voting are attached to your proxy card. If you prefer, you can vote by mail by completing and signing your proxy card and returning it in the enclosed envelope.

We hope that you will be able to join us on June 1st.

Sincerely,

/s/ JuE Wong

JuE Wong

President and Chief Executive Officer

| | | | | |

| Olaplex Holdings, Inc. 1187 Coast Village Rd, Suite 1-520 Santa Barbara, CA 93108 |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

The 2022 Annual Meeting of Stockholders (the “Annual Meeting”) of Olaplex Holdings, Inc. (the “Company”) will be a virtual meeting conducted exclusively via live webcast at www.virtualshareholdermeeting.com/OLPX2022 on Wednesday, June 1, 2022, at 11:00 a.m. (Eastern Time) for the following purposes as further described in the proxy statement accompanying this notice (the “Proxy Statement”):

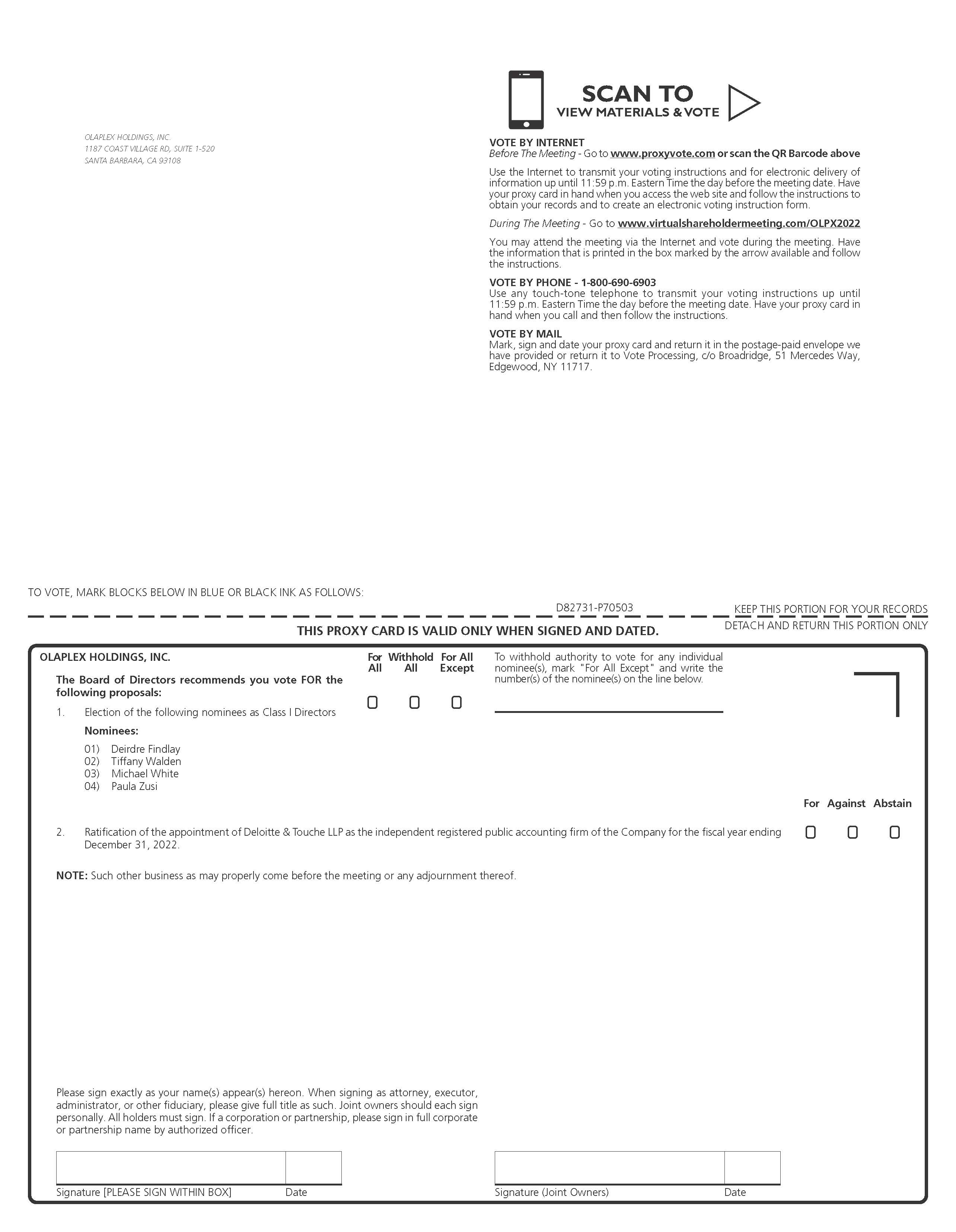

•To elect the four Class I director nominees specifically named in the Proxy Statement, each to serve for a term of three years.

•To ratify the appointment of Deloitte & Touche LLP, as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2022.

•To consider any other business properly brought before the Annual Meeting.

Stockholders of record at the close of business on April 14, 2022 are entitled to notice of, and entitled to vote at, the Annual Meeting and any adjournments or postponements thereof.

In light of the fact that we are a fully remote company, as well as the continued public health and travel safety concerns related to the coronavirus (COVID-19) pandemic, we have decided to hold a virtual annual meeting in order to facilitate stockholder attendance and participation by enabling stockholders to participate from any location and at no cost. You will be able to attend the meeting online, vote your shares electronically and submit questions during the meeting by visiting www.virtualshareholdermeeting.com/OLPX2022. To participate in the virtual meeting, you will need the control number included on your proxy card or voting instruction form. The meeting webcast will begin promptly at 11:00 a.m. (Eastern Time). We encourage you to access the meeting prior to the start time. Online check-in will begin at 10:45 a.m. (Eastern Time), and you should allow ample time for the check-in procedures. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the Virtual Shareholder Meeting log in page.

By Order of the Board of Directors,

/s/ John C. Duffy

John C. Duffy

General Counsel and Secretary

April 19, 2022

Table of Contents

OLAPLEX HOLDINGS, INC.

PROXY STATEMENT

2022 ANNUAL MEETING OF STOCKHOLDERS

June 1, 2022

11:00 a.m. (Eastern Time)

INTRODUCTION

This proxy statement (the “Proxy Statement”) provides information for stockholders of Olaplex Holdings, Inc. (“we,” “us,” “our,” “Olaplex” and the “Company”), as part of the solicitation of proxies by the Company and its Board of Directors (the “Board”) from holders of the outstanding shares of the Company’s common stock, par value $0.001 per share (“Common Stock”), for use at the Company’s annual meeting of stockholders to be held as a virtual meeting conducted exclusively via live webcast at www.virtualshareholdermeeting.com/OLPX2022 on Wednesday, June 1, 2022 at 11:00 a.m. (Eastern Time), and at any adjournments or postponements thereof (the “Annual Meeting”).

At the Annual Meeting, stockholders will be asked to vote either directly or by proxy on the following matters discussed herein:

1.To elect the four Class I director nominees specifically named in this Proxy Statement, each to serve for a term of three years (Proposal 1).

2.To ratify the appointment of Deloitte & Touche LLP (“Deloitte”) as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2022 (Proposal 2).

3.To consider any other business properly brought before the Annual Meeting.

On or about April 19, 2022, we will commence sending the Notice of Internet Availability of Proxy Materials (the “Notice”) to all stockholders entitled to vote at the Annual Meeting, which will contain instructions on how to access the proxy materials and our 2021 Annual Report on Form 10-K (the “2021 Annual Report”).

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

ANNUAL MEETING TO BE HELD ON JUNE 1, 2022: THIS PROXY STATEMENT AND THE 2021 ANNUAL

REPORT ARE AVAILABLE AT WWW.PROXYVOTE.COM.

INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Although we encourage you to read this Proxy Statement in its entirety, we include this Q&A section to provide some background information and answers to several questions you might have about the Annual Meeting.

Why are we providing these materials?

Our Board is providing these materials to you in connection with our Annual Meeting, which will be a virtual meeting conducted exclusively via live webcast at www.virtualshareholdermeeting.com/OLPX2022 on June 1, 2022 at 11:00 a.m. (Eastern Time). Stockholders are invited to attend the Annual Meeting online and are requested to vote on the proposals described herein.

What information is contained in this Proxy Statement?

This Proxy Statement contains information relating to the proposals to be voted on at the Annual Meeting, the voting process, the compensation of our directors and most highly paid officers, and other required information.

What proposals will be voted on at the Annual Meeting?

There are two proposals scheduled to be voted on at the Annual Meeting:

•the election of the four Class I director nominees specifically named in this Proxy Statement, each to serve for a term of three years; and

•the ratification of Deloitte as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2022.

We will also consider other business properly brought before the Annual Meeting.

Can I attend the Annual Meeting?

In light of the fact that we are a fully remote company, as well as the continued public health and travel safety concerns related to the coronavirus (COVID-19) pandemic, we have decided to hold a virtual annual meeting in order to facilitate stockholder attendance and participation by enabling stockholders to participate from any location and at no cost.

To participate in the virtual meeting, you will need the control number included on your proxy card or voting instruction form. The meeting webcast will begin promptly at 11:00 a.m. (Eastern Time). We encourage you to access the meeting prior to the start time. Online check-in will begin at 10:45 a.m. (Eastern Time), and you should allow ample time for the check-in procedures. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the Virtual Shareholder Meeting log in page.

We are committed to ensuring that stockholders will be afforded the same rights and opportunities to participate as they would at an in-person meeting. You will be able to attend the meeting online, vote your shares electronically and submit questions during the meeting by visiting www.virtualshareholdermeeting.com/OLPX2022. We will try to answer as many stockholder-submitted questions as time permits that comply with the meeting rules of conduct. However, we reserve the right to edit inappropriate language or to exclude questions that are not pertinent to meeting matters or that are otherwise inappropriate. If we receive substantially similar questions, we will group such questions together and provide a single response to avoid repetition.

What shares can I vote?

You may vote all shares of Common Stock that you owned as of the close of business on the record date, April 14, 2022. You may cast one vote per share, including shares (i) held directly in your name as the stockholder of record and (ii) held for you as the beneficial owner through a broker, bank, or other nominee. The proxy card will indicate the number of shares that you are entitled to vote.

As of April 14, 2022, there were 648,928,202 shares of Common Stock outstanding, all of which are entitled to be voted at the Annual Meeting.

We will make available a list of stockholders of record as of the record date for inspection by stockholders for any purpose germane to the Annual Meeting during the ten days preceding the Annual Meeting. To access the stockholder list during this time, please send your request, and proof of ownership, to our corporate secretary via e-mail at proxy@olaplex.com. A list of stockholders will also be available electronically on the virtual meeting website during the meeting.

What is the difference between being a stockholder of record and a beneficial owner of shares held in street name?

Many of our stockholders hold their shares through brokers, banks, or other nominees, rather than directly in their own names. As summarized below, there are some differences between being a stockholder of record and a beneficial owner of shares held in street name.

Stockholder of record: If your shares are registered directly in your name with Olaplex’s transfer agent, American Stock Transfer and Trust Company, LLC (“AST”), you are the stockholder of record with respect to those shares and the proxy materials were sent directly to you. As the stockholder of record, you have the right to grant your voting proxy directly to the individuals named on the proxy card and to vote at the Annual Meeting.

Beneficial owner of shares held in street name: If your shares are held in a brokerage account or by a bank or other nominee, then you are the “beneficial owner of shares held in street name” and the proxy materials were forwarded to you by your broker, bank or other nominee, who is considered to be the stockholder of record. As a beneficial owner, you have the right to instruct the broker, bank or other nominee holding your shares how to vote your shares.

How do I vote?

There are four ways to vote:

•By attending the Annual Meeting Online. During the Annual Meeting, you may vote online by following the instructions at www.virtualshareholdermeeting.com/OLPX2022. Have your proxy card or voting instruction form available when you access the virtual meeting webpage.

•Online. You may vote by proxy by visiting www.proxyvote.com and entering the control number found on your proxy card. The availability of online voting may depend on the voting procedures of the broker, bank or other nominee that holds your shares.

•Phone. You may vote by proxy by calling the toll-free number found on your proxy card. The availability of phone voting may depend on the voting procedures of the broker, bank or other nominee that holds your shares.

•Mail. You may vote by proxy by filling out your proxy card and returning it in the envelope provided.

All shares represented by valid proxies received prior to the taking of the vote at the Annual Meeting will be voted and, where a stockholder specifies by means of the proxy a choice with respect to any matter to be acted upon, the shares will be voted in accordance with the stockholder’s instructions. Even if you plan on attending the Annual Meeting online, we encourage you to vote your shares in advance to ensure that your vote will be represented at the Annual Meeting.

Can I change my vote or revoke my proxy?

You may revoke your proxy and change your vote at any time before the taking of the vote at the Annual Meeting.

•By Attending the Annual Meeting Online. You may revoke your proxy and change your vote by attending the Annual Meeting online and voting electronically during the meeting (although attendance at the Annual Meeting will not, by itself, revoke a proxy).

•Online. You may change your vote using the online voting method described above, in which case only your latest internet proxy submitted prior to the Annual Meeting will be counted.

•Phone. You may change your vote using the phone voting method described above, in which case only your latest telephone proxy submitted prior to the Annual Meeting will be counted.

•Mail. You may revoke your proxy and change your vote by signing and returning a new proxy card dated as of a later date, in which case only your latest proxy card received prior to the Annual Meeting will be counted.

What happens if I do not instruct how my shares should be voted?

Stockholders of record. If you are a stockholder of record and you:

•indicate when voting online or by phone that you wish to vote as recommended by the Board; or

•sign and return a proxy card without giving specific instructions,

then the persons named as proxy holders, JuE Wong, John Duffy, and Eric Tiziani, will vote your shares in the manner recommended by the Board on all matters presented in this Proxy Statement and as they may determine in their best judgment with respect to any other matters properly presented for a vote at the Annual Meeting.

Beneficial owners of shares held in street name. If you are a beneficial owner of shares held in street name and do not provide the broker, bank or other nominee that holds your shares with specific voting instructions, then the broker, bank or other nominee that holds your shares may generally vote your shares in their discretion on “routine” matters, but cannot vote on “non-routine” matters.

What are routine and non-routine matters?

Although the determination of whether a broker, bank or other nominee will have discretionary voting power for a particular item is typically determined only after proxy materials are filed with the Securities and Exchange Commission (the "SEC"), we expect that the following proposal will be a routine matter:

•The ratification of the appointment of Deloitte as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2022 (Proposal 2).

A broker, bank or other nominee may generally vote in their discretion on routine matters, and therefore no broker non-votes are expected in connection with Proposal 2.

We expect the following proposal will be a non-routine matter:

•Election of directors (Proposal 1).

If the broker, bank or other nominee that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, that broker, bank or other nominee will inform the inspector of election that it does not have the authority to vote on the matter with respect to your shares. This is generally referred to as a “broker non-vote.” Therefore, broker non-votes may exist in connection with Proposal 1.

What constitutes a quorum for the Annual Meeting?

The presence at the meeting, online or by proxy, of the holders of Common Stock representing a majority of the shares outstanding and entitled to vote for the election of directors is necessary to constitute a quorum for all purposes.

What vote is required to approve each proposal?

Proposal 1: Election of directors. Directors are elected by a plurality of the votes cast. Therefore, if you do not vote for a nominee, or you “withhold authority to vote” for a nominee, your vote will not count either “for” or “against” the nominee.

Proposal 2: Ratification of Deloitte. The affirmative vote of a majority of the votes cast is required to ratify the selection of Deloitte as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2022. Abstentions will not count either “for” or “against” the ratification and will have no effect on the outcome of Proposal 2.

What effect will broker non-votes and abstentions have?

Broker non-votes and abstentions are counted as present and entitled to vote for purposes of determining whether a quorum is present. Broker non-votes and abstentions will have no effect on the outcome of Proposals 1 and 2.

How are votes counted?

Broadridge Financial Solutions, Inc. has been appointed to be the inspector of elections and in this capacity will supervise the voting, decide the validity of proxies and certify the results.

Why did I receive a Notice of Internet Availability of Proxy Materials instead of a full set of proxy materials?

In accordance with the rules of the SEC, we have elected to furnish our proxy materials, including this Proxy Statement and our 2021 Annual Report, primarily via the Internet. The Notice containing instructions on how to access our proxy materials is first being mailed on or about April 19, 2022 to all stockholders entitled to vote at the Annual Meeting.

Stockholders may request to receive all future proxy materials in printed form by mail or electronically by e-mail by following the instructions contained in the Notice. We encourage stockholders to take advantage of the availability of our proxy materials on the Internet to help reduce the environmental impact and cost of our annual meetings of stockholders.

Who pays for costs relating to the proxy materials and Annual Meeting?

The costs of preparing, assembling and mailing this Proxy Statement, the proxy card and the 2021 Annual Report, along with the cost of posting the proxy materials on a website, are to be borne by Olaplex. In addition to the use of mail, our directors, officers and employees may solicit proxies personally and by telephone, facsimile and other electronic means. They will receive no compensation in addition to their regular salaries. We may request banks, brokers and other custodians, nominees and fiduciaries to forward copies of the proxy materials to their principals and to request authority for the execution of proxies. We may reimburse these persons for their expenses in doing so.

Where can I find the voting results of the Annual Meeting?

We will announce preliminary voting results at the Annual Meeting. We will also disclose voting results on a Current Report on Form 8-K that we will file with the SEC within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the Annual Meeting, we will file a Form 8-K to publish preliminary results and will provide the final results in an amendment to the Form 8-K as soon as they become available.

Who should I call if I have any questions?

If you have any questions about the Annual Meeting, voting or your ownership of our Common Stock, please call us at (310) 691-0776 or send an email to proxy@olaplex.com.

BOARD OF DIRECTORS

PROPOSAL 1

ELECTION OF DIRECTORS

Olaplex has a classified Board currently consisting of four directors with terms expiring in 2022 (Class I), four directors with terms expiring in 2023 (Class II) and three directors with terms expiring in 2024 (Class III). At each annual meeting of stockholders, directors in one class are elected for a full term of three years to succeed those directors whose terms are expiring. Deirdre Findlay, Tiffany Walden, Michael White and Paula Zusi are the Class I directors whose terms expire at the Annual Meeting. Our Board has nominated, and stockholders are being asked to re-elect, Deirdre Findlay, Tiffany Walden, Michael White and Paula Zusi for three-year terms expiring at our 2025 annual meeting of stockholders. If elected, the nominees will each hold office until our 2025 annual meeting of stockholders and a successor is duly elected and qualified or until earlier death, resignation, or removal.

Each of the above nominees has indicated her or his willingness to serve, if elected. However, if a nominee should be unable to serve, the shares of Common Stock represented by proxies may be voted for a substitute nominee designated by the Board. Management has no reason to believe that any of the above-mentioned persons will not serve her or his term as a director.

All of our nominees have served previously on our Board, which has provided them with significant exposure to both our business and the industry in which we compete. We believe that all of our nominees possess the professional and personal qualifications necessary for board service, and we have highlighted particularly noteworthy attributes for each director in the individual biographies below.

The Board recommends a vote FOR the election of each of the director nominees.

The following table sets forth the name, age and class, as of April 19, 2022, of individuals who currently serve as directors on our Board.

| | | | | | | | | | | |

| Name | Age | Position | Class |

| Deirdre Findlay | 48 | Director | Class I |

| Tiffany Walden | 35 | Chief Operating Officer and Director | Class I |

| Michael White | 34 | Director | Class I |

| Paula Zusi | 61 | Director | Class I |

| Janet Gurwitch | 69 | Director | Class II |

| Martha Morfitt | 64 | Director | Class II |

| David Mussafer | 58 | Director | Class II |

| Emily White | 43 | Director | Class II |

| Christine Dagousset | 57 | Chair of the Board | Class III |

| Tricia Glynn | 41 | Lead Director | Class III |

| JuE Wong | 58 | President, Chief Executive Officer and Director | Class III |

Class I – Directors with Terms Expiring in 2022

| | | | | | | | |

|

DEIRDRE FINDLAY

Age: 48

Director |

Deirdre Findlay has served as a member of our Board since August 2021. Prior to the Pre-IPO Reorganization (as defined herein under “Board Meetings and Executive Sessions”), Ms. Findlay had been a member of the board of managers of Penelope Group GP, LLC (the “Board of Managers of Penelope Group GP”) – the former general partner of Penelope Group Holdings, L.P. (“Penelope Group Holdings”) – since September 2020. Ms. Findlay is currently the Chief Marketing Officer of Condé Nast, a global media company, a position she has held since January 2020. She was the Chief Marketing Officer of Stitch Fix, a personal style service company, from May 2018 to January 2020. Prior to Stitch Fix, she served as Senior Director of Global Hardware Marketing with Google, a global internet services and products company, from May 2013 to May 2018, Senior Director of Consumer Marketing at eBay, a global ecommerce company, from July 2011 to April 2013, and as Senior Vice President of Digitas, a marketing agency, from July 2000 to June 2011. Ms. Findlay currently serves as a director for Sonos. Ms. Findlay holds a B.A. in Economics from Williams College and an M.B.A. from The Tuck School of Business at Dartmouth College. We believe Ms. Findlay is qualified to serve on our Board because of her extensive experience in digital marketing and consumer insights leadership. |

|

TIFFANY WALDEN

Age: 35

Chief Operating Officer and Director |

Tiffany Walden has served as a member of our Board since August 2021 and currently serves as our Chief Operating Officer. Prior to the Pre-IPO Reorganization, Ms. Walden had been a member of the Board of Managers of Penelope Group GP since January 2020. Ms. Walden has deep knowledge of Olaplex, having joined the company in 2016 as our General Counsel, a position she held until 2018, and has since held a variety of roles, including Chief Administrative Officer from 2018 to 2019, Chief Legal Officer from 2018 to August 2021 and Chief Operating Officer, Chief Legal Officer and Secretary from August 2021 to April 2022. Ms. Walden is an integral part of the management team. Prior to her role at Olaplex, Ms. Walden served as Director of Intellectual Property and Senior Counsel at Tory Burch from 2011 to 2016, where she oversaw all intellectual property and brand protection matters for the company. Ms. Walden holds a J.D. from William & Mary School of Law and a B.A. in Individualized Study with a concentration in Journalism & Business from New York University. |

| | | | | | | | |

|

MICHAEL WHITE

Age: 34

Director |

Michael White has served as a member of our Board since August 2021. Prior to the Pre-IPO Reorganization, Mr. White had been a member of the Board of Managers of Penelope Group GP since January 2020. Mr. White is a principal at Advent International Corporation and has focused on buyouts and growth equity investments in the retail, consumer and leisure sector since joining Advent in 2019. Advent International Corporation is affiliated with the Advent Funds that acquired the Olaplex business in January 2020. Prior to Advent, Mr. White worked at TPG Capital from 2012 to 2018 and Bain & Company from 2009 to 2012. He is currently a director at First Watch Restaurant Group, Inc. Mr. White earned an H.B.A. with distinction and an Ivey Scholar designation, from Ivey Business School at Western University, and an M.B.A., with distinction, from Harvard Business School. We believe Mr. White is qualified to serve on our Board because of his experience advising and investing in retail and consumer companies. |

|

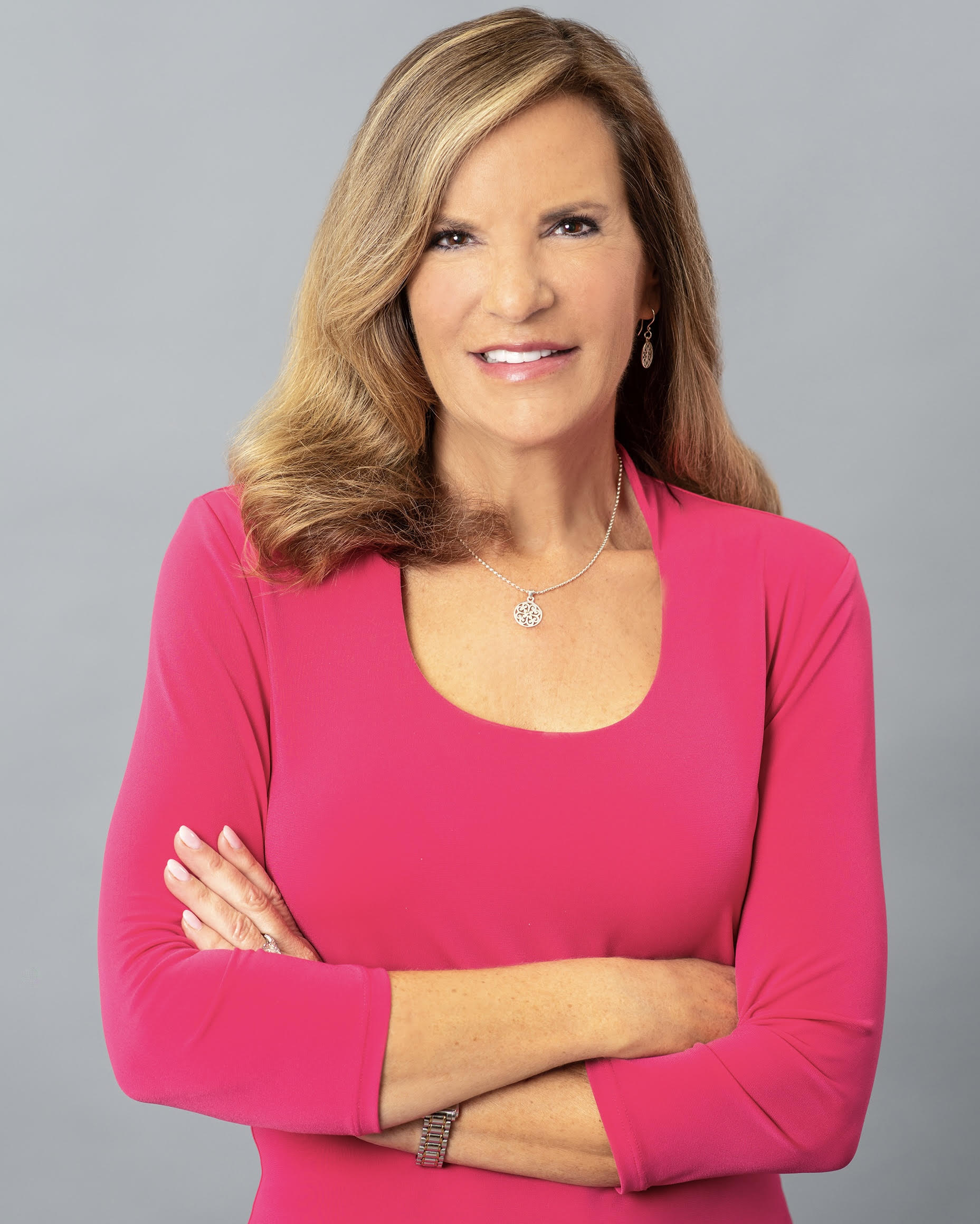

PAULA ZUSI

Age: 61

Director |

Paula Zusi has served as a member of our Board since August 2021. Prior to the Pre-IPO Reorganization, Ms. Zusi had been a member of the Board of Managers of Penelope Group GP since July 2020. In 2015, Ms. Zusi founded Global Retail Advisors, LLC, which provides consulting on supply chain and operational capabilities to companies and investment firms, including Advent International Corporation and some of its portfolio companies. Advent International Corporation is affiliated with the Advent Funds that acquired the Olaplex business in January 2020. Ms. Zusi specializes in driving gross margin improvement, as well as building supply chain and operational capabilities for high growth companies. Previously, Ms. Zusi was the Executive Vice President and Chief Supply Chain Officer at Ann Inc., parent company of the Ann Taylor and Loft brands from 2008 to 2014. Prior to joining Ann Inc., Ms. Zusi was the Corporate Vice President at Liz Claiborne, Inc. from 1999 to 2008. Prior to joining Liz Claiborne Inc., Ms. Zusi held leadership roles in various apparel and retail related companies. Ms. Zusi is currently a Board member and former Chairman of the American Apparel and Footwear Association and serves on the Advisory Board of the University of Delaware college of Fashion and Apparel studies. Ms. Zusi earned a B.S. in Fashion and Apparel Studies from the University of Delaware. We believe Ms. Zusi is qualified to serve on our Board because of her more than 30 years of experience in supply chain and operations. |

Class II – Directors with Terms Expiring in 2023

| | | | | | | | |

|

JANET GURWITCH

Age: 69

Director

|

Janet Gurwitch has served as a member of our Board since August 2021. Prior to the Pre-IPO Reorganization, Ms. Gurwitch had been a member of the Board of Managers of Penelope Group GP since May 2020. Ms. Gurwitch has worked with Advent International Corporation since April 2020 as an operating partner focusing on the beauty and wellness sector. Advent International Corporation is affiliated with the Advent Funds that acquired the Olaplex business in January 2020. Prior to Advent, Ms. Gurwitch served as an operating partner for Castanea Partners, a Boston-based private equity firm, from 2009 to 2019. In addition, Ms. Gurwitch founded Laura Mercier Cosmetics & Skincare in 1995, where she served as Chief Executive Officer from 1995 to 2008. Prior to founding Laura Mercier, Ms. Gurwitch served as the Executive Vice President of Neiman Marcus from 1992 to 1995. Ms. Gurwitch currently serves on the board of directors of Houston Astros baseball team. She formerly served on the board of directors of Drybar from 2012 to 2022, Tatcha from 2017 to 2019, First Aid Beauty from 2015 to 2018, and Urban Decay Cosmetics from 2009 to 2012. Ms. Gurwitch earned a B.A. in Retail from the University of Alabama. We believe Ms. Gurwitch is qualified to serve on our Board because of her expertise in the beauty consumer industry and her experience founding, advising and investing in beauty and retail companies. |

|

MARTHA MORFITT

Age: 64

Director

|

Martha (Marti) Morfitt has served as a member of our Board since August 2021. Prior to the Pre-IPO Reorganization, Ms. Morfitt had been a member of the Board of Managers of Penelope Group GP since April 2021. Ms. Morfitt is a principal of River Rock Partners, Inc., a business and cultural transformation consulting firm, where she has served since 2008. Additionally, Ms. Morfitt served as the Chief Executive Officer of Airborne, Inc. from 2009 to 2012. Ms. Morfitt also held various positions at CNS, Inc., including President and Chief Executive Officer from 2001 to 2007 and Chief Operating Officer from 1998 to 2001. Prior to that, Ms. Morfitt worked for The Pillsbury Company in a succession of marketing and leadership roles beginning in 1982. Ms. Morfitt currently serves on the board of directors of Graco, Inc. and Lululemon Athletica, Inc. She previously served on the Board of Mercer International, Inc. from 2017 to 2020 and Life Time Fitness, Inc. from 2008 to 2015. She earned her H.B.A. in Marketing & Strategy from the Richard Ivey School of Business at the University of Western Ontario, and an M.B.A. from the Schulich School of Business at York University. We believe Ms. Morfitt is qualified to serve on our Board because of her exceptional knowledge of business and strategy and her vast management experience. |

| | | | | | | | |

|

DAVID MUSSAFER

Age: 58

Director

|

David Mussafer has served as a member of our Board since August 2021. Prior to the Pre-IPO Reorganization, Mr. Mussafer had been a member of the Board of Managers of Penelope Group GP since January 2020. Mr. Mussafer is Chairman and Managing Partner of Advent International Corporation, which he joined in 1990. Advent International Corporation is affiliated with the Advent Funds that acquired the Olaplex business in January 2020. Prior to Advent, Mr. Mussafer worked at Chemical Bank from 1985 to 1988. Mr. Mussafer has led or co-led more than 30 buyout investments at Advent across a range of industries. Mr. Mussafer’s current directorships include Aimbridge Hospitality, First Watch Restaurant Group, Inc., Lululemon Athletica, Inc. and Thrasio. Mr. Mussafer holds a B.S.M., cum laude, from Tulane University and an M.B.A. from the Wharton School of the University of Pennsylvania. We believe Mr. Mussafer is qualified to serve on our Board because his extensive experience enables him to provide valuable insights regarding board processes and operations as well as the relationship between our Board and stockholders. |

|

EMILY WHITE

Age: 43

Director

|

Emily White has served as a member of our Board since August 2021. Prior to the Pre-IPO Reorganization, Ms. White had been a member of the Board of Managers of Penelope Group GP since January 2020. She has served as President of Anthos Capital, a Los Angeles-based investment firm since 2018. She spent the last two decades helping build and operate some of technology’s most notable companies including Google, Facebook, Instagram and Snapchat. Ms. White served as Snapchat’s Chief Operating Officer from 2014 to 2015. Prior to joining Snapchat, Ms. White held several leadership roles at Facebook Inc., a social networking company, from 2010 to 2013 including Director of Local Business Operations, Director of Mobile Business Operations and Head of Business Operations at Instagram. From 2001 to 2010, Ms. White worked at Google where she ran North American Online Sales and Operations, Asia Pacific & Latin America business and the Emerging Business channel. Ms. White is also a board member to companies including Lululemon Athletica, Inc., a public athletic apparel retailer, and Graco, Inc., a publicly traded fluid handling systems and components company, and private companies including Railsbank and Guayaki. She has also served on the boards of the National Center for Women in I.T., a non-profit coalition working to increase the participation of girls and women in computing and technology, X-Prize, a non-profit focused on creating breakthroughs that pull the future forward. She received a B.A. in Art History from Vanderbilt University. We believe Ms. White is qualified to serve on our Board because of her extensive experience with social networking and technology companies, her understanding of the demographics in which our principal customers reside and the diversity in background and experience she provides to our Board. |

Class III – Directors with Terms Expiring in 2024

| | | | | | | | |

|

CHRISTINE DAGOUSSET

Age: 57

Chair of Board of Directors

|

Christine Dagousset has served as a member of our Board since August 2021. Prior to the Pre-IPO Reorganization, Ms. Dagousset had been a member of the Board of Managers of Penelope Group GP since May 2020. Ms. Dagousset has worked at Chanel since 1998, holding various roles including Senior Vice President from 1998 to 2005, Executive Vice President from 2005 to 2014, Global President of Fragrance and Beauty from 2015 to 2018 and, most recently, Global Long Term Development Officer. Ms. Dagousset’s current directorships include Capsum, Developer of Cosmetic Innovation Technologies, 2016 to present and Detox Market, a Clean Beauty Marketplace, 2018 to present. Ms. Dagousset earned a Marketing Degree from Institut Supérieur de Gestion ISG. We believe Ms. Dagousset is qualified to serve on our Board because her extensive experience in the beauty industry enables her to provide valuable and current insights to the Board. |

|

TRICIA GLYNN

Age: 41

Lead Director

|

Tricia Glynn has served as a member of our Board since August 2021. Prior to the Pre-IPO Reorganization, Ms. Glynn had been a member of the Board of Managers of Penelope Group GP since January 2020. Ms. Glynn has worked at Advent International Corporation since 2016 as a managing director, focusing on buyouts and growth equity investments in the retail, consumer and leisure sector. Advent International Corporation is affiliated with the Advent Funds that acquired the Olaplex business in January 2020. Prior to Advent, Ms. Glynn spent 15 years investing across both Bain Capital Private Equity and the Private Equity Group of Goldman, Sachs & Co. She has closed transactions across the retail, healthcare, business services, real estate and media sectors, both domestically and internationally. From 2012 to 2018, Ms. Glynn served on the board of Burlington Stores Inc. and from 2017 until June 2021, Ms. Glynn served on the board of Lululemon Athletica, Inc. Her current directorships include First Watch Restaurant Group, Inc. and SavageXFenty. Ms. Glynn earned a B.A. in Biochemical Sciences cum laude from Harvard College and an M.B.A., with high distinction, as a Baker Scholar from Harvard Business School. We believe Ms. Glynn is qualified to serve on our Board because her experience advising and investing in retail and consumer companies enables her to provide valuable and current insights to our Board. |

| | | | | | | | |

|

JUE WONG

Age: 58

President, Chief Executive Officer and Director |

JuE Wong has served as a member of our Board since August 2021, has served as our Chief Executive Officer since January 2020 and has served as President and Chief Executive Officer of Olaplex Holdings, Inc. since August 2021. Prior to the Pre-IPO Reorganization, Ms. Wong had been a member of the board of managers of Penelope Group GP since February 2020. Ms. Wong has extensive experience in scaling business and financial performance for all classes of business from emerging businesses, middle market growth organizations and established/ legacy companies. She has strategic and operating expertise in digital and technology-driven platforms of growth. Prior to joining Olaplex, Ms. Wong served as the Global Chief Executive Officer of Moroccanoil Inc. from 2017 to 2019, the President of Elizabeth Arden from 2015 to 2017, and the Chief Executive Officer of StriVectin from 2012 to 2015. Ms. Wong currently serves as a director for Cosmetics Executive Women and Committee of 200 (C200). Ms. Wong earned a B.A. (Honors) in Political Science from the Australian National University. |

DIRECTOR COMPENSATION

The following table sets forth information concerning the compensation earned by our directors during fiscal year 2021. Mses. Wong and Walden did not receive any compensation for their respective service as a director during fiscal year 2021. The compensation Mses. Wong and Walden received in respect of their employment is included in the section entitled “Executive Compensation—Summary Compensation Table.”

| | | | | | | | | | | |

| Name | Fees earned or paid in cash ($) | Option awards ($) | Total ($) |

| (1) | (2) | |

| Christine Dagousset | 115,000 | | 115,000 |

| Deirdre Findlay | 103,750 | | 103,750 |

| Tricia Glynn | 37,500 | | 37,500 |

| Janet Gurwitch | 292,500 | | 292,500 |

| Martha Morfitt | 82,500 | 492,988 | 575,488 |

| David Mussafer | 27,500 | | 27,500 |

| Emily White | 27,500 | | 27,500 |

| Michael White | 28,750 | | 28,750 |

| Paula Zusi | 103,750 | | 103,750 |

(1)Amounts shown in this column reflect (i) cash retainers earned by certain of our directors in fiscal year 2021 prior to the Company’s initial public offering (the “IPO”) at a rate of $100,000 per year for Mses. Dagousset, Morfitt, Findlay, and Zusi, and a rate of $350,000 per year for Ms. Gurwitch, with the amount for Ms. Morfitt reflecting pro ration for her partial year of service in fiscal year 2021 prior to the IPO, and (ii) cash retainers earned by our directors in fiscal year 2021 subsequent to the IPO at a rate of $100,000 per year plus applicable amounts for each additional chair position as described further below.

(2)Amounts shown in this column reflect the aggregate grant date fair value of non-qualified options to purchase shares of common stock of Penelope Holdings Corp., a wholly owned subsidiary of the Company, granted in fiscal year 2021, computed in accordance with FASB ASC Topic 718, excluding the effect of estimated forfeitures. The assumptions used to calculate this amount are disclosed in Note 11 to the Company's consolidated financial statements for the year ended December 31, 2021, including the assumed probability that an exit event or other liquidity event will occur. In connection with the Pre-IPO Reorganization and the IPO, each outstanding option to purchase shares of common stock of Penelope Holdings Corp., including each option held by the non-employee members of our Board, was converted into an option to purchase a number of shares of Common Stock of Olaplex Holdings, Inc. based on the exchange ratio at which Class A common units of Penelope Group Holdings, L.P. were exchanged for shares of Common Stock of Olaplex Holdings, Inc. with a corresponding adjustment to the exercise price that preserved the option’s spread value.

As of December 31, 2021, the non-employee members of our Board held the following number of options to purchase Common Stock of Olaplex Holdings, Inc.: Christine Dagousset (506,250), Deirdre Findlay (506,250), Janet Gurwitch (1,350,000). Martha Morfitt (506,525) and Paula Zusi (506,250). These stock options are eligible to vest as follows, subject to the director’s continued service through the applicable vesting date: (1) 130,140 of Ms. Dagousset’s options were vested as of December 31, 2021, 231,660 of Ms. Dagousset’s options are eligible to vest in four equal installments on each of May 1, 2022, May 1, 2023, May 1, 2024, and May 1, 2025, and 144,450 of Ms. Dagousset’s options are eligible to vest in three equal installments on October 4, 2022, October 4, 2023 and October 4, 2024; (2) 130,140 of Ms. Findlay’s options were vested as of December 31, 2021, 231,660 of Ms. Findlay’s options are eligible to vest in four equal installments on each of September 28, 2022, September 28, 2023, September 28, 2024, and September 28, 2025, and 144,450 of Ms. Findlay’s options are eligible to vest in three equal installments on October 4, 2022, October 4, 2023 and October 4, 2024; (3) 347,220 of Ms. Gurwitch’s options were vested as of December 31, 2021, 616,680 of Ms. Gurwitch’s options are eligible to vest in four equal installments on each of May 1, 2022, May 1, 2023, May 1, 2024, and May 1, 2025, and 386,100 of Ms. Gurwitch’s options are eligible to vest in three equal installments on October 4, 2022, October 4, 2023 and October 4, 2024; (4) 72,225 of Ms. Morfitt’s options were vested as of December 31, 2021, 289,575 of Ms. Morfitt’s options are eligible to vest in five equal installments on each of April 20, 2022, April 20, 2023, April 20, 2024, April 20, 2025, and April 20, 2026, and 144,450 of Ms. Morfitt’s options are eligible to vest in three equal installments on October 4, 2022, October 4, 2023 and October 4, 2024; and (5) 130,140 of Ms. Zusi’s options were vested as of December 31, 2021, 231,660 of Ms. Zusi’s options are eligible to vest in four equal installments on each of July 21, 2022, July 21, 2023, July 21, 2024, and July 21, 2025, and 144,450 of Ms. Zusi’s options are eligible to vest in three equal installments on October 4, 2022, October 4, 2023 and October 4, 2024. These options vest in full upon a change of control, subject to the director’s continued service through the change of control.

In connection with our IPO, our Board adopted a non-employee director compensation policy, which policy became effective upon the completion of the IPO and for compensation beginning October 1, 2021, to be paid in arrears at the beginning of our fiscal year 2022.

Under our non-employee director compensation policy, each non-employee director will receive an annual cash retainer for service on our Board and an additional annual cash retainer for service on any committee of our Board or for serving as the chair of our Board or any of its committees, in each case, pro-rated for partial years of service, as follows:

•each non-employee director will receive an annual cash retainer of $100,000 ($150,000 for the chair of our Board and $120,000 for the lead director);

•each non-employee director who is a member of the Audit Committee will receive an additional annual cash retainer of $15,000 ($30,000 for the Audit Committee chair);

•each non-employee director who is a member of the Compensation Committee will receive an additional annual cash retainer of $10,000 ($20,000 for the Compensation Committee chair); and

•each non-employee director who is a member of the Nominating and Corporate Governance Committee will receive an additional annual cash retainer of $10,000 ($15,000 for the Nominating and Corporate Governance Committee Chair).

On the date of the first Board meeting following each annual meeting of our stockholders, each non-employee director will be granted an award of restricted stock units of Olaplex Holdings, Inc. with an aggregate value of approximately $150,000 (or $250,000 in the case of the Board chair). Each annual award will vest on the first anniversary of the date of grant, subject to the non-employee director’s continued service as a director through such date.

All cash retainers will be paid quarterly, in arrears, or upon the earlier resignation or removal of the non-employee director.

Each non-employee director is entitled to reimbursement for reasonable travel and other expenses incurred in connection with attending meetings of our Board and any committee on which he or she serves.

CORPORATE GOVERNANCE

Board Meetings and Executive Sessions

In connection with the IPO, we completed a corporate reorganization, pursuant to which former members of the board of managers of Penelope Group GP became directors of Olaplex Holdings, Inc., the parent of Olaplex, Inc., our primary operating subsidiary (the “Pre-IPO Reorganization”). Since the Pre-IPO Reorganization, our Board held three meetings during 2021. During that time, no member of our Board attended fewer than 75% of the aggregate of (i) the total number of meetings of our Board (held during the period for which she/he was a director) and (ii) the total number of meetings held by all committees of our Board on which she/he served (held during the period that such director served).

Periodically throughout the year, the non-employee and independent directors meet in executive session without members of management present. These meetings allow such directors to discuss issues of importance to the Company, including the business and affairs of the Company and matters concerning management, without any member of management present.

Controlled Company Status

We are a “controlled company” within the meaning of the corporate governance standards of the Nasdaq Stock Market LLC. Under these corporate governance standards, a company of which more than 50% of the voting power for the election of directors is held by an individual, group or other company is a “controlled company” and may

elect, and we have elected, not to comply with certain corporate governance standards, including the requirements that (1) a majority of our Board consist of independent directors, (2) our Board have a compensation committee that consists entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities, and (3) our director nominations be made, or recommended to our full Board, by our independent directors or by a nominations committee that consists entirely of independent directors and that we adopt a written charter or board resolution addressing the nominations process. In the event that we cease to be a “controlled company” and our shares continue to be listed on the Nasdaq Global Select Market, we will be required to comply with these provisions within the applicable transition periods.

Board Independence

Our Corporate Governance Guidelines provide that our Board shall consist of such number of directors who are independent as is required and determined in accordance with applicable laws and regulations and requirements of the Nasdaq Stock Market LLC and the SEC rules. Under our Corporate Governance Guidelines, an “independent” director shall be one who meets the qualification requirements for being an independent director under applicable laws and the corporate governance listing standards of the Nasdaq Stock Market LLC, including the requirement that the Board must have affirmatively determined that the director has no material relationships with the Company, either directly or as a partner, stockholder or officer of an organization that has a relationship with the Company in order to be considered “independent.” To guide its determination as to whether or not a business or charitable relationship between the Company and an organization with which a director is so affiliated is material, the Board, or designated committee of the Board, may from time to time adopt categorical standards of independence.

Since we are a “controlled company,” the Board is not required to consist of a majority of independent directors and the Compensation Committee and the Nominating and Corporate Governance Committee are not required to consist entirely of independent directors. The Board has determined to rely on exemptions permitted for controlled companies.

Committees and Committee Composition

During fiscal 2021, the Board had three standing committees: the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. The members of each committee are appointed by the Board and serve until their successor is elected and qualified, unless they are earlier removed or resign. In addition, from time to time, special committees may be established under the direction of the Board when necessary to address specific issues. As we are a “controlled company” within the meaning of the corporate governance standards of the Nasdaq Stock Market LLC, our Compensation Committee and Nominating and Corporate Governance Committee are not composed entirely of independent directors as defined under such standards. The controlled company exception does not modify the independence requirements for the Audit Committee and we currently comply with the audit committee requirements of the Sarbanes-Oxley Act and the corporate governance standards of the Nasdaq Stock Market LLC. Pursuant to such requirements, the Audit Committee must be composed of at least three members, a majority of whom must be independent within 90 days of the listing of our Common Stock on the Nasdaq Global Select Market, and all of whom must be independent within one year of the listing of our Common Stock on the Nasdaq Global Select Market. The table below provides information about the membership of these committees during fiscal 2021:

| | | | | | | | | | | |

| Name | Audit | Compensation | Nominating and Corporate Governance |

| Christine Dagousset | | X | |

| Deirdre Findlay | | | C |

| Tricia Glynn | | C | X |

| Janet Gurwitch | | | X |

| Martha Morfitt | C | | |

| David Mussafer | | X | |

| | | | | | | | | | | |

| Emily White | | | X |

| Michael White | X | | |

| Paula Zusi | X | | |

| Number of meetings during fiscal 2021 following the Pre-IPO Reorganization | 1 | 1 | 0 |

C Committee Chairperson

Audit Committee — The Audit Committee’s purpose, roles and responsibilities are set forth in a written charter adopted by our Board, which can be found on the Investors Relations website at https://ir.olaplex.com/ under “Governance.” The Audit Committee reports to the Board and is responsible for the following:

•appoint or replace, compensate and oversee the outside auditors, who will report directly to the Audit Committee, for the purpose of preparing or issuing an audit report or related work or performing other audit, review or attest services for us;

•pre-approve all auditing services and permitted non-audit services (including the fees and terms thereof) to be performed for us by our outside auditors, subject to de minimis exceptions that are approved by the Audit Committee prior to the completion of the audit;

•review and discuss with management and the outside auditors the annual audited and quarterly unaudited financial statements, our disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the selection, application and disclosure of critical accounting policies and practices used in such financial statements; and

•discuss with management and the outside auditors any significant financial reporting issues and judgments made in connection with the preparation of our financial statements, including any significant changes in our selection or application of accounting principles, any major issues as to the adequacy of our internal controls and any special steps adopted in light of material control deficiencies.

The Audit Committee consists of Martha Morfitt, Michael White and Paula Zusi, with Martha Morfitt serving as the chairperson of the Committee. Our Board has determined that each of Martha Morfitt and Paula Zusi meets the independence requirements of Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the governance and listing standards of the Nasdaq Stock Market LLC. We intend to continue to comply with the audit committee requirements of the Sarbanes-Oxley Act and the governance and listing standards of the Nasdaq Stock Market LLC. Pursuant to such requirements, the Audit Committee must be composed of at least three members, a majority of whom must be independent within 90 days of the listing of our Common Stock on the Nasdaq Global Select Market, and all of whom must be independent within one year of the listing of our Common Stock on Nasdaq Global Select Market. Pursuant to these requirements, Mr. White will no longer be eligible to serve on the Audit Committee as of September 30, 2022. Our Board has determined that all members of our Audit Committee have financial sophistication as contemplated under the Nasdaq Stock Market LLC listing standards and that Martha Morfitt is an “audit committee financial expert” within the meaning of the applicable rules of the SEC. Our Board has adopted a written charter under which the Audit Committee operates. A copy of the charter, which satisfies the applicable standards of the SEC and the Nasdaq Stock Market LLC, is available on our Investor Relations website at https://ir.olaplex.com/ under “Governance”.

Compensation Committee — The purpose of the Compensation Committee is to assist the Board in fulfilling its responsibilities relating to oversight of the compensation and benefits of the Company’s officers, employees and directors, assessing the adequacy of the Company’s compensation principles and philosophy and administering the Company’s compensation, benefit and equity-based plans. The Compensation Committee consists of Christine Dagousset, Tricia Glynn and David Mussafer, with Tricia Glynn serving as the chairperson of the Committee. Our Board has adopted a written charter under which the Compensation Committee operates. A copy of the charter, which satisfies the applicable standards of the SEC and the Nasdaq Stock Market LLC, is available on our Investor Relations website at https://ir.olaplex.com/ under “Governance”.

Nominating and Corporate Governance Committee — The purpose of the Nominating and Corporate Governance Committee is to identify individuals qualified to become members of the Board, recommend to the Board director nominees for the next annual meeting of stockholders, develop and recommend to the Board a set of corporate governance principles applicable to the Company and oversee the evaluation of the Board and its dealings with management as well as appropriate committees of the Board. The Nominating and Corporate Governance Committee consists of Deirdre Findlay, Janet Gurwitch, Tricia Glynn and Emily White, with Deirdre Findlay serving as the chairperson of the Committee. Our Board has adopted a written charter under which the Nominating and Corporate Governance Committee operates. A copy of the charter, which satisfies the applicable standards of the SEC and the Nasdaq Stock Market LLC, is available on our Investor Relations website at https://ir.olaplex.com/ under “Governance”.

Compensation Committee Interlocks and Insider Participation

None of our executive officers serves as a member of the Board or Compensation Committee, or other committee serving an equivalent function, of any other entity that has one or more of its executive officers serving as a member of our Board or Compensation Committee.

Our Board’s Role in Risk Oversight

It is management’s responsibility to manage risk and bring to the Board’s attention risks that are material to Olaplex. The Board has oversight responsibility for the systems established to report and monitor the most significant risks applicable to Olaplex. The Board believes that evaluating the executive team’s management of the various risks confronting Olaplex is one of its most important areas of oversight. In accordance with this responsibility, the Board administers its risk oversight role directly and through its committee structure and the committees’ regular reports to the Board at Board meetings. The Board reviews strategic business and corporate plans, oversees the Company’s risk management and mitigation activities, monitors the administration of policies, and safeguards the integrity of the Company’s business operations and financial reporting. The Audit Committee oversees financial and accounting matters, including financial reporting, disclosure, internal controls over financial reporting, ethics and compliance programs, and regulatory compliance. In addition, the Audit Committee also oversees and reviews with management the Company’s policies, procedures and practices with respect to risks related to information security, cyber security and data protection. The Compensation Committee oversees and assesses the adequacy of, and any risk inherent in, the Company’s compensation and benefits, as well as reviews and administers compensation programs, plans and arrangements.

Commitment to Social and Environmental Consciousness

We are passionate about promoting wellness, starting with the integrity of your hair and extending to supporting our communities and minimizing our impact on the environment, allowing us to drive social and environmental awareness in the beauty industry. Our Board, through its Nominating and Corporate Governance Committee, oversees Olaplex’s policies and practices with respect to corporate social responsibility and environmental sustainability applicable to Olaplex. Our key initiatives include:

• Supporting Small Businesses. We are invested in the success of our hairstylist community as

their businesses grow alongside ours. We are especially focused on providing support to the small business community and minority hairstylists; currently 98% of our salon community is made up of small businesses and a meaningful percentage of our hairstylists are racial or ethnic minorities. In addition, we offer complimentary live education, detailed product knowledge training, certification testing and (once certified), a printable certificate and an "Olaplex Certified Stylist" title as part of our professional community education support programs.

• Environmental Sustainability. We continue to explore ways to reduce our carbon footprint and

contribute to a more sustainable future for our planet. By taking preventative measures, we’re able to lighten our carbon footprint and do our part in making the world a better place. One of our key initiatives is to reduce the impact of our packaging. We are focused on limiting the use of secondary packaging in which

our products are sold. By pursuing these packaging reduction initiatives, we believe that between 2015 to 2021 we avoided the use of approximately 2.9 million pounds of paper packaging, which we believe prevented approximately 23 million pounds of greenhouse gas from being emitted into the environment, conserved approximately 37 million gallons of water and saved approximately 29,000 trees from deforestation, as compared to manufacturing, packaging and distribution alternatives. In addition, our products are cruelty-free, and we strive to produce clean products that exclude certain harmful ingredients and promote wellness of hair without threatening the environment. These efforts are well recognized in the industry. As of December 2021, OLAPLEX was one of only 26 haircare brands (out of 74 total haircare brands sold by Sephora) accredited with the “Clean at Sephora” designation, which is defined as products that are free from over 50 ingredients including sulfates, parabens, phthalates, mineral oil, and formaldehyde.

• Charitable Donations. In March 2022, we introduced the Shopping Gives program to our website,

www.olaplex.com. Shopping Gives is a charitable initiative whereby we donate $1 for every order that a retail or professional customer buys, at no additional cost to the customer. Customers can choose from a list of causes to benefit from their purchase.

• Diversity, Equity, and Inclusion. We believe it is important that our employees reflect the diversity of our hairstylist and consumer community. Our Diversity, Equity, and Inclusion (“DE&I”) initiatives focus on promoting a workplace of inclusion and acceptance. In January 2021, we established “DE&I Champions,” which is a group of six employees who reinforce our collective commitment to foster a diverse, equitable, and inclusive culture. Their role is to identify opportunities to further engage our employees through training and education, encouraging candid conversations, and leading by example. The DE&I Champions have weekly conversations to identify strategies to help Olaplex further evolve the DE&I strategy, and Olaplex holds monthly cultural events for all employees.

As a result of our efforts, we have created a diverse workplace environment with 76% of our employees identifying as female and 46% identifying as non-white, as of December 31, 2021. We are especially proud that our diverse workforce reflects the community of professional hairstylists we serve, of which 92% identify as women and 37% identify as African American, Asian or Latino as of December 31, 2021. Many of our current Olaplex employees are former stylists whose unique perspectives and insights have helped us better understand our diverse consumer base and what matters to them. Additionally, nine of the 11 members of our Board are female, and we believe our shared commitment to diversity helps us better understand our professional consumer base and connect with the hairstylist community.

• Employee Wellbeing. We prioritize supporting the overall wellbeing of our employees. We are proud of the fact that an employee survey from February 2022 found that 97% of our employees agree that they are proud to work for Olaplex. In 2022, we also introduced a Professional Development Reimbursement Policy to encourage employees to attend trainings, courses, and other programs that are directly related to their career growth at Olaplex. In addition, we have a Hero Recognition Program, whereby two employees are chosen to receive an award for their outstanding performance each month. As a fully remote company, we have also adopted a New Hire Bond Buddy program to help new employees integrate into the Company and meet fellow employees. We also offer competitive pay and benefits, including a 401(k) plan with matching contribution opportunities.

Diversity and Board Expertise

We seek to have a Board that represents diversity as to experience, gender and ethnicity/race, but we do not have a formal policy with respect to diversity. We also seek to have a Board that embodies a combination of skills, professional experience and diversity of viewpoints necessary to oversee our business.

| | | | | | | | | | | | | | |

| Board Diversity Matrix (as of April 19, 2022) |

| Total Number of Directors | 11 |

| Female | Male | Non-Binary | Did Not Disclose Gender |

| Part I: Gender Identity |

| Directors | 9 | 2 | - | - |

| Part II: Demographic Background |

| African American or Black | 1 | - | - | - |

| Alaskan Native or Native American | - | - | - | - |

| Asian | 1 | - | - | - |

| Hispanic or Latinx | - | - | - | - |

| Native Hawaiian or Pacific Islander | - | - | - | - |

| White | 7 | 2 | - | - |

| Two or More Races or Ethnicities | - | - | - | - |

| LGBTQ+ | - |

| Demographic Background Undisclosed | - |

Board and Committee Annual Performance Reviews

Our Corporate Governance Guidelines provide that the Nominating and Corporate Governance Committee is responsible for reporting annually to the Board an evaluation of the overall performance of the Board. In addition, the written charters of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee provide that each such committee shall evaluate its performance on an annual basis using criteria that it has developed and shall report to the Board on its findings.

Director Nominations

Criteria and Process of Identifying and Evaluating Candidates for Consideration as a Director Nominee

Under its charter, our Nominating and Corporate Governance Committee is responsible for recommending to the Board candidates to stand for election to the Board at the Company’s annual meeting of stockholders and for recommending candidates to fill vacancies on the Board that may occur between annual meetings of stockholders. The Nominating and Corporate Governance Committee may receive suggestions for new directors from a number of sources, including Board members and our President and Chief Executive Officer, and may also, in its discretion, employ a third-party search firm to assist in identifying candidates for director. The Corporate Governance Guidelines provide that each director should possess a combination of skills, professional experience and diversity of viewpoints necessary to oversee the Company’s business. Board members are expected to become and remain informed about the Company, its business and its industry and rigorously prepare for, attend and participate in all Board and applicable committee meetings. The Nominating and Corporate Governance Committee evaluates each individual in the context of ability, judgment, experience, and overall diversity and composition of the Board, with the objective of recommending a group that can best perpetuate the success of our business and represent stockholder interests through the exercise of sound judgment. In addition, the Nominating and Corporate Governance Committee considers, in light of our business, each director nominee’s experience, qualifications, attributes and skills that are identified in the biographical information contained in this Proxy Statement.

Procedures for Recommendation of Director Nominees by Stockholders

The Nominating and Corporate Governance Committee considers properly submitted recommendations for candidates to the Board from stockholders in accordance with our Amended and Restated Bylaws (“Bylaws”). Any

stockholder may submit in writing a candidate for consideration for each stockholder meeting at which directors are to be elected by no later than the close of business on the 90th day nor earlier than the close of business on the 120th day prior to the anniversary date of the prior year’s annual meeting, except that if the annual meeting is set for a date that is not within 30 days of such anniversary date, we must receive the notice no later than the close of business on the tenth day following the day on which the date of the annual meeting is first disclosed in a public announcement. Any stockholder recommendations for consideration by the Nominating and Corporate Governance Committee should include the candidate’s name, biographical information and the information required by Section 1.2 of our Bylaws. The Nominating and Corporate Governance Committee evaluates candidates for the position of director recommended by stockholders in the same manner as candidates from other sources.

Board Leadership Structure

Our Board has elected Christine Dagousset as the Chair of the Board. While our Corporate Governance Guidelines allow for our Chair to also be an executive officer, the Board believes that it is currently in the best interests of the Company to separate these roles. Our Board has also elected Tricia Glynn as Lead Director.

The Board believes that the combination of the Chair and Lead Director, as well as the exercise of key Board oversight responsibilities by independent directors, provides an effective balance for the management of the Company in the best interest of our stockholders.

Classified Board Structure

Since our IPO, we have maintained a classified board structure in which directors are divided into three classes and one class is elected each year to serve a three-year term. The Board believes that this classified board structure promotes continuity and stability of strategy, encourages a long-term perspective by Company management, because a majority of directors will always have experience as directors of the Company, and facilitates the ability of the Board to focus on creating long-term stockholder value.

Succession Planning

The Chief Executive Officer reviews succession planning and management development with the Board and the Nominating and Corporate Governance Committee on an annual basis. This succession planning includes the development of policies and principles for selection of the Chief Executive Officer, including succession in the event of an emergency or retirement.

Policies Relating to Directors and Service

It is the belief of the Board that directors who retire or otherwise change the principal occupation or background association they held when they were originally invited to join the Board will provide notice of the change to the Nominating and Corporate Governance Committee or the Board and, if the Nominating and Corporate Governance Committee determines it to be appropriate, offer to resign from the Board. The Board does not believe that directors who retire or otherwise change the principal occupation or background association they held when they were originally invited to join the Board should necessarily leave the Board. There should, however, be an opportunity for the Board to review the continued appropriateness of that director’s membership under the new circumstances.

Our Corporate Governance Guidelines also require that each director should advise the Nominating and Corporate Governance Committee or the Board in advance of accepting an invitation to serve as a member on another board of directors. In general, the Board does not have a policy limiting the number of other public company boards of directors upon which a director may sit. However, the number of other boards of directors (or comparable governing bodies), particularly with respect to public companies, on which a prospective nominee is a member, may be a factor considered by the Board in recommending any candidate for nomination. Although the Board does not impose a limit on outside directorships, it does recognize the substantial time commitments attendant to membership on the Board and expects that directors devote all such time as is necessary to fulfill their accompanying responsibilities, both in terms of preparation for, and attendance and participation at, meetings.

It is assumed that when the Chief Executive Officer resigns from that position that she or he will also offer her or his resignation from the Board to the Nominating and Corporate Governance Committee, as well as offer her or his resignation from the boards of directors of any subsidiaries of the Company on which she or he serves. Whether that individual continues to serve on the Board is a matter for discussion at that time between the Board and the new Chief Executive Officer. In addition, a director, other than the Chief Executive Officer, who is also an employee of the Company, should offer her or his resignation from the Board to the Nominating and Corporate Governance Committee contemporaneously with her or his retirement/resignation from the management of the Company. The Board will then have an opportunity to review the continued appropriateness of that director’s membership under the circumstances.

Pursuant to our Audit Committee charter, members may serve on no more than three additional public company audit committees simultaneously without prior review and determination by the Board that such simultaneous service would not impair the ability of such member to effectively serve on the Company’s Audit Committee.

Communications with Directors

Stockholders and other interested parties may communicate directly with the Board, the non-employee directors or the independent directors as a group, or specified individual directors by e-mailing to such individual or group c/o Secretary, Olaplex Holdings, Inc., at proxy@olaplex.com. The Secretary will forward such communications to the relevant group or individual at or prior to the next meeting of the Board.

Code of Conduct and Ethics

We have adopted a written Code of Conduct and Ethics, applicable to all of our directors, officers, employees and “Business Associates”, which includes brand ambassadors, brand advocates, vendors and contractors performing services or carrying out activities on behalf of the Company. The Code of Conduct and Ethics is designed to ensure that our business is conducted with integrity. It covers, among other things, professional conduct, conflicts of interest, accurate recordkeeping and reporting, public communications and the protection of confidential information, as well as adherence to laws and regulations applicable to the conduct of our business. In the event that any substantive amendment is made or any waiver is granted, the waiver will be posted on our Investor Relations website.

Policy Against Hedging of Stock

Our Insider Trading Policy prohibits our directors, officers and employees from entering into hedging transactions, including through the use of financial instruments such as prepaid variable forwards, equity swaps, collars and exchange funds, because such transactions may permit a director, officer or employee to continue to own securities obtained through our employee benefit plans or otherwise, but without the full risks and rewards of ownership. When that occurs, the individual may no longer have the same objectives as our other stockholders.

Stock Ownership Guidelines

On February 28, 2022 (the “Adoption Date”), the Board adopted stock ownership guidelines that require each of our executive officers (“Executive Officers”), all non-employee directors, or “outside directors” other than members of the Board who are designated by investment funds affiliated with Advent International Corporation (“Outside Directors”) and all other executives of the Company designated by the Compensation Committee of the Board as subject to the guidelines (each, a “Designated Executive,” and collectively with the Executive Officers, “Covered Employees”) to maintain a stock ownership level equal to a specific multiple of their total target annual cash compensation or their annual retainer, as applicable. Pursuant to the guidelines, (i) our Chief Executive Officer and Chief Operating Officer are required to hold vested equity (as measured in accordance with the guidelines) with a value equal to at least five (5) times his or her total target annual cash compensation, (ii) all other Covered Employees are required to hold vested equity with a value equal to at least three (3) times his or her total target annual cash compensation and (iii) Outside Directors are required to hold vested equity with a value equal to five

(5) times the amount of the annual retainer paid to Outside Directors for service on the Board (excluding additional chair or lead director, committee or committee chair retainers, if any).

Covered Employees who were employed by the Company as of September 30, 2021 will be required to achieve the applicable level of ownership as of the Adoption Date. Covered Employees who commence their employment with the Company after September 30, 2021 will be required to achieve the applicable level of ownership within five (5) years following the later of the Adoption Date and the date the person was initially designated an Executive Officer or Designated Executive.

Outside Directors who were serving on the Board as of September 30, 2021 will be required to achieve the applicable level of ownership as of the Adoption Date. Outside Directors who join the Board after September 30, 2021 will be required to achieve the applicable level of ownership by the later of (a) the 2026 annual meeting of stockholders; or (b) five (5) years from the date the person first became an Outside Director.

Shares that count toward satisfaction of the guidelines include (i) shares of Common Stock owned outright by the Covered Employee or Outside Director or a member of his or her immediate family, (ii) shares of Common Stock held in trust for the benefit of the Covered Employee or Outside Director or a member of his or her immediate family, (iii) shares of Common Stock held in the Company’s 401(k) plan or deferred compensation retirement plans, and (iv) shares of Common Stock underlying vested incentive equity awards (including, without limitation, vested stock options, vested stock appreciation rights, and vested restricted stock unit awards that have not yet been settled). Unvested equity awards do not count towards satisfaction of the guidelines.

Until the required ownership level is reached, Covered Employees and Outside Directors are expected to retain one hundred percent (100%) of the shares of Common Stock net of applicable tax withholding and the payment of any exercise or purchase price (if applicable), received upon the vesting or settlement of equity awards or the exercise of stock options.

All of our Covered Employees and incumbent Outside Directors have either achieved the recommended ownership level or are expected to achieve the recommended ownership level within the required timeframe.

Clawback Policy